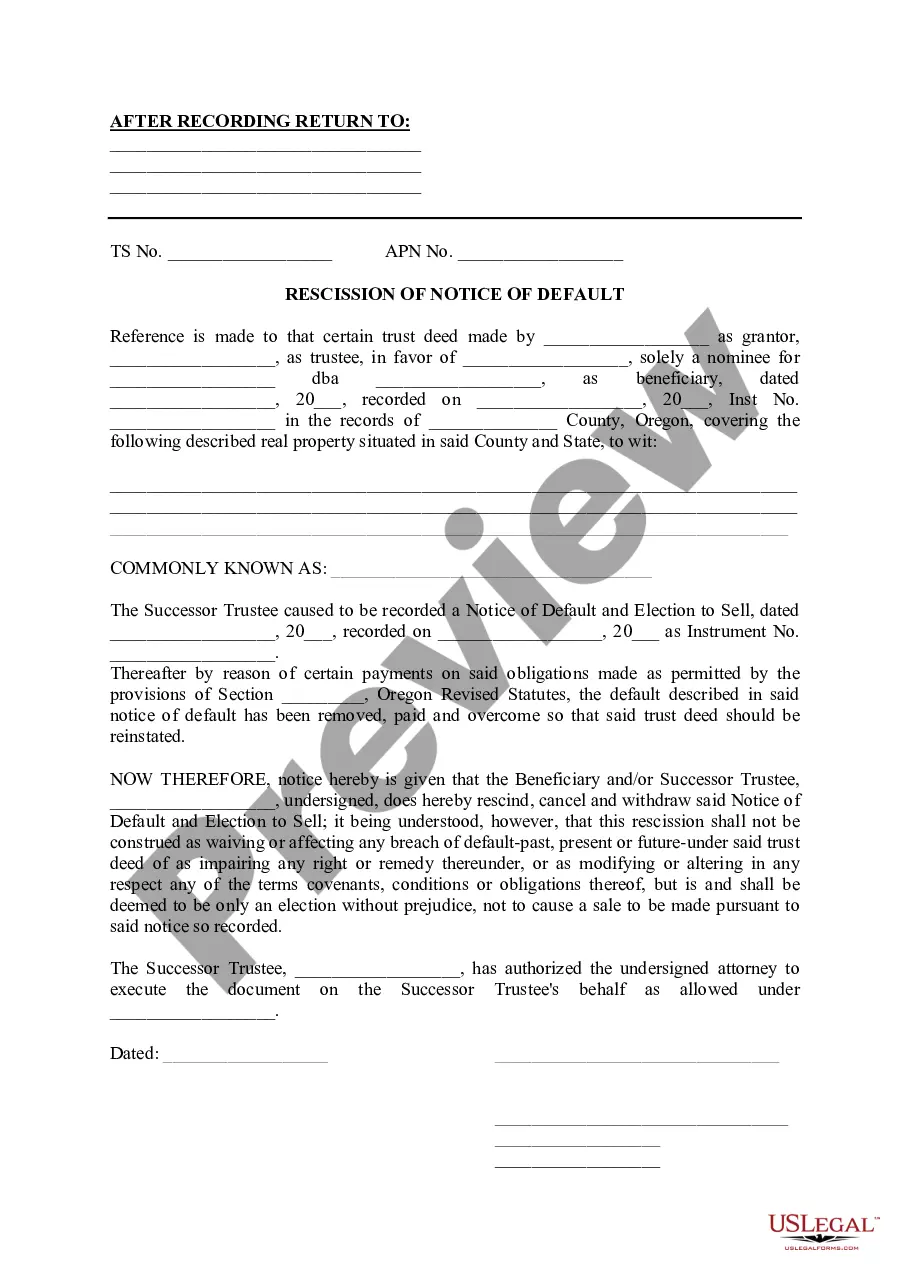

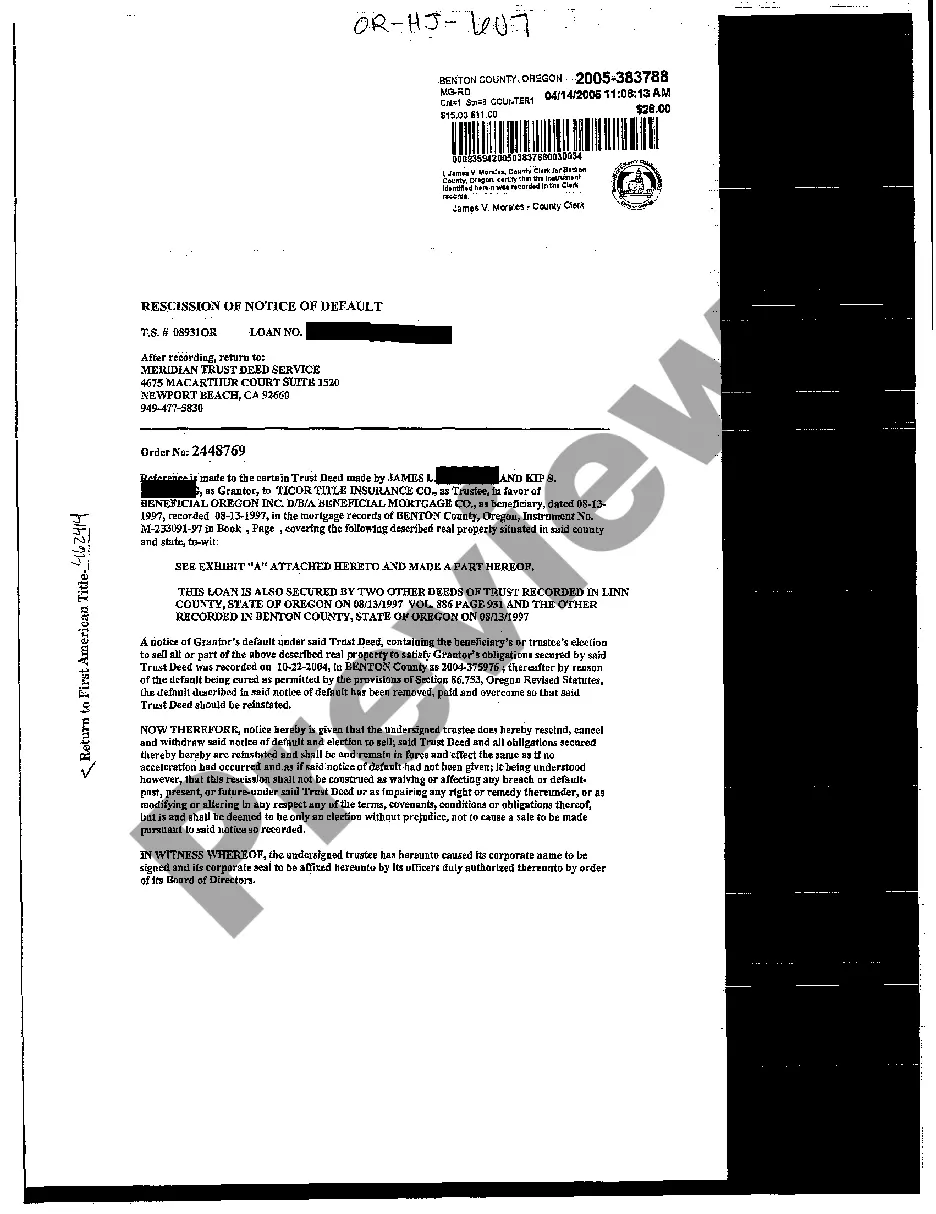

Oregon Rescission of Notice of Default

Description

How to fill out Oregon Rescission Of Notice Of Default?

Creating papers isn't the most uncomplicated task, especially for people who almost never deal with legal paperwork. That's why we advise using accurate Oregon Rescission of Notice of Default samples created by skilled attorneys. It allows you to stay away from problems when in court or handling formal institutions. Find the templates you need on our website for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the template page. After getting the sample, it will be saved in the My Forms menu.

Customers without a subscription can quickly create an account. Use this simple step-by-step help guide to get the Oregon Rescission of Notice of Default:

- Make sure that the form you found is eligible for use in the state it is needed in.

- Confirm the file. Use the Preview option or read its description (if available).

- Buy Now if this sample is what you need or utilize the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these straightforward actions, you are able to fill out the form in an appropriate editor. Check the completed data and consider requesting an attorney to examine your Oregon Rescission of Notice of Default for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.

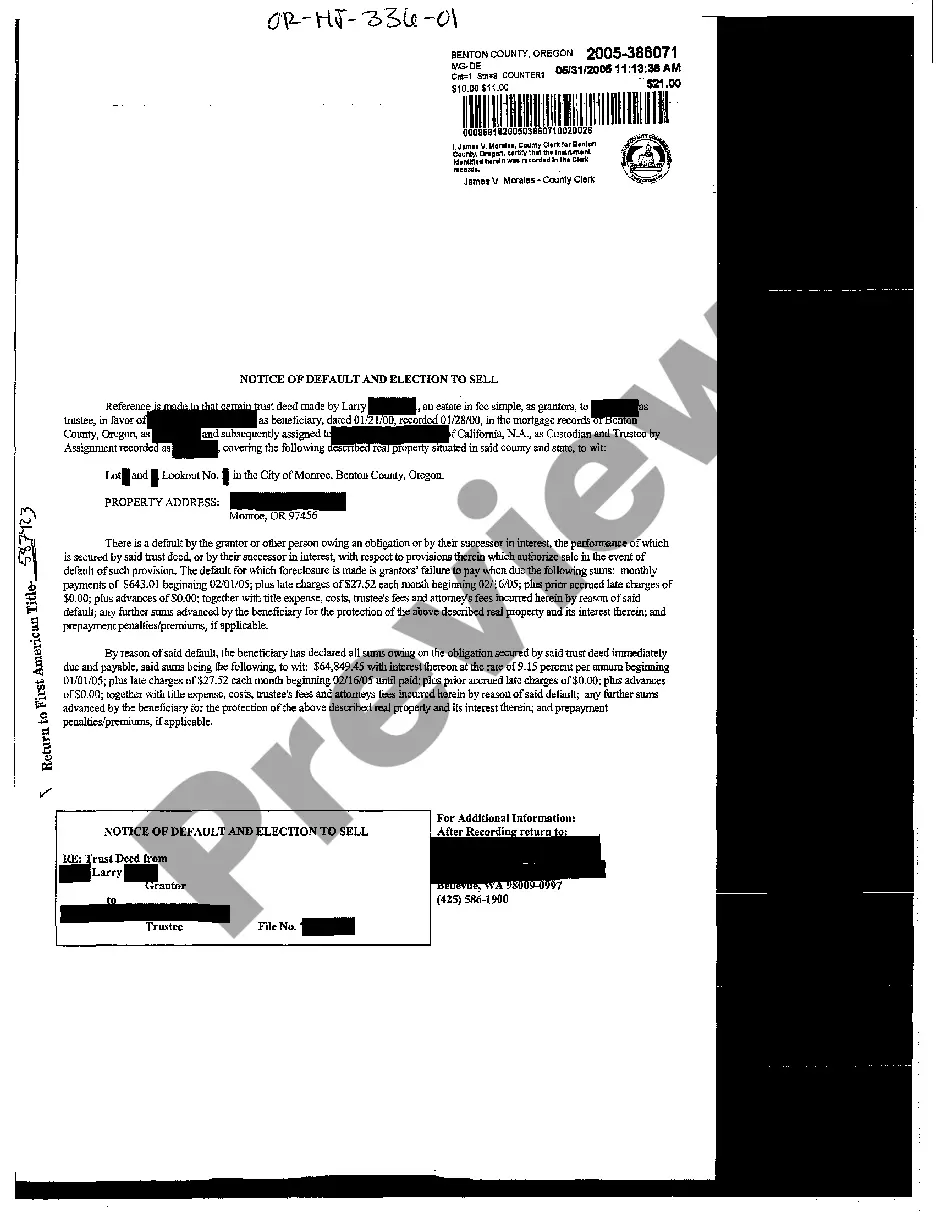

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

Generally, a homeowner has to be at least 120 days delinquent before a mortgage servicer starts a foreclosure. Applying for a foreclosure avoidance option, called loss mitigation, might delay the start date even further.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

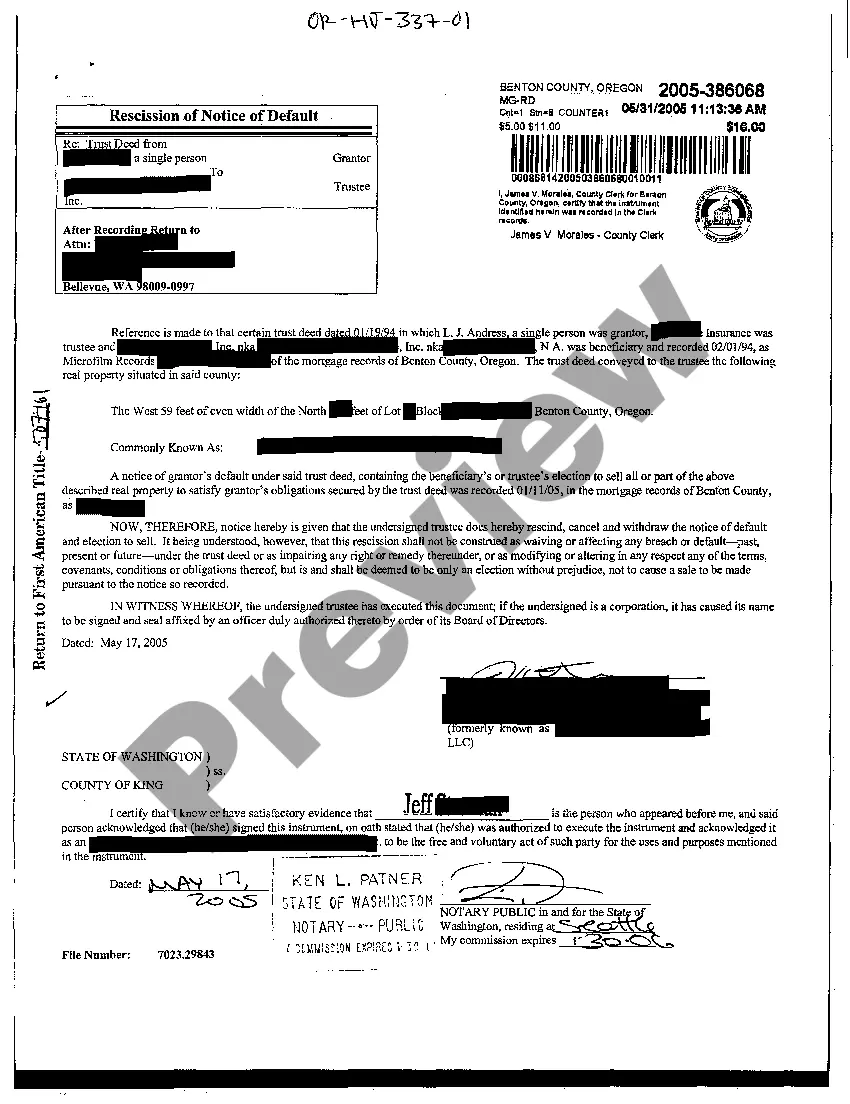

Again, most residential foreclosures in Oregon are nonjudicial. Here's how the process works. Before filing a notice of default, the lender provides you (the borrower) with notice about participating in a resolution conference (mediation).

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

The length of the entire foreclosure process depends on state law and other factors, including whether negotiations are taking place between the lender and the borrower in an effort to stop the foreclosure. Overall, completing the foreclosure process can take from 6 months to more than a year.

In Oregon, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.