Oklahoma End User Online Services Terms and Conditions

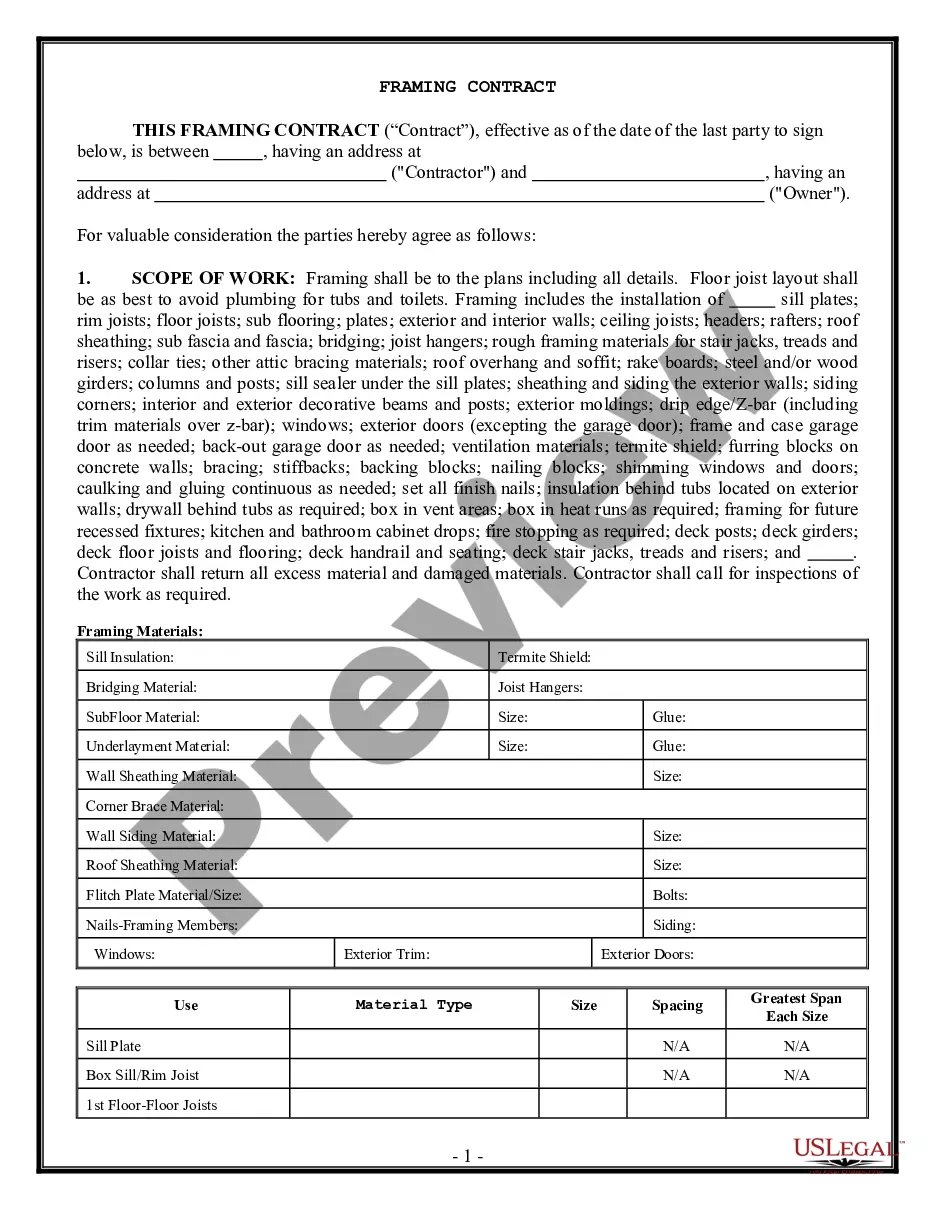

Description

How to fill out End User Online Services Terms And Conditions?

Have you found yourself in a scenario where you require documents for various business or personal reasons almost every workday.

There are numerous reliable document templates accessible online, but acquiring versions you can trust isn't simple.

US Legal Forms offers a vast array of form templates, including the Oklahoma End User Online Services Terms and Conditions, crafted to comply with state and federal regulations.

When you find the right form, simply click Acquire now.

Select the pricing plan you need, provide the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Oklahoma End User Online Services Terms and Conditions template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to examine the document.

- Check the description to guarantee you have selected the right form.

- If the form isn't what you require, use the Search box to locate the form that fits your needs.

Form popularity

FAQ

Services in Oklahoma are generally not taxable.

Sales of janitorial services are exempt from the sales tax in Oklahoma.

Oklahoma Sales Tax Exemption: Electronically Delivered Software. The Oklahoma sales tax exemption for software also applies to sales of software that is delivered electronically. Section 1357(32) of Title 68 of the Oklahoma Statutes provides this specific exemption for electronically delivered software.

Sales Tax Exemptions in Oklahoma Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

Contractors are defined by statute as consumer/users and must pay sales tax on all taxable services and tangible personal property, including materials, supplies, and equipment purchased to develop, repair, alter, remodel, and improve real property.

Oklahoma Tax Nexus Generally, a business has nexus in Oklahoma when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

Oklahoma does not require businesses to collect sales tax on the sale of digital goods or services.

Sales Tax Exemptions in Oklahoma Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.