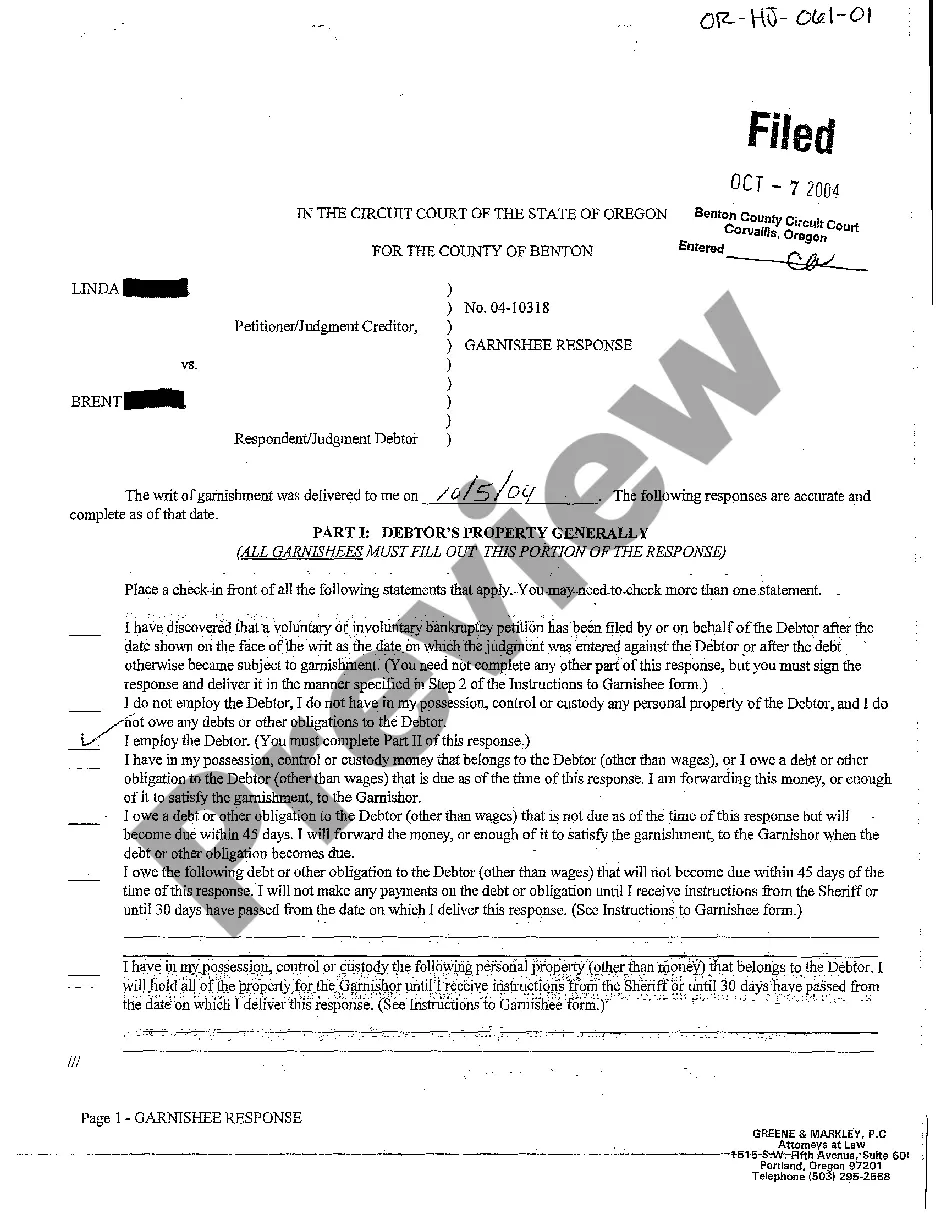

Oregon Garnishee Response

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Garnishee Response?

In terms of submitting Oregon Garnishee Response, you most likely think about an extensive process that requires choosing a perfect form among numerous similar ones and after that being forced to pay out an attorney to fill it out for you. Generally speaking, that’s a slow and expensive option. Use US Legal Forms and pick out the state-specific template in just clicks.

In case you have a subscription, just log in and click on Download button to find the Oregon Garnishee Response template.

If you don’t have an account yet but need one, keep to the step-by-step guide below:

- Make sure the document you’re getting applies in your state (or the state it’s needed in).

- Do this by reading through the form’s description and by clicking on the Preview function (if offered) to find out the form’s content.

- Click on Buy Now button.

- Pick the proper plan for your budget.

- Subscribe to an account and select how you want to pay: by PayPal or by credit card.

- Save the document in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Skilled lawyers work on drawing up our templates to ensure after saving, you don't have to bother about enhancing content outside of your personal details or your business’s details. Be a part of US Legal Forms and get your Oregon Garnishee Response document now.

Form popularity

FAQ

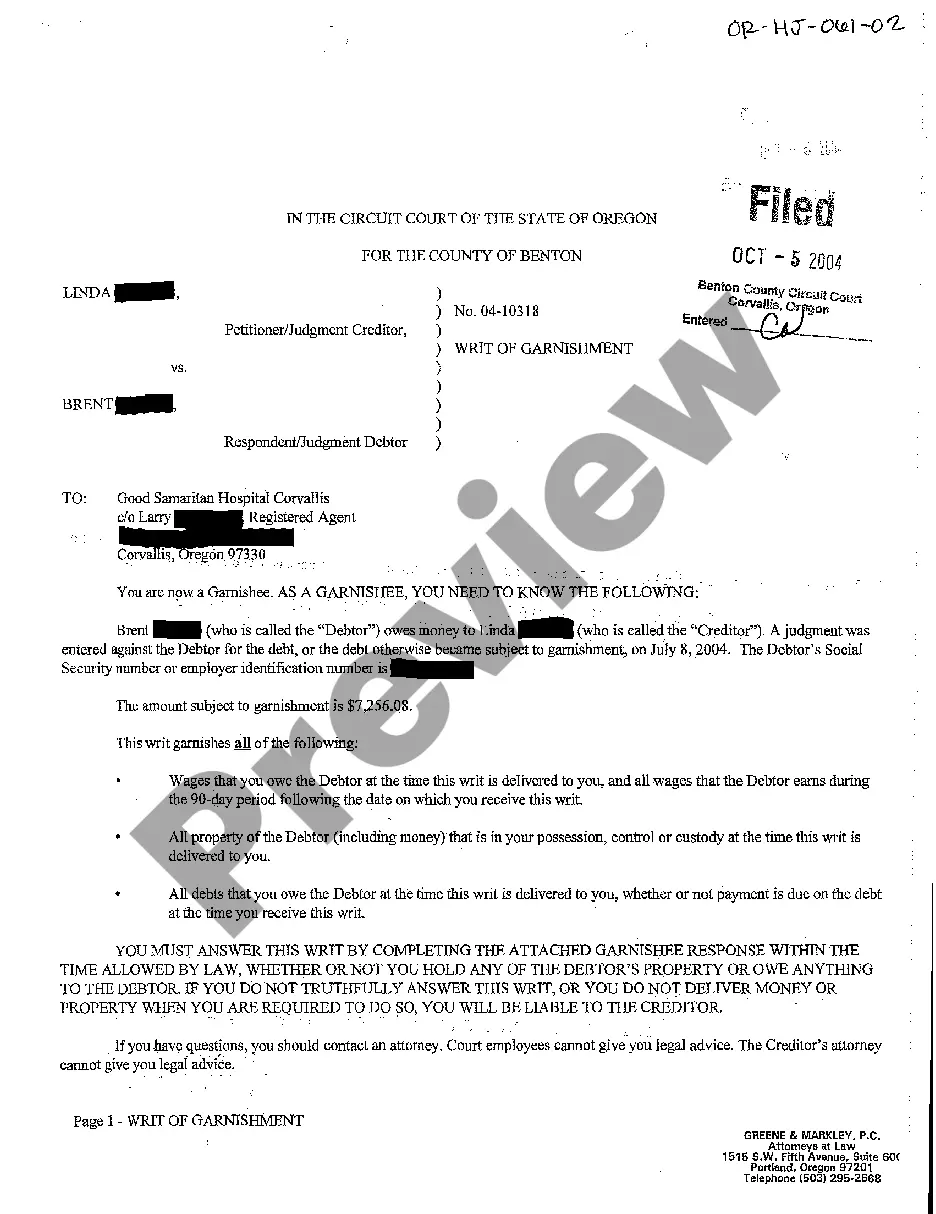

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

File a claim in your county courthouse. A SUMMONS is delivered to you. Default judgment is awarded if no settlement can be reached. Apply for a Writ of Garnishment.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

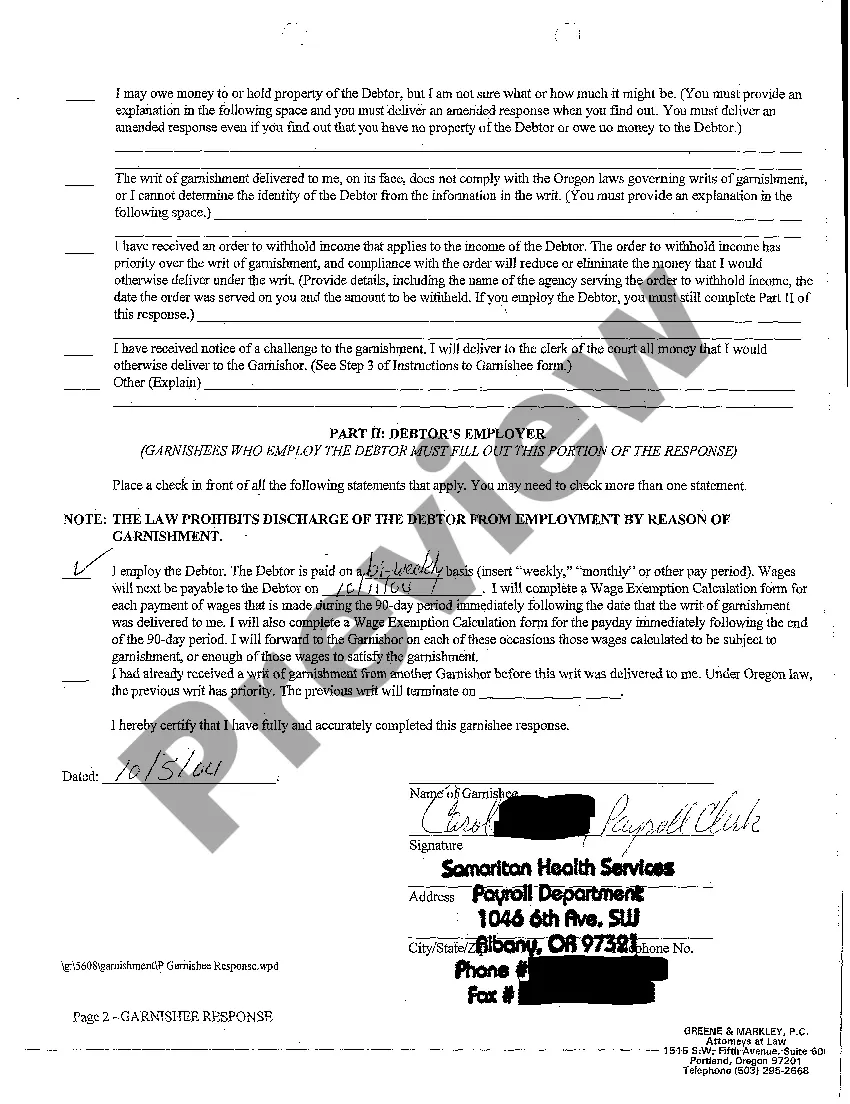

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

A wage garnishment lasts for 90 days and can be renewed by the creditor multiple times until the entire debt you owe is satisfied. A garnishment can intercept 25% of your net paycheck so long as you retain a certain minimum amount of money about $220 per week of work.