Oregon Nonrecourse Assignment of Account Receivables

Description

How to fill out Nonrecourse Assignment Of Account Receivables?

Have you been within a place in which you will need papers for possibly company or personal reasons virtually every day time? There are plenty of lawful document themes available on the Internet, but discovering ones you can rely isn`t easy. US Legal Forms delivers a huge number of develop themes, just like the Oregon Nonrecourse Assignment of Account Receivables, that are published to fulfill state and federal requirements.

If you are currently knowledgeable about US Legal Forms web site and get your account, simply log in. Following that, it is possible to download the Oregon Nonrecourse Assignment of Account Receivables web template.

Should you not come with an accounts and want to start using US Legal Forms, adopt these measures:

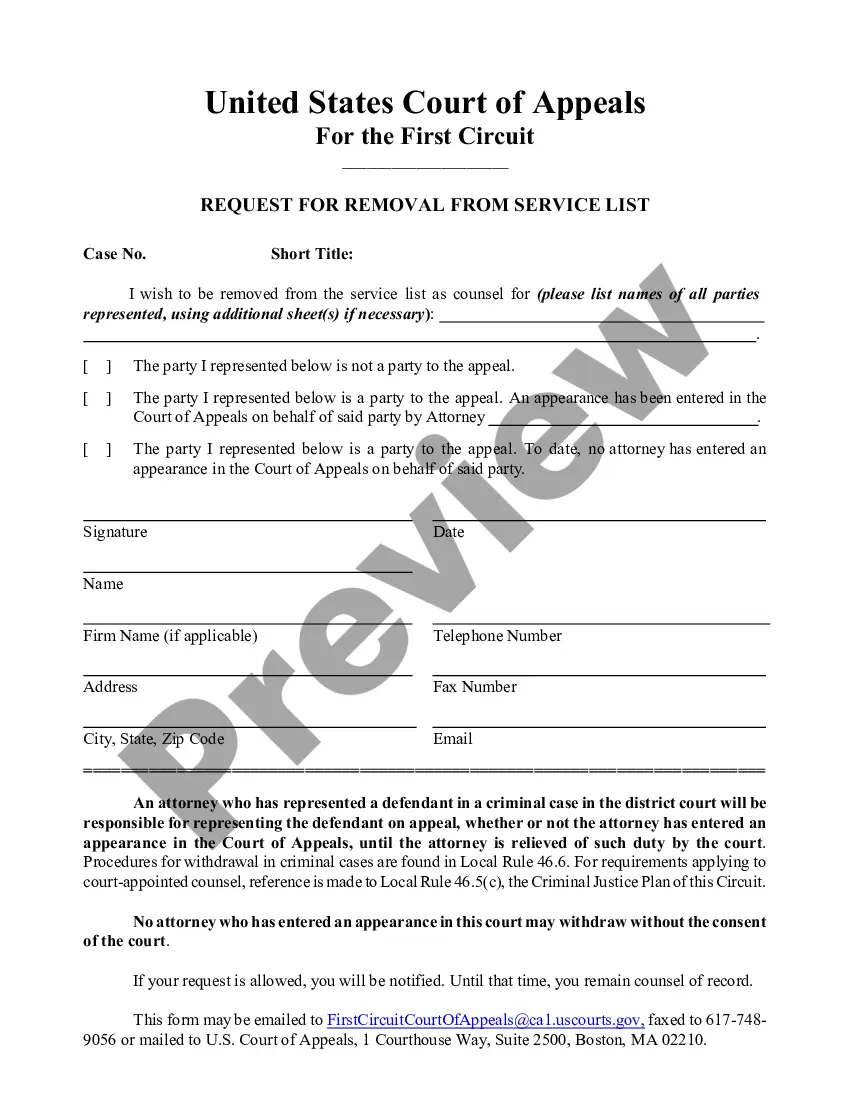

- Get the develop you require and make sure it is for your proper city/county.

- Make use of the Preview option to analyze the form.

- Browse the information to actually have chosen the right develop.

- If the develop isn`t what you`re seeking, use the Search industry to get the develop that fits your needs and requirements.

- Once you obtain the proper develop, click on Acquire now.

- Choose the prices strategy you would like, fill out the specified information to make your bank account, and pay for the transaction with your PayPal or credit card.

- Decide on a practical paper format and download your version.

Locate all of the document themes you may have bought in the My Forms menus. You can aquire a further version of Oregon Nonrecourse Assignment of Account Receivables at any time, if needed. Just click on the needed develop to download or print the document web template.

Use US Legal Forms, one of the most extensive selection of lawful types, to save efforts and stay away from mistakes. The services delivers expertly manufactured lawful document themes that can be used for a range of reasons. Generate your account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

Factoring without recourse means that the risk of accounts receivable being uncollectible transfers from the buyer to the seller. Basically, if an accounts receivable cannot be collected, the seller does not have to reimburse the buyer like they would if the factoring was ?with recourse?.

A nonrecourse debt (loan) does not allow the lender to pursue anything other than the collateral. For example, if a borrower defaults on a nonrecourse home loan, the bank can only foreclose on the home. The bank generally cannot take further legal action to collect the money owed on the debt.

A Factor that executes an invoice purchase agreement with a company without asking the company to repurchase unpaid or past due accounts receivable is automatically non-recourse. In a non-recourse arrangement, the Factor assumes the credit risk and liability of non-payment on a factored invoice. Recourse vs. Non-Recourse Factoring - What's the Difference? capstonetrade.com ? recourse-vs-non-recourse-fac... capstonetrade.com ? recourse-vs-non-recourse-fac...

When receivables are sold with recourse the seller of the receivables incurs? When a company sells accounts receivable with recourse, the seller retains all of the risk of bad debts. In effect, the seller guarantees that the buyer will be paid even if some receivables prove to be uncollectible.

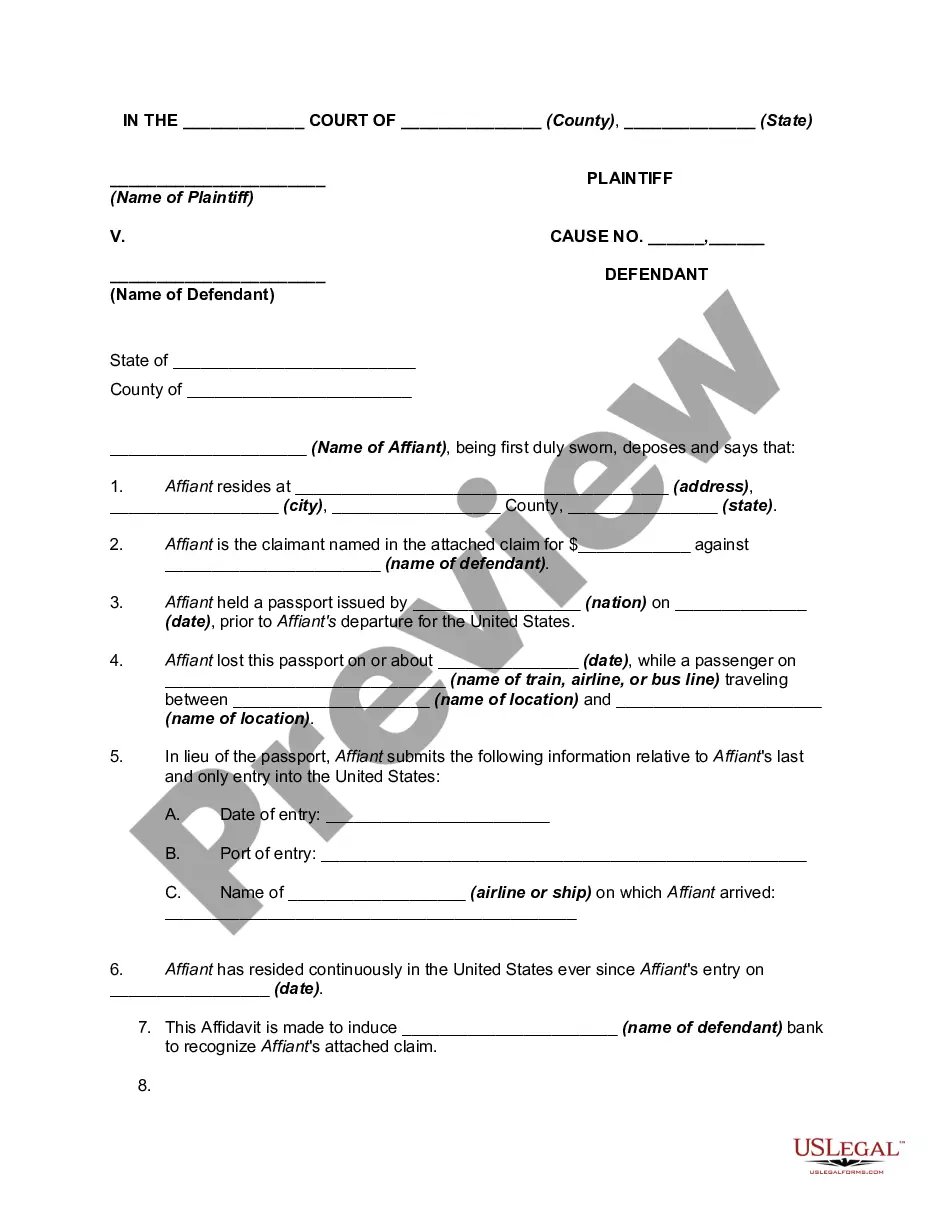

A receivable assignment agreement is an agreement by which a creditor ? the ?assignor? ? assigns to another person ? the ?assignee? ? a receivable it holds against a third person ? the ?assigned debtor?. The assigned debtor is not a party to the assignment agreement. Contract for the assignment of receivables - e2.law e2.law ? document ? contract-for-the-assign... e2.law ? document ? contract-for-the-assign...

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers. Assignment of Accounts Receivable: The Essential Guide unitedcapitalsource.com ? blog ? assignment... unitedcapitalsource.com ? blog ? assignment...

With factoring accounts receivables without recourse, the factoring company assumes the credit risk on invoices when there's non-payment because of the debtor's insolvency, effectively insulating the client from this credit risk. What is Factoring Accounts Receivables without Recourse? coralcapitalsolutions.com ? what-factoring-accoun... coralcapitalsolutions.com ? what-factoring-accoun...

Non-Recourse Factoring: What's the Difference? With recourse factoring, you're responsible for the debt if your customers don't pay. With non-recourse factoring, the factoring company accepts the loss for nonpayment. Randa Kriss is a lead writer and small-business specialist at NerdWallet.