Oregon Restricted Endowment to Educational, Religious, or Charitable Institution

Description

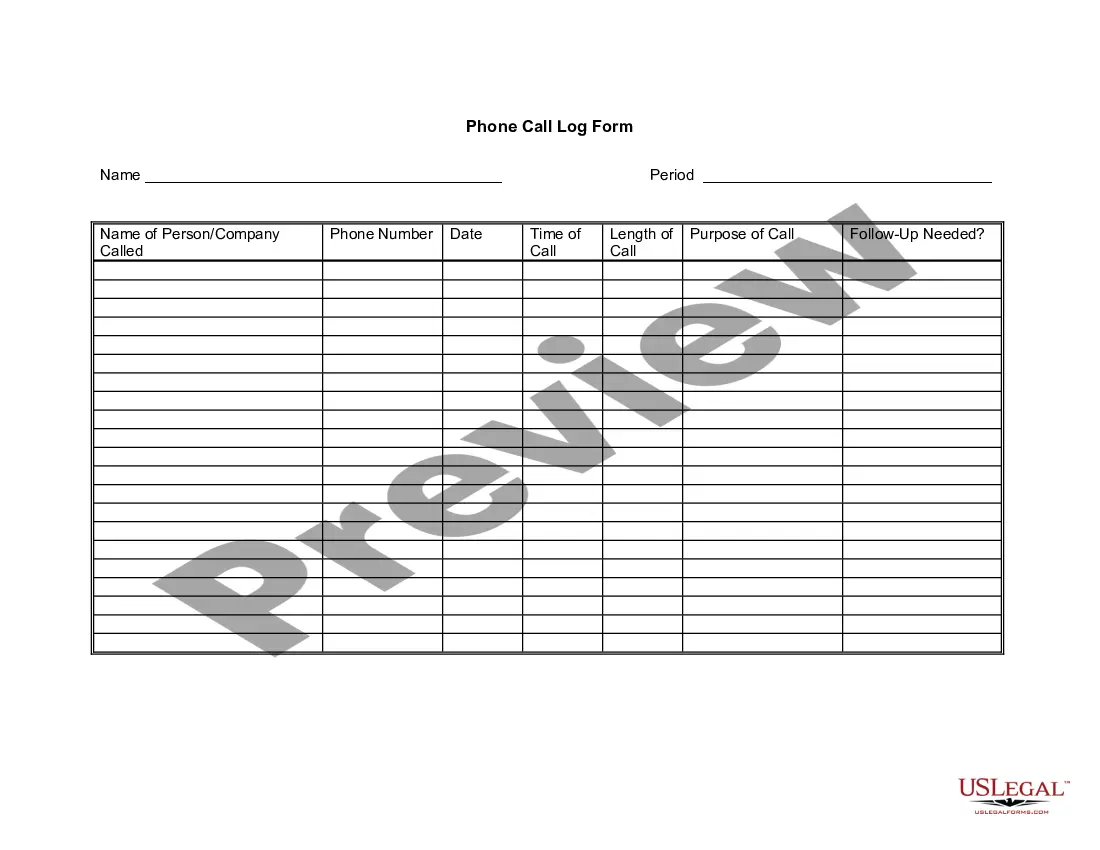

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

If you wish to finalize, acquire, or produce authentic document templates, utilize US Legal Forms, the most extensive collection of authentic varieties, that can be accessed online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for businesses and specific purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Oregon Restricted Endowment to Educational, Religious, or Charitable Institution with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and then click the Download button to access the Oregon Restricted Endowment to Educational, Religious, or Charitable Institution.

- You can also access forms you previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

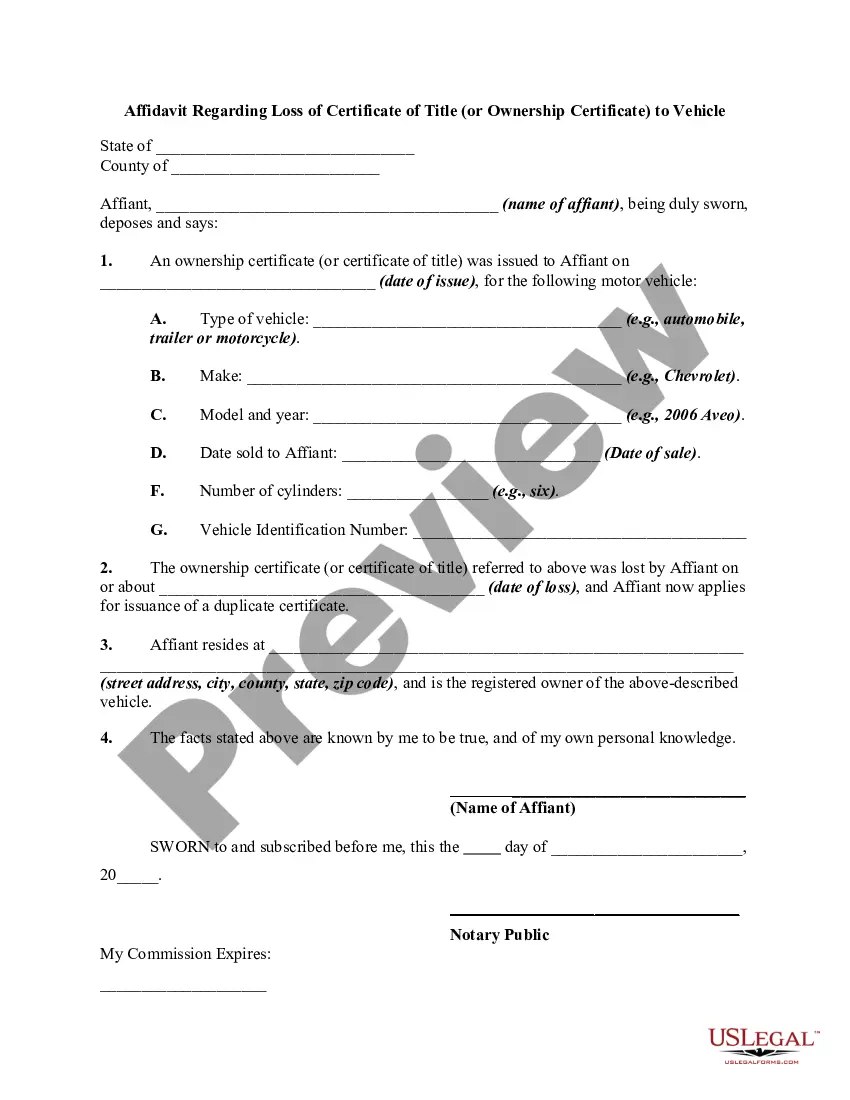

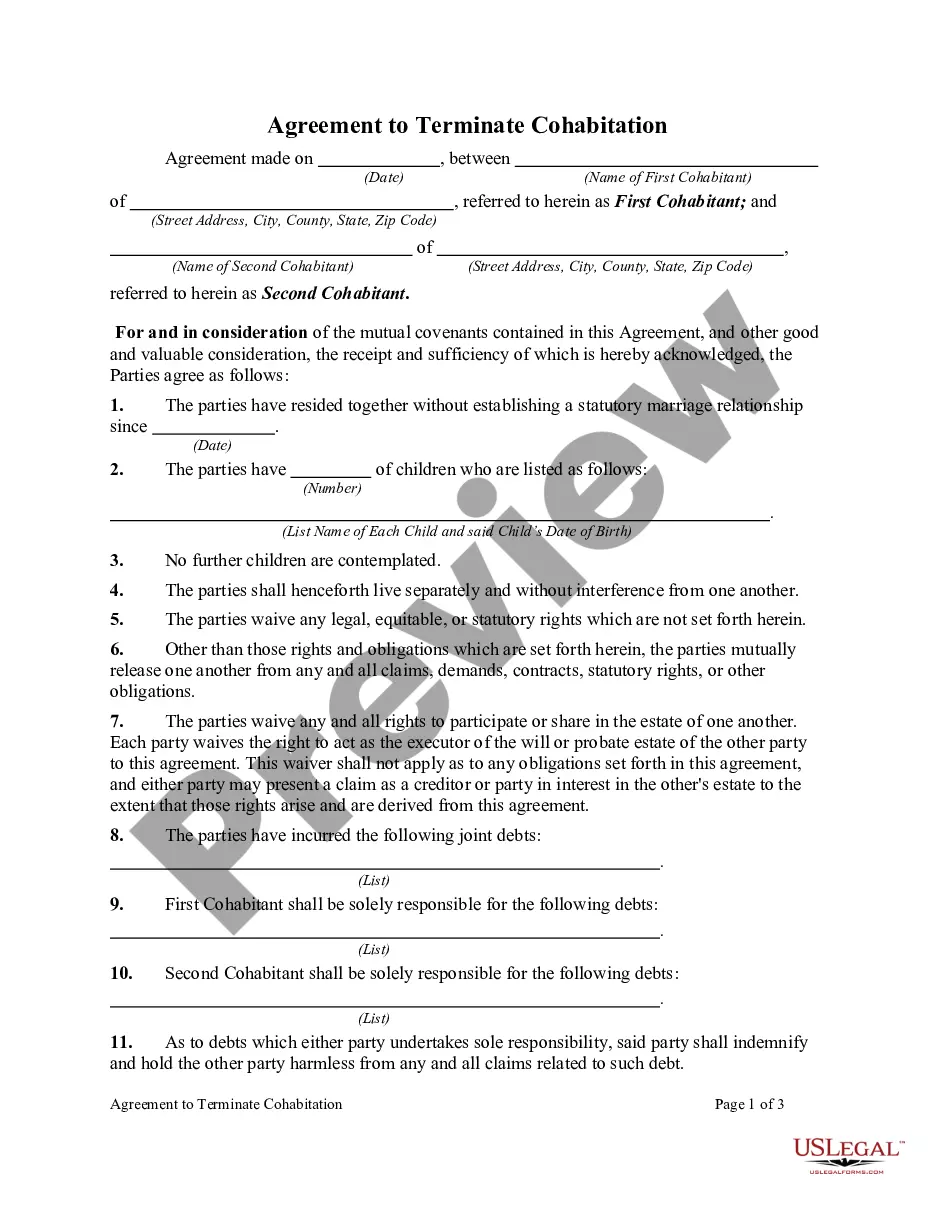

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternate versions of the legitimate form template.

Form popularity

FAQ

A restricted endowment is a financial fund with specific limitations on how the principal can be used. In the case of an Oregon Restricted Endowment to Educational, Religious, or Charitable Institution, the funds are designated for particular purposes, such as educational programs or charitable activities. This ensures that the financial support provided is used in a way that honors the donor's intent and meets legal requirements.

To create a journal entry for releasing restricted funds from an Oregon Restricted Endowment to Educational, Religious, or Charitable Institution, you will typically debit the restricted fund account and credit the appropriate expense or designated account. This entry ensures proper accounting for the funds being used according to the terms set forth in the endowment agreement. Always confirm with your financial expert to maintain accurate records.

Spending restricted funds from an Oregon Restricted Endowment to Educational, Religious, or Charitable Institution must align with the specific purpose outlined in the endowment agreement. Fund usage is often monitored to ensure compliance, and any spending should be transparent. If you have questions on how to manage these funds effectively, consider utilizing UsLegalForms to find relevant resources and forms.

Yes, restricted funds can be transferred, but only under specific conditions. When dealing with an Oregon Restricted Endowment to Educational, Religious, or Charitable Institution, you must adhere to the stipulations of the original endowment agreement. Transferring these funds usually requires approval from relevant authorities and may involve complex legal steps.

To release restricted funds from an Oregon Restricted Endowment to Educational, Religious, or Charitable Institution, you must follow the guidelines set forth in the endowment agreement. Typically, this process involves submitting a formal request to the governing body overseeing the endowment. It's crucial to provide all necessary documentation to justify the release, ensuring compliance with both legal and ethical standards.

Endowment in charity refers to funds that are invested to provide ongoing support for charitable endeavors. This approach not only maximizes the impact of charitable gifts but also ensures long-term sustainability for the beneficiaries. By leveraging the concept of the Oregon Restricted Endowment to Educational, Religious, or Charitable Institution, charities can create a reliable source of funding that withstands economic fluctuations.

An endowed donation is a contribution made to establish an endowment fund, with specific instructions on how the income should be used. This type of donation supports longevity and sustainability for educational or charitable initiatives. When placing your funds in an Oregon Restricted Endowment to Educational, Religious, or Charitable Institution, you ensure that your generosity creates lasting benefits for your chosen cause.

In the context of donations, an endowment refers to a contribution that is intended to be invested for long-term growth, with the income generated used to support specific purposes. This form of support ensures that a donation continues to provide benefits far into the future. Therefore, understanding the Oregon Restricted Endowment to Educational, Religious, or Charitable Institution can enhance your impact as a donor.

A charitable endowment represents a fund established to provide perpetual support for charitable activities. These endowments ensure a steady flow of income to support causes over time, aligning with the principles of sustainability. The Oregon Restricted Endowment to Educational, Religious, or Charitable Institution exemplifies how funds can serve specific philanthropic purposes while creating a lasting impact.

A restricted endowment is designated for a specific purpose, while an unrestricted endowment can be used for any institutional need. This distinction is vital for institutions relying on the Oregon Restricted Endowment to Educational, Religious, or Charitable Institution, as it dictates how funds can be utilized and impacts long-term planning for educational and charitable initiatives.