Texas Release of Lien

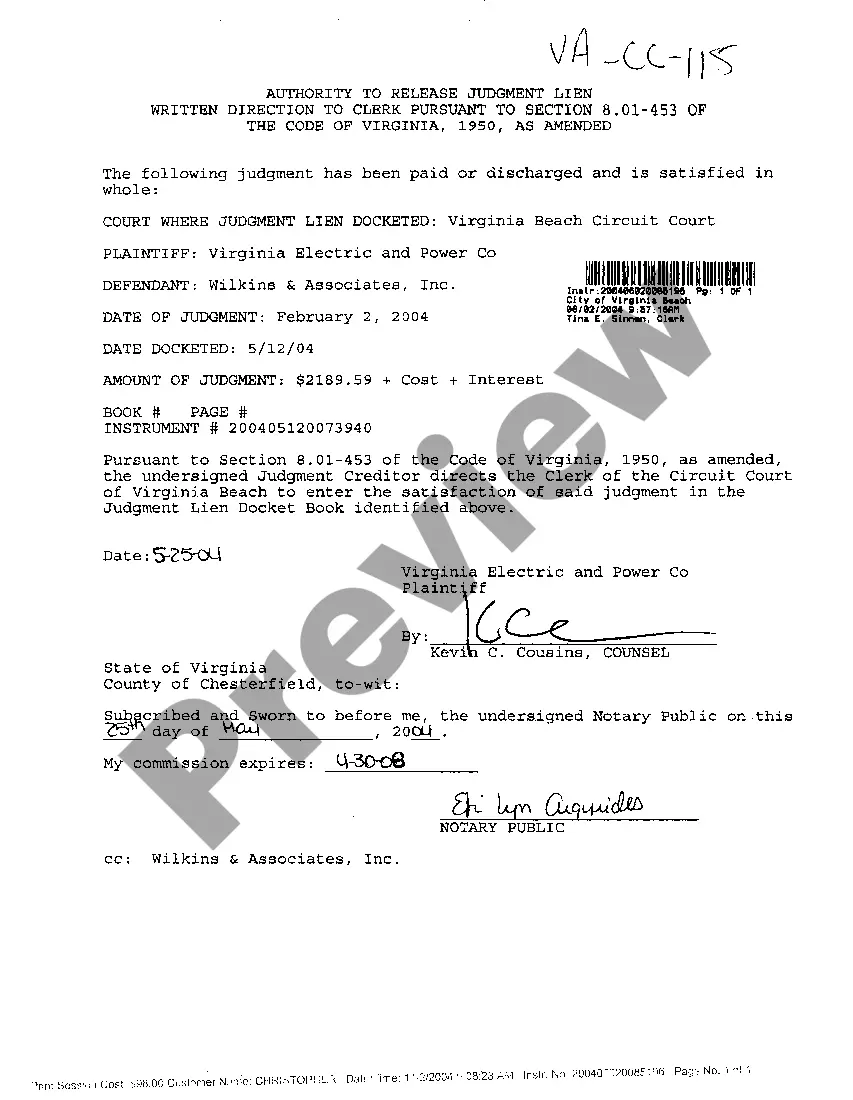

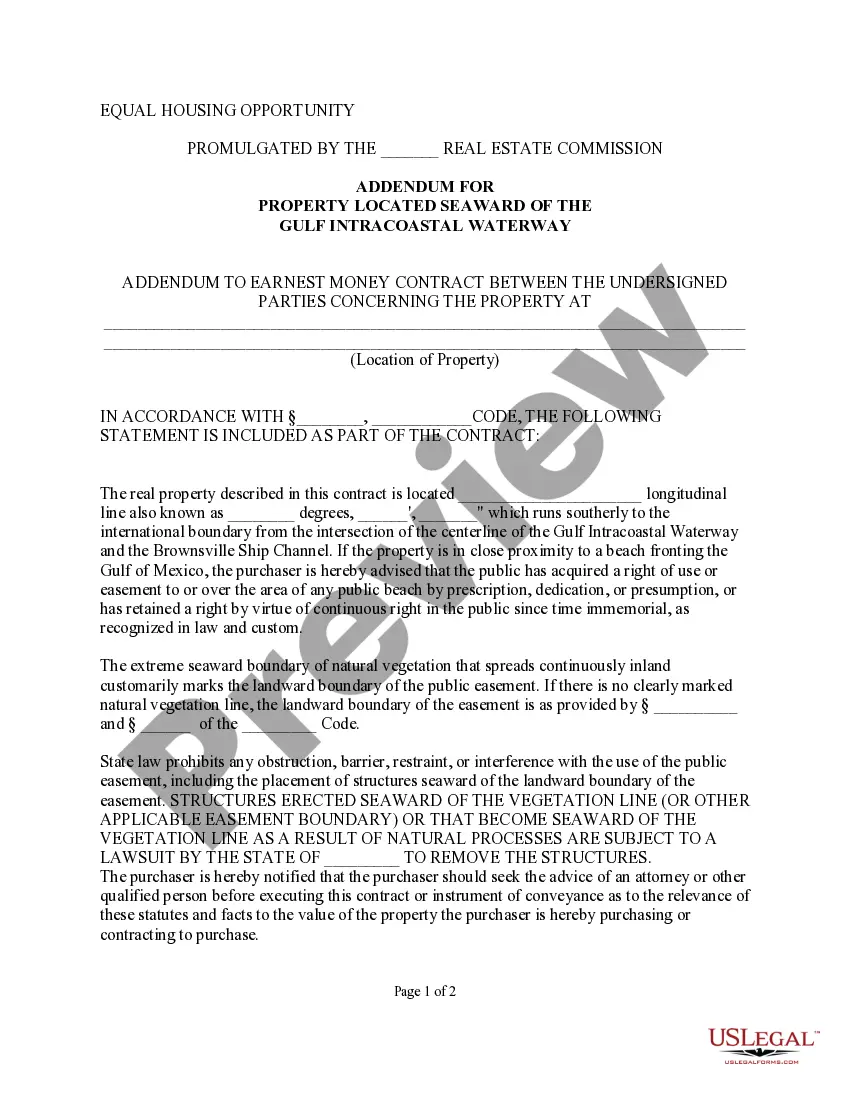

The Release of Lien is a legal document that formally removes a lien from a property. This form is typically used when a borrower has paid off their debt secured by a deed of trust, and the lienholder agrees to release their claim on the property. Unlike other forms that may establish or modify liens, this document specifically indicates the discharge of a lien, providing clarity and security for property ownership.

- Details of the granting party (Grantor) and property involved.

- Identification of the lienholder and the trustee associated with the deed of trust.

- Specific reference to the deed of trust, including recording information.

- Statement confirming the lienholder's agreement to release the property from the deed of trust lien.

- Signature lines for the lienholder, including acknowledgment sections for individual and corporate representatives.

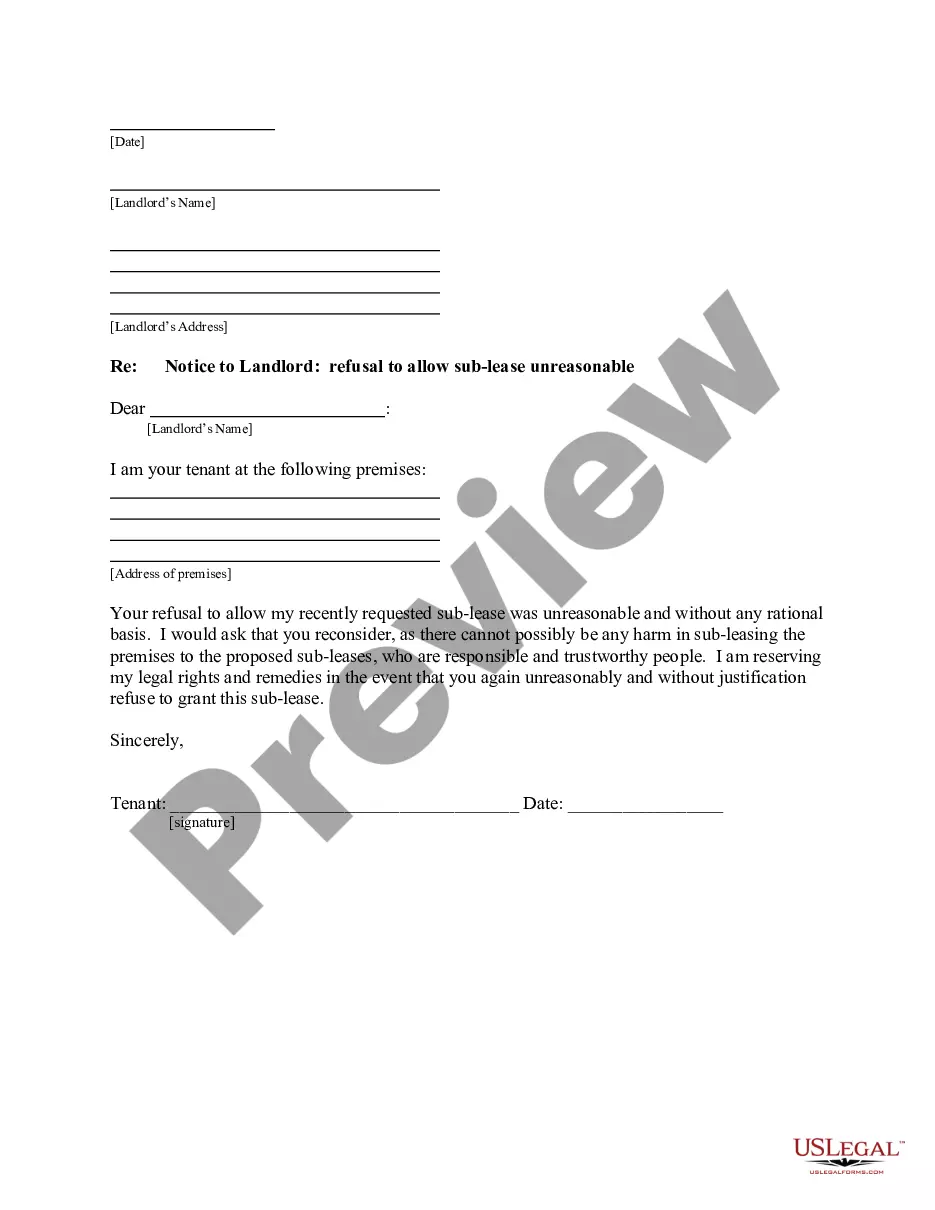

This form should be used when the lienholder agrees to release a lien placed on a property due to an outstanding deed of trust. Common scenarios include when a mortgage is fully paid off, or when refinancing options are being explored that do not require the previous lien to remain in place. Utilizing this form ensures that the property records are updated accurately to reflect the lien's release.

This form is intended for:

- Homeowners who have paid off their mortgage and need to eliminate the lien from the public records.

- Lienholders, such as banks or financial institutions, who want to formally release their interest in the property.

- Real estate professionals assisting clients in the property sales process.

Follow these steps to complete the Release of Lien:

- Identify and enter the names of the Grantor and Lienholder.

- Detail the property description and the specific county in Texas where the property is located.

- Reference the previous deed of trust, including its recording volume and page numbers.

- Complete the execution date and signatures for the lienholder, ensuring proper acknowledgment if required.

- If applicable, obtain notarization to validate the document.

This form must be notarized to be legally valid. Notarization ensures the authenticity of the signatures and the legitimacy of the release. US Legal Forms offers integrated online notarization, allowing you to complete this step easily through a secure video call at your convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

- Failing to include complete property details, which can lead to complications in future transactions.

- Not obtaining necessary notarization or witnesses if required by local law.

- Using incorrect recording information for the original deed of trust.

- Conveniences of instant download and local customization enhance efficiency.

- Editable templates allow users to fill in specific details without legal jargon.

- Access to forms created by licensed attorneys, providing peace of mind in legal accuracy.

Looking for another form?

Form popularity

FAQ

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

All you have to do to take your name off of a car title is sign the back of the title over to the person or organization you wish to transfer your car. Make sure that any title transfer is treated like a sale, you being the seller and the person or organization being the buyer.

When a lien is filed, it states the amount that is owed to the contractor. If the stated amount is paid in full, the contractor should file a full release of the lien. This results in completely removing the lien from the property.With a partial release, a lien remains on the property, but for a reduced amount.

The lender will also notify the Department of Motor Vehicles (DMV) that the loan has been paid in full. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied. This request can be made through the DMV or directly to the lender.

The car (vehicle) lien release form is a document that is used by a lending institution or entity after a borrower has paid the loan in full and the borrower would like to retrieve the title to their vehicle.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

Depending on state laws, paper titles are generally mailed and electronic titles and/or liens are released to the motor vehicle agency approximately 10 business days after the payoff is received. Allow 15-30 days for receipt of your title based on mail time and/or motor vehicle agency process.

A Lien Release (also considered a Lien Cancellation or Release of Lien) is a legally binding document that is sent by the current lien holder, the individual who has leased the property or provided payment to secure the property, that informs any debt in relation to that property has been fulfilled and they relinquish

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.