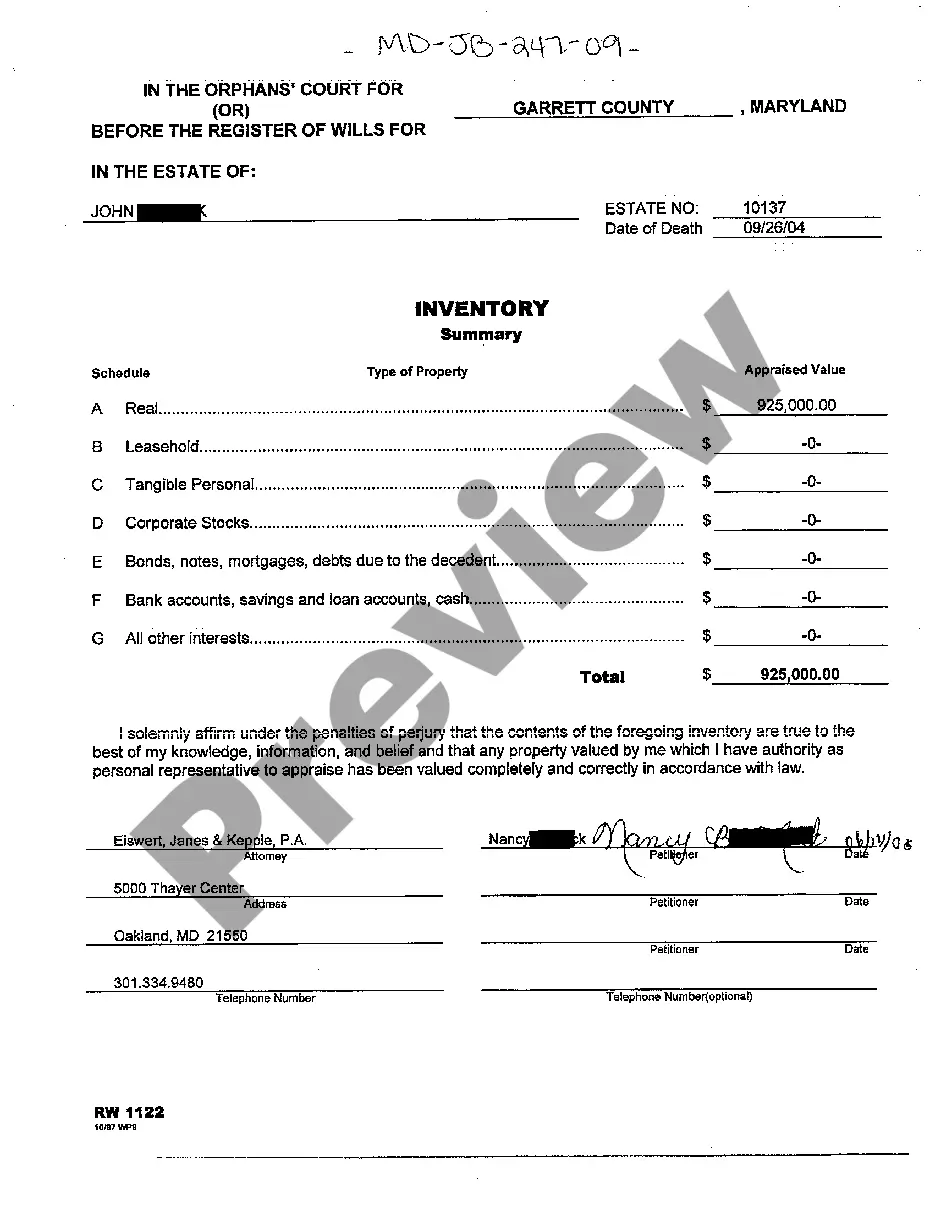

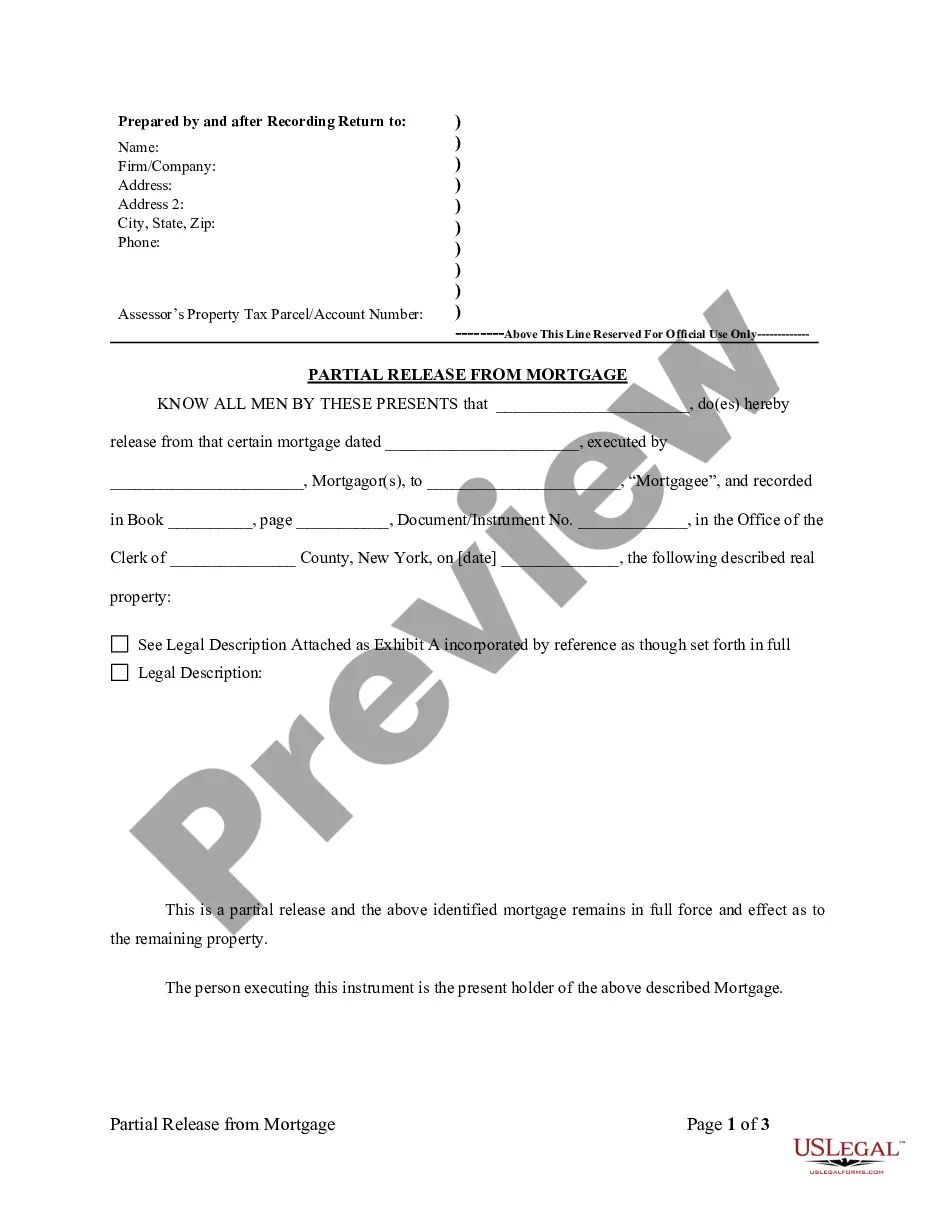

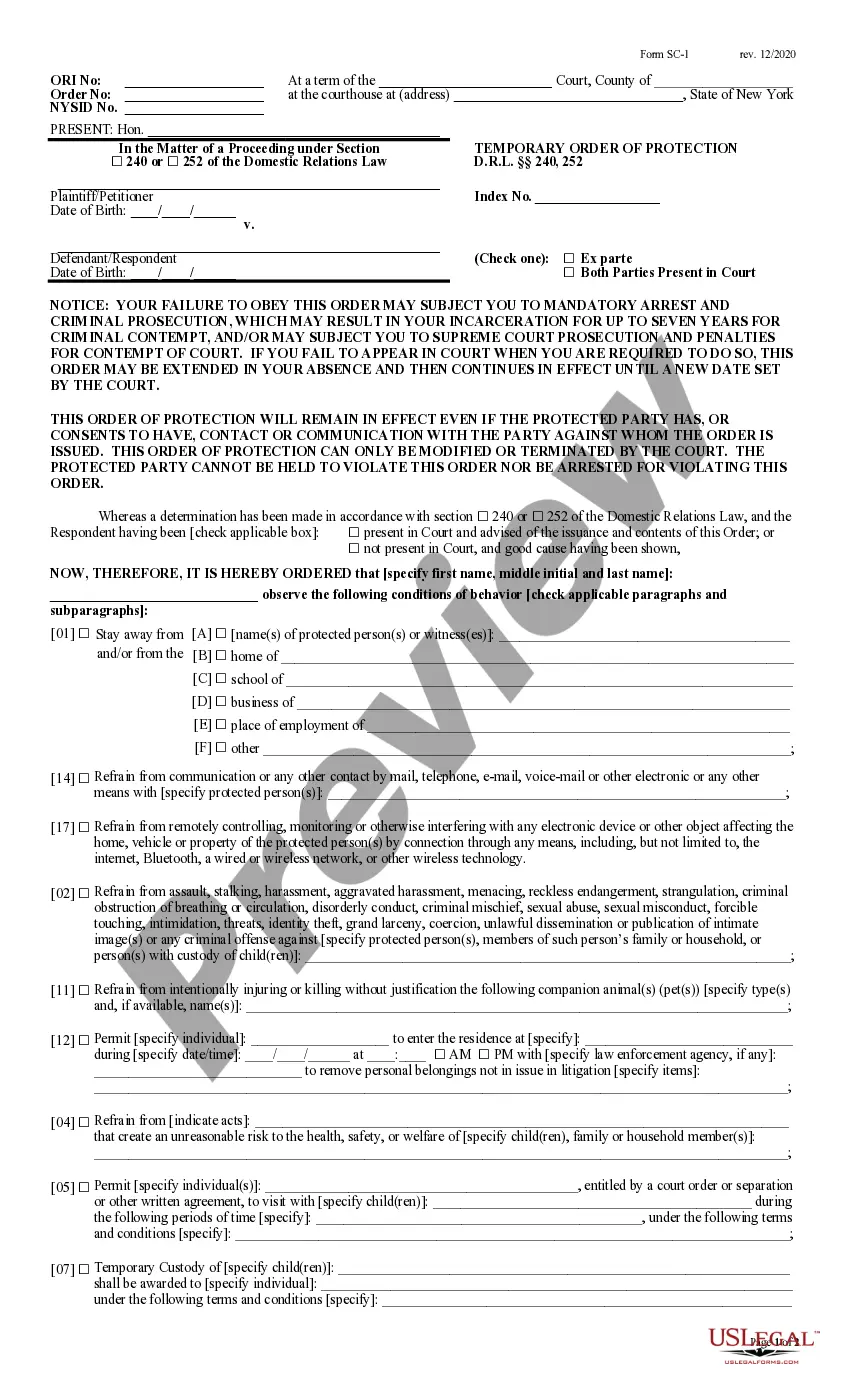

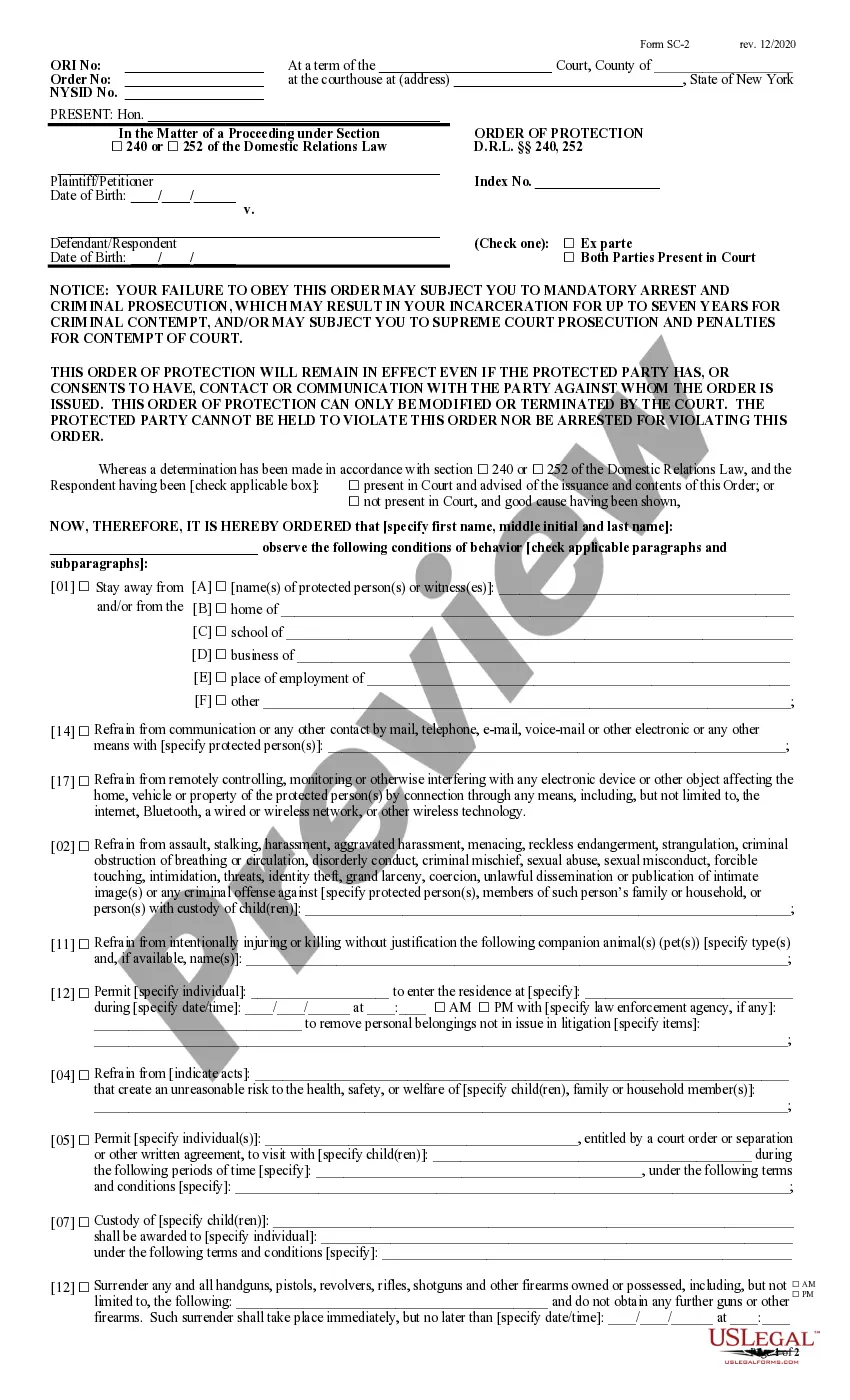

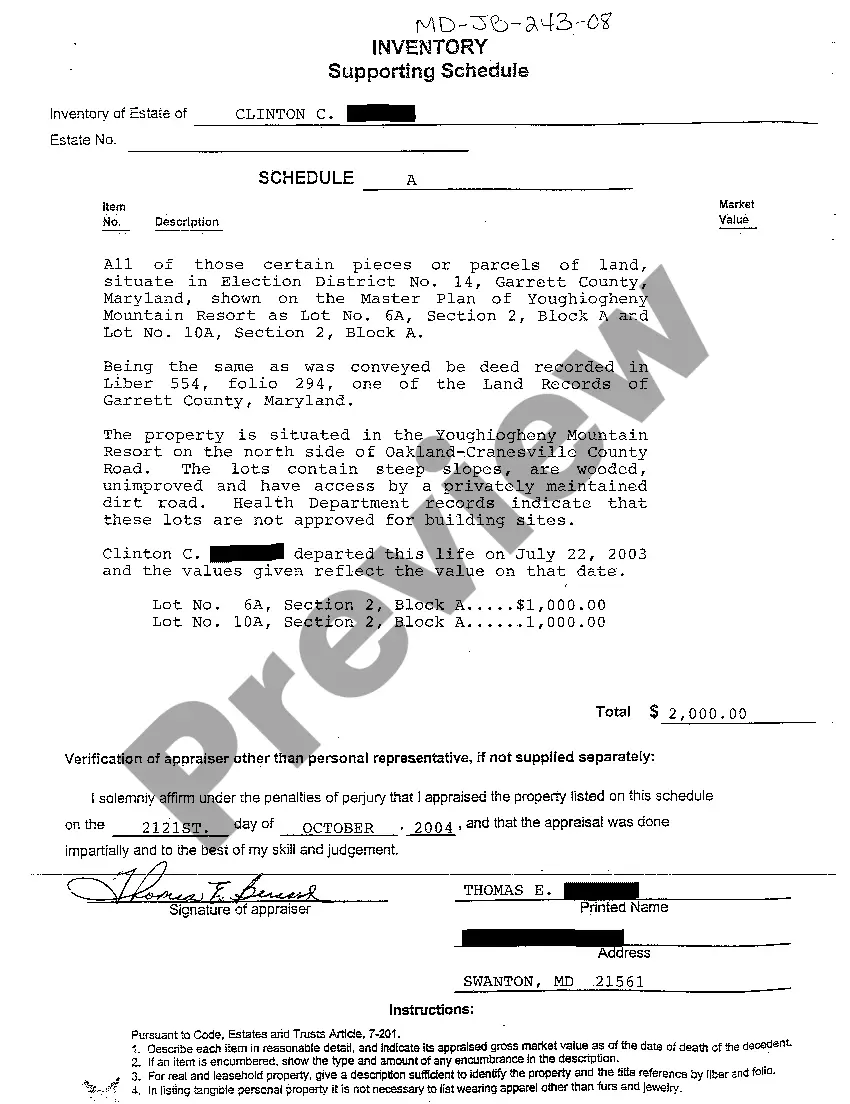

Maryland Inventory Supporting Schedule

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Inventory Supporting Schedule?

Greetings to the largest legal documentation repository, US Legal Forms.

Here you can obtain any illustration including Maryland Inventory Supporting Schedule forms and save them (as many as you desire/require). Prepare official documents in just a few hours, instead of days or even weeks, without spending a fortune on a lawyer.

Acquire your state-specific illustration in just a few clicks and feel assured knowing that it was prepared by our certified legal specialists.

Print the document and complete it with your/your business’s details. After you’ve finalized the Maryland Inventory Supporting Schedule, send it to your lawyer for verification. It’s an additional step, but a vital one to ensure you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable samples.

- If you’re already a registered user, simply Log In to your account and select Download next to the Maryland Inventory Supporting Schedule you need.

- Since US Legal Forms is an online platform, you’ll always have access to your saved forms, no matter the device you’re utilizing.

- Find them in the My documents section.

- If you don't have an account yet, what are you waiting for.

- Follow our guidelines below to get started.

- If this is a document specific to your state, verify its validity in your state.

- Check the description (if available) to determine if it’s the correct template.

- View additional content with the Preview feature.

- If the sample meets all your needs, click Buy Now.

- To create your account, choose a pricing plan.

- Register using a card or PayPal account.

- Download the template in the format you need (Word or PDF).

Form popularity

FAQ

The new format of the balance sheet is also called vertical format balance sheet and it lists the equities and liabilities on the top followed by the assets at the bottom.

13. Schedule XIII Income: These includes: (1) Interest Earned: (i) Interest, Discounts on advance and bills; (ii) Income on investment; (iii) Interest on balance with RBI. (2) Others.

In accounting, a schedule is defined as the supporting report or document which constitutes detailed information, explaining the elements of the chief financial report.In other words, accounting schedules provide all the financial accounting in detail which cannot be illustrated within the chief report.

The schedule of accounts receivable is a report that lists all amounts owed by customers. The report lists each outstanding invoice as of the report date, aggregated by customer.The collections team examines the schedule to determine which invoices are overdue, and then makes collection calls to customers. Credit.

The government has decided to revise schedule VI to the Companies Act, which stipulates the manner in which every company prepares and presents its balance sheet and profit and loss account.The draft revised schedule VI requires companies to classify assets and liabilities into current and non-current categories.

The Balance Sheet includes:Equity and Liabilities comprising of Shareholders' Funds , Share Application, money pending allotment, Non-Current Liabilities , and Current Liabilities . Assets comprising of Non-Current Assets and Current Assets .

The fixed asset schedule comprises of the fixed assets listing in detail, which is mentioned in the general ledger.The accumulated depreciation account is an account for the assets which are having a credit balance i.e. it appears as a deduction from the total fixed assets amount reported on the balance sheet.

The fixed asset schedule comprises of the fixed assets listing in detail, which is mentioned in the general ledger.The accumulated depreciation account is an account for the assets which are having a credit balance i.e. it appears as a deduction from the total fixed assets amount reported on the balance sheet.

21 April 2015 Schedule III of the Companies Act, 2013 contains a format for preparation and presentation of financial statements. . Except for addition of general instructions for preparation of Consolidated Financial Statements (CFS), the format of financial statements given in the Companies Act, 2013 is the same as