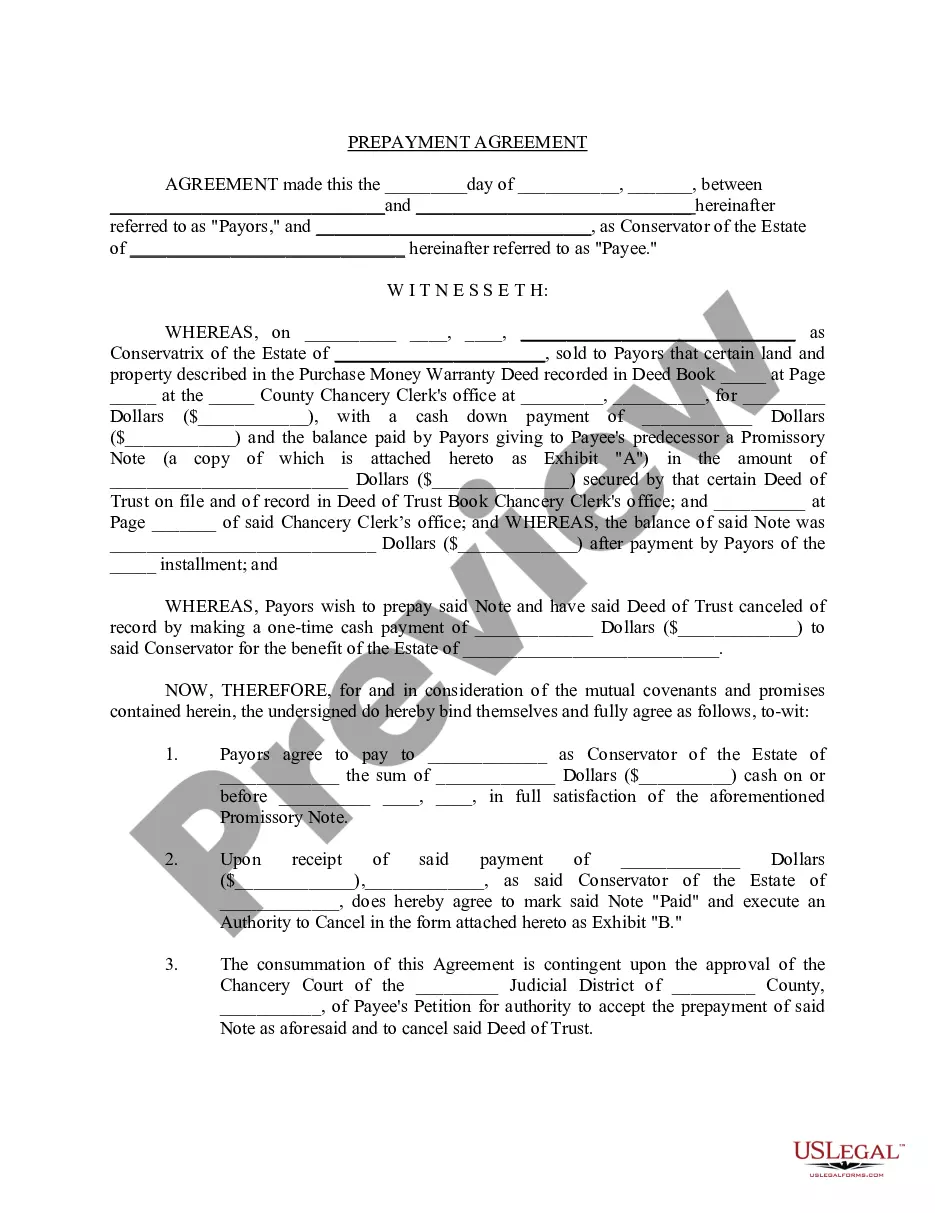

Oregon Prepayment Agreement

Description

How to fill out Prepayment Agreement?

Are you within a place that you require documents for both company or person purposes virtually every working day? There are tons of lawful record templates accessible on the Internet, but getting versions you can trust is not straightforward. US Legal Forms gives a huge number of type templates, much like the Oregon Prepayment Agreement, that are published in order to meet federal and state specifications.

If you are previously informed about US Legal Forms site and possess a merchant account, basically log in. Next, you may obtain the Oregon Prepayment Agreement format.

Unless you have an profile and wish to start using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for your appropriate area/region.

- Use the Preview switch to examine the form.

- Look at the explanation to actually have chosen the appropriate type.

- In the event the type is not what you`re looking for, utilize the Look for industry to obtain the type that suits you and specifications.

- If you get the appropriate type, just click Purchase now.

- Opt for the costs prepare you would like, submit the desired details to create your bank account, and pay for the order using your PayPal or bank card.

- Choose a handy paper format and obtain your backup.

Locate every one of the record templates you have bought in the My Forms menus. You may get a additional backup of Oregon Prepayment Agreement at any time, if required. Just click the required type to obtain or produce the record format.

Use US Legal Forms, the most extensive selection of lawful varieties, to save lots of time and avoid faults. The services gives appropriately created lawful record templates that you can use for a range of purposes. Make a merchant account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Prepayment clause: If you can afford it, you can choose to pay off your principal loan amount over and above your monthly instalment, before the stipulated loan tenure. This is known as prepayment.

You can always try to negotiate having it removed from the contract; ask your lender if they will waive the fee. If they agree (which is unlikely but always worth a try), make sure you have it in writing. You can also ask your lender for a quote without the penalty, but remember that might increase your interest rate.

In Oregon, promissory notes require the signature of both the lender and the sender for the contract to be valid. Without both signatures, the deal is not legal. If one of the parties voids the agreement, the matter cannot be taken to court for judgment. The case will be thrown out.

(1) The terms of a subprime mortgage or nontraditional mortgage that a lender offers or originates may impose a prepayment penalty for a full or partial repayment of principal made within two years after the closing date for the mortgage or during a period that ends 60 days before the first scheduled adjustment of the ...

Eleven states generally prohibit prepayment penalties on residential first mortgages. These include Alabama, Alaska, Illinois (if the interest rate is over 8%), Iowa, New Jersey, New Mexico, North Carolina (under $100,000), Pennsylvania (under $50,000), South Carolina (under $100,000), Texas, and Vermont.

Some states go so far as to ban prepayment penalties on all types of loans. But some banks are regulated by federal law, not state law, so it's important to do your research and talk to your lender so you know which policies apply to your loan.

Virtually all voluntary liens secured by Oregon real estate are trust deeds and are therefore governed by the Oregon Trust Deed Act, ORS 86.705 ? 86.795, which has been in existence since 1959.

For many kinds of new mortgages, the lender can't charge a prepayment penalty?a charge for paying off your mortgage early. If your lender can charge a prepayment penalty, it can only do so for the first three years of your loan and the amount of the penalty is capped.