Oregon Unrestricted Charitable Contribution of Cash

Description

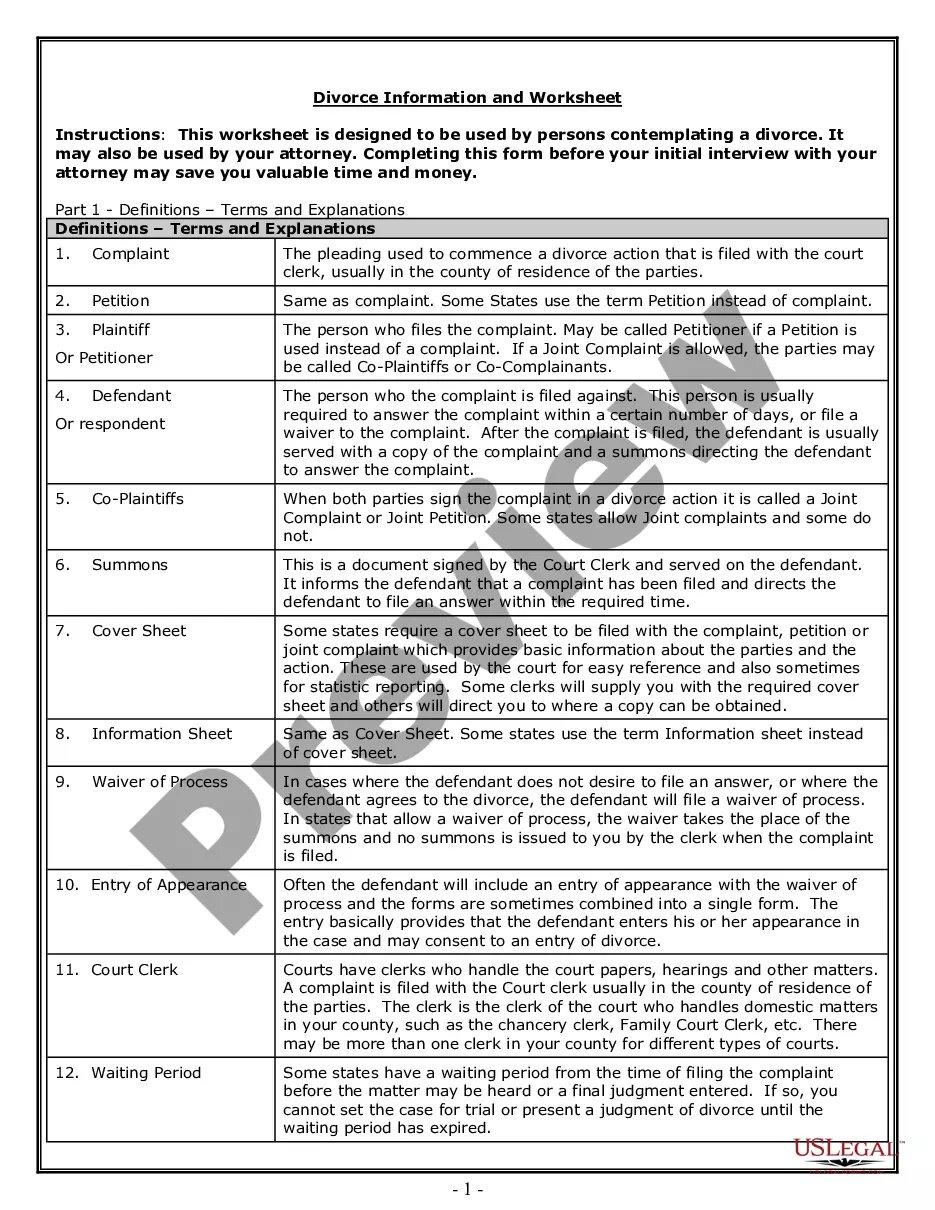

How to fill out Unrestricted Charitable Contribution Of Cash?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms such as the Oregon Unrestricted Charitable Contribution of Cash in just a few minutes.

If you possess a membership, Log In and download the Oregon Unrestricted Charitable Contribution of Cash from the US Legal Forms collection. The Download button will appear on each document you view. You can access all previously downloaded forms in the My documents section of your account.

To utilize US Legal Forms for the first time, here are some straightforward instructions to help you get started: Ensure you have selected the correct form for your specific area/region. Click the Review button to evaluate the form's content. Check the form description to confirm you have chosen the right document. If the form does not meet your needs, use the Search box at the top of the screen to find the one that does. If you are satisfied with the document, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your details to register for an account. Process the transaction. Use a Visa or Mastercard or PayPal account to complete the transaction. Choose the format and download the document to your device. Make changes. Fill out, edit, print, and sign the downloaded Oregon Unrestricted Charitable Contribution of Cash.

- Each template you added to your account has no expiration date and belongs to you indefinitely.

- Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire.

- Access the Oregon Unrestricted Charitable Contribution of Cash through US Legal Forms, one of the most extensive libraries of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

In 2022, taxpayers must return to itemizing their deductions on Schedule A in order to take a charitable tax deduction. The special 2021 rules were not extended. For 2022, the usual 60% of AGI ceiling on charitable cash contributions to qualified charities has been restored.

The availability of charitable and other allowable itemized deductions is limited to resident taxpayers who itemize their federal income tax deductions in DC, GA, ID, KS, ME, MD, MO, NE, NM, ND, OK, SC and VA; other states permit resident taxpayers to itemize state income tax deductions and deduct qualified charitable ...

Taxpayers can donate all, or a portion, of their personal income tax refund to any or all of the 29 charities approved by the Charitable Checkoff Commission. Taxpayers need to use Form OR-DONATE to designate the amount of their refund to donate to charity. Charities are rotated on Form OR-DONATE every two years.

When you make donations to public organizations such as churches, educational institutions and hospitals, your total charitable deduction (including both cash and noncash donations) cannot exceed 50% of your adjusted gross income (AGI).

If you itemize, you can deduct a part of your medical and dental expenses, amounts you paid for certain taxes, inter- est, gifts to charity, and certain miscellaneous expenses. Don't include items that you deducted elsewhere on your federal or Oregon tax return forms or schedules, such as Schedule C, C-EZ, E, or F.

Ground rules for giving Request a receipt if you donate $250 or more to a single charity. If the donation is in cash, regardless of amount, you'll need a receipt or supporting bank records. Get an independent, written appraisal for gifts of property in excess of $5,000 ($10,000 for closely held stock).

?Qualified Charitable Distributions (QCDs) In addition to the benefits of giving to UCP Oregon, a QCD excludes the amount donated from taxable income, which is unlike regular withdrawals from an IRA.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.