Oklahoma Adjustments in the event of reorganization or changes in the capital structure

Description

How to fill out Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

You are able to spend hrs on-line looking for the lawful document design that meets the state and federal specifications you will need. US Legal Forms offers a large number of lawful varieties which are evaluated by experts. You can actually obtain or printing the Oklahoma Adjustments in the event of reorganization or changes in the capital structure from our assistance.

If you already have a US Legal Forms bank account, you may log in and click on the Download button. After that, you may complete, edit, printing, or indication the Oklahoma Adjustments in the event of reorganization or changes in the capital structure. Every lawful document design you acquire is your own property eternally. To get another copy of any purchased type, check out the My Forms tab and click on the related button.

If you use the US Legal Forms web site the very first time, follow the easy recommendations under:

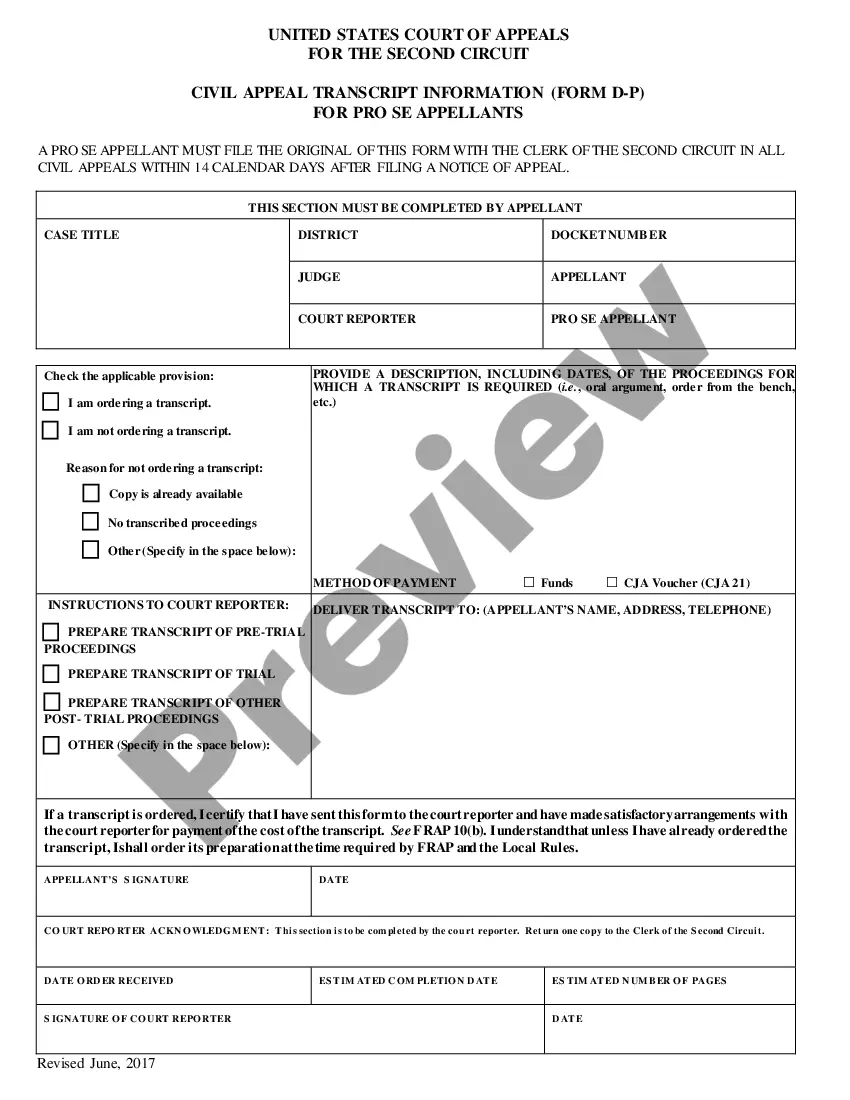

- Very first, make sure that you have selected the proper document design to the state/area that you pick. See the type explanation to ensure you have selected the right type. If accessible, utilize the Review button to search throughout the document design too.

- If you want to find another edition of your type, utilize the Lookup area to discover the design that suits you and specifications.

- Upon having found the design you need, simply click Acquire now to continue.

- Pick the costs plan you need, type your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal bank account to cover the lawful type.

- Pick the formatting of your document and obtain it for your system.

- Make modifications for your document if possible. You are able to complete, edit and indication and printing Oklahoma Adjustments in the event of reorganization or changes in the capital structure.

Download and printing a large number of document web templates making use of the US Legal Forms web site, which provides the largest collection of lawful varieties. Use expert and express-distinct web templates to deal with your small business or specific requirements.

Form popularity

FAQ

Section 7-17-3 - What constitutes "Nexus" (a) If a corporation has one or more of the following activities in Oklahoma, it is considered to have "nexus" and shall be subject to Oklahoma income taxes: (1) Maintenance of any business location in Oklahoma, including any kind of office.

Physical nexus means having enough tangible presence or activity in a state to merit paying sales tax in that state. Economic nexus means passing a states' economic threshold for total revenue or the number of transactions in that state.

The difference between federal depletion and Oklahoma depletion is the Oklahoma depletion adjustment. On resident returns, income or losses from non-Oklahoma properties is totally eliminated from Oklahoma income through the "Out of state income" deduction or the "Out of state loss" addition on Form 511.

Withholding is not required in the following instances: (1) When an entity is not required to file a federal income tax return, or properly elects out of such duty; (2) When a pass-through entity is making distributions of income not subject to Oklahoma income tax; (3) When a pass-through entity has withheld tax on ...

All resident partners must file individual income tax returns with Oklahoma if they are required to file individual Federal Income Tax Returns. All nonresident partners that have gross income of $1,000.00 must file an Oklahoma Return even though their net may actually be a loss.

Oklahoma's apportionment formula consists of sales, payroll and property weighted equally and a throwback rule which takes out-of-state sales and lumps them into a corporation's Oklahoma income when the corporation makes sales in a state that does not tax the income.

Pursuant to OAC 7-17-1, the Oklahoma Small Business Corporation Income and Franchise Tax Return must be filed electronically. Refunds must be made by direct deposit. Failure to supply direct deposit information will delay the processing of the refund.

Capital gain from qualifying property, as described above, held by a pass-through entity (PTE) is eligible for the Oklahoma capital gain deduction, provided the individual has been a member of the PTE for an uninterrupted period of the applicable two or five years and the PTE has held the asset for not less than the ...