Oregon Employee Evaluation Form for Nonprofit

Description

How to fill out Employee Evaluation Form For Nonprofit?

Selecting the optimal sanctioned document format can be challenging.

Clearly, there are numerous templates available online, but how can you locate the sanctioned form you require.

Use the US Legal Forms website. This service provides thousands of templates, including the Oregon Employee Evaluation Form for Nonprofit, which can be utilized for both business and personal purposes.

If the form does not meet your criteria, utilize the Search section to find the appropriate form.

- All the templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Oregon Employee Evaluation Form for Nonprofit.

- Use your account to search through the authorized forms you have previously purchased.

- Go to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, make sure you have selected the correct form for your city/state. You can view the form using the Review button and read the form summary to ensure it is suitable for you.

Form popularity

FAQ

Filing Oregon Form WR may be necessary if you have employees subject to withholding requirements. This form allows you to report annual withholding amounts and ensures compliance with state laws. If you’re running a nonprofit, using the Oregon Employee Evaluation Form for Nonprofit can help you assess your employees' performances, which in turn supports the integrity of your financial reporting.

The Oregon Form W-4, unlike the Oregon Employee Evaluation Form for Nonprofit, is designed for employees to indicate their tax withholding preferences. Employees complete this form to ensure the right amount is withheld from their paychecks for state income tax. Accurate completion of the W-4 helps employees manage their taxes efficiently throughout the year.

To form a nonprofit in Oregon, you must first choose a unique name and file the articles of incorporation with the Secretary of State. Next, create a set of bylaws to govern your organization and hold an initial board meeting to establish your structure. Finally, consider implementing best practices, such as utilizing the Oregon Employee Evaluation Form for Nonprofit, which can help ensure effective management and employee performance tracking.

To file the Oregon WR, you'll first need to complete the appropriate forms that detail your withholdings from employee wages. This includes accurately filling out the Oregon Employee Evaluation Form for Nonprofit if you're assessing an employee's performance with regard to their contributions. Submitting the WR can be done online or by mail, ensuring compliance with state regulations.

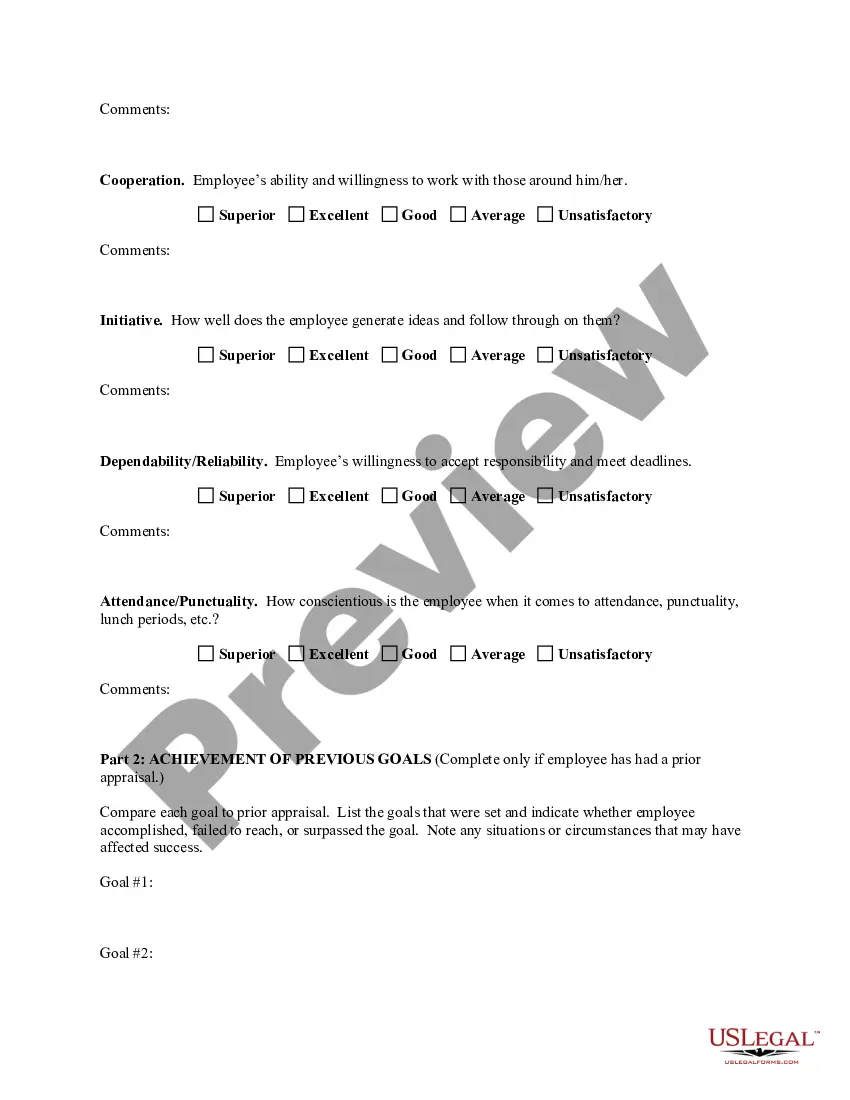

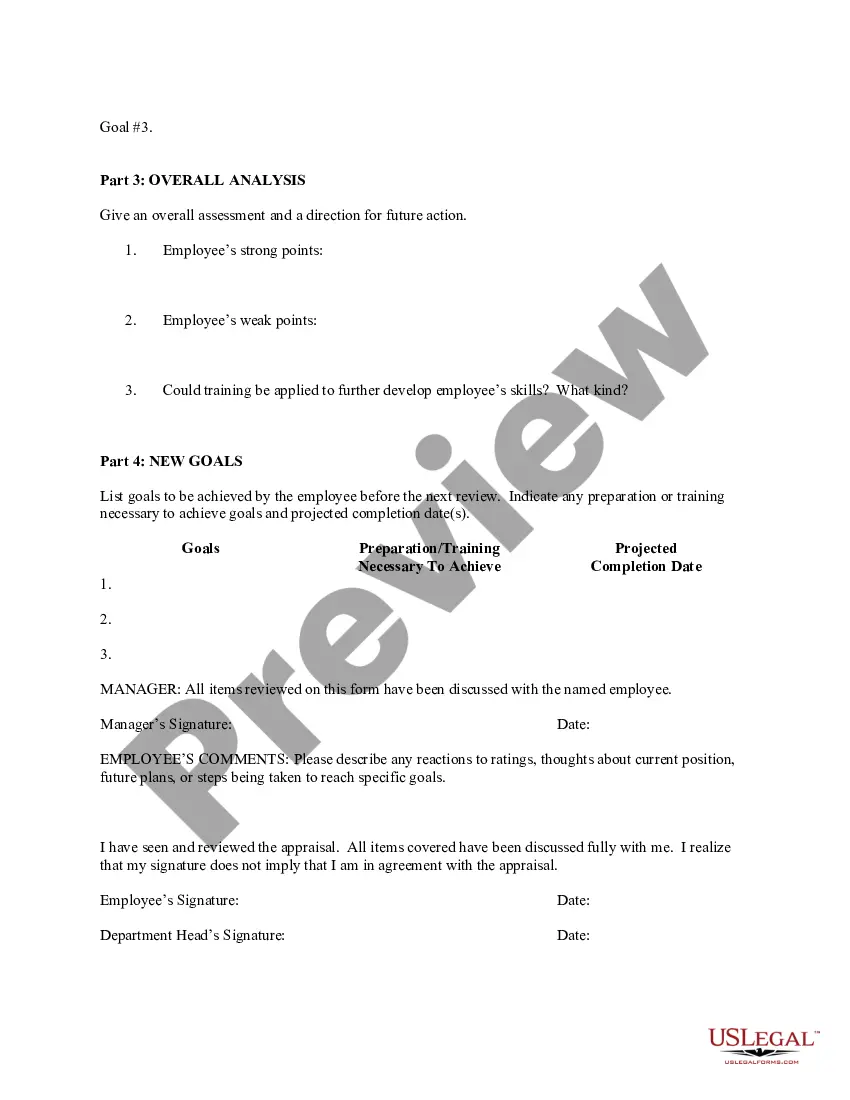

The Oregon Employee Evaluation Form for Nonprofit is a standardized document designed to guide organizations in assessing employee performance within nonprofit settings. This form helps in documenting employee achievements, setting future goals, and identifying areas for development. By using this form, nonprofits can ensure that evaluations are consistent and equitable, ultimately supporting overall organizational effectiveness.

The board assessment (also called a board evaluation) is simply an assessment of board performance, typically measured using written questionnaires, in-person interviews, or a combination of the two.

Examine the income for previous years to identify the average revenue generated annually and compare it with the current year. This will tell you whether the organization is on track with growth targets or experiencing a slump. Deduct total expenses from total income and divide the result by total income.

Framework for Board EvaluationsStep 1: Define Evaluation Objectives.Step 2: Determine Who Will be Evaluated: Board, Board Committees, Individual Directors.Step 3: Determine Role of Board Leaders and Management in the Process.Step 4: Establish Evaluation Methodology.More items...?

Now that we understand the three main parts of needs assessment are initiation, data collection & analysis, and final product, let's explore how to do each of these parts.

Seven Steps for Conducting a Successful Needs AssessmentStep one: Clearly define your needs assessment objectives.Step two: Be realistic about your resources and capacity.Step three: Identify target audiences and data sources.Step four: Think small and big when summarizing results.Step five: Get feedback.More items...