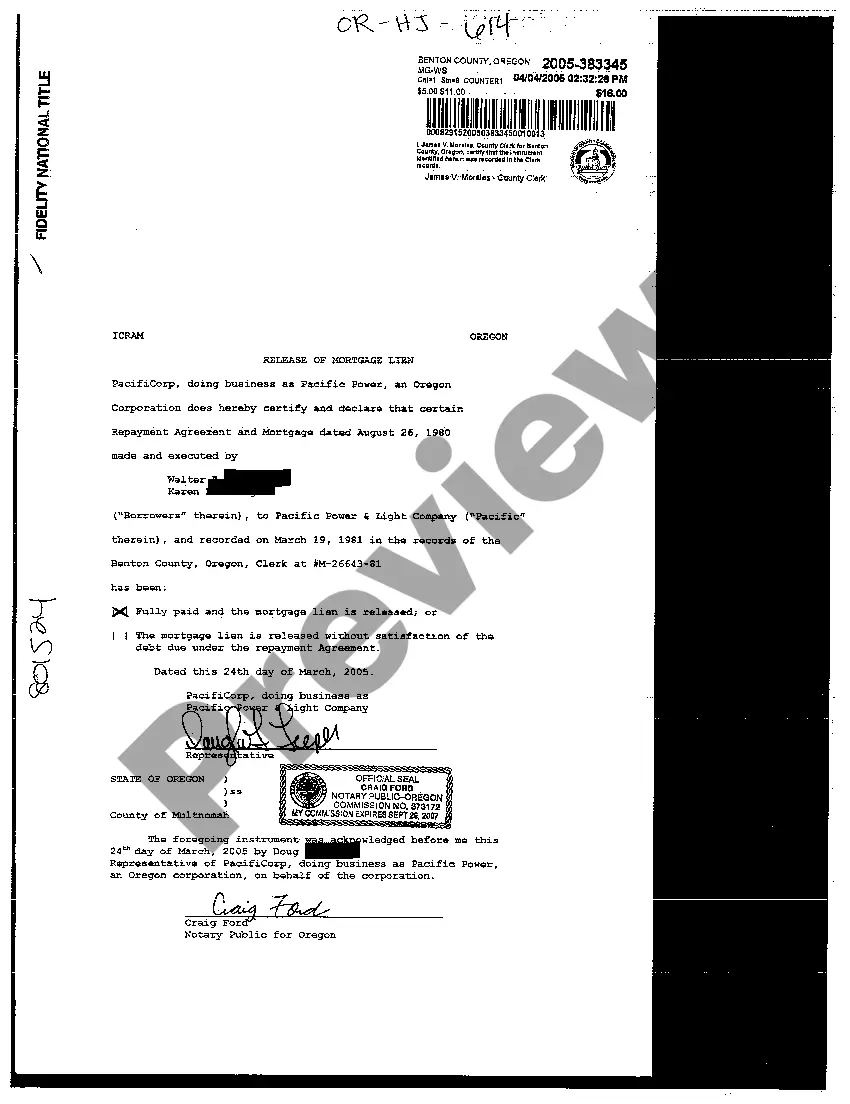

Oregon Release of Mortgage Lien

Description

Key Concepts & Definitions

Release of Mortgage Lien: This is the legal process wherein a lender releases the borrower from the mortgage lien, effectively stating that the mortgage has been fully paid and that the lien on the property is cleared. A lien is a legal right or interest that a lender has in the borrower's property, which lasts until the debt obligation is satisfied.

Step-by-Step Guide to Obtaining a Release of Mortgage Lien

- Verify Payment Completion: Ensure that all payments under the mortgage have been completed, including principal, interest, and any applicable fees.

- Request a Release: Contact your lender to request a release of lien. This typically involves submitting a formal letter or filling out a form provided by the lender.

- Submit Required Documentation: Provide proof of payment completion and any other documents requested by the lender, such as identity verification or property details.

- Receive and File Release Document: Once approved, the lender will provide a release of lien document. File this document with the local county recorders office to officially clear the lien from public records.

Risk Analysis

Not obtaining a release of mortgage lien can have several risks, including:

- Difficulty in Selling the Property: A clear title is generally required to sell or refinance a property. A lingering lien can complicate or block these transactions.

- Credit Damage: Unreleased liens may mistakenly appear as active debt on credit reports, potentially affecting future loan eligibility or terms.

- Legal Complications: Future disputes over property ownership or debt responsibility may arise if the lien is not officially released.

Common Mistakes & How to Avoid Them

- Not Confirming Lien Release: Always confirm with the county recorders office that the lien release has been officially recorded. Merely receiving the document from your lender is not sufficient.

- Ignoring Local Recording Requirements: Each state or locality might have different requirements for filing a lien release. Ensure to comply with specific local regulations to avoid unnecessary delays or rejections.

- Delaying the Release Process: Promptly initiate the release process after the final mortgage payment to prevent potential issues from arising.

FAQ

- What happens if my lender does not provide a release of lien? If a lender fails to issue a lien release, you can appeal to state banking authorities or seek legal advice to resolve the situation.

- How long does it take to get a mortgage lien released? The time varies by lender and jurisdiction but typically occurs within 30 to 90 days after the last payment is confirmed.

- Is there a fee to file a release of lien? Filing fees depend on the county but generally involve a modest cost necessary to update the public record.

How to fill out Oregon Release Of Mortgage Lien?

Creating papers isn't the most straightforward job, especially for people who rarely deal with legal papers. That's why we advise utilizing correct Oregon Release of Mortgage Lien templates created by professional lawyers. It gives you the ability to stay away from difficulties when in court or dealing with formal organizations. Find the templates you need on our site for top-quality forms and accurate explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the template webpage. After accessing the sample, it’ll be saved in the My Forms menu.

Customers without a subscription can easily get an account. Make use of this short step-by-step guide to get your Oregon Release of Mortgage Lien:

- Make certain that the sample you found is eligible for use in the state it is required in.

- Verify the file. Make use of the Preview option or read its description (if available).

- Click Buy Now if this template is the thing you need or return to the Search field to get a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

After completing these simple steps, you can complete the sample in a preferred editor. Check the filled in info and consider requesting a legal representative to review your Oregon Release of Mortgage Lien for correctness. With US Legal Forms, everything gets much simpler. Try it out now!

Form popularity

FAQ

A promissory note is the written evidence of the debt owed and the promise to pay that debt. Which is FALSE regarding a promissory note used in connection with a mortgage or trust deed? It insures that the debt will be paid.

What are the major differences between a mortgage and a deed of trust? The number of parties involved and the method of foreclosure on default. extra info: In a mortgage, there are two parties involved while a deed of trust has three involved parties with the trustee holding the legal title and right to foreclose.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

The promissory note a legal instrument in which one party (the mortgagor or borrower) promises to pay the designated sum of money to another party (the lender or mortgagee). This is basically an IOU to your mortgage lender. This always accompanies the mortgage or deed of trust.

A judgment lien will expire in 7 years, unless renewed. A voluntary lien, like a mortgage, deed of trust, or car loan may never expire. Most liens can be renewed before they expire, and so can technically, like a Vampire, live forever.

What is the function of a note in a mortgage or trust deed financing arrangement? It is evidence of the lender's interest in the collateral property. trust deed or mortgage. If a borrower obtains an interest only loan of $75,000 at an annual interest rate of 8%, what is the monthly interest payment?

In lien theory states, the borrower holds the title to the property. Instead of a Deed of Trust, a Mortgage is recorded in the public record and acts as a lien against the property until the debt is paid off.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.