Oklahoma Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document formats that you can download or print.

By using the website, you can obtain thousands of forms for both business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form in just minutes.

If you already have a monthly subscription, Log In and download the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously acquired forms from the My documents tab of your account.

Make adjustments. Fill out, modify, print, and sign the downloaded Oklahoma Self-Employed Independent Contractor Consideration For Hire Form.

Every template you add to your account has no expiration date and belongs to you permanently. So, if you wish to download or print another version, simply go to the My documents section and click on the form you need. Gain access to the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form with US Legal Forms, the most extensive collection of legal document formats. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs and requirements.

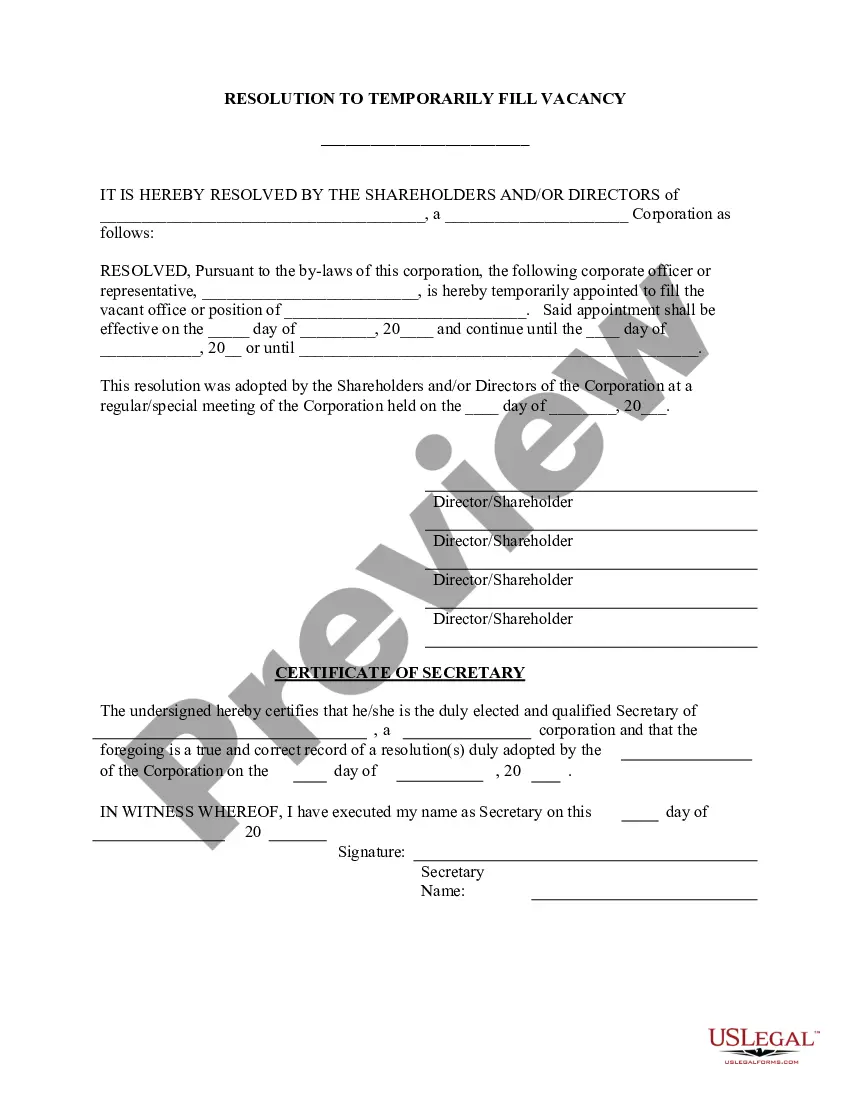

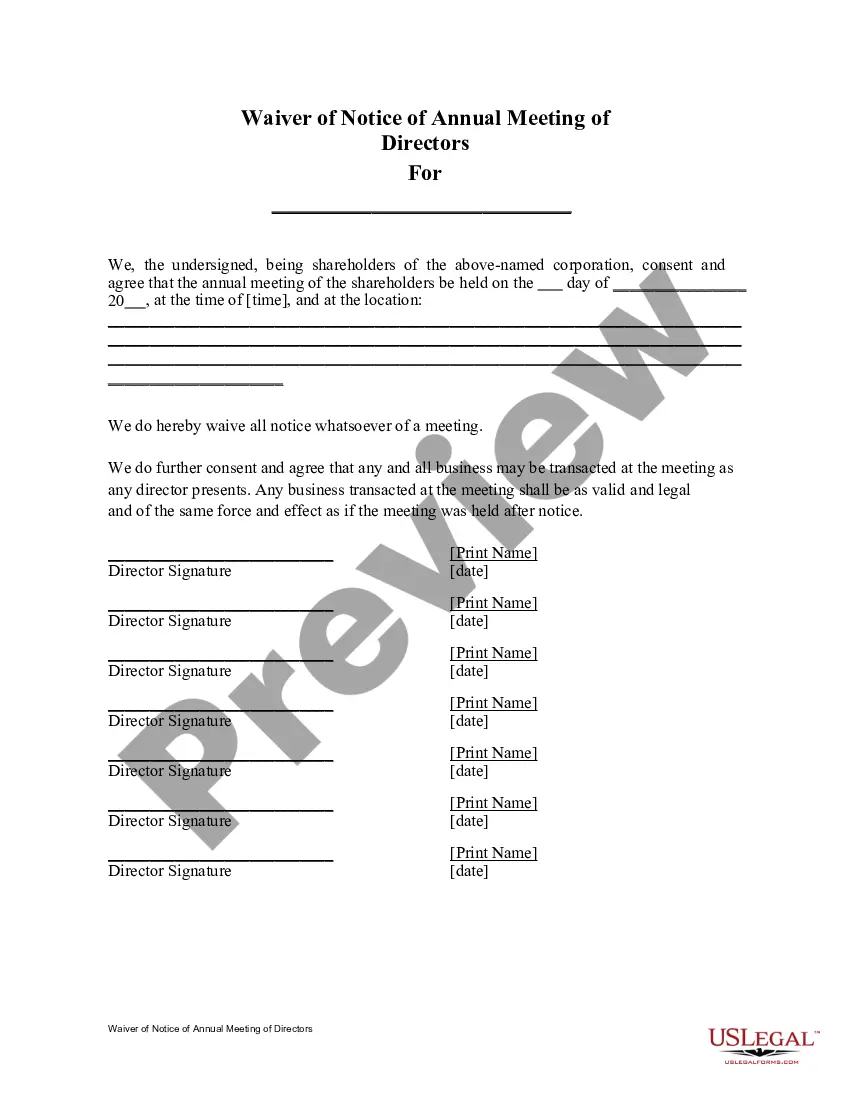

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the content of the form.

- Review the form description to confirm that you have selected the right document.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then select your preferred pricing plan and enter your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

The primary consideration in determining whether a hired person is an independent contractor is the level of control over how the work is performed. Independent contractors typically operate their own businesses and decide how to achieve results, unlike employees who are subject to employer direction. Utilizing the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form can help clarify this distinction and support your hiring decisions.

When an independent contractor is hired by a firm, they will need to fill out a W-9 form. This form provides the firm with the contractor's taxpayer identification information, enabling them to report payments accurately for federal income tax purposes. Understanding this requirement can enhance your hiring process, especially when supported by the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form.

When hiring an independent contractor, the choice between a 1099 and a W-9 form is essential to understand. The W-9 form collects taxpayer identification information, while the 1099 is used to report payments made to the contractor for tax purposes. Generally, you must obtain a W-9 form first, and then issue a 1099 at the end of the year, making adherence to the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form beneficial for accuracy.

The necessary paperwork to hire an independent contractor includes a written agreement, along with a W-9 form for tax documentation. Make sure to outline the services and payment schedule clearly in the contract. For a comprehensive solution, consider using the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form, which helps streamline the setup and ensures compliance.

Independent contractors typically need to complete a W-9 form for tax purposes and may also require a contract form to solidify the agreement with the hiring party. Depending on the nature of the work, other specific forms may be relevant. The Oklahoma Self-Employed Independent Contractor Consideration For Hire Form is an excellent option to guide you through the proper documentation required.

Hiring independent contractors as a sole proprietor requires a clear understanding of your business needs and the role you're hiring for. Start by drafting a detailed contract that specifies the services and payment details. Additionally, utilizing the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form allows you to maintain proper records while effectively managing deadlines and expectations.

When hiring an independent contractor, paperwork typically includes a contract detailing the services, payment structure, and timeline. You may also need a W-9 form to collect the contractor's taxpayer identification information for reporting purposes. Using legal resources like the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form can simplify this process and ensure you fulfill all necessary documentation.

The legal requirements for independent contractors in Oklahoma include the need for a valid agreement that outlines the terms of the working relationship. It's important to ensure that both parties understand expectations regarding work scope, payment terms, and deadlines. Additionally, using the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form can help clarify these terms and legal obligations, making your hiring process more efficient and compliant.

Filling out an independent contractor form involves providing essential details, such as the contractor’s name, contact information, and the nature of the services provided. It’s crucial to accurately describe the work agreement and payment terms. By using the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form available on the US Legal Forms platform, you can ensure all necessary information is included and compliant with legal standards.

Various factors determine a person's classification, such as the type of work, the level of autonomy, and the contractual agreement. Factors might include whether the worker regularly receives payments, the method of payment, and benefits provided. Using the Oklahoma Self-Employed Independent Contractor Consideration For Hire Form can help clarify these distinctions.