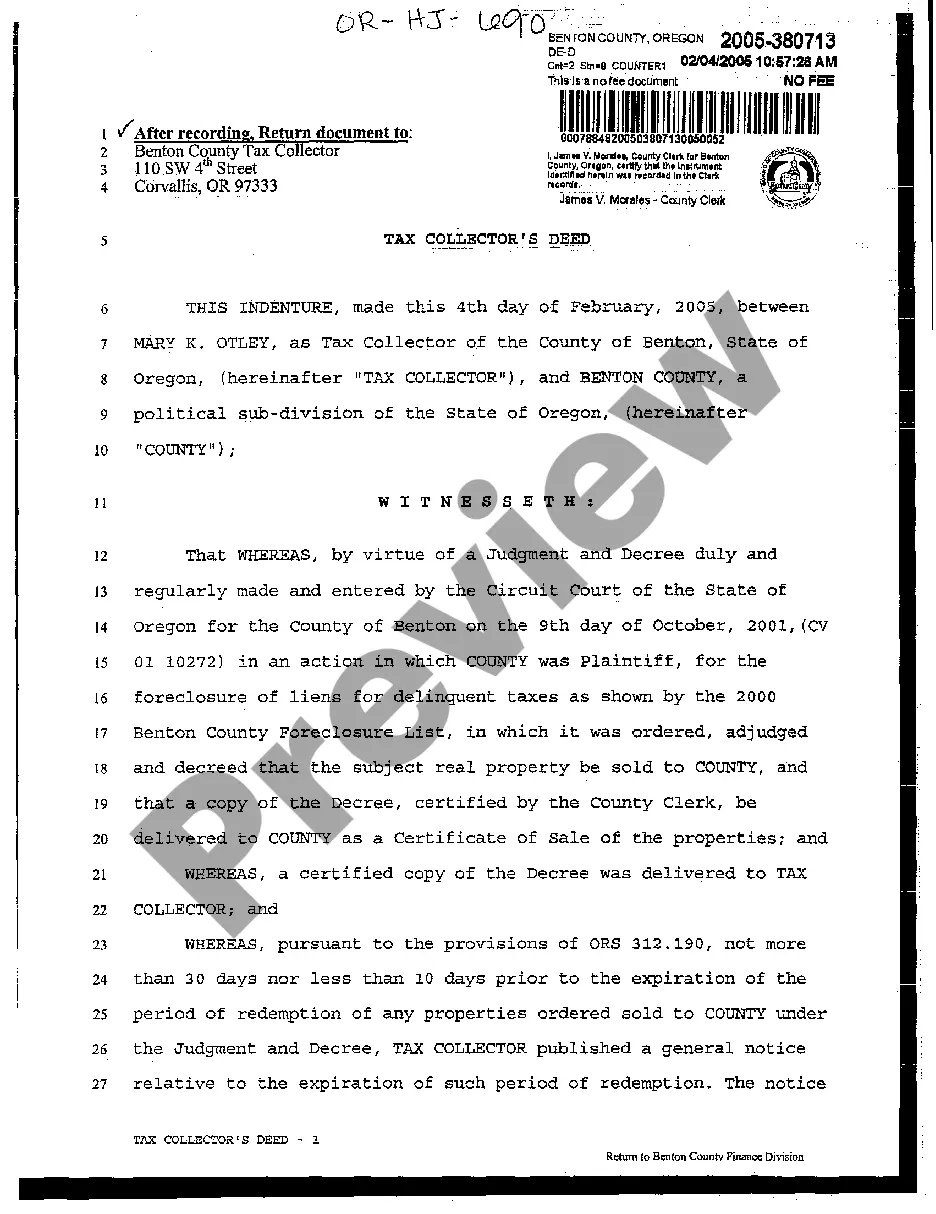

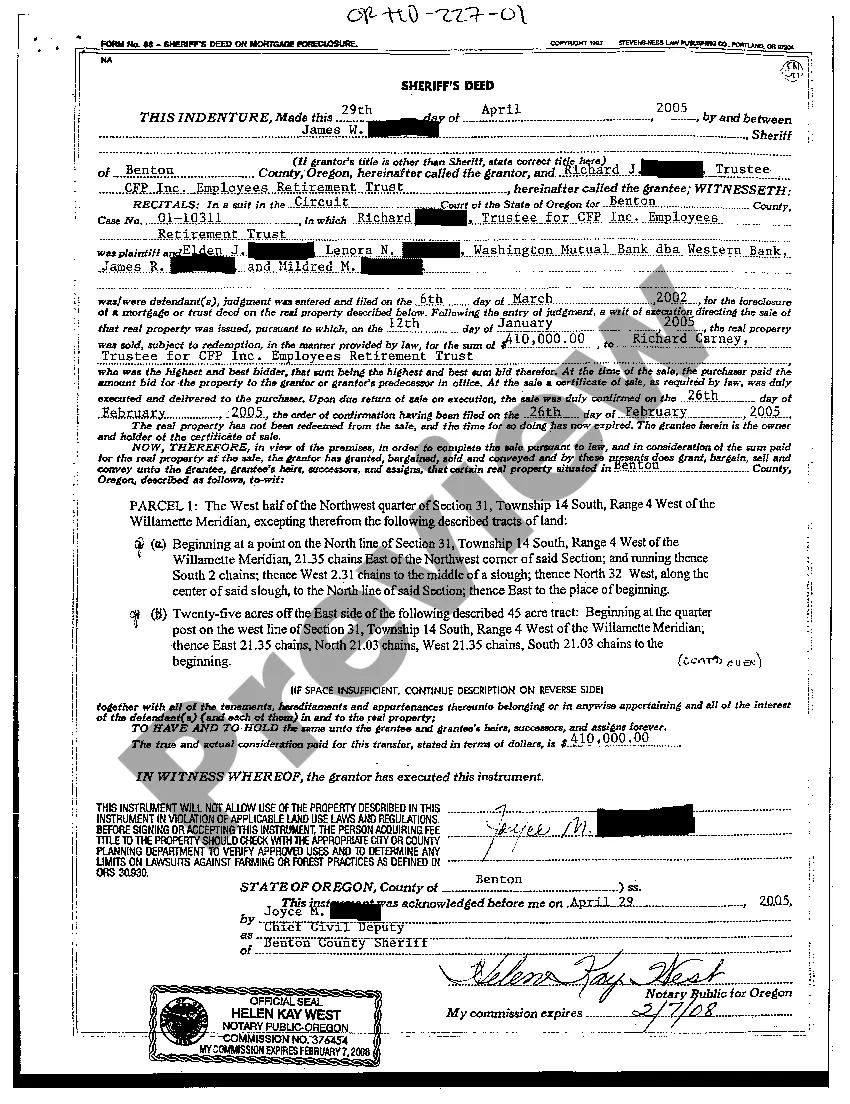

Oregon Tax Collector's Deed

Description

How to fill out Oregon Tax Collector's Deed?

The work with documents isn't the most simple process, especially for people who rarely work with legal paperwork. That's why we recommend utilizing accurate Oregon Tax Collector's Deed templates created by professional lawyers. It gives you the ability to stay away from troubles when in court or working with official institutions. Find the samples you require on our website for top-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the file webpage. Right after downloading the sample, it will be saved in the My Forms menu.

Customers with no a subscription can easily get an account. Look at this simple step-by-step help guide to get the Oregon Tax Collector's Deed:

- Be sure that the sample you found is eligible for use in the state it’s necessary in.

- Verify the file. Use the Preview feature or read its description (if readily available).

- Click Buy Now if this form is the thing you need or use the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After doing these easy actions, it is possible to fill out the form in your favorite editor. Double-check completed info and consider asking a lawyer to examine your Oregon Tax Collector's Deed for correctness. With US Legal Forms, everything gets much simpler. Try it out now!

Form popularity

FAQ

Alabama. Arizona. Colorado. Florida. Illinois. Indiana. Iowa. Kentucky.

Louisiana. This is one of the best states to shop for a tax lien. Mississippi. Mississippi tax liens may not have the most favorable auction policies, but its 18% interest rate and 2-year waiting period are attractive to investors. Iowa. Iowa is another state with a unique way of selling tax liens. Florida.

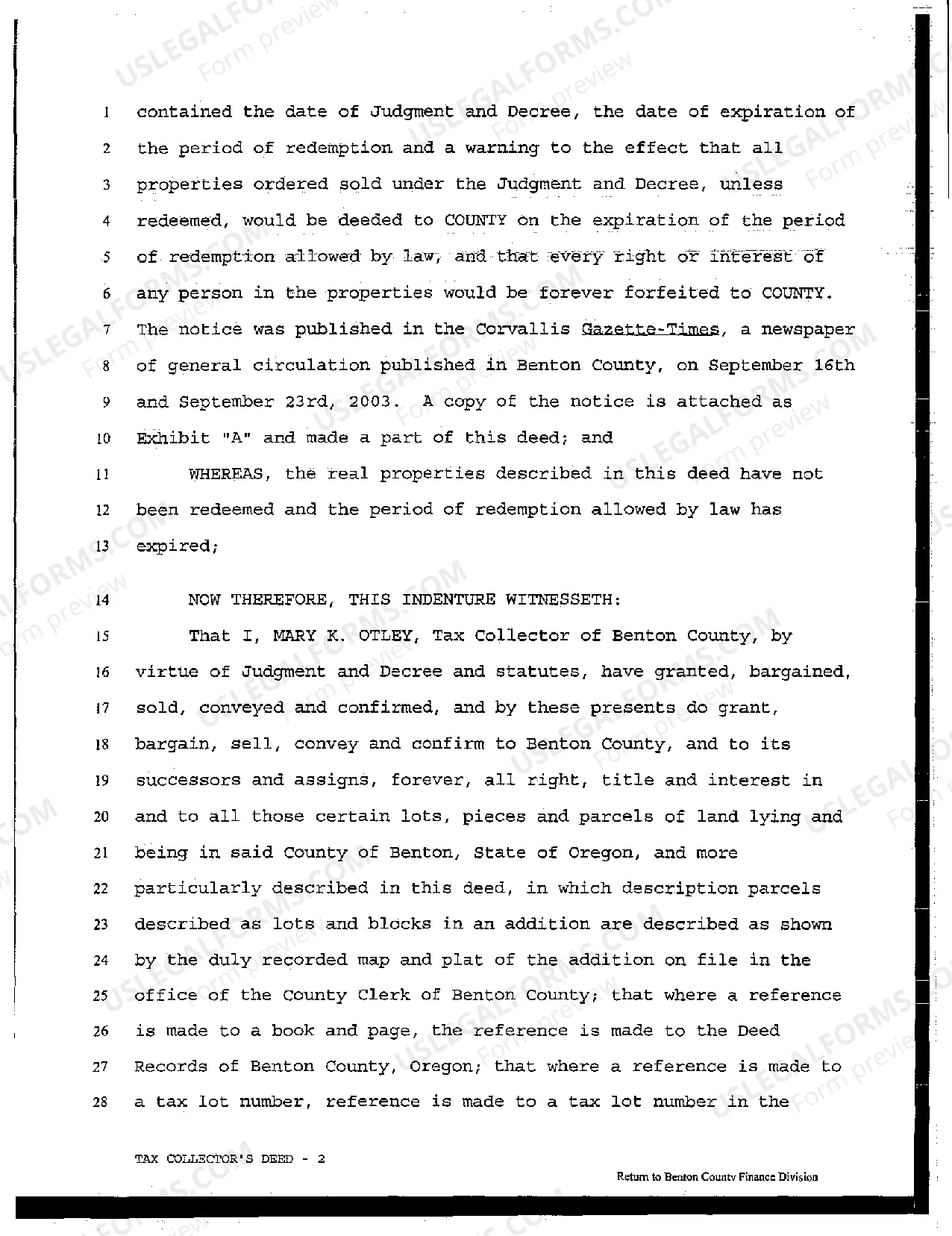

People who own real property have to pay property taxes. The government uses the money that property taxes generate to pay for schools, public services, libraries, roads, parks, and the like.When Oregon homeowners don't pay their property taxes, the overdue amount becomes a lien on the property.

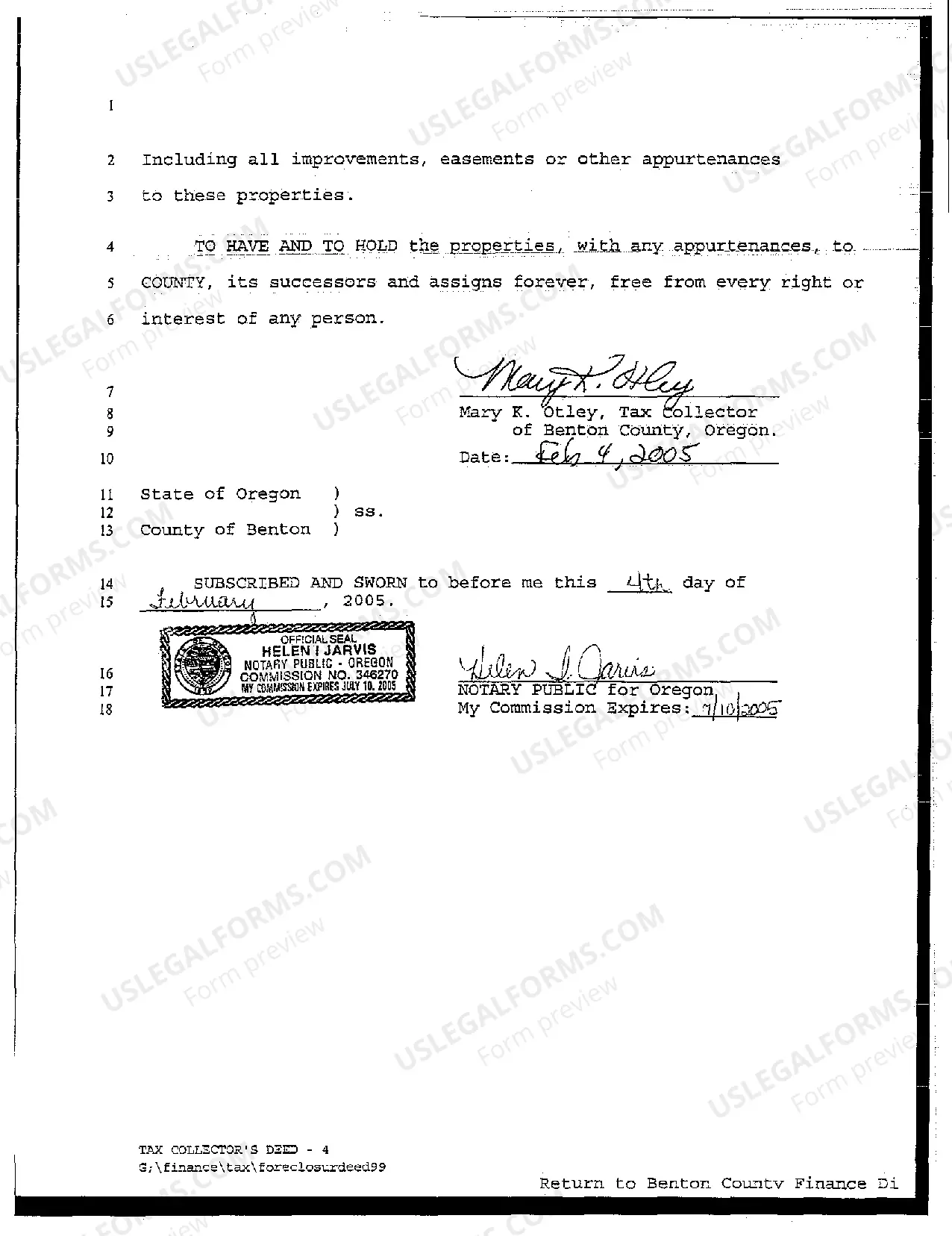

After a tax sale happens, the homeowner might be able to redeem the property. "Redemption" is the right of the property owner to reclaim the property by paying the entire sale price, plus certain additional costs and interest, after the sale so long as it is within the time period allowed by statute.

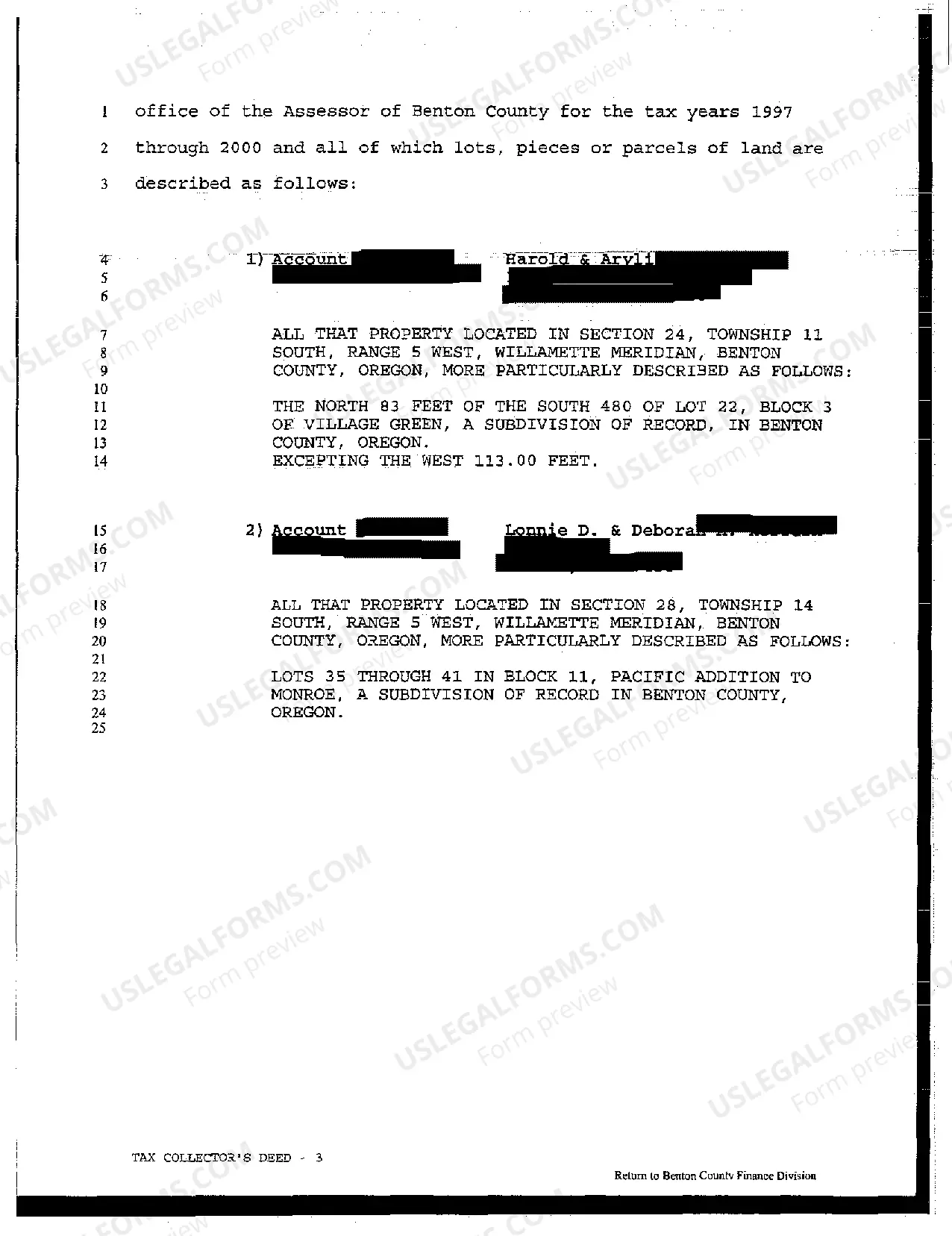

Tax deed sales must eliminate any community association liens and debts acquired prior to the tax deed. Tax deed sales must reduce any code enforcement liens to hard costs if the tax deed investor timely addresses such liens and underlying issues after purchasing the tax deed.

In Oregon, real proper- ty is subject to foreclosure three years after the taxes become delinquent. When are taxes delinquent? Property taxes can be paid in full by November 15 or in three installments: November 15, February 15, and May 15. If the taxes aren't paid in full by May 16 they are delinquent.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.

Purchasing a tax lien does not obligate you to pay any future property taxes that become delinquent or pay for other property liabilities.Unlike an investment in a tax lien, an investment in a tax deed requires that your adequately maintain the property until you are able to sell it.

In Oregon, property taxes that aren't paid on or before May 15 of the tax year in which they're billed are delinquent. The property is subject to a tax foreclosure three years after the first date of delinquency.It then applies for a judgment with the court and publishes the foreclosure list in a newspaper.