Oregon Seller's Affidavit of Nonforeign Status

Description

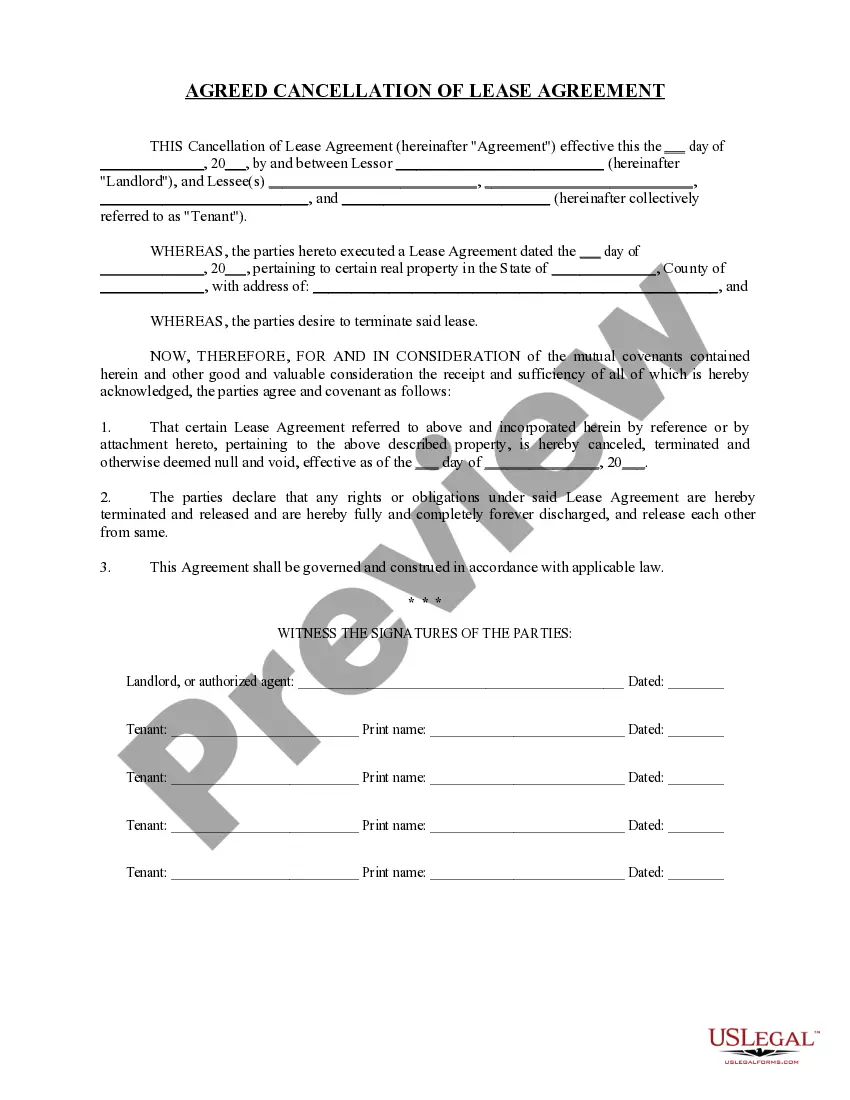

How to fill out Seller's Affidavit Of Nonforeign Status?

Choosing the best authorized papers template can be quite a struggle. Of course, there are a variety of layouts accessible on the Internet, but how do you get the authorized type you want? Take advantage of the US Legal Forms site. The assistance provides a large number of layouts, like the Oregon Seller's Affidavit of Nonforeign Status, which you can use for company and private needs. Every one of the forms are inspected by pros and meet up with federal and state demands.

Should you be already listed, log in in your account and click on the Obtain switch to have the Oregon Seller's Affidavit of Nonforeign Status. Utilize your account to search throughout the authorized forms you might have ordered in the past. Check out the My Forms tab of the account and acquire yet another backup of the papers you want.

Should you be a fresh consumer of US Legal Forms, listed here are basic directions that you should stick to:

- Initial, make sure you have selected the right type for your city/area. You can examine the shape utilizing the Review switch and look at the shape information to ensure this is the best for you.

- If the type does not meet up with your requirements, utilize the Seach field to find the proper type.

- When you are certain that the shape is suitable, click on the Acquire now switch to have the type.

- Choose the costs prepare you would like and type in the required info. Build your account and pay money for your order using your PayPal account or charge card.

- Opt for the document file format and download the authorized papers template in your product.

- Full, revise and printing and indication the obtained Oregon Seller's Affidavit of Nonforeign Status.

US Legal Forms may be the most significant local library of authorized forms where you can find different papers layouts. Take advantage of the company to download professionally-produced files that stick to condition demands.

Form popularity

FAQ

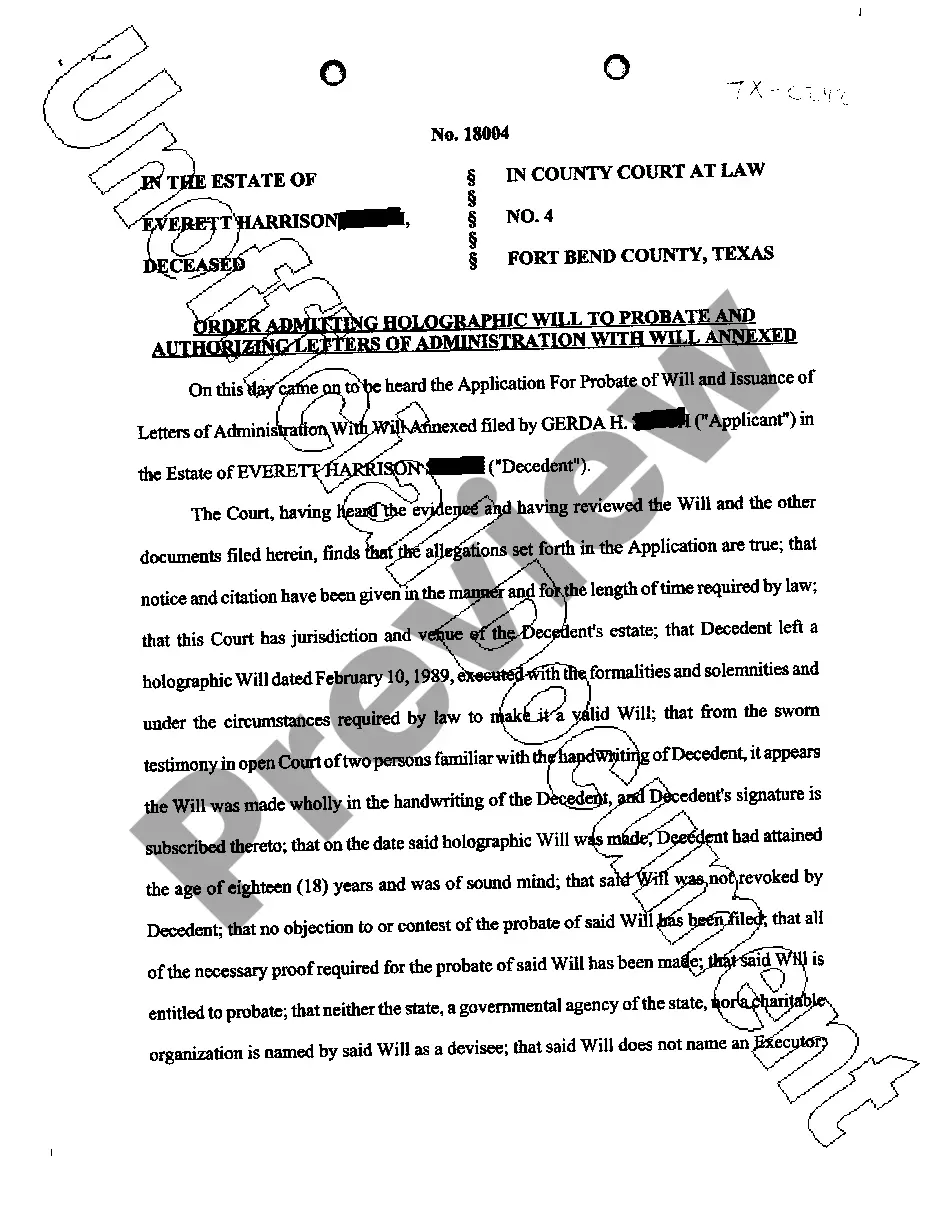

With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign.

Qualified Substitute is the Default. The seller will then manually complete Paragraph 3B and provide the form to the title or escrow company acting as the qualified substitute. The title or escrow company may use C.A.R. Form QS, or its own form, to satisfy its obligation to notify the buyer.

If you're applying for a FIRPTA withholding certificate for reasons one, two, or three, you should file Form 8288-B (Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests).

A buyer or other transferee of a USRPI must complete and file Part I of Form 8288 to report and transmit the amount withheld. A corporation, QIE, or fiduciary that is required to withhold tax under section 1445(e) must complete and file Part II of Form 8288 to report and transmit the amount withheld.

The only fail-safe protection is to have the seller sign a ?FIRPTA Affidavit? ? also known as ?Affidavit of Non Foreign Status?.

Therefore, Buyers and Sellers should use a Settlement Agent that is knowledgeable and experienced in this law. It is the buyer's responsibility to complete forms 8288 and the 8288A these require the Buyer's name, address and ITIN as they are the ?Withholding Agent?.

If you purchase publicly traded stock in a company owned by a foreign person or corporation, you don't have to pay FIRPTA withholding taxes. This rule also applies to partnerships and trusts that purchase publicly traded stock in foreign corporations.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.