Oklahoma Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

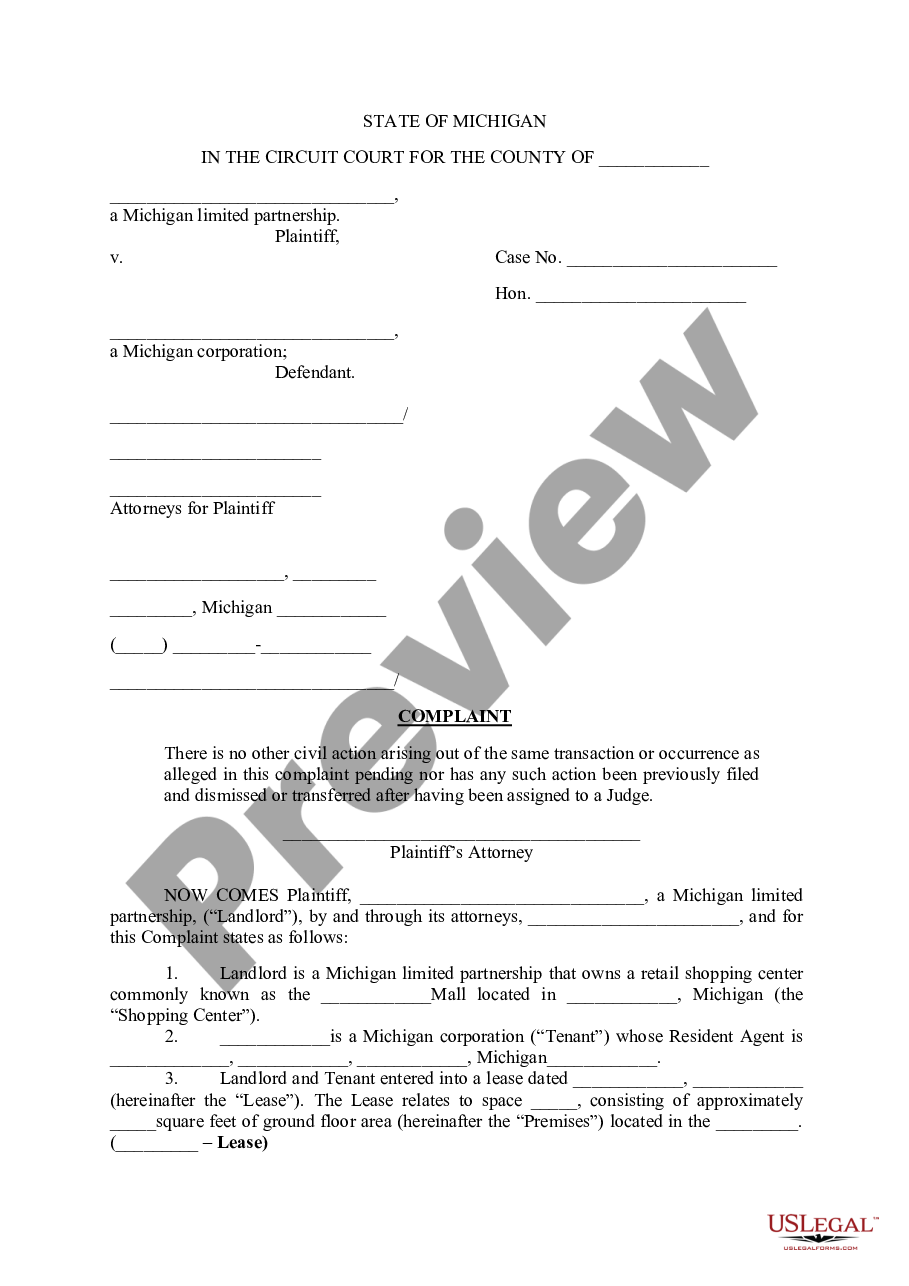

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers a variety of legal document templates you can obtain or print.

By using the website, you can find numerous forms for business and personal use, organized by categories, states, or keywords. You will discover the latest editions of forms such as the Oklahoma Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift in moments.

If you already have a subscription, Log In and obtain the Oklahoma Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift from the US Legal Forms collection. The Obtain button will appear on every form you view. You can access all previously saved forms from the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the saved Oklahoma Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift. Each template you added to your account has no expiration date and belongs to you indefinitely. So, if you need to download or print another version, simply visit the My documents section and click on the form you require. Access the Oklahoma Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift with US Legal Forms, one of the largest collections of legal document templates. Utilize a wide range of professional and state-specific templates that meet your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are straightforward instructions to get you started.

- Ensure you have selected the correct form for your specific city/county.

- Click the Review button to examine the form's content.

- Read the form summary to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Examples of acknowledge in a Sentence They acknowledged that the decision was a mistake. Do you acknowledge that you caused this mess? They readily acknowledged their mistake. She won't acknowledge responsibility for her actions.

Acknowledging each donation gives you an additional opportunity to show your gratitude to donors. It also serves as immediate confirmation. At the same time, the year-end acknowledgment letter is an excellent opportunity to summarize your donor's charitable giving and highlight what it helped accomplish.

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

Sample Donor Acknowledgement Letter for Non-Cash Donation On [DATE], you donated [DESCRIPTION ? WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission. In exchange for this contribution, you received [GOODS OR SERVICES ? WITH ESTIMATE OF FAIR MARKET VALUE].

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

Gift acknowledgment letters are letters sent to donors that formally acknowledge their generous donation. These letters should express gratitude and appreciation while also providing the donor with a record of the donation.

Tip #1: Although the IRS doesn't require acknowledgment letters to be sent for gifts under $250, it's a good rule of thumb to express thanks for every gift, regardless of its size.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.