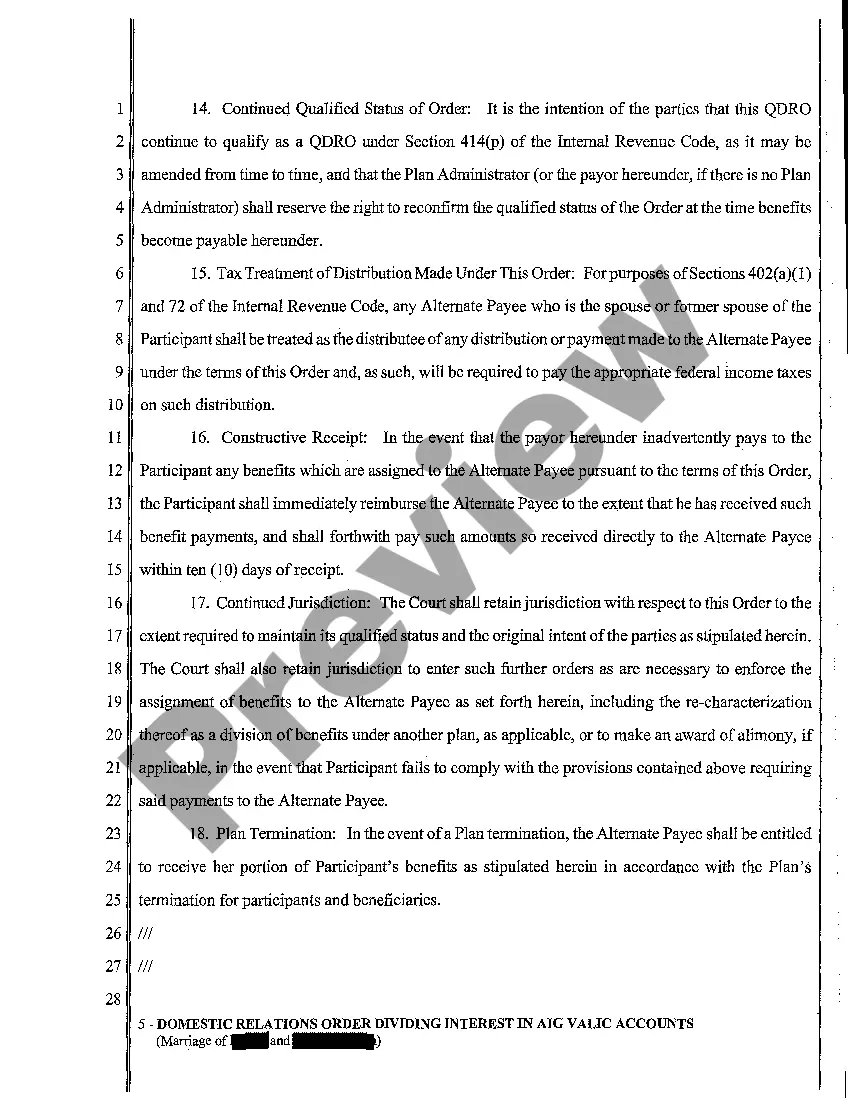

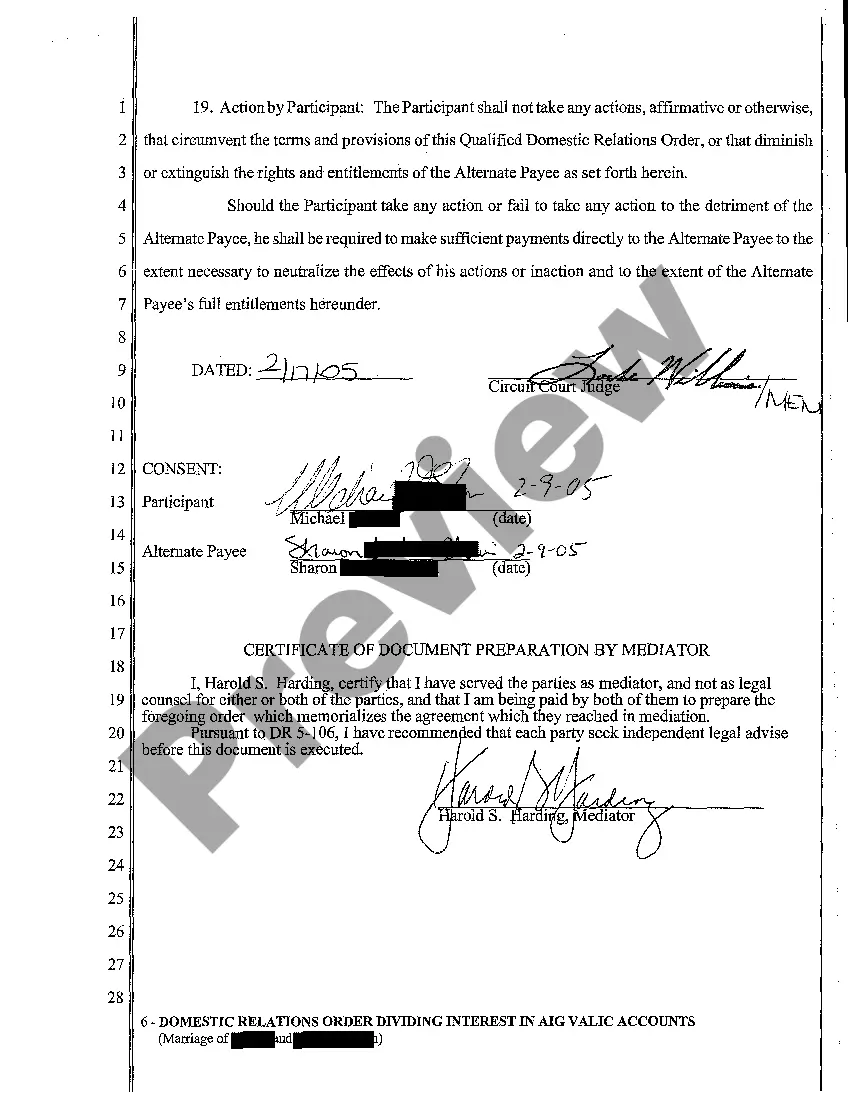

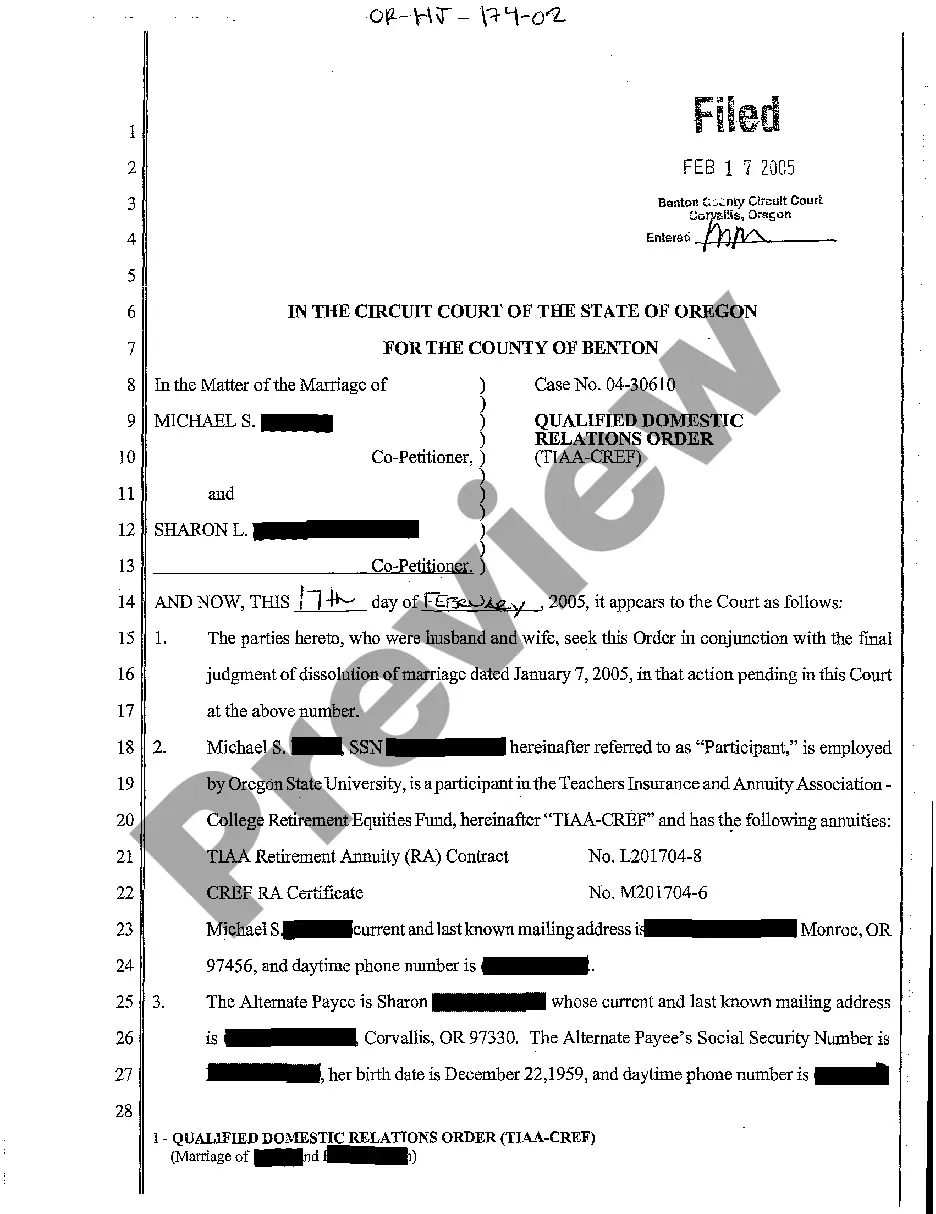

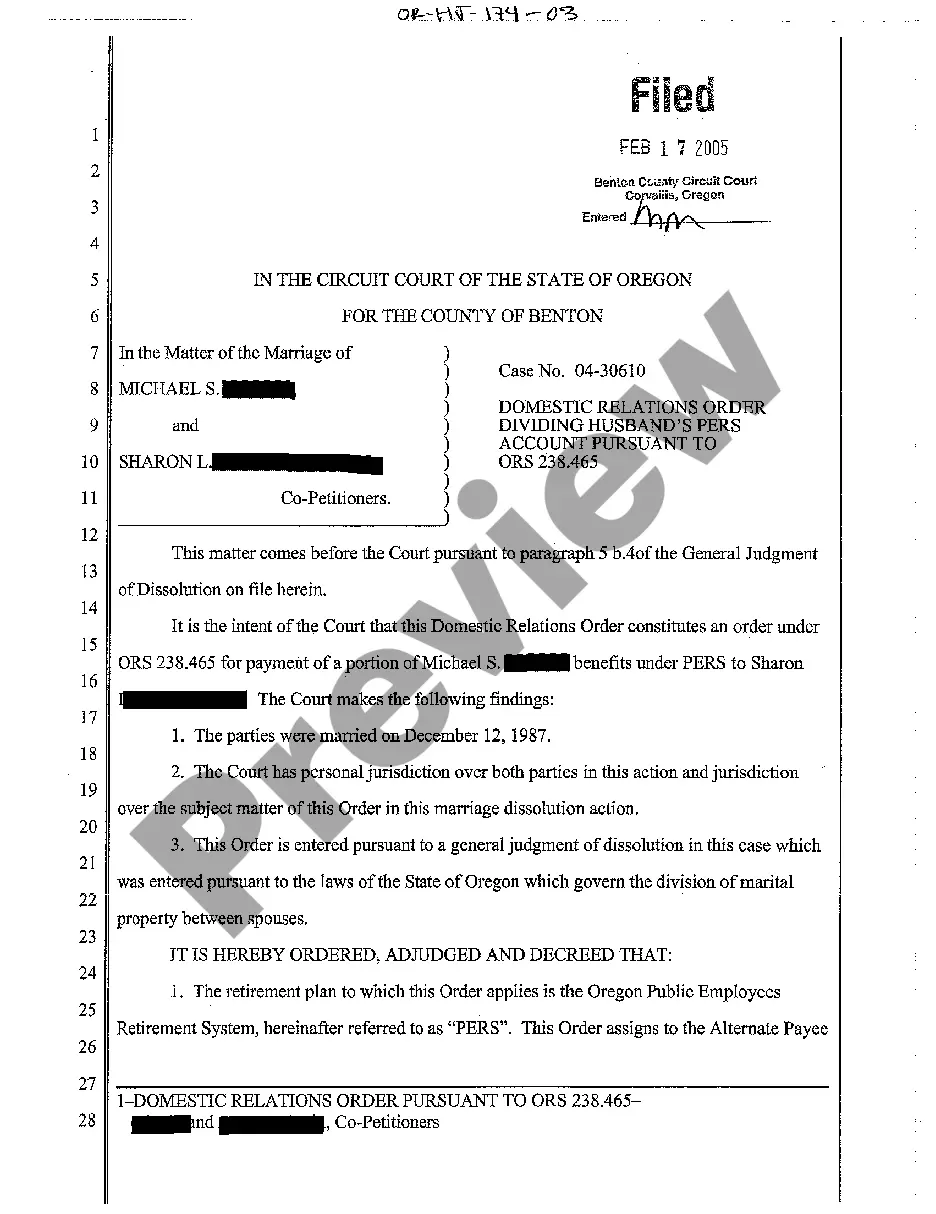

Oregon Domestic Relations Order Dividing Interest in Aig Valic Accounts

Description

How to fill out Oregon Domestic Relations Order Dividing Interest In Aig Valic Accounts?

Creating documents isn't the most straightforward task, especially for people who almost never work with legal paperwork. That's why we recommend utilizing correct Oregon Domestic Relations Order Dividing Interest in Aig Valic Accounts templates created by skilled lawyers. It allows you to prevent troubles when in court or dealing with formal institutions. Find the samples you want on our website for top-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the file webpage. After getting the sample, it will be saved in the My Forms menu.

Customers with no an activated subscription can quickly get an account. Make use of this simple step-by-step guide to get the Oregon Domestic Relations Order Dividing Interest in Aig Valic Accounts:

- Be sure that file you found is eligible for use in the state it’s needed in.

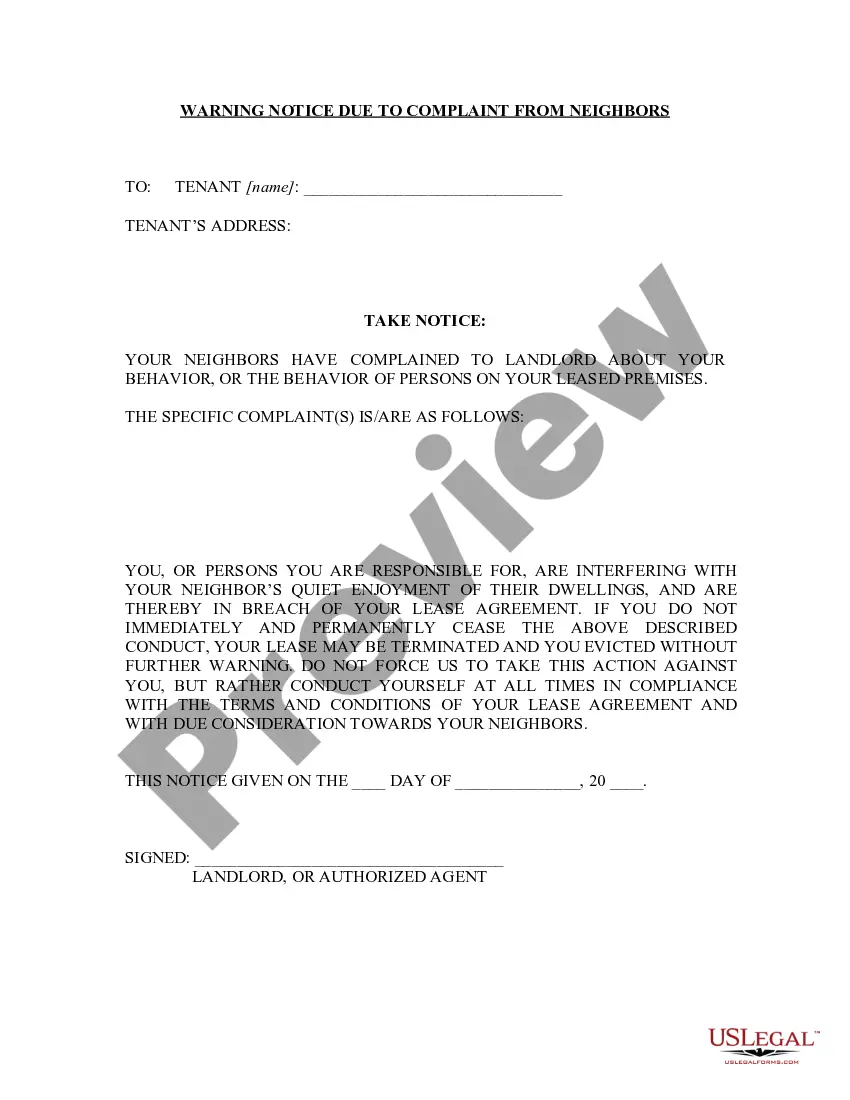

- Confirm the file. Make use of the Preview feature or read its description (if readily available).

- Buy Now if this sample is what you need or go back to the Search field to find another one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these simple steps, you can complete the sample in a preferred editor. Check the filled in information and consider asking a lawyer to examine your Oregon Domestic Relations Order Dividing Interest in Aig Valic Accounts for correctness. With US Legal Forms, everything gets easier. Try it now!

Form popularity

FAQ

Distributions made pursuant to QDROs are generally taxed in the same manner as any other typical plan distribution. One key difference is that a cash-out distribution from a QDRO is not subject to the 10% early withdrawal penalty.

AIG Retirement Services represents AIG member companies - The Variable Annuity Life Insurance Company (VALIC) and its subsidiaries, VALIC Financial Advisors, Inc.All are members of American International Group, Inc. (AIG). This information is general in nature and may be subject to change.

VALIC, a retirement plan provider for health care, K-12, higher education, government, religious, charitable and other not-for-profit organizations, will now be known as AIG Retirement Services.

A. Yes. The law says that money may be taken out of your account (that is to say, the money may be distributed) when you retire, become disabled, leave your job or die. In certain cases of need, furthermore, you may make a hardship withdrawal.

Many states, such as New Jersey, Pennsylvania, New York, and California, use a coverture approach in terms of dividing a pension in a deferred distribution scheme (QDRO).The coverture fraction is defined by marital service divided by total service.

A domestic relations order that creates or recognizes the existence of an alternate payee's right to receive, or assigns to an alternate payee the right to receive, all or a portion of a participant's benefits under an employer-sponsored retirement plan.

The answer to this question depends on what type of retirement plan is being divided. If it is a defined contribution plan (a 401(k), 457, 403(b) or similar plan), or an IRA, the funds are typically transferred into an account in the alternate payee's name within two to five weeks.

A QDRO will instruct the plan administrator on how to pay the non-employee spouse's share of the plan benefits. A QDRO allows the funds in a retirement account to be separated and withdrawn without penalty and deposited into the non-employee spouse's retirement account (typically an IRA).