Michigan Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out Buy Sell Agreement Between Shareholders And A Corporation?

Are you in the situation where you require documentation for business or personal purposes almost every day.

There are various legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Michigan Buy Sell Agreement Between Shareholders and a Corporation, which are designed to fulfill federal and state requirements.

Once you find the suitable form, click Purchase now.

Select the pricing plan you prefer, complete the necessary details to create your account, and pay for the order using your PayPal or Visa or MasterCard.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Michigan Buy Sell Agreement Between Shareholders and a Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

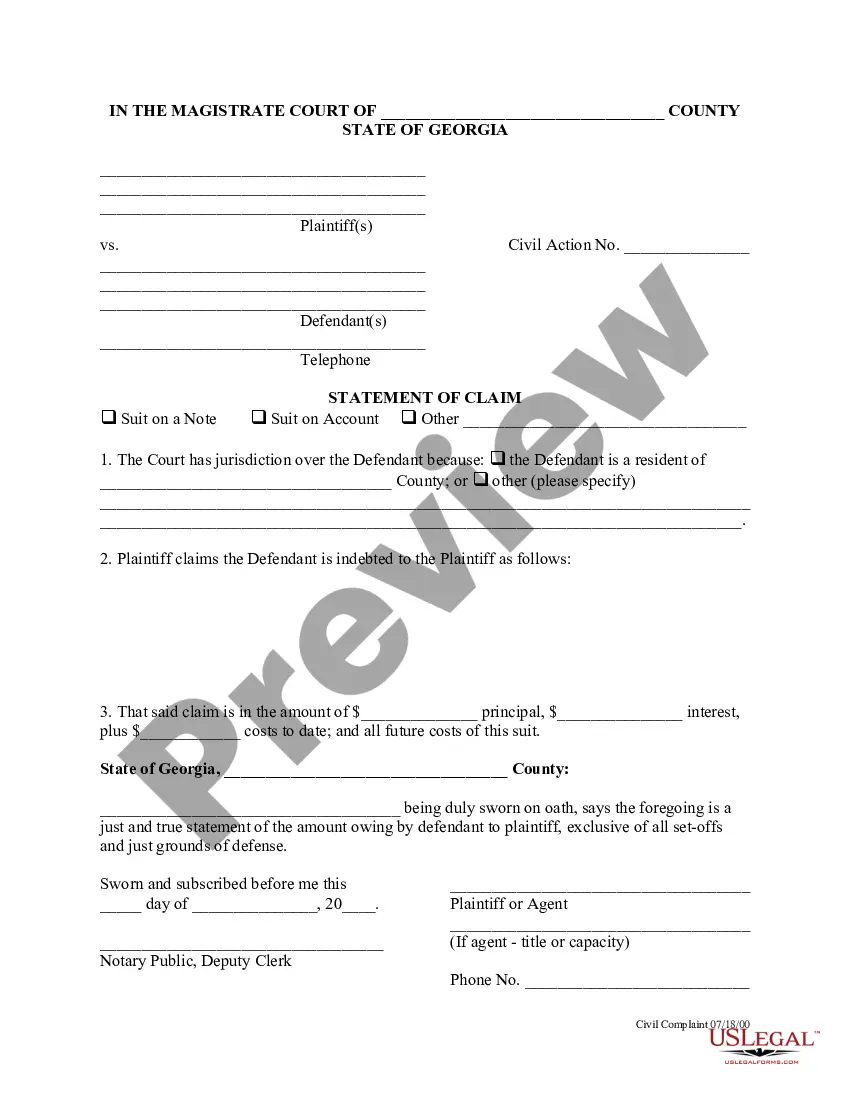

- Utilize the Review button to check the form.

- Examine the description to ensure you have selected the right form.

- If the form is not what you seek, use the Search section to locate the form that meets your requirements.

Form popularity

FAQ

Filling out a Michigan Buy Sell Agreement Between Shareholders and a Corporation involves several key steps. First, you need to identify the shareholders and the corporation involved in the agreement. Next, outline the conditions that trigger the buy-sell agreement, such as retirement, death, or dispute. Finally, ensure all parties sign the document to make it legally binding, providing clear terms for the buyout process.

Yes, a properly structured buy-sell agreement generally allows for the transfer of shares outside of the probate process. Since the shares pass according to the terms of the agreement, they typically do not become part of the deceased's estate. This feature makes the Michigan Buy Sell Agreement Between Shareholders and a Corporation a beneficial tool for managing share transfers efficiently.

When a corporation buys out the stock of a deceased stockholder, this is commonly referred to as a 'corporate redemption.' This ensures that the shares do not pass outside the ownership structure, keeping control within the remaining shareholders. The Michigan Buy Sell Agreement Between Shareholders and a Corporation is vital in facilitating this process.

The primary beneficiaries of a buy-sell agreement include shareholders and the corporation itself. In cases of a shareholder's death or exit, the beneficiary could also be their heirs or estates, depending on the agreement terms. This ensures that the Michigan Buy Sell Agreement Between Shareholders and a Corporation remains a strategic tool for protecting the interests of all parties involved.

A shareholder agreement primarily focuses on the rights and responsibilities of the shareholders, while a buy-sell agreement outlines the conditions under which shares can be bought or sold. Essentially, the buy-sell agreement acts as a subset of the larger shareholder agreement. Both are essential components for a smooth operation of a Michigan Buy Sell Agreement Between Shareholders and a Corporation.

To execute a buy-sell agreement, both shareholders and the corporation must sign the document. First, ensure that all parties understand the terms and conditions outlined. Then, you might want to have it notarized for added legal weight. Always consider consulting a legal expert to navigate the details of the Michigan Buy Sell Agreement Between Shareholders and a Corporation.

When shareholders do not agree, it can lead to conflicts and potential disruptions within the corporation. A Michigan Buy Sell Agreement Between Shareholders and a Corporation can help mitigate these issues by providing clear plans for conflict resolution. Using effective communication and legal agreements can keep your business relationship intact and prevent complications that may arise from disagreements.

While it is beneficial for all shareholders to reach consensus, not every shareholder needs to agree for an agreement to be ratified. Depending on the company's bylaws, a Michigan Buy Sell Agreement Between Shareholders and a Corporation can be established with a majority vote. However, fostering a spirit of collaboration can lead to better outcomes for all involved.

No, shareholder agreements are not legally mandated but are highly recommended. They provide guidelines and structure that can prevent misunderstandings and disputes among shareholders. Invest in a Michigan Buy Sell Agreement Between Shareholders and a Corporation to safeguard your interests and clarify your corporate intentions, creating a smoother operational environment.

A shareholder buy-sell agreement, often part of a Michigan Buy Sell Agreement Between Shareholders and a Corporation, outlines the procedures for selling or transferring shares among shareholders. This agreement protects current shareholders from unwanted transfers and ensures the continued stability of the corporation. It serves as a crucial tool for conflict resolution and planning for future changes.