Oklahoma Professional Fundraiser Services Contract - Self-Employed

Description

How to fill out Professional Fundraiser Services Contract - Self-Employed?

Are you in a circumstance where you require paperwork for both business or personal reasons nearly every day.

There are numerous legitimate document templates accessible online, but finding ones you can trust isn’t simple.

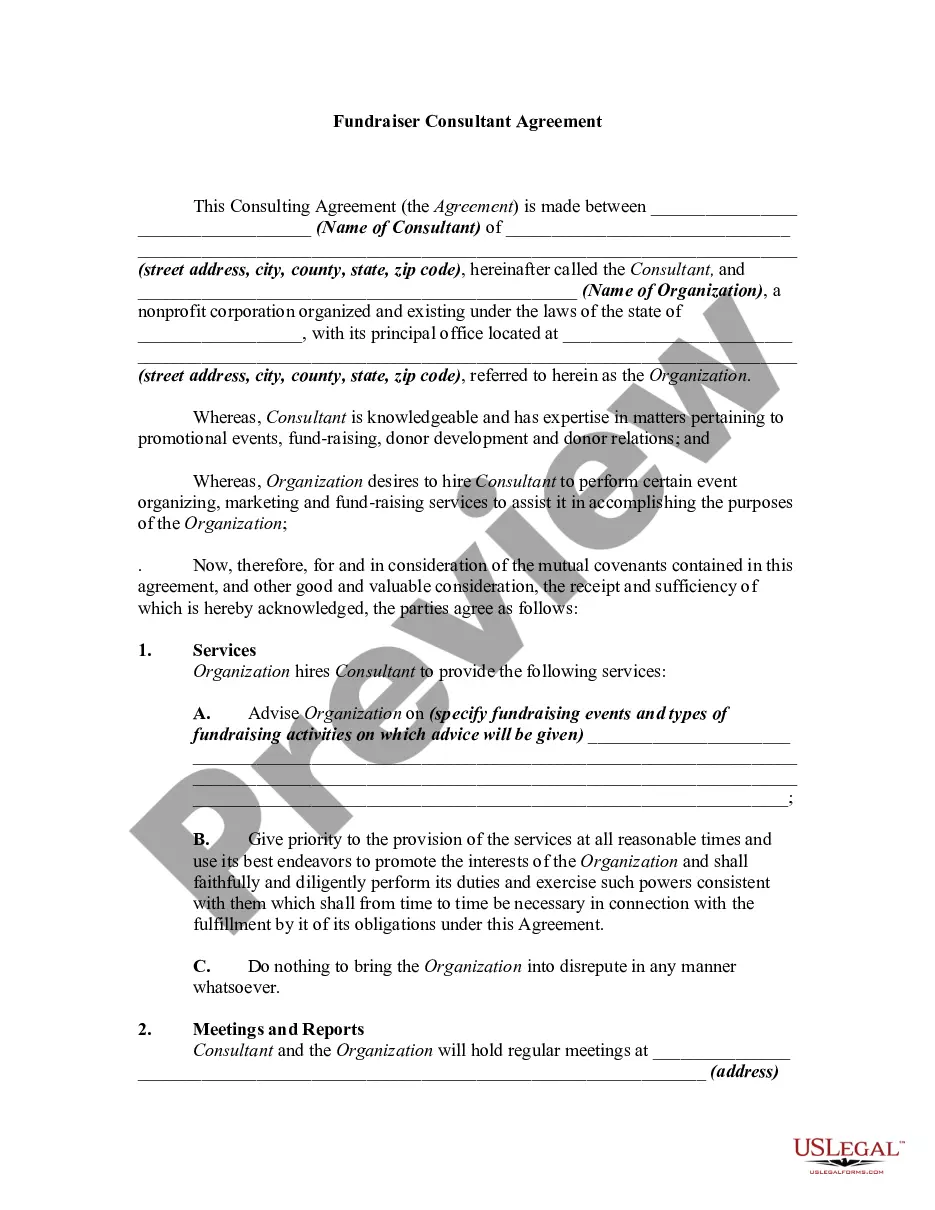

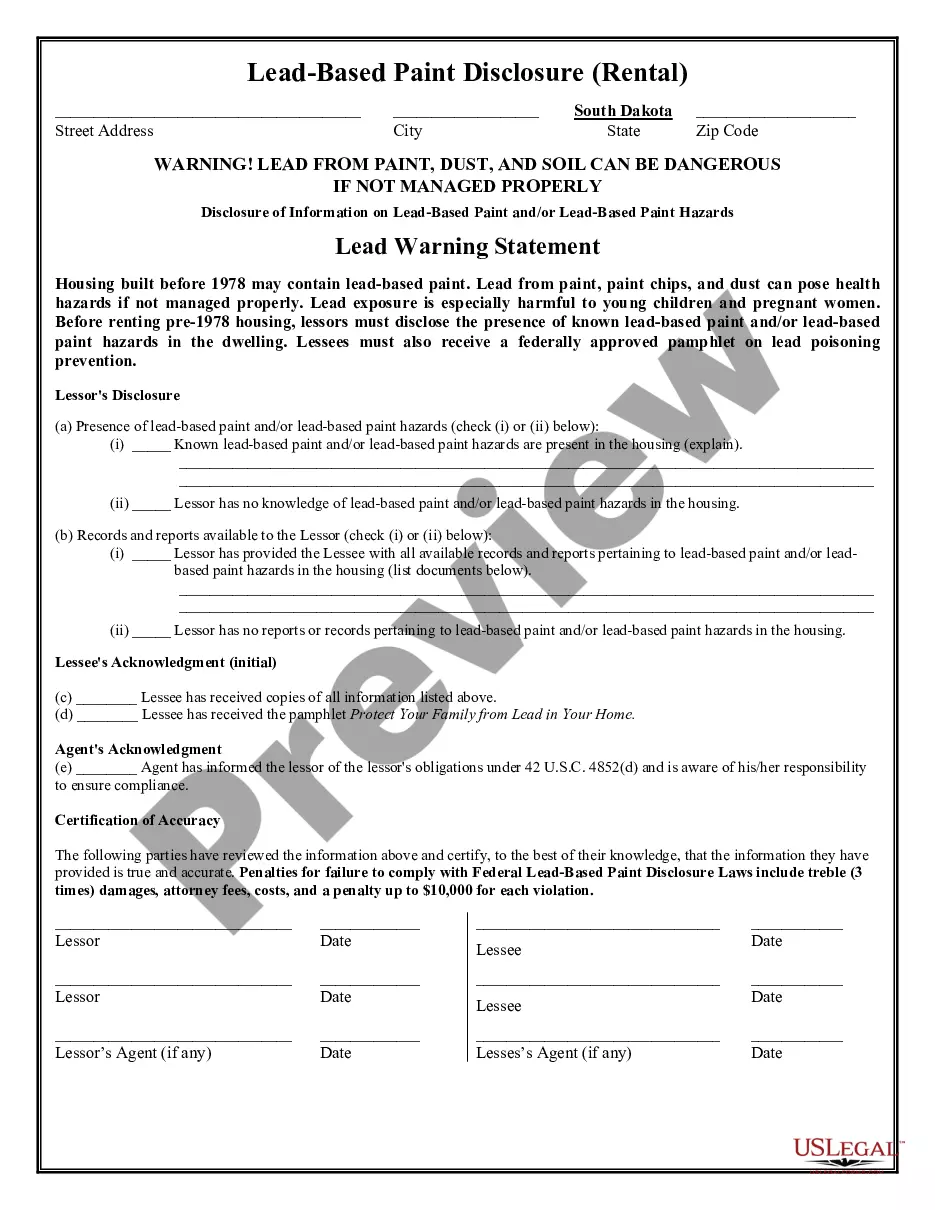

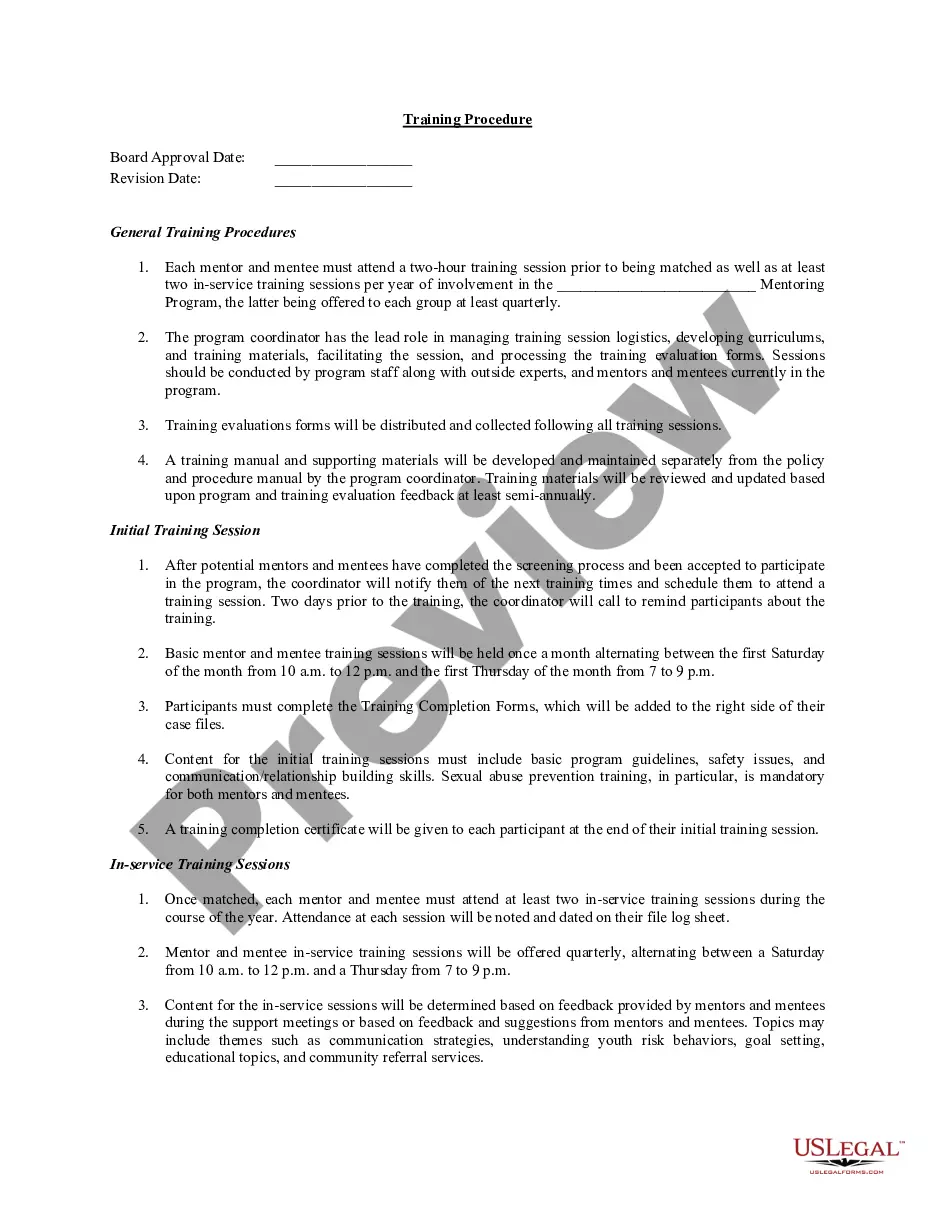

US Legal Forms offers a multitude of form templates, such as the Oklahoma Professional Fundraiser Services Contract - Self-Employed, which can be printed to comply with federal and state regulations.

Once you acquire the correct form, click Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oklahoma Professional Fundraiser Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Preview option to examine the form.

- Review the summary to confirm that you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Yes, you can start and run a nonprofit organization by yourself. However, even as a self-employed professional, it is essential to adhere to state laws and regulations, including obtaining an Oklahoma Professional Fundraiser Services Contract. This contract can help you navigate the financial aspects of fundraising while maintaining compliance with legal standards. Utilizing resources like the uslegalforms platform can guide you through the required documentation and help you build a solid foundation for your nonprofit.

The IRS rules for non-profit organizations include regulations on how these entities must operate, maintain their tax-exempt status, and report their financial information. Nonprofits must adhere to guidelines regarding fundraising, transparency, and governance. Understanding these rules is critical when entering into an Oklahoma Professional Fundraiser Services Contract - Self-Employed to ensure compliance and avoid potential penalties.

The 33 percent rule emphasizes that a nonprofit must spend at least one-third of its total budget on programs that directly serve its mission. This practice showcases the organization’s commitment to its cause, which can positively influence fundraising efforts. Incorporating this principle into your Oklahoma Professional Fundraiser Services Contract - Self-Employed can enhance your organization’s credibility and effectiveness.

The 33 rule refers to the guideline that at least one-third of a nonprofit's expenditures should go towards direct services or programmatic activities. This principle promotes accountability and transparency, encouraging donors to see how their contributions are utilized. When drafting your Oklahoma Professional Fundraiser Services Contract - Self-Employed, keeping this rule in mind can improve trust with your donor base.

The 33% rule states that a nonprofit organization should allocate at least one-third of its revenue to program services. This ensures that funds are used effectively to further the organization’s mission and impact. Understanding this rule is vital when creating an Oklahoma Professional Fundraiser Services Contract - Self-Employed, as it helps align fundraising practices with the organization’s goals.

The 80 20 rule suggests that 80% of your funding typically comes from 20% of your donors. For nonprofits, this means identifying and nurturing those key supporters is crucial for sustainable funding. By focusing your efforts on these vital relationships, you can enhance your fundraising strategy and maximize the benefits of your Oklahoma Professional Fundraiser Services Contract - Self-Employed.

The Oklahoma Solicitation of Charitable Contributions Act regulates how charitable organizations can solicit donations. It ensures that individuals or entities raising funds are transparent and ethical in their practices. If you are considering the Oklahoma Professional Fundraiser Services Contract - Self-Employed, it's essential to understand these laws to remain compliant and protect your organization’s reputation.

The rule of 7 in fundraising suggests that potential donors need to see or hear a message seven times before they make a donation. This principle emphasizes the importance of consistent communication and engagement in fundraising efforts. Implementing this rule can greatly benefit your strategy when dealing with an Oklahoma Professional Fundraiser Services Contract - Self-Employed, as it encourages persistent outreach to maximize donations.

A professional fundraiser is typically someone who is compensated to conduct fundraising activities on behalf of a charitable organization. This includes individuals or companies that engage in solicitation, planning, or implementing fundraising campaigns. By establishing an Oklahoma Professional Fundraiser Services Contract - Self-Employed, the scope of their services and legal responsibilities can be clearly defined.

The Oklahoma Charitable Solicitations Act governs how charities and professional fundraisers can solicit donations in the state. This legislation aims to protect donors and ensure transparency in fundraising activities. Understanding the Oklahoma Charitable Solicitations Act is crucial for those entering into an Oklahoma Professional Fundraiser Services Contract - Self-Employed, as it outlines important legal obligations.