Oklahoma End User Online Services Terms and Conditions

Description

How to fill out End User Online Services Terms And Conditions?

Are you presently in a place where you require files for both business or specific purposes nearly every day? There are a lot of legal papers web templates accessible on the Internet, but getting kinds you can depend on isn`t easy. US Legal Forms gives a huge number of type web templates, like the Oklahoma End User Online Services Terms and Conditions, that are published in order to meet state and federal specifications.

When you are presently familiar with US Legal Forms web site and have an account, simply log in. Next, you may acquire the Oklahoma End User Online Services Terms and Conditions web template.

Should you not offer an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the type you will need and make sure it is for that correct town/region.

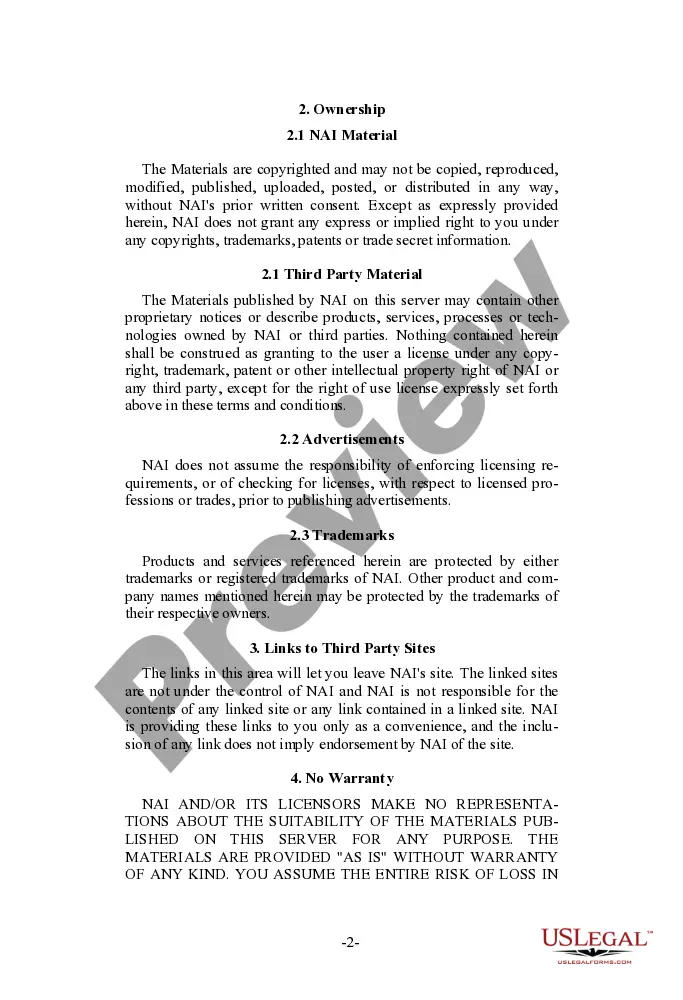

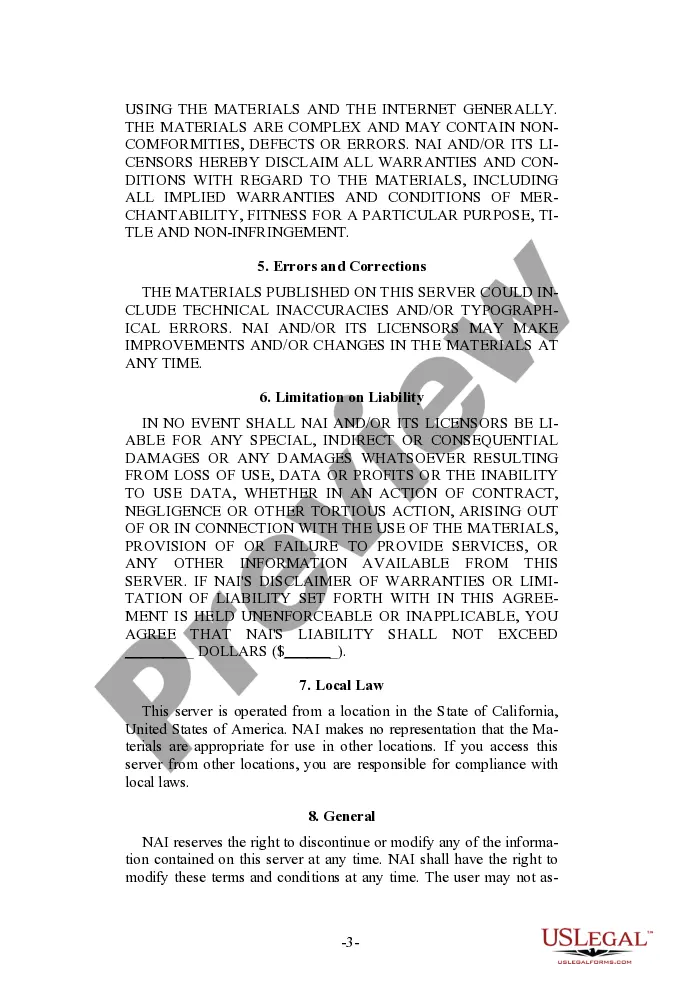

- Utilize the Review option to analyze the form.

- Look at the description to ensure that you have selected the correct type.

- If the type isn`t what you are looking for, take advantage of the Lookup industry to obtain the type that suits you and specifications.

- When you discover the correct type, click Buy now.

- Choose the pricing plan you desire, fill out the necessary information and facts to make your account, and pay money for an order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free paper structure and acquire your backup.

Get every one of the papers web templates you possess bought in the My Forms menu. You may get a extra backup of Oklahoma End User Online Services Terms and Conditions whenever, if needed. Just go through the needed type to acquire or printing the papers web template.

Use US Legal Forms, one of the most substantial collection of legal forms, in order to save time as well as stay away from faults. The services gives expertly manufactured legal papers web templates which you can use for a variety of purposes. Produce an account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

Tax-exempt customers Some customers are exempt from paying sales tax under Oklahoma law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Tax Exempt Items Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services.

Being tax-exempt means that some or all of a transaction, entity or person's income or business is free from federal, state or local tax. Tax-exempt organizations are typically charities or religious organizations recognized by the IRS. Internal Revenue Service.

Tangible products are taxable in Oklahoma, though a few products have an exemption, such as certain prescription medications. There is also an exemption for medical equipment and supplies.

CHARACTERISTICS OF A CONTRACT ? Parties capable of contracting. ? Consent. ? A lawful object; can't involve illegal activity. ? Sufficient cause or consideration.

The sales tax is levied upon the gross receipts or gross proceeds of the sale of natural or artificial gas, electricity, ice, steam, or any other utility or public service, except water, sewage, and refuse, and those specifically exempt (including exempt residential uses, discussed below).