Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

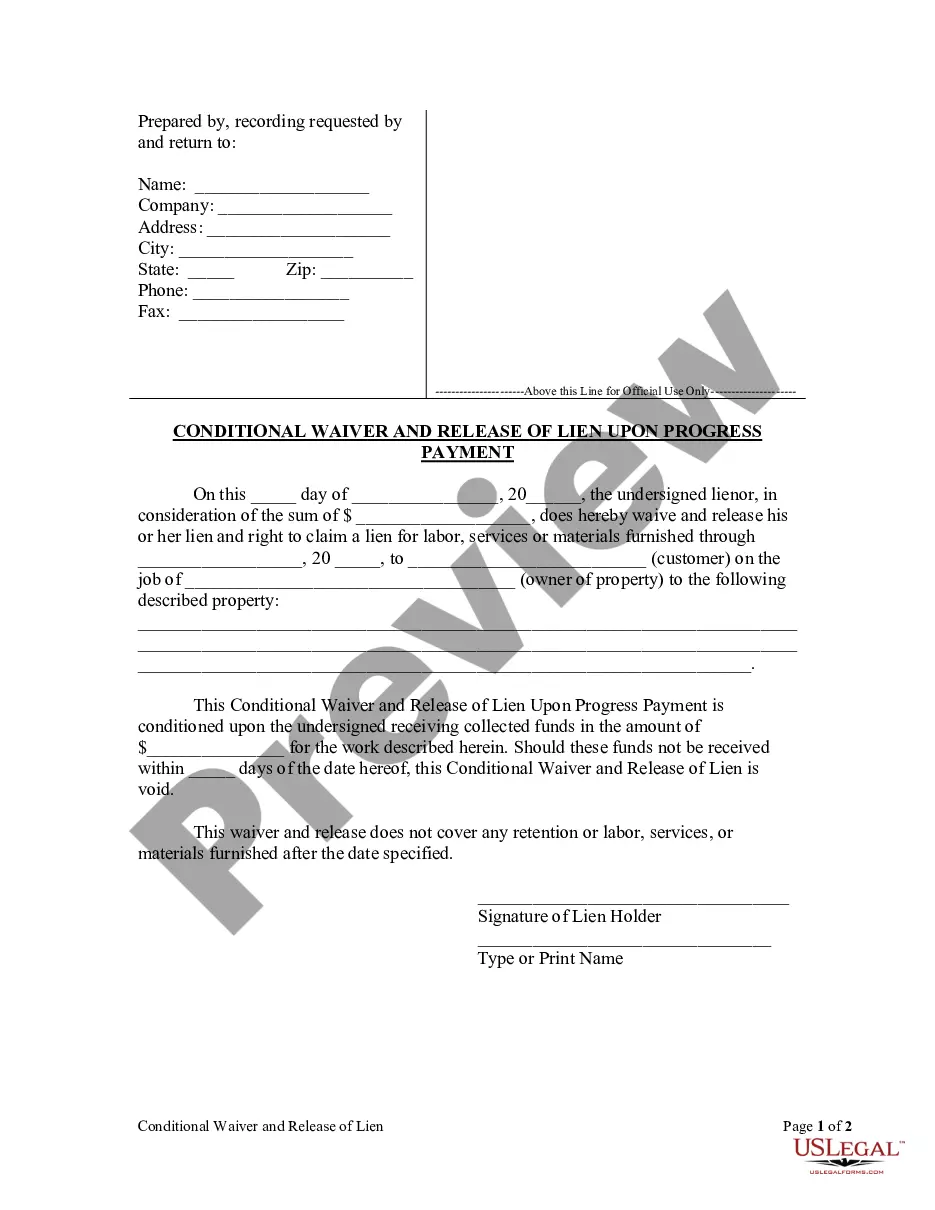

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

Are you in the situation where you need documents for both professional or personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones is not simple.

US Legal Forms offers a plethora of form templates, such as the Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor, that are designed to comply with state and federal regulations.

If you locate the correct form, simply click Buy now.

Choose the payment plan you prefer, provide the necessary information to process your payment, and finalize the order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor at any time if needed. Click the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct area/region.

- Utilize the Review feature to examine the form.

- Check the summary to confirm that you have selected the right form.

- If the form does not meet your requirements, use the Search section to find the template that suits your needs.

Form popularity

FAQ

Writing a power of attorney letter involves creating a clear and concise document that specifies the powers you are granting. Start by identifying yourself and the person you are appointing, and include specific details about the powers being granted, such as the Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor. Utilize templates and resources from platforms like USLegalForms to ensure that your letter is legally sound and comprehensive.

Yes, in Oregon, a power of attorney typically needs to be notarized to be legally binding. This requirement helps to prevent fraud and ensures that the document is accepted by banks and other institutions. If you are creating an Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor, make sure to follow the notarization rules to safeguard your interests. USLegalForms offers reliable resources to help you navigate this process effectively.

Not all power of attorneys must be notarized, but notarization is recommended for most situations to enhance validity and acceptance. In Oregon, specific types of powers, like the Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor, often require notarization to ensure proper execution. To avoid any legal complications, using a streamlined service like USLegalForms can ensure you meet all necessary requirements.

Yes, a power of attorney (POA) generally needs to be notarized in Oregon to be valid. This notary requirement ensures that the document is authenticated and the signer's identity is verified. However, if you are using the Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor, it is crucial to follow specific guidelines for notarization to ensure your executor’s authority is recognized. Consider using USLegalForms to access the right templates and guidance.

To grant someone power of attorney in Oregon, you need to complete a power of attorney form. This document should clearly outline the powers you are giving, including the Oregon Irrevocable Power of Attorney for Transfer of Stock by Executor if applicable. It is important to sign the form in the presence of a notary public or witness, depending on your needs. Using a reliable platform like USLegalForms can help you create a compliant document easily.

Executors have a fiduciary obligation to safeguard the value of the estate assets and manage them on behalf of the beneficiaries. The executor can sell shares to prevent or minimize losses unless the will directs that the shares be transferred directly to a beneficiary.

To facilitate a transfer, the executor will need a copy of the decedent's will or a letter from the probate court confirming that the beneficiary in question is indeed the person entitled to receive the shares. The executor must then send these documents to a transfer agent, who can complete the transfer of ownership.

An executor will administer your will when you die making sure your wishes are carried out; an attorney protects your interests while you're still alive.

Irrevocable Trust DisadvantagesInflexible structure. You don't have any wiggle room if you're the grantor of an irrevocable trust, compared to a revocable trust.Loss of control over assets. You have no control to retrieve or even manage your former assets that you assign to an irrevocable trust.Unforeseen changes.

An executor can appoint an attorney to act in their place even if they have intermeddled in the estate, so as long as the grant of probate has not been applied for.