Oklahoma Anti-Dilution Adjustments

Description

How to fill out Anti-Dilution Adjustments?

Are you presently within a placement the place you require files for sometimes enterprise or personal uses virtually every day time? There are tons of legal file layouts available on the net, but discovering types you can trust isn`t effortless. US Legal Forms gives 1000s of kind layouts, such as the Oklahoma Anti-Dilution Adjustments, that happen to be created to satisfy state and federal specifications.

If you are presently acquainted with US Legal Forms site and have a merchant account, basically log in. After that, it is possible to acquire the Oklahoma Anti-Dilution Adjustments format.

If you do not have an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the kind you want and make sure it is for your appropriate area/area.

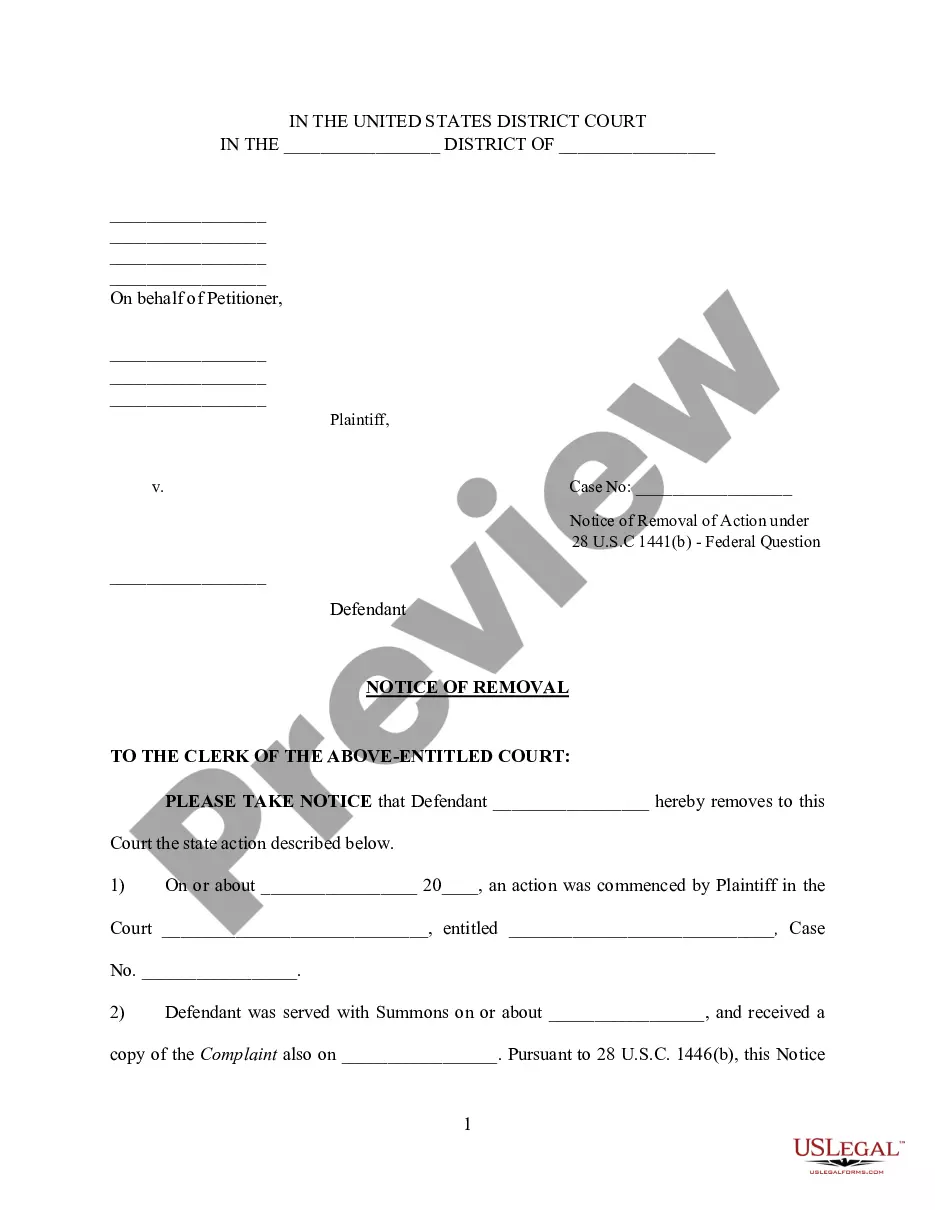

- Make use of the Preview button to analyze the shape.

- See the description to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you are seeking, make use of the Lookup industry to find the kind that meets your requirements and specifications.

- Whenever you obtain the appropriate kind, simply click Buy now.

- Opt for the prices prepare you need, submit the required details to generate your money, and purchase the order using your PayPal or Visa or Mastercard.

- Select a convenient file format and acquire your duplicate.

Get all of the file layouts you possess purchased in the My Forms menu. You may get a more duplicate of Oklahoma Anti-Dilution Adjustments any time, if necessary. Just click on the essential kind to acquire or produce the file format.

Use US Legal Forms, one of the most extensive variety of legal forms, in order to save some time and avoid mistakes. The assistance gives expertly made legal file layouts that can be used for a selection of uses. Produce a merchant account on US Legal Forms and begin producing your lifestyle a little easier.

Form popularity

FAQ

Anti-dilution provisions are clauses built into convertible preferred stocks and some options to help shield investors from their investment potentially losing value. When new issues of a stock hit the market at a cheaper price than that paid by earlier investors in the same stock, then equity dilution can occur.

The anti-dilution adjustment clause is a provision contained in a security or merger agreement. The anti-dilution clause provides current investors with the right to maintain their ownership percentage in the company by purchasing a proportionate number of new shares at a future date when securities are issued.

The conversion ratio is 1 to 1. Adjusting the conversion ratio can be used to maintain an investor's value in the company through anti-dilution provisions. The idea is that the investor paid too much for the shares early in the company's life.

Typically, one share of preferred stock converts to one share of common stock, but anti-dilution provisions adjust the conversion ratio to offset value dilution by increasing the number of common shares that one share of preferred stock converts into.

Anti-dilution provisions are clauses that allow investors the right to maintain their ownership percentages in the event that new shares are issued. They are rights that are usually associated with preferred shares.

Weighted average anti-dilution protection gives consideration to the relationship between the total shares outstanding as compared to the shares held by the original investor. The formula is CP2 = CP1 * (A+B) / (A+C).

Very simply, if the original conversion price was $5 and in a later round the conversion price is $2.50, the investor's original conversion price would adjust to $2.50. The weighted average provision uses the following formula to determine new conversion prices: C2 = C1 x (A + B) / (A + C)

It is made to protect the investor's rights and can be an outstanding obligation for an entrepreneur to fulfill. An anti-dilution provision is a contractual clause typically included in investment agreements, such as convertible notes or preferred stock agreements, to protect investors' rights.