Oregon Accounts Receivable - Contract to Sale

Description

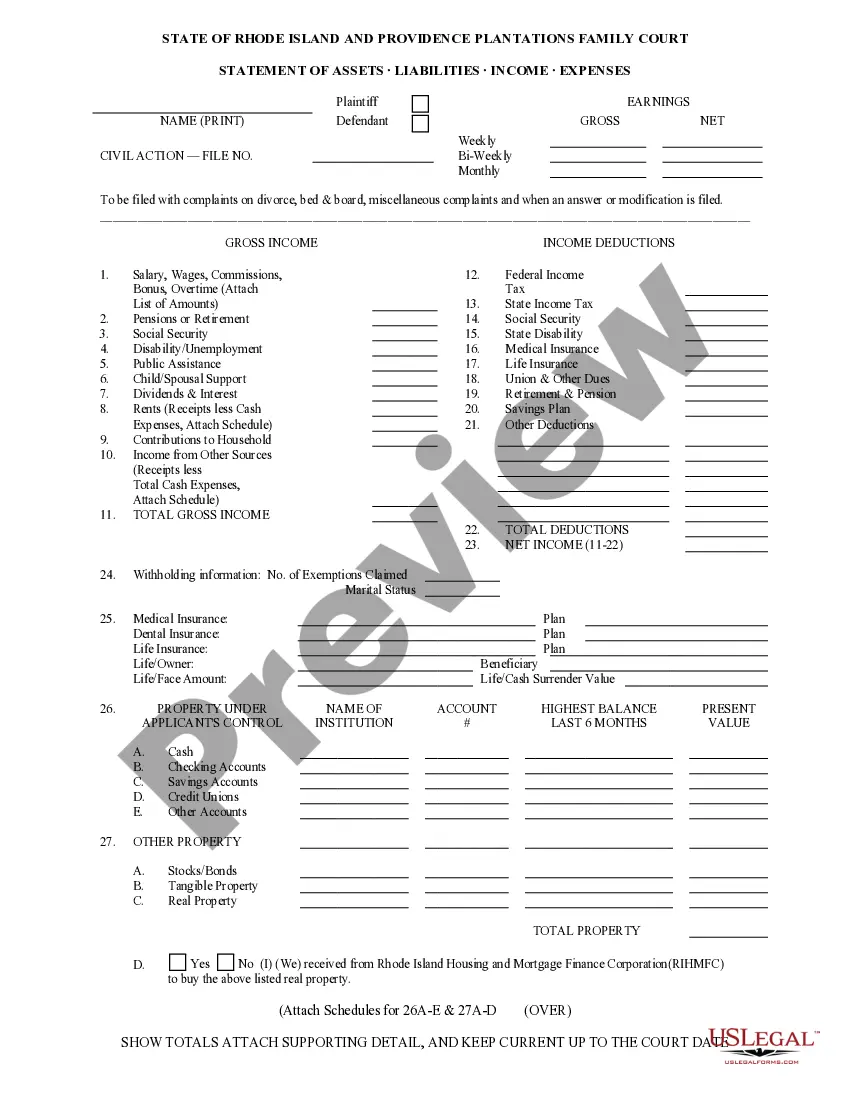

How to fill out Accounts Receivable - Contract To Sale?

If you wish to finalize, download, or create sanctioned document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Employ the site's user-friendly and straightforward search to find the documents you need. Numerous templates for commercial and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Oregon Accounts Receivable - Contract to Sale with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Oregon Accounts Receivable - Contract to Sale. Every legal document template you purchase belongs to you permanently. You have access to each form you acquired in your account. Click the My documents section and select a form to print or download again. Stay competitive and download, and print the Oregon Accounts Receivable - Contract to Sale with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Oregon Accounts Receivable - Contract to Sale.

- You can also retrieve forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you desire, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

Form popularity

FAQ

The accounts receivable sales agreement outlines the terms under which accounts receivable are sold from one party to another. This document specifies the rights and obligations of both the seller and the buyer regarding the collection of outstanding debts. It ensures that both sides understand the transaction's details, including payment timelines and responsibilities. For effective agreements, you can rely on the Oregon Accounts Receivable - Contract to Sale available through US Legal Forms.

Any sale involving the transfer of ownership of a business that has outstanding invoices requires recording accounts receivable. This includes asset sales, where the buyer acquires specific assets along with the rights to collect on those invoices. Properly documenting these accounts is essential to ensure clear ownership and collection rights post-sale. Using an Oregon Accounts Receivable - Contract to Sale can help facilitate this process.

To fill out a sales contract effectively, start by clearly identifying the parties involved in the agreement. Include essential details such as the product or service being sold, the payment terms, and the delivery schedule. Ensure that you specify any contingencies or conditions that may affect the sale. Utilizing tools like USLegalForms can simplify this process by providing templates tailored for Oregon Accounts Receivable - Contract to Sale.

In a business sale, accounts receivable are usually included in the transaction and become part of the assets sold. The seller may negotiate the terms regarding how outstanding invoices are handled post-sale. Understanding the Oregon Accounts Receivable - Contract to Sale is crucial in these negotiations, as it outlines how these assets will be transferred. This clarity can help both parties reach a fair agreement.

Yes, accounts receivable are included in the calculation of sales, as they represent the amounts customers owe for goods or services rendered. However, they are recorded separately on the balance sheet to show amounts not yet collected. Understanding how Oregon Accounts Receivable - Contract to Sale impacts your financial statements is key to maintaining accurate records. This knowledge enables you to analyze your revenue more effectively.

The 10 rule for accounts receivable suggests that a business should aim to collect 90% of its accounts receivable within 10 days of the due date. This principle emphasizes the importance of timely collections to maintain liquidity. Applying the Oregon Accounts Receivable - Contract to Sale strategy can help streamline this process. With proper documentation and follow-up, you can enhance your collection efforts.

A receivable purchase agreement is a contract between a seller and a financial institution that allows the seller to sell unpaid invoices from buyers to the financial institution. This means that the seller can enable cash flow until payment is received from the buyer.

Factoring is simply selling your accounts receivables at a discount. While not for every business, it is a short-term solution ? typically two years or less ? for companies with an equally brief need for cash flow. Factoring: Sell Your Accounts Receivables for Fast Cash The Hartford ? growing-business ? sell... The Hartford ? growing-business ? sell...

An account receivable is an asset recorded on the balance sheet as a result of an unpaid sales transaction, explains BDC Advisory Services Senior Business Advisor Nicolas Fontaine. ?More specifically, it is a monetary asset that will realize its value once it is paid and converts into cash.

You determine which invoices you want to sell to a factoring company, then apply for factoring services. Your factoring company will evaluate your customers and accounts receivables, deciding if they will purchase the invoices. The factoring company then buys your invoices, giving you a percentage upfront. Selling Your Business Accounts Receivables: A Complete Guide Porter Capital ? Blog Porter Capital ? Blog