Oregon Restricted Endowment to Religious Institution

Description

How to fill out Restricted Endowment To Religious Institution?

Are you currently in a scenario where you will require documents for both corporate and personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, including the Oregon Limited Endowment to Religious Institution, which are designed to meet state and federal requirements.

If you find the appropriate form, click on Buy now.

Select the pricing plan you want, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Oregon Limited Endowment to Religious Institution template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

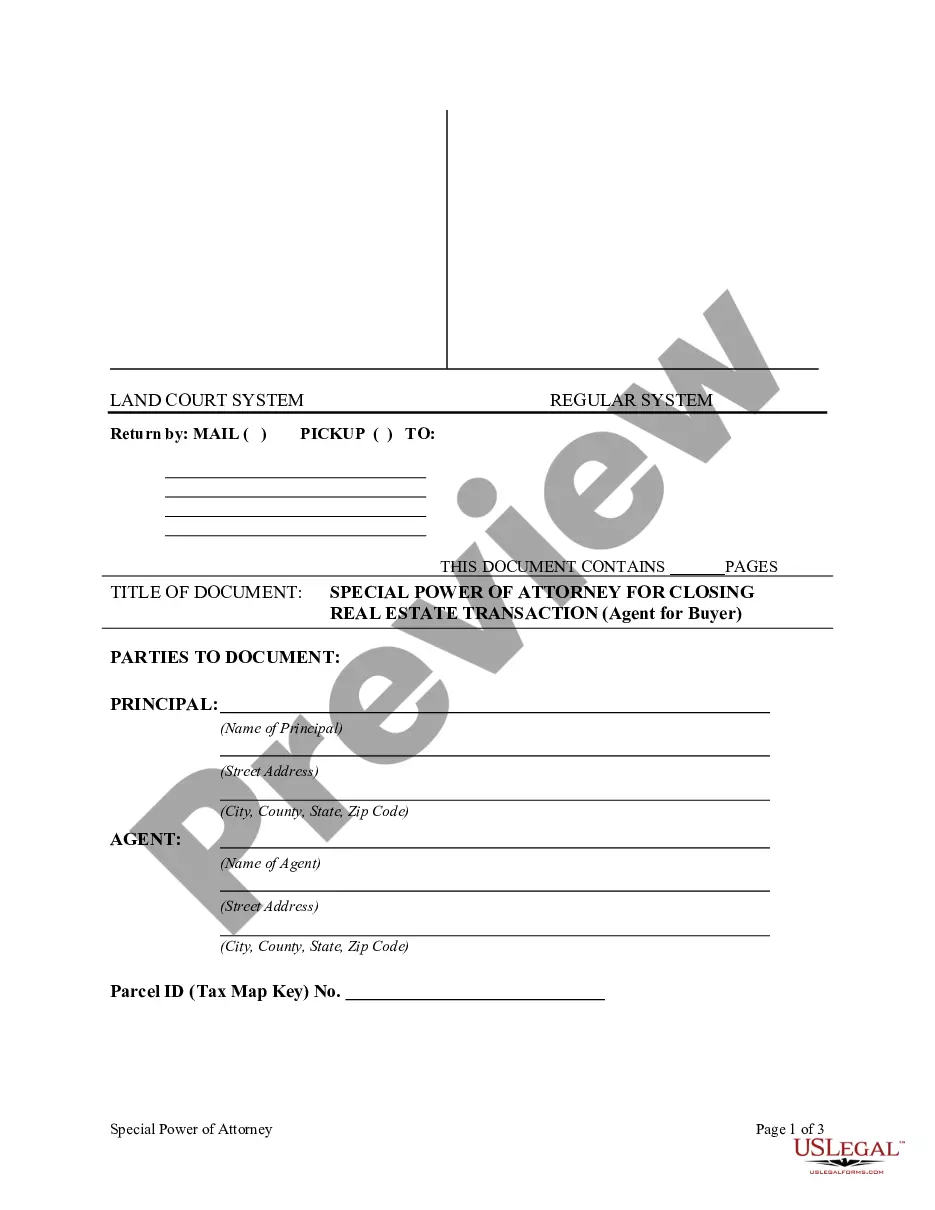

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to find the form that fits your needs and requirements.

Form popularity

FAQ

An endowment typically indicates a fund with restrictions on spending, where the principal is preserved indefinitely to generate income over time. Conversely, a quasi endowment allows for some expenditures from the principal, giving organizations more leeway. Knowing how the Oregon Restricted Endowment to Religious Institution functions can empower you to choose the right funding structure. This choice can significantly impact your organization's financial health.

The primary difference between quasi and permanent endowment lies in their restrictions. A permanent endowment requires that the principal remains untouched, securing funds for long-term use. On the other hand, a quasi-endowment permits spending from the principal under certain conditions, providing more versatility. The Oregon Restricted Endowment to Religious Institution helps organizations decide which type of endowment best suits their financial goals.

endowment is often not permanently restricted like traditional endowments. It allows organizations to tap into the principal under certain circumstances while retaining the intent behind the fund. With the Oregon Restricted Endowment to Religious Institution, understanding these nuances is vital for proper fund management. Organizations can benefit from quasiendowments by maintaining some flexibility in their financial strategies.

Oregon's endowment refers to various funds established within the state, designed to support specific causes, including education and religious institutions. The Oregon Restricted Endowment to Religious Institution plays a crucial role in funding religious communities while adhering to specific restrictions. These endowments contribute to the stability and sustainability of organizations across Oregon. By knowing the details of these funds, you can make informed decisions about your contributions.

An endowment typically refers to a fund that supports a specific purpose, such as scholarships or building maintenance. In contrast, an unrestricted endowment allows the organization to allocate funds as needed, providing more flexibility. The Oregon Restricted Endowment to Religious Institution often restricts funds for particular uses, creating a clear distinction. Understanding these differences helps organizations better manage their resources.

Endowments can be categorized into various types, including restricted, unrestricted, true, quasi, and term endowments. Restricted endowments, such as the Oregon Restricted Endowment to Religious Institution, focus on specific uses, while unrestricted allow for more flexibility. Understanding these distinctions helps institutions and donors align their goals effectively.

A restricted endowment means that the donated funds are earmarked for specific purposes, limiting how the institution can use them. The Oregon Restricted Endowment to Religious Institution exemplifies this concept, as its funds are directed to particular goals, enhancing accountability and ensuring that donor intent is honored. Such restrictions are vital for maintaining trust between donors and institutions.

The four main types of endowments are true endowments, term endowments, quasi-endowments, and donor-advised funds. True endowments, analogous to the Oregon Restricted Endowment to Religious Institution, maintain the principal indefinitely while supporting specific causes. Each type serves different strategic goals based on donor intent and institutional needs.

The 4% rule is a guideline for spending from an endowment sustainably. It suggests that institutions can withdraw approximately 4% of the fund’s market value each year without exhausting the principal. This rule is particularly relevant for funds like the Oregon Restricted Endowment to Religious Institution, ensuring that the endowment continues to support its intended purpose for generations.

As of recent reports, the University of Oregon has an endowment exceeding $1 billion. This substantial fund is instrumental in supporting various programs and scholarships, including initiatives similar to the Oregon Restricted Endowment to Religious Institution. Such significant endowments help maintain the quality of education and resources available to students and faculty.