Oregon Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

Locating the correct authentic document template may pose challenges. Of course, there are numerous templates available online, but how can you identify the genuine one you require? Utilize the US Legal Forms website. This service provides a vast array of templates, including the Oregon Accounts Receivable - Guaranty, suitable for both business and personal purposes. All forms are verified by professionals and adhere to state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Oregon Accounts Receivable - Guaranty. Use your account to access the legal forms you have previously ordered. Navigate to the My documents section of your account and download another copy of the document you need.

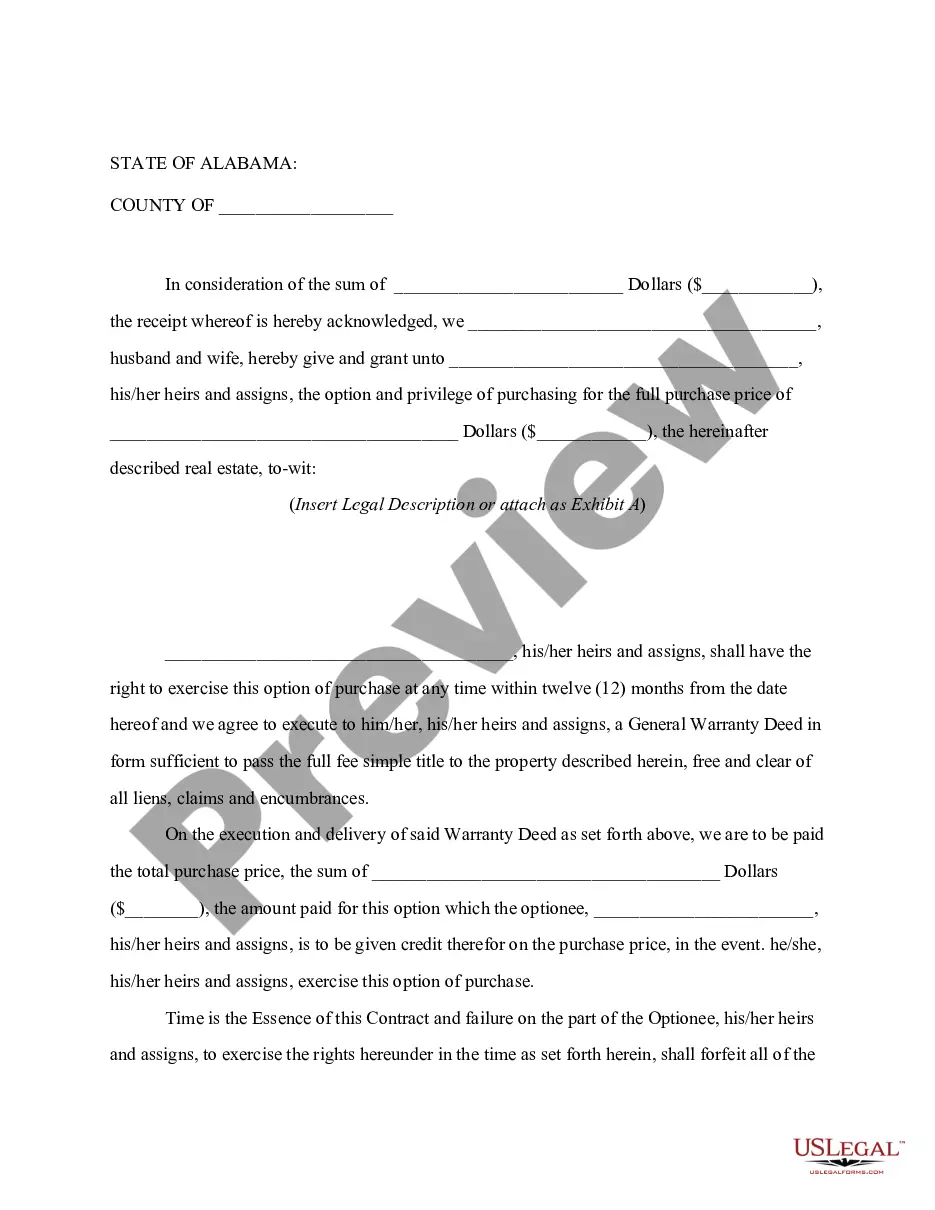

If you are a new user of US Legal Forms, here are some simple steps for you to follow: First, ensure you have selected the correct form for your area/region. You can review the form using the Preview button and examine the form outline to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click the Download now button to acquire the form. Choose the pricing plan you desire and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, revise, print, and sign the acquired Oregon Accounts Receivable - Guaranty.

Overall, US Legal Forms is an excellent resource for obtaining the legal documents you need efficiently.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to download professionally crafted documents that comply with state requirements.

- The platform offers a wide range of templates for different legal needs.

- All documents are reviewed to ensure they meet legal standards.

- Access your previously purchased documents easily.

- The user-friendly interface makes finding and downloading forms simple.

Form popularity

FAQ

The 3-year rule in Oregon refers to the time frame during which certain debts can be collected before they become time-barred. Specifically, it relates to the collection of debts that are not secured by a judgment. After three years, creditors may have limited options to enforce collection. Learning about Oregon Accounts Receivable - Guaranty can help you understand how this rule impacts your financial obligations.

If you need to contact the Oregon Department of Revenue for issues related to Other Agency Accounts, you can reach them at (503) 378-4988. They can assist you with various inquiries regarding tax collection and accounts receivable. For comprehensive support regarding Oregon Accounts Receivable - Guaranty, consider exploring our platform for additional resources.

In Oregon, debt collectors can pursue old debts for a period of six years, known as the statute of limitations. This means that after six years, a creditor cannot take you to court to collect the debt. However, the debt may still affect your credit report for a longer period. Utilizing resources like Oregon Accounts Receivable - Guaranty can provide clarity on your debt situation and your rights.

GAAP, or Generally Accepted Accounting Principles, outlines the standards for reporting accounts receivable. These rules ensure transparency and accuracy in financial statements, particularly concerning Oregon Accounts Receivable - Guaranty. Adhering to GAAP helps businesses maintain compliance and build trust with stakeholders regarding their financial health.

The 80/20 rule in accounts receivable states that approximately 80% of your revenue comes from 20% of your customers. Understanding this principle can help prioritize efforts in managing Oregon Accounts Receivable - Guaranty. By focusing on your most valuable customers, you can optimize your collections strategy and enhance overall profitability.

In Oregon, debt collectors can pursue collections for a period of up to six years for most debts. This timeframe is crucial for understanding your rights under Oregon Accounts Receivable - Guaranty laws. If you receive communication from a debt collector, it’s essential to know your rights and to respond appropriately to protect yourself.

The 5 C's of accounts receivable management are character, capacity, capital, collateral, and conditions. These elements help assess the creditworthiness of your customers in the context of Oregon Accounts Receivable - Guaranty. By evaluating these factors, you can make informed decisions about extending credit and managing your accounts receivable more effectively.

Yes, Oregon offers various debt relief programs designed to assist residents facing financial challenges. These programs can help with managing debts, including those related to Oregon Accounts Receivable - Guaranty. It's important to explore your options and understand the eligibility criteria for each program to find the best fit for your situation.

In Oregon, a debt generally becomes uncollectible after six years, according to the statute of limitations. This timeframe starts from the date of the last payment or acknowledgment of the debt. It is crucial to keep track of your accounts receivable and act promptly to recover outstanding debts. Using an Oregon Accounts Receivable - Guaranty can enhance your efforts in collecting these debts before they reach that uncollectible status.