Oklahoma Executive Officer One-Year Incentive Plan

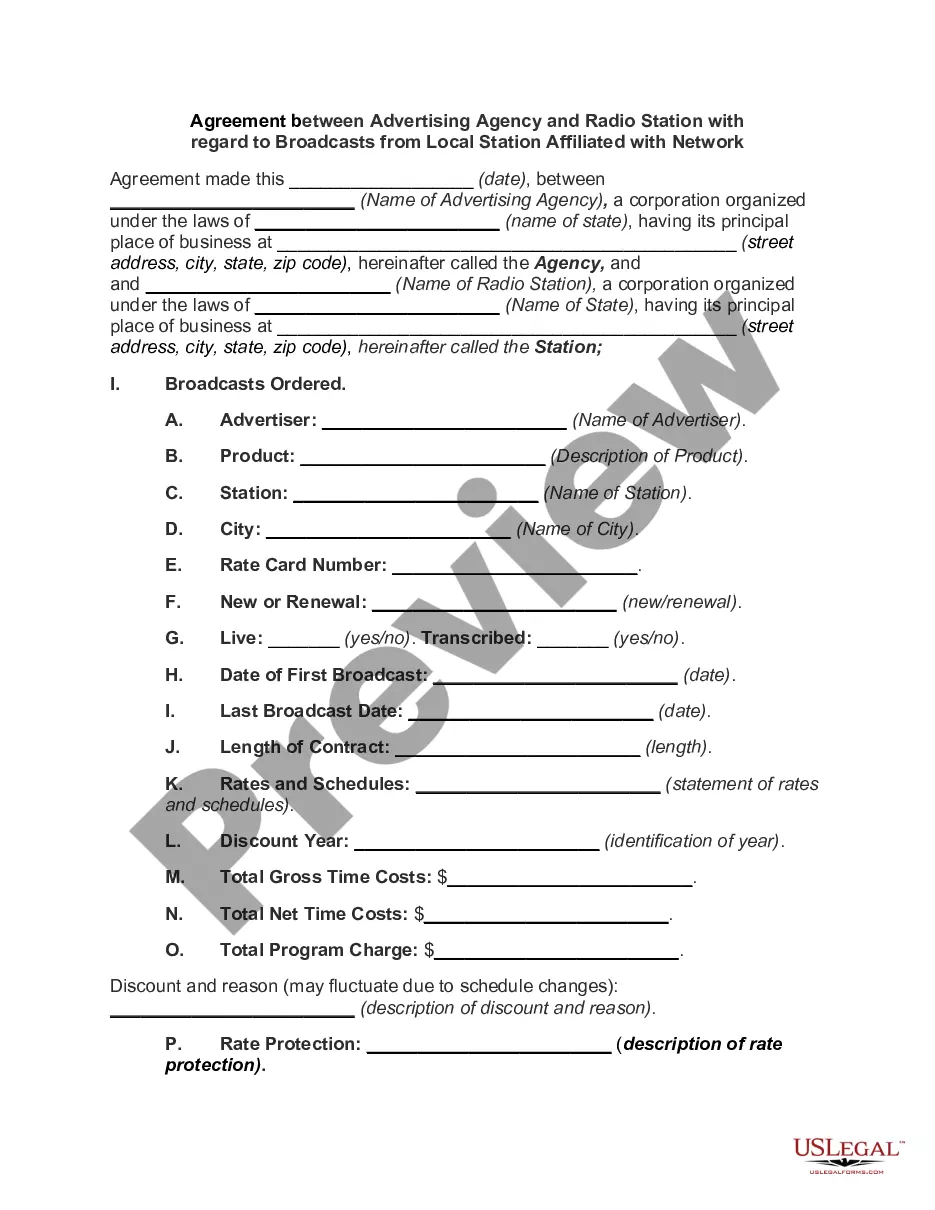

Description

How to fill out Executive Officer One-Year Incentive Plan?

Finding the right authorized file template can be quite a have difficulties. Needless to say, there are tons of layouts accessible on the Internet, but how will you find the authorized form you need? Make use of the US Legal Forms internet site. The assistance gives a huge number of layouts, like the Oklahoma Executive Officer One-Year Incentive Plan, which can be used for organization and personal requirements. Every one of the types are checked out by pros and satisfy state and federal demands.

When you are already authorized, log in to your profile and click on the Download key to find the Oklahoma Executive Officer One-Year Incentive Plan. Make use of profile to look throughout the authorized types you might have ordered in the past. Go to the My Forms tab of your respective profile and get yet another backup in the file you need.

When you are a fresh customer of US Legal Forms, allow me to share basic recommendations that you can comply with:

- Initial, make sure you have chosen the correct form to your city/county. You may examine the form using the Review key and study the form explanation to guarantee this is the right one for you.

- In case the form does not satisfy your needs, utilize the Seach discipline to obtain the correct form.

- When you are certain that the form is proper, select the Buy now key to find the form.

- Choose the rates plan you want and enter in the needed info. Design your profile and purchase an order using your PayPal profile or Visa or Mastercard.

- Pick the data file formatting and obtain the authorized file template to your gadget.

- Total, revise and produce and sign the attained Oklahoma Executive Officer One-Year Incentive Plan.

US Legal Forms will be the greatest local library of authorized types that you can see numerous file layouts. Make use of the company to obtain skillfully-made files that comply with status demands.

Form popularity

FAQ

To receive longevity pay, an employee must be continuously employed in the classified or unclassified service of the state for a minimum of two years in full-time or part-time (more than 1,000 hours per year) status.

Annual Longevity Payment. At least 2 years but less than 4 years. $250.00. At least 4 years but less than 6 years. $426.00.

The Oklahoma Public Employees Retirement System (OPERS) administers retirement plans for several different types of Oklahoma state and local government employees. The primary plan is a defined benefit retirement plan.

Another option in determining longevity pay is basing it on a percentage of the employees salary. This may be based exclusively on the employee's annual salary or include bonuses and other forms of compensation. Certain cases of longevity pay can also have wage caps on specific job titles.

Longevity pay is additional wages, salary, or another form of compensation given to an employee or worker based on the length of their service. Longevity pay is determined in contractual agreements reached between an employer and employee ing to the employee's level of seniority.

If an employee has a fraction of a year toward the next higher percentage rate, the payment would be based on the higher rate. For example, if an employee has 19 years and 3 months service, the payment would be 3.25% rather than 2.25%.

The longevity pay amount shall be computed on the salary as of the last day worked; then it is prorated by an amount equal to the proportion of the year worked toward the annual eligibility date. Example: The employee will receive 1/12 of the annual amount for each month worked toward the next longevity payment.

Paid Time Off (PTO) in Oklahoma Private employers in Oklahoma are not required to provide paid or unpaid vacation. However, if an employer chooses to offer vacation leave to its employees, paid or unpaid, it must comply with appropriate state law, established company policy, and the employment contract.