Utah Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act

Description

How to fill out Designation Of Successor Custodian By Donor Pursuant To The Uniform Transfers To Minors Act?

You might spend hours online searching for the legal document template that meets the federal and state requirements you require. US Legal Forms provides a vast array of legal forms that are reviewed by experts.

It is easy to download or print the Utah Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act from the service.

If you have a US Legal Forms account, you can Log In and select the Acquire option. Afterwards, you can complete, edit, print, or sign the Utah Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act. Every legal document template you purchase is yours permanently.

Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make adjustments to the document if necessary. You can complete, edit, and sign and print the Utah Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act. Obtain and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of the purchased form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have selected the correct document template for the area/region of your choice.

- Review the form description to confirm that you have chosen the right form.

- If available, use the Review option to check the document template as well.

- To find another version of your form, use the Lookup section to locate the template that suits your requirements.

- Once you have found the template you desire, click Purchase now to proceed.

Form popularity

FAQ

UTMA allows the property to be gifted to a minor without establishing a formal trust. The donor or a custodian manages the property for the minor's benefit until the minor reaches a certain age. Once the child reaches a specified age set by the state, the child will have full control over the property.

TO WHOSE ESTATE DOES THE CUSTODIAL ACCOUNT BELONG? Custodial accounts are part of the minor's estate in the event of the minor's or custodian's death prior to the minor attaining distribution age unless you, as the donor who established the custodial account, are also the custodian.

The Uniform Gifts to Minors Act provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point they assume control of the account.

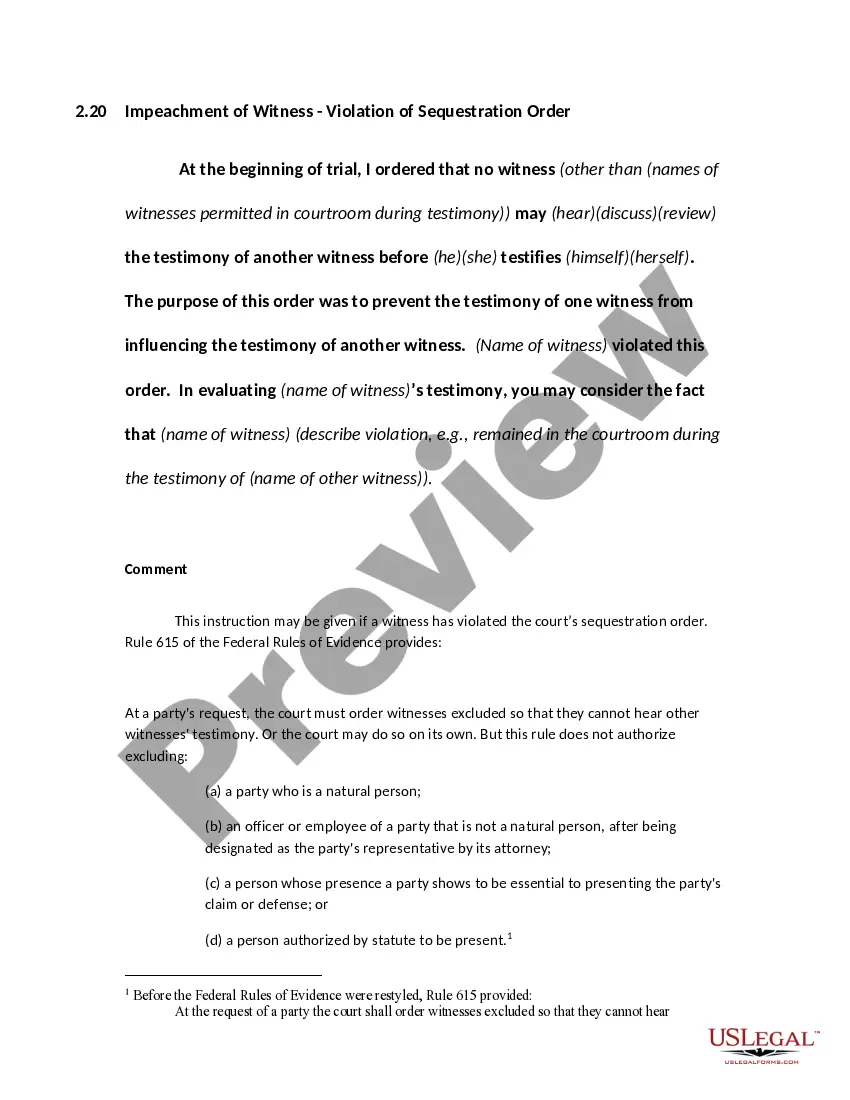

Form used to designate a successor custodian for either an UGMA or UTMA account in the event that the original custodian resigns, dies, is incapacitated or is removed as custodian.

Generally, when UTMA or UGMA accounts (UTMA/UGMA Accounts) are established, the beneficiary (a minor) becomes the owner of the property at the time of the gift; however, the custodian manages and invests the property on the beneficiary's behalf until the beneficiary reaches the age of majority, at which point the ...

Only one custodian, one beneficiary (i.e., minor) and one successor custodian* can be assigned to an account. *A successor custodian is highly recommended in case of custodian's death.

If a donor acting as the custodian dies before the account terminates, the account value will be included in the donor's estate for estate tax purposes. If a minor dies before the age of majority, a custodial account is considered part of the minor's estate and is distributed ing to state law.

If appointing a new custodian, the signature of the previous custodian, a death certificate, or an official court document must be provided. If the former minor's legal name has changed, please provide the previous and new names where indicated.