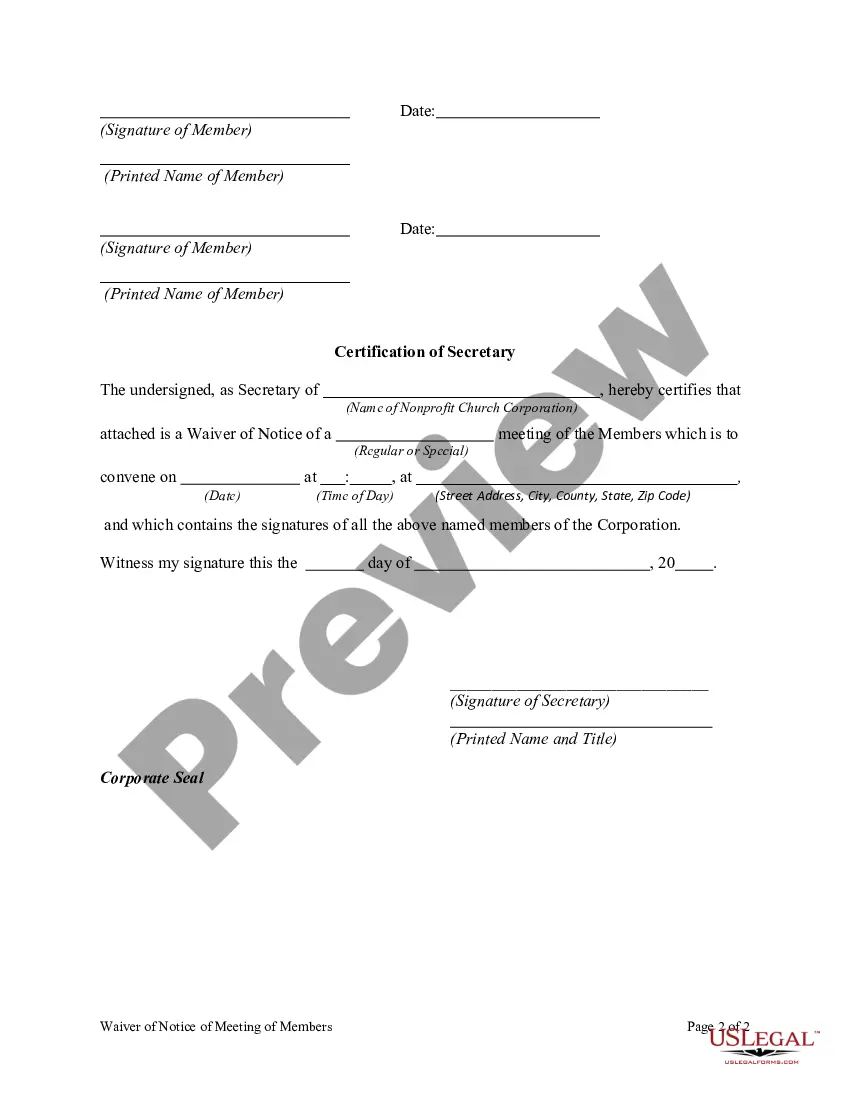

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Oregon Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

You can spend several hours online trying to locate the official document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of official forms which can be assessed by experts.

You can effortlessly obtain or print the Oregon Waiver of Notice of Meeting of members of a Nonprofit Church Corporation through the services.

If you want to acquire another version of the form, utilize the Search area to find the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain option.

- Then, you can complete, edit, print, or sign the Oregon Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

- Every official document template you buy is yours indefinitely.

- To get an additional copy of any purchased form, visit the My documents tab and click on the relevant option.

- If you’re using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, make sure you have selected the correct document template for the area or city of your choice.

- Check the form description to ensure you have picked the right document.

Form popularity

FAQ

'Notice of presentation waived' indicates that members have agreed to proceed with discussions or decisions without the usual advance notice. This concept ties closely to the Oregon Waiver of Notice of Meeting of members of a Nonprofit Church Corporation, where the expectation of formal notice is eliminated. This agreement fosters a collaborative environment where members can quickly engage in dialogue and take action as needed.

Yes, many non-profits, including those structured as nonprofit church corporations in Oregon, are subject to the Open Meetings Act. This means they must conduct meetings in a manner that is accessible to the public. It's essential for these organizations to understand their obligations to ensure transparency in their operations. The Oregon Waiver of Notice of Meeting of members of a Nonprofit Church Corporation can help streamline meeting processes while maintaining compliance.

Rather than dissolution, an organization may determine that dormancy, putting the nonprofit into an inactive state, may be the best option.

Non-profit LLC operating agreements specify that the limited liability company cannot violate the bylaws or restrictions of its member non-profit 501(c)(3) corporation.

What's the difference in bylaws vs operating agreement? Bylaws are internal governing documents for corporations, while an operating agreement lays out internal operating procedures for an LLC.

Yes. An organization can suspend its operations for a short period without losing its 501(c)(3) status.

Of the 150,000 nonprofit corporations in California, many are dormant. If these inactive corporations fail to make routine filings with the Secretary of State (SOS) and Franchise Tax Board (FTB), they risk triggering a series of increasingly unfortunate events.

A nonprofit corporation can have its powers, rights and privileges in California suspended in two ways: (1) by the Secretary of State for failure to file the required Statement of Information; and/or (2) by the Franchise Tax Board for failure to file a tax return and/or failure to pay taxes, penalties or interest.

A 501(c)(3) eligible nonprofit board of directors in Oregon MUST: Have at least three board members that are not related to each other. Elect the following members: president and secretary.

The last two years have seen countless businesses run out of time and file bankruptcy. Fortunately, most nonprofits can hold on2026even if it means putting your programs on hiatus until you can correct some things.