Oklahoma Acknowledgment Form for Consultants or Self-Employed Independent Contractors

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

US Legal Forms - one of the most important collections of legal templates in the USA - provides a vast selection of legal document formats that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can find the latest versions of forms like the Oklahoma Acknowledgment Form for Consultants or Self-Employed Independent Contractors in moments.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

Once satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose your preferred payment plan and provide your details to create an account.

- If you have a subscription, Log In and obtain the Oklahoma Acknowledgment Form for Consultants or Self-Employed Independent Contractors from your US Legal Forms library.

- The Download button will be visible on every form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- To start using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

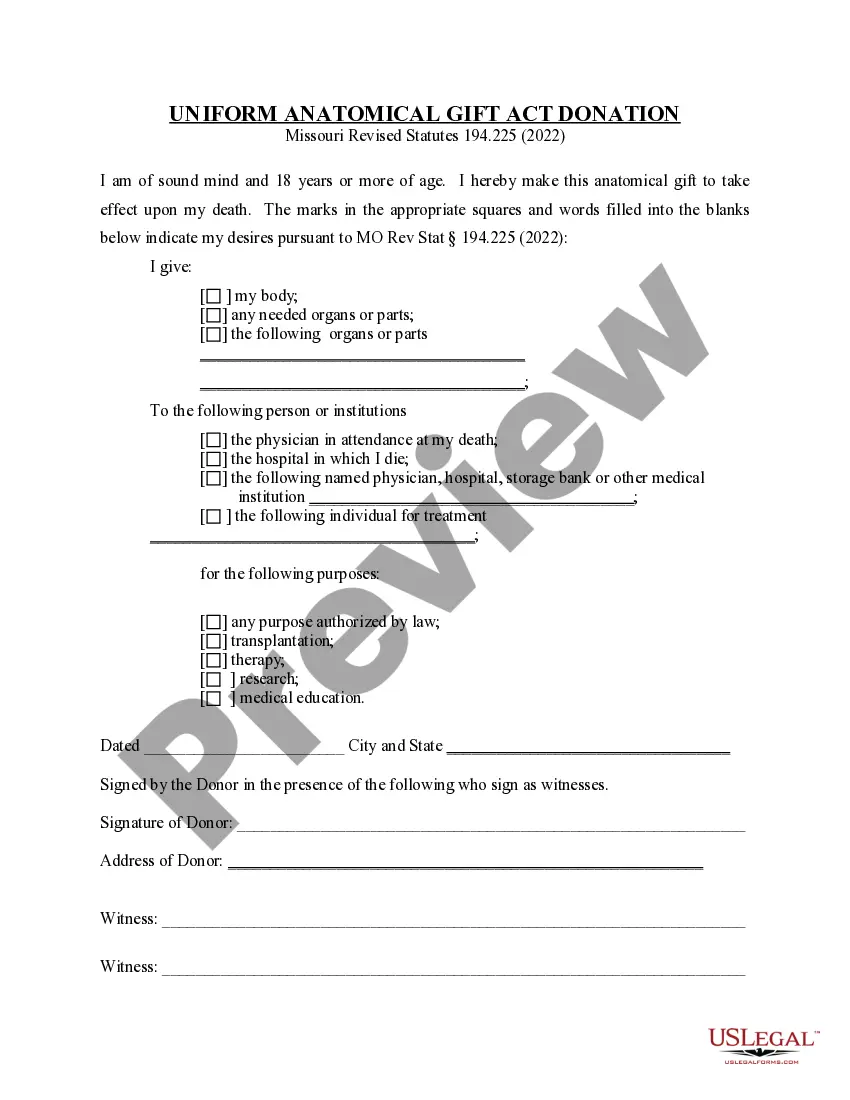

- Use the Review option to examine the details of the form.

Form popularity

FAQ

The 1099-MISC and 1099-NEC forms serve different purposes in reporting income. The 1099-NEC focuses solely on payments made to independent contractors, while the 1099-MISC covers various miscellaneous income types, including rents and royalties. Since the IRS redesigned the reporting system, understanding these distinctions is crucial for accurate tax filing. The Oklahoma Acknowledgment Form for Consultants or Self-Employed Independent Contractors can help ensure proper documentation in such transactions.

No, a W-9 and a 1099 are not the same. The W-9 form is used to collect tax identification information from independent contractors, while the 1099 form reports income earned during the year. Clients issue the 1099 form to the contractors to disclose payments made. To ensure proper documentation, consider using the Oklahoma Acknowledgment Form for Consultants or Self-Employed Independent Contractors.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.