Oregon Personnel Status Change Worksheet

Description

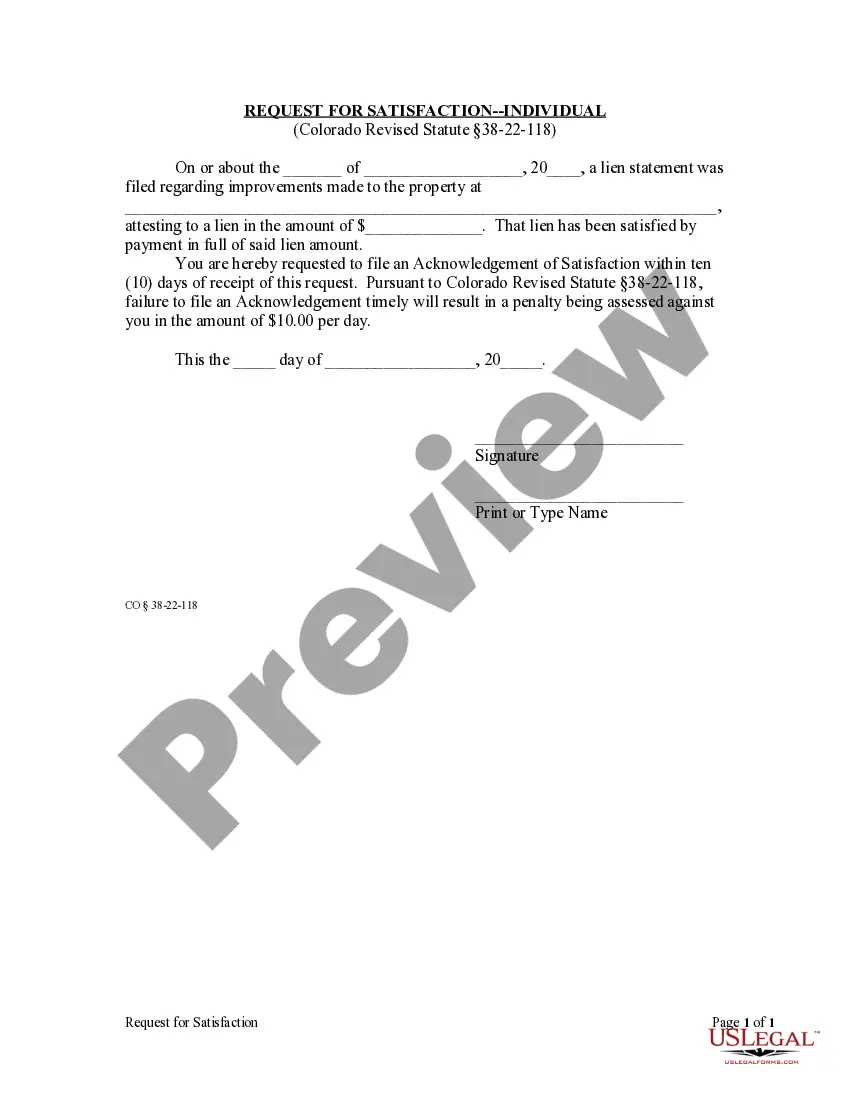

How to fill out Personnel Status Change Worksheet?

If you require to complete, download, or print authentic legal document templates, utilize US Legal Forms, the most comprehensive collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to obtain the documents you need. A selection of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Use US Legal Forms to access the Oregon Personnel Status Change Worksheet in just a few clicks.

Every legal document format you purchase is yours indefinitely. You have access to every document you saved in your account. Visit the My documents section and choose a form to print or download again.

Be proactive and download and print the Oregon Personnel Status Change Worksheet using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and then click the Download option to find the Oregon Personnel Status Change Worksheet.

- You can also access forms you previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your specific state/country.

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal document format.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Oregon Personnel Status Change Worksheet.

Form popularity

FAQ

The amount you should withhold for Oregon state tax depends on your income level and filing status. Generally, Oregon uses a progressive tax system, so rates increase as income rises. To determine the right withholding amount, consider using the Oregon Personnel Status Change Worksheet to ensure that your employer updates your withholding status in accordance with your current financial situation.

Definitions as they pertain to Oregon Employment Department Law. An employer is subject to unemployment insurance taxes when the employer pays wages of $1,000 or more in a calendar quarter, or employs one or more individuals in any part of 18 separate weeks during any calendar year.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

File Form OR-WR on Revenue Online at . Mail your Form OR-WR separately from your 2018 4th quarter Form OQ and 4th quarter statewide transit tax form. If you amend Form OR-WR, you will also need to amend Form OQ and 4th quarter statewide transit tax form. Make a copy for your records.

Forms OR-40, OR-40-P and OR-40-N can be found at or you can contact us to order it. Nonresidents stationed in Oregon.

Download forms from the Oregon Department of Revenue website . Order forms by calling 1-800-356-4222. Contact your regional Oregon Department of Revenue office.

Qualifications for EUC:Your base year wages must equal or exceed 40 times your weekly benefit amount. (If your claim pays 26 weeks of benefits, you have met this qualification.) Your most recent claim must have tired regular benefits or be expired.