Vermont Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act

Description

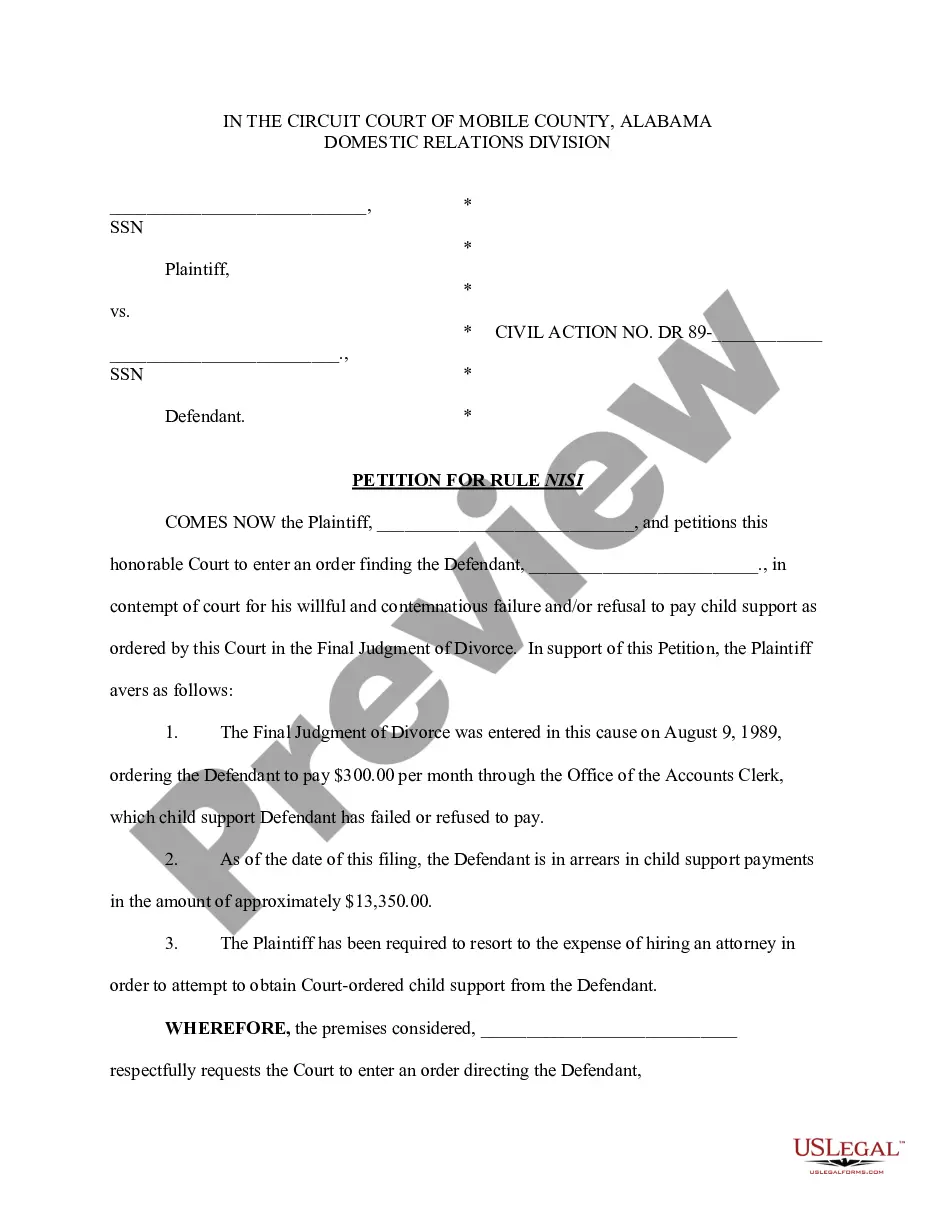

How to fill out Designation Of Successor Custodian By Donor Pursuant To The Uniform Transfers To Minors Act?

If you wish to full, down load, or print out lawful document web templates, use US Legal Forms, the greatest assortment of lawful forms, which can be found on-line. Utilize the site`s simple and easy hassle-free research to discover the paperwork you will need. Different web templates for organization and individual purposes are sorted by categories and states, or search phrases. Use US Legal Forms to discover the Vermont Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act in a number of click throughs.

In case you are already a US Legal Forms buyer, log in to the profile and then click the Download switch to have the Vermont Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act. You can also access forms you previously acquired in the My Forms tab of your respective profile.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for your right area/land.

- Step 2. Make use of the Review option to examine the form`s content material. Don`t neglect to see the description.

- Step 3. In case you are unsatisfied using the type, use the Look for industry near the top of the screen to locate other versions of the lawful type web template.

- Step 4. Upon having found the form you will need, click the Get now switch. Opt for the prices strategy you favor and put your qualifications to register to have an profile.

- Step 5. Process the transaction. You can use your credit card or PayPal profile to accomplish the transaction.

- Step 6. Pick the file format of the lawful type and down load it on your own gadget.

- Step 7. Complete, modify and print out or sign the Vermont Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act.

Each lawful document web template you acquire is yours eternally. You might have acces to every single type you acquired in your acccount. Click the My Forms segment and select a type to print out or down load again.

Contend and down load, and print out the Vermont Designation of Successor Custodian by Donor Pursuant to the Uniform Transfers to Minors Act with US Legal Forms. There are many expert and express-specific forms you can use for your organization or individual demands.

Form popularity

FAQ

Form used to designate a successor custodian for either an UGMA or UTMA account in the event that the original custodian resigns, dies, is incapacitated or is removed as custodian.

If you want to transfer cash, stocks, or bonds, a UGMA would fit the purpose. If you want to transfer real estate, or if you want more flexibility in how the assets are used, then a UTMA may be the better option.

No, a parent cannot take money out of a UTMA account. The assets remain under the control of the custodian until the minor reaches the majority age. At that time, all remaining funds in the account are turned over to the beneficiary, free from further court supervision or management.

Cons. Greater impact on financial aid. Because they're held in the name of the child, UTMA/UGMA accounts hurt financial aid eligibility more than comparable 529 plans. Money becomes the child's at majority.

UTMA withdrawals and tax rules UTMA accounts have no withdrawal limits. However, the funds belong to the minor from the moment of transfer, so the funds can only be used for the direct benefit of the minor.

All states have adopted the UGMA. On the other hand, Vermont and South Carolina do not allow UTMA accounts. Donors should examine state law carefully, as the specific implementation of both the UGMA and the UTMA can differ from state to state.

A Letter of Successor is a document that appoints a person or institution to take over should the trustee or custodian die, resign, or otherwise become unable to act.

A UGMA account is limited to purely financial products such as cash, stocks, mutual funds, bonds, other securitized instruments and insurance policies. A UTMA account, on the other hand, can hold any form of property, including real property and real estate.