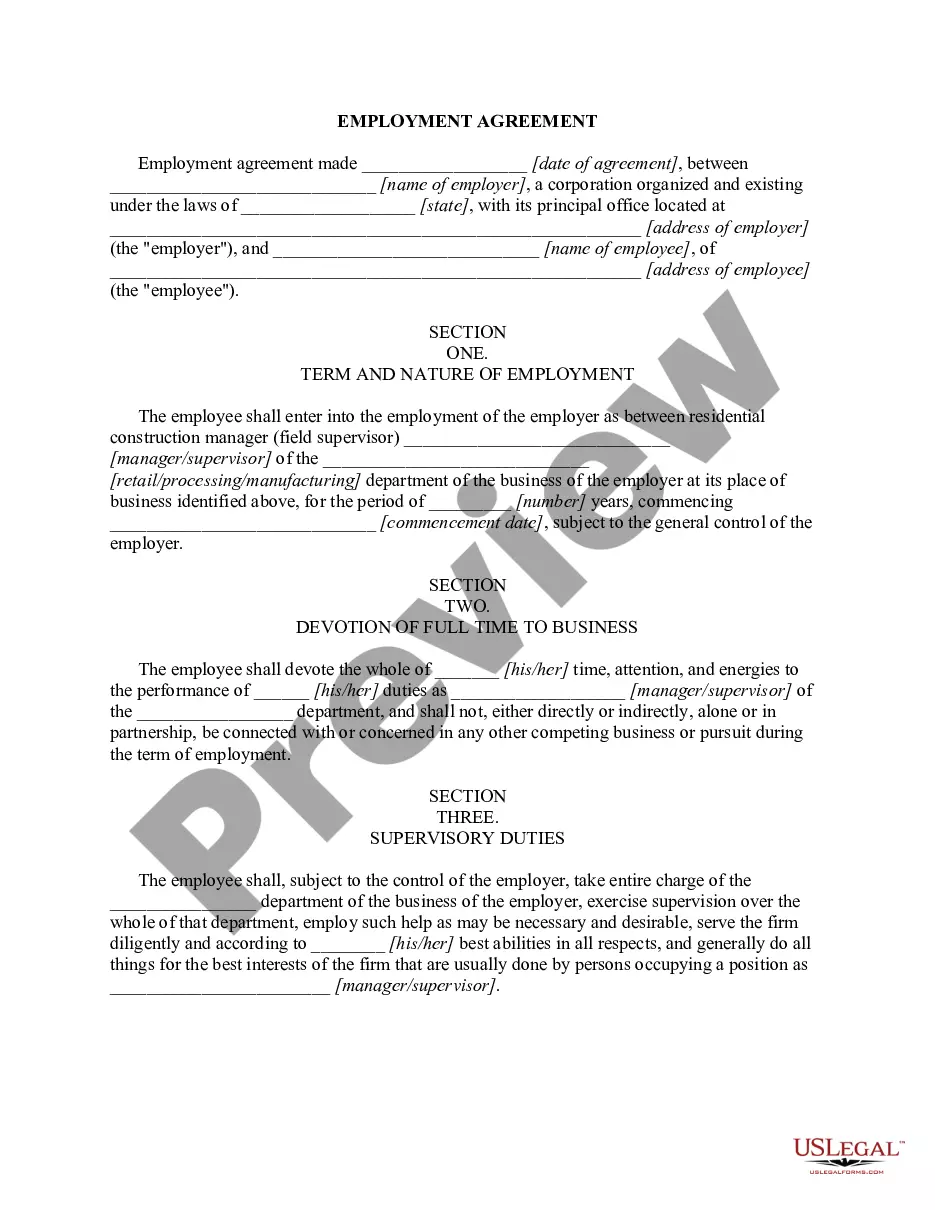

New Jersey Employment Agreement with Construction Worker

Description

How to fill out Employment Agreement With Construction Worker?

You can dedicate countless hours online searching for the sanctioned document template that meets the federal and state requirements you will require.

US Legal Forms provides an extensive collection of legal forms that have been reviewed by experts.

You can obtain or print the New Jersey Employment Agreement with Construction Worker from your service.

If available, utilize the Preview button to check the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the New Jersey Employment Agreement with Construction Worker.

- Each legal document template you obtain is yours forever.

- To receive another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions listed below.

- First, ensure that you have selected the appropriate document template for the region/town of your preference.

- Review the form description to confirm you have chosen the correct document.

Form popularity

FAQ

To be a binding contract, an agreement must have the following: (1) offer and acceptance, (2) the parties must have a "meeting of the minds" about the agreement's essential terms, (3) there must be valid consideration - in other words, there must be mutual obligations from each party to the other, (4) finally, there

The main distinction between an employee or at-will employee and an independent contractor is that the independent contractor is responsible to the principal solely for the result of the work that is the subject of the contract between the parties.

The differences are subtle, but important. An employee usually works as the employer directs them. A contractor runs their own business and provides a service, usually works the hours required to do a task, and has a high level of control over the way they work.

Why Correct Worker Status is Important Determining whether a worker is an independent contractor (IC) or an employee is important because it determines whether payroll taxes (income taxes and FICA taxes) are withheld from the person's payment.

A contract of employment is a legally binding agreement between you and your employer. A breach of that contract happens when either you or your employer breaks one of the terms, for example your employer doesn't pay your wages, or you don't work the agreed hours. Not all the terms of a contract are written down.

More affordable Although you may pay more per hour for an independent contractor, your overall costs are likely to be less. You don't have to withhold taxes, pay for unemployment and workers comp insurance or provide healthcare benefits, nor do you have to cover the cost of office space or equipment.

Types of Employment Contracts: Permanent employment, temporary employment and independent contractors.

The client's HR department has certainly got the wrong end of the stick, as there is no legislation that states that contractors or freelancers gain the right to demand permanent employment after two years. Contractors like Liam are business-to-business service providers.

Typically, an independent contractor operates as an independent business and may perform work for multiple clients. The contractor submits an invoice for completed work and provides their own tools and equipment. The independent contractor is responsible for both the individual and employer side of taxes.

Employment Agreements in New Jersey are enforceable during your employment and after your employment terminates for any reason. New Jersey employment contracts typically contain non-compete, non-solicitation and other covenants that will restrict you from competing in the future against the employer.