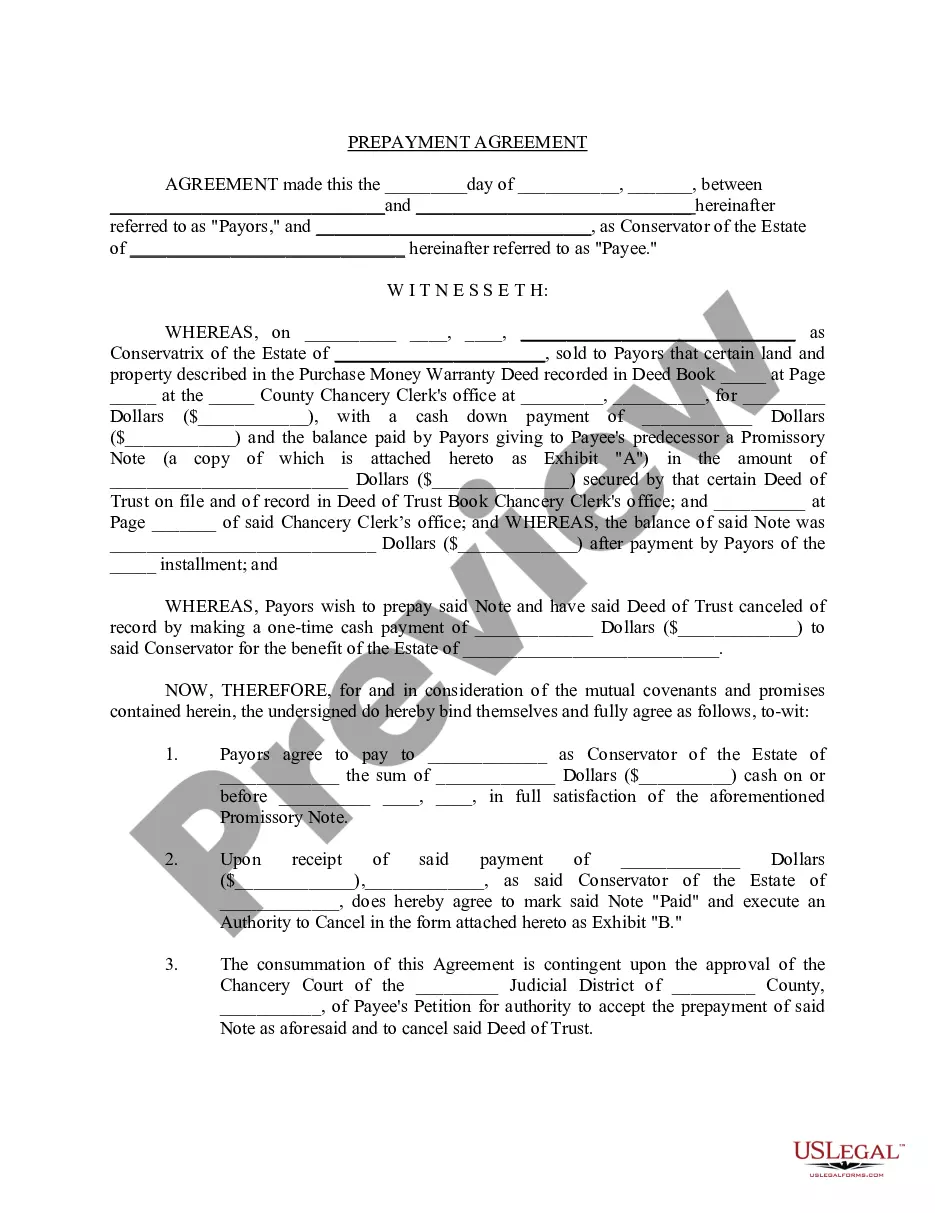

Pennsylvania Prepayment Agreement

Description

How to fill out Prepayment Agreement?

Discovering the right legal document format can be a have a problem. Obviously, there are tons of templates available on the net, but how will you find the legal develop you want? Use the US Legal Forms website. The services offers 1000s of templates, for example the Pennsylvania Prepayment Agreement, that can be used for company and private requires. All the varieties are checked by experts and fulfill federal and state needs.

If you are previously authorized, log in to your profile and click the Down load switch to get the Pennsylvania Prepayment Agreement. Make use of profile to look with the legal varieties you might have acquired earlier. Check out the My Forms tab of your profile and get yet another backup in the document you want.

If you are a brand new customer of US Legal Forms, here are simple instructions so that you can adhere to:

- Very first, make sure you have chosen the correct develop for the city/county. You may check out the shape utilizing the Preview switch and study the shape description to ensure this is basically the best for you.

- When the develop fails to fulfill your preferences, utilize the Seach industry to find the proper develop.

- Once you are sure that the shape is acceptable, click the Purchase now switch to get the develop.

- Opt for the costs program you desire and enter the needed details. Make your profile and pay for your order utilizing your PayPal profile or bank card.

- Pick the submit formatting and acquire the legal document format to your product.

- Full, change and printing and signal the acquired Pennsylvania Prepayment Agreement.

US Legal Forms may be the greatest collection of legal varieties for which you can see different document templates. Use the service to acquire expertly-produced files that adhere to status needs.

Form popularity

FAQ

2022 Pennsylvania Income Tax Return (PA-40)

To what address do I mail my PA-40 personal income tax return or supporting documentation? If you filed electronically and need to submit supporting documentation, please mail it to the following address: PA Department of Revenue Electronic Filing Section PO Box 280507 Harrisburg, PA ...

Every participating nonresident individual owner must make an election to be part of the PA-40 NRC in writing each year. The elections must be maintained in the pass-through en- tity's files.

The safe harbor is the minimum amount of payments and credits paid toward your tax liability that protects you from a penalty for underpayment of your estimated taxes.

For all tax years, amended returns can be filed using a paper PA-40, Individual Income Tax return, regardless of the method used for filing the original return.

SAFE HARBOR METHOD INCOME If a full-year PA-40 return was filed in 2020, enter 100% of the net PA taxable income from Line 11 of the 2020 PA-40, Personal Income Tax Return. If a return was not filed for 2020 or a part-year resident return was filed, the safe harbor method is not permitted to be used.

Use PA-40 Schedule T to report gambling and lottery win- nings as well as the costs for any gambling and lottery wa- gering of the taxpayer and/or spouse. Gambling and lottery winnings from any source, except non- cash prizes from playing the Pennsylvania Lottery, must be reported.

Who has to make estimated tax payments? Any individual who expects to receive more than $8,000 of Pennsylvania-taxable income not subject to withholding by a PA employer must estimate and pay personal income tax quarterly. Tax due dates for individuals are April 15, June 15, Sept. 15 and Jan.