Oregon Employee Evaluation Form for Nanny

Description

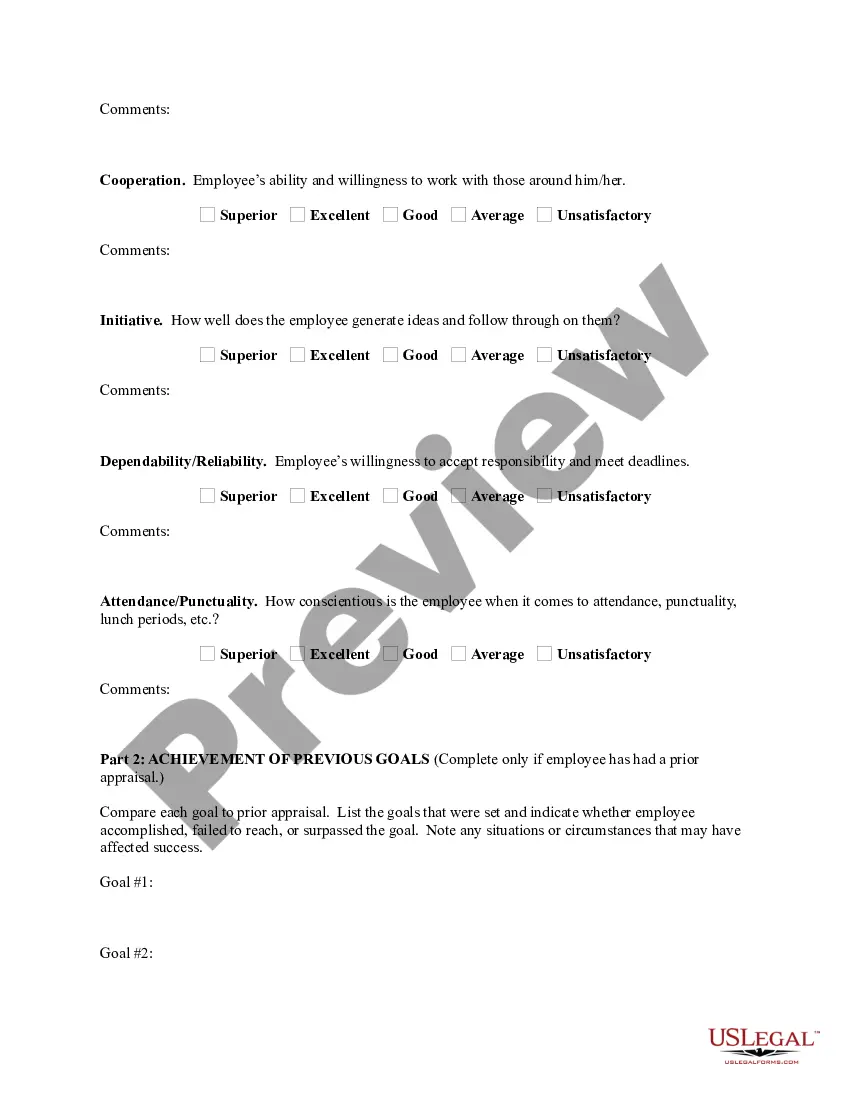

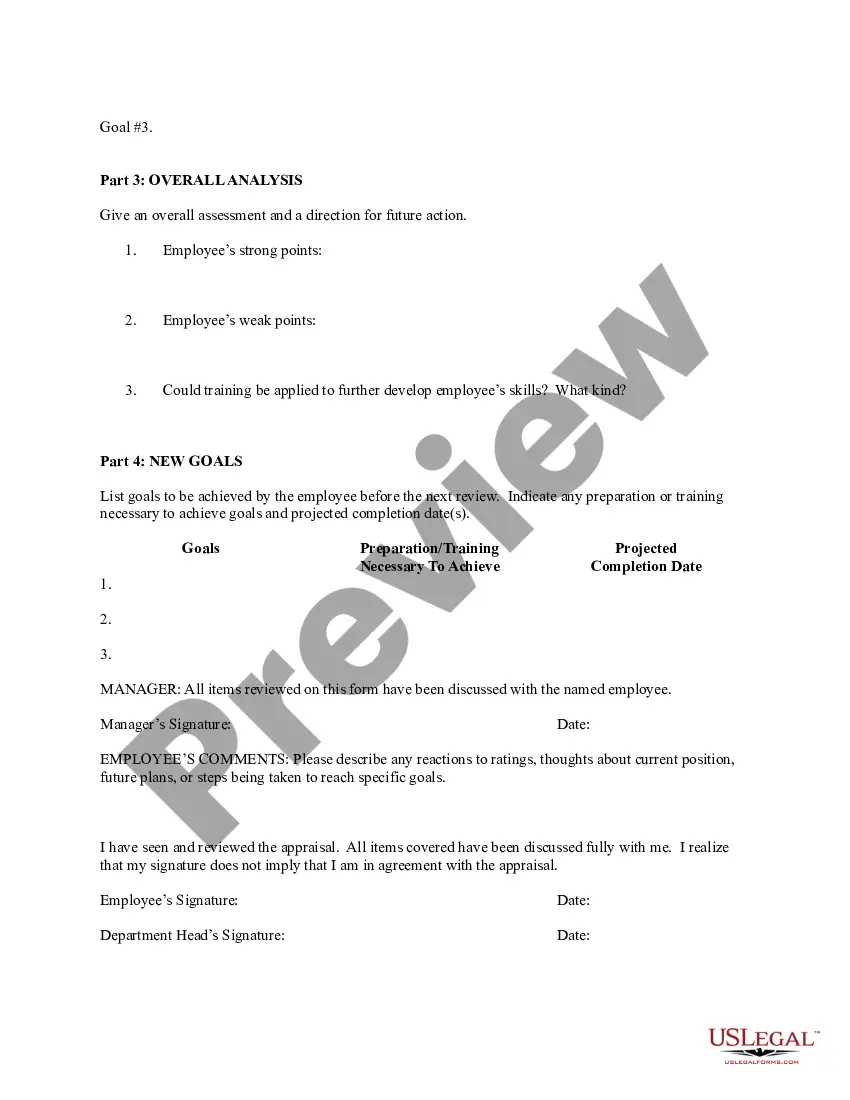

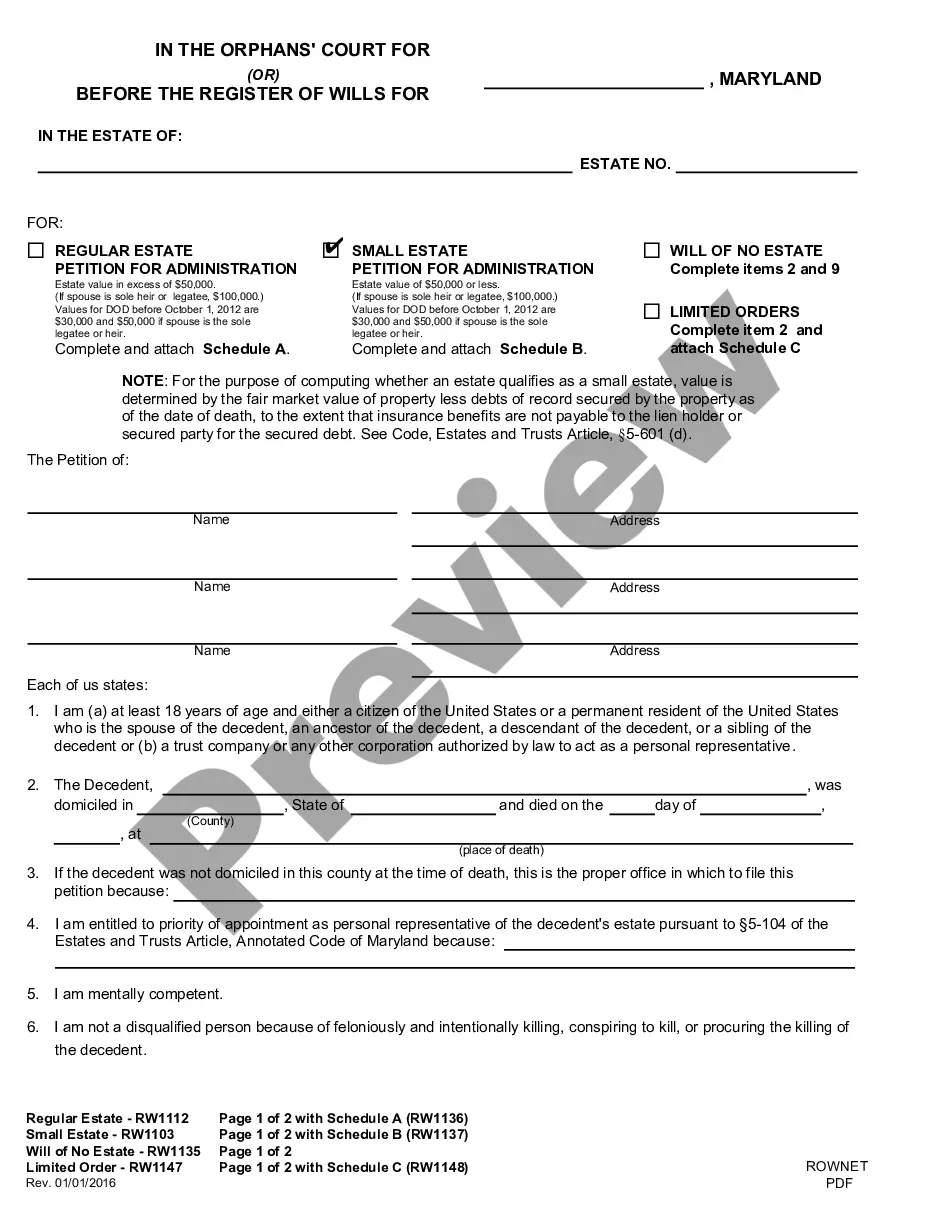

How to fill out Employee Evaluation Form For Nanny?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive selection of legal form templates available for download or print.

Through the website, you can obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can easily find the latest form templates such as the Oregon Employee Evaluation Form for Nanny within minutes.

If you already have a subscription, Log In and download the Oregon Employee Evaluation Form for Nanny from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the purchase. Use your Visa or MasterCard or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Oregon Employee Evaluation Form for Nanny. Every template saved in your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Oregon Employee Evaluation Form for Nanny with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your locality/county.

- Choose the Preview option to review the form's content.

- Read the form description to confirm you have selected the right document.

- If the form does not fulfill your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Next, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

One of the most common questions (and misunderstandings) surrounding household employment is whether a family can provide their nanny a Form 1099-MISC (or 1099-NEC) at tax time and consider them an independent contractor rather than a household employee. The short answer is no. You can't give your nanny a 1099.

Oregon Payroll TaxesIt's a progressive income tax ranging from 4.75% to 9.9%, meaning the more money your employees make, the higher the income tax. Employees who work in Oregon also have to pay a transit tax of 0.01%. You must withhold this tax from employee wages.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

It's tax season and one of the first steps for household employers is to provide Form W-2 to their workers. Your nanny will need Form W-2 to file their personal tax return. It documents how much they were paid and how much has been withheld in taxes.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Pay and file payroll taxes onlineStep 1: Complete your tax setup. Before you can pay or file payroll taxes, make sure you complete your tax setup.Step 2: Confirm what and when you need to file. Once you've signed up, you need to confirm what taxes you need to file and pay for.Step 3: Pay your taxes.Step 4: File forms.

To electronically pay state payroll taxes (including the WBF assessment) by electronic funds transfer (EFT), use the Oregon Department of Revenue's self-service site, Revenue Online200b. You can make ACH debit payments through this system at any time, with or without a Revenue Online account.

File Form OR-WR on Revenue Online at . Mail your Form OR-WR separately from your 2018 4th quarter Form OQ and 4th quarter statewide transit tax form. If you amend Form OR-WR, you will also need to amend Form OQ and 4th quarter statewide transit tax form. Make a copy for your records.

Oregon Annual Domestic Report- Form OA Domestic Use this form each year to document how you calculate the annual amounts for UI tax, withholding tax and the WBF assessment you owe.

Oregon law generally exempts an individual who performs child care services (either in the home of the individual or in the home of the child) from state minimum wage and overtime requirements. However, under federal law a nanny would still be entitled to federal minimum wage (currently $7.25 per hour).