Rhode Island Accounting Procedures

Description

How to fill out Accounting Procedures?

If you have to comprehensive, acquire, or produce lawful document templates, use US Legal Forms, the biggest selection of lawful types, that can be found on the web. Take advantage of the site`s simple and practical lookup to find the paperwork you need. Various templates for organization and personal uses are sorted by types and says, or keywords. Use US Legal Forms to find the Rhode Island Accounting Procedures within a number of click throughs.

When you are already a US Legal Forms client, log in for your accounts and then click the Download switch to find the Rhode Island Accounting Procedures. You can even accessibility types you in the past delivered electronically from the My Forms tab of your accounts.

Should you use US Legal Forms initially, refer to the instructions beneath:

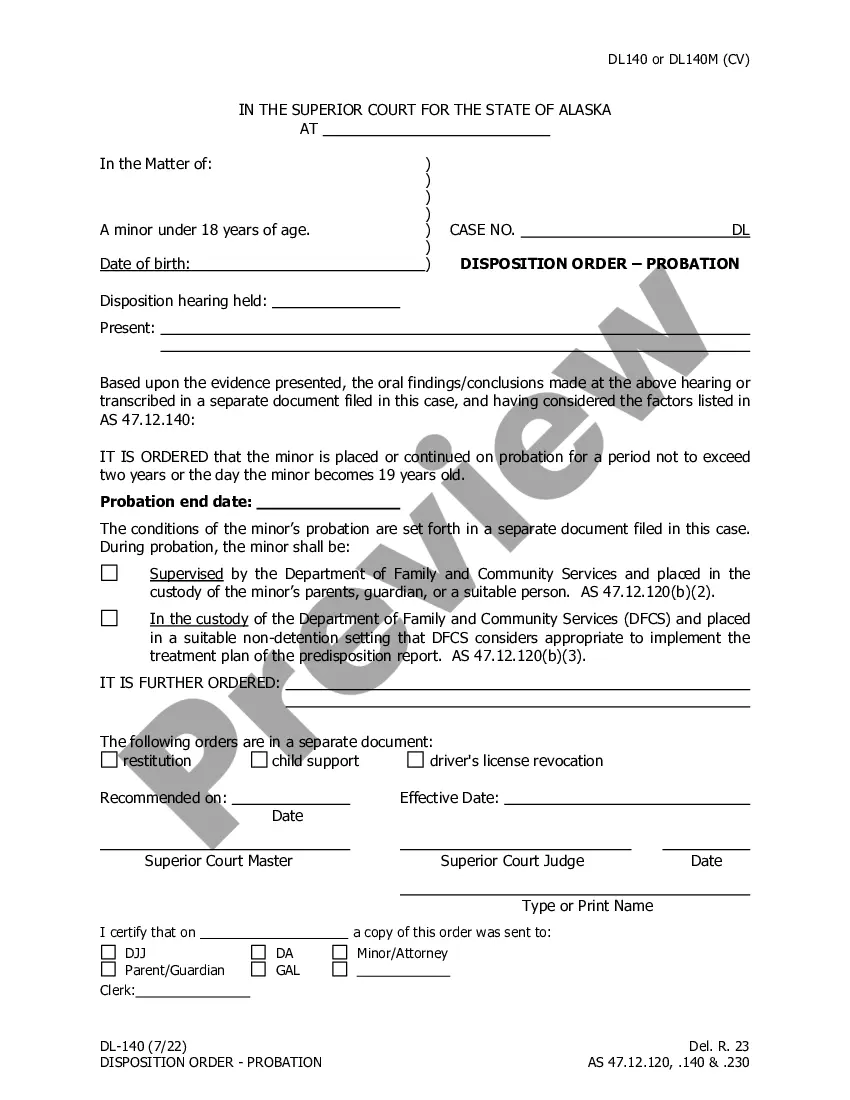

- Step 1. Be sure you have chosen the form to the proper metropolis/nation.

- Step 2. Utilize the Review method to look through the form`s content. Don`t neglect to read the description.

- Step 3. When you are unsatisfied with the form, utilize the Research industry at the top of the display screen to get other models of the lawful form format.

- Step 4. Once you have found the form you need, go through the Acquire now switch. Pick the costs plan you prefer and include your credentials to sign up for the accounts.

- Step 5. Process the transaction. You can use your bank card or PayPal accounts to perform the transaction.

- Step 6. Choose the file format of the lawful form and acquire it in your device.

- Step 7. Comprehensive, edit and produce or sign the Rhode Island Accounting Procedures.

Each lawful document format you purchase is your own property eternally. You might have acces to each form you delivered electronically with your acccount. Click the My Forms portion and select a form to produce or acquire yet again.

Compete and acquire, and produce the Rhode Island Accounting Procedures with US Legal Forms. There are many expert and condition-particular types you can use for your organization or personal demands.

Form popularity

FAQ

Selection of accounting policies is a major goal for a company to establish. For various purposes like transactions, sales management, etc. selection of accounting policies is necessary. Accounting policies are specific policies which alter at times to help in maintaining the profit rate.

Financial and accounting policies are a set of standards, methods and measurement systems that govern the preparation and reporting of your company's financial information. These policies area approved by your management team and developed for a long term, reflecting your company's values and ethics.

Accounting policies are important to any business to maintain consistency and to set up a standard for decision-making. For example, the importance of such a policy is due to the fact that in larger companies accountants may determine different accounting treatments for the same transaction.

Have a separate section for each accounting process, such as accounts payable, accounts receivable and fixed assets. Give each policy and procedure (P&P) a number and use the numbering system to organize the documentation. For example, all accounts receivable P&Ps could start with a 1, accounts payable with a 2.

Accounting rules help to compare financial information and statements easily. Transparency in the financial system is maintained, and efficient detection of financial fraud is possible. The accounting principles allow investors to analyse and tally significant information to make financial decisions.

Accounting policies are the specific procedures implemented by a company's management team that are used to prepare its financial statements. These include any accounting methods, measurement systems, and procedures for presenting disclosures.

Benefits of Accounting Standards 1] Attains Uniformity in Accounting. ... 2] Improves Reliability of Financial Statements. ... 3] Prevents Frauds and Accounting Manipulations. ... 4] Assists Auditors. ... 5] Comparability. ... 6] Determining Managerial Accountability. ... 1] Difficulty between Choosing Alternatives. ... 2] Restricted Scope.

Accounting policies are important, as they set a framework, which all companies follow, and provide comparable and consistent standard financial statements across years and relative to other companies.