Oregon Resident Information Sheet

Description

How to fill out Resident Information Sheet?

Selecting the appropriate authorized document template can be quite a challenge.

Clearly, there are countless templates accessible online, but how can you secure the legal form you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, like the Oregon Resident Information Sheet, suitable for both business and personal use.

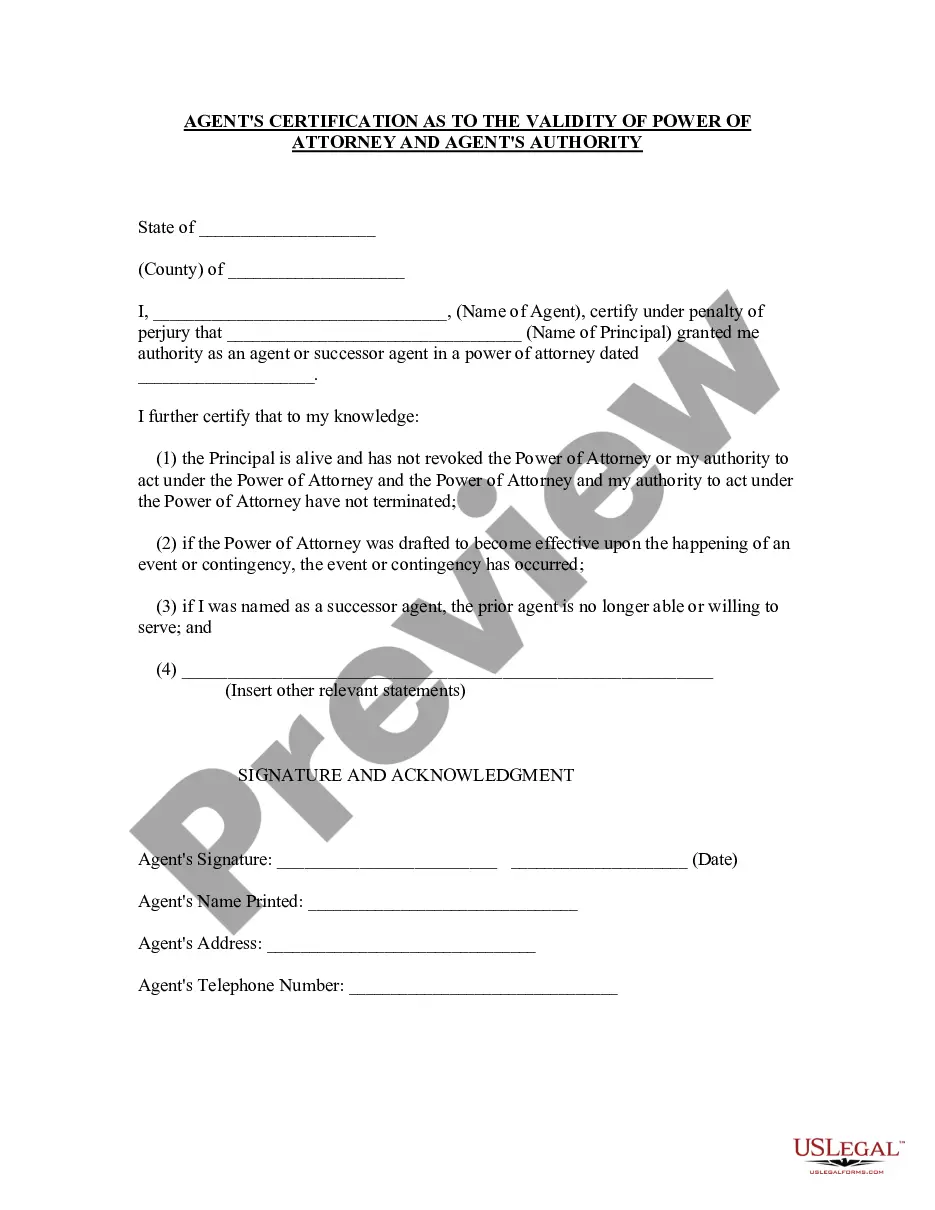

You can preview the document using the Preview button and review the form description to confirm this is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already authorized, Log In to your account and click the Acquire button to obtain the Oregon Resident Information Sheet.

- Use your account to search for the legal forms you have purchased previously.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

Residency Definitions In order to establish a domicile in Oregon, a person must maintain a predominant physical presence in Oregon for 12 consecutive months after moving to the state.

2020 Form OR-40-P, Oregon Individual Income Tax Return for Part-year Residents, 150-101-055. Page 1. Office use only. Amended return. If amending for an NOL, tax year the NOL was generated: Calculated using as if federal return.

Acceptable proof of your residence address includes: 2022 Mortgage document; 2022 Property tax statement; 2022 Mail from a verifiable business or government agency; 2022 Oregon vehicle title or registration card; Page 15 11 2022 Payment booklet; 2022 Voter registration, selective service, medical, or health card; 2022 Utility hookup order

If a permanent place of abode is maintained in Oregon, and the person is in this state for more than 200 days during the tax year, then the person is taxed as a resident of Oregon.

Factors that contribute to determining domicile include family, business activities and social connections. For example, assume Ron maintains a home in Oregon and works in Oregon. He purchased a summer home in Nevada and each year thereafter spent about three or four months in that state.

2020 Form OR-40-N, Oregon Individual Income Tax Return for Nonresidents, 150-101-048.

To qualify as an Oregon resident (for tuition purposes), one must live in Oregon for 12 consecutive months while taking eight credits or fewer per term while demonstrating that they are in the state for a primary purpose other than education (such as working, volunteering, or other purposes).

A property tax record, utility bills, rent receipts, a lease or rental agreement or other document that shows you reside in Oregon; Enrollment records or other documentation that you are attending an educational institution maintained by public funds and pay resident tuition fees; Motel, hotel, campground or

2020 Form OR-40-N, Oregon Individual Income Tax Return for Nonresidents, 150-101-048.