Oregon Power of Attorney by Trustee of Trust

Description

How to fill out Power Of Attorney By Trustee Of Trust?

US Legal Forms - one of the largest repositories of legal documents in the country - offers a broad selection of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can discover the latest editions of forms like the Oregon Power of Attorney by Trustee of Trust in just moments.

Examine the form's description to confirm that you have picked the right document.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and download the Oregon Power of Attorney by Trustee of Trust from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

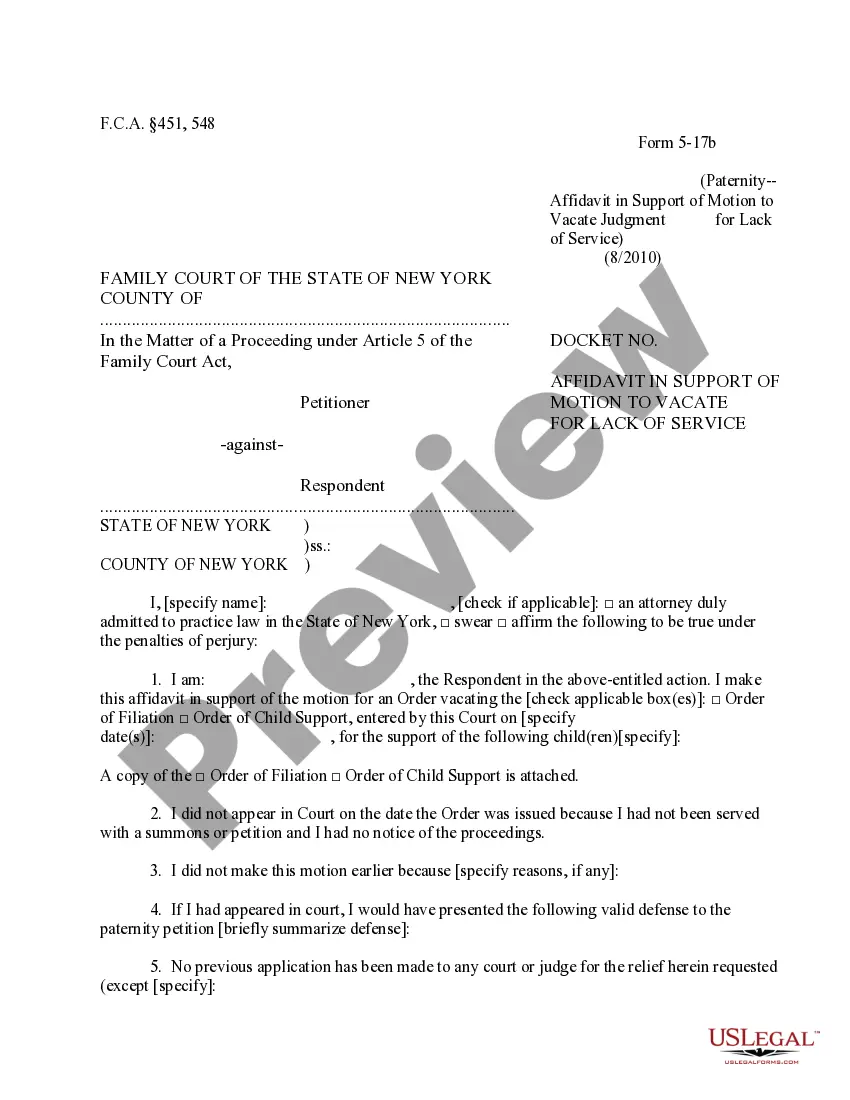

- Click the Preview button to review the content of the form.

Form popularity

FAQ

You cannot receive your inheritance until the estate has been properly administered. This generally takes between nine and 12 months, although it can take longer in complex estates.

When Trust Fund Distributions to Beneficiaries Are Made Even a simple trust may require 12-18 months before they can end trust administration and transfer of trust property to beneficiaries, although it can take several years if the trust is complex.

If you are a trust beneficiary, you have a right to information about the trust, your interest in the trust, and the various assets of the trust and how they are being administered, invested and distributed.

In other words, the beneficiaries are the rightful owners of the assets and therefore have a right to them, but the trustees take care of the administration until, for example, a child turns 25. A beneficiary cannot dispose of the assets until he or she takes control of them.

Generally speaking, a Trustee (who is not also the Grantor) cannot appoint a Power of Attorney to take over the Trustee's duties or responsibilities, unless this is something that is directly permitted by the Trust Deed or a court order.

Trustees have a duty to beneficiaries to disclose certain information; however, simply because you are a beneficiary, you cannot demand access to all the information regarding a trust.

Right to information.Current and remainder beneficiaries have the right to be provided enough information about the trust and its administration to know how to enforce their rights.

In the case of a good Trustee, the Trust should be fully distributed within twelve to eighteen months after the Trust administration begins. But that presumes there are no problems, such as a lawsuit or inheritance fights.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

The trustee must provide the notice of the right to a trustee's report required by subsection (2)(c) of this section at the end of the six-month period if the beneficiary has not received distribution of the specific item of property or specific amount of money before the end of the period.