Oklahoma Affidavit of Succession of Trustee

Description

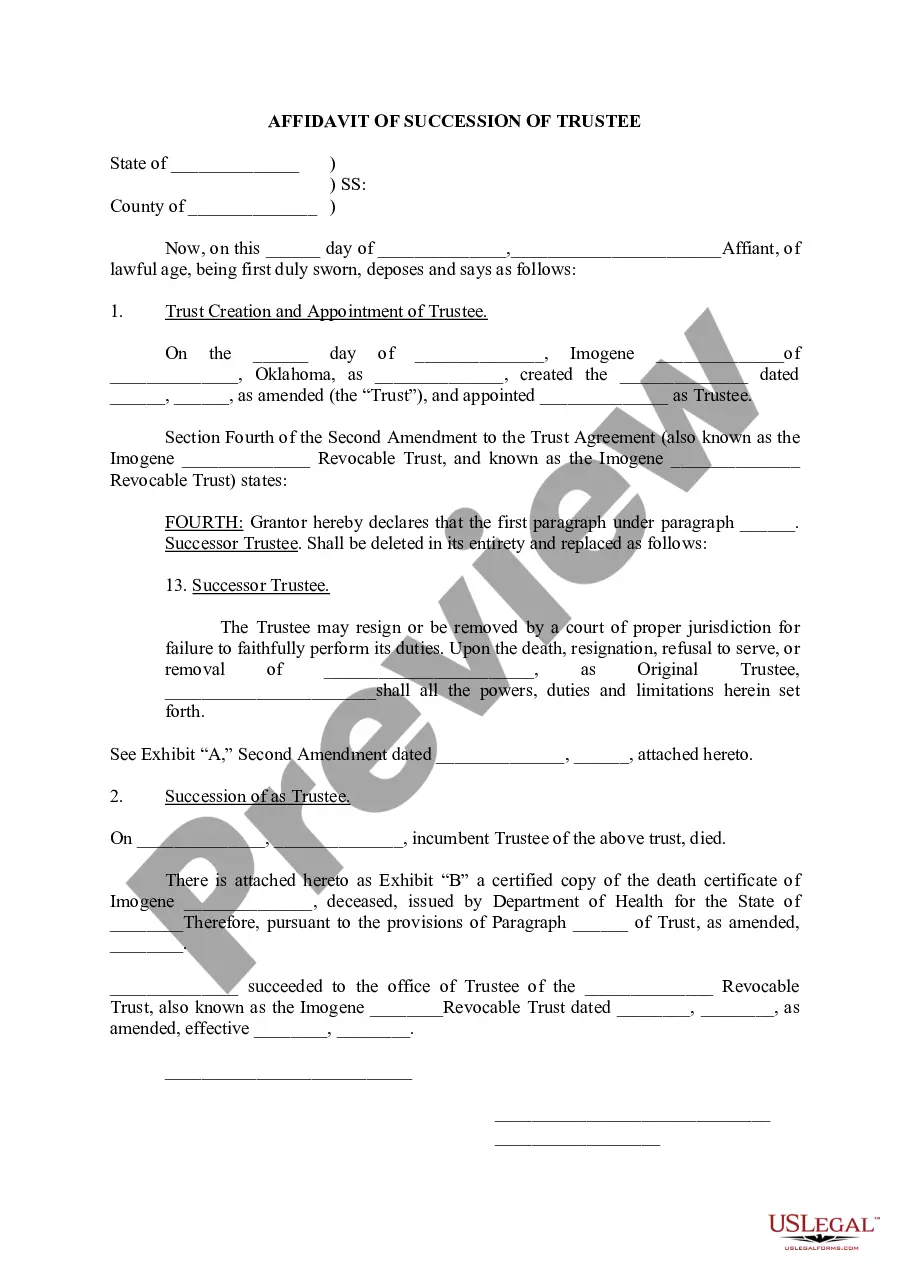

What Is an Affidavit of Succession of Trustee?

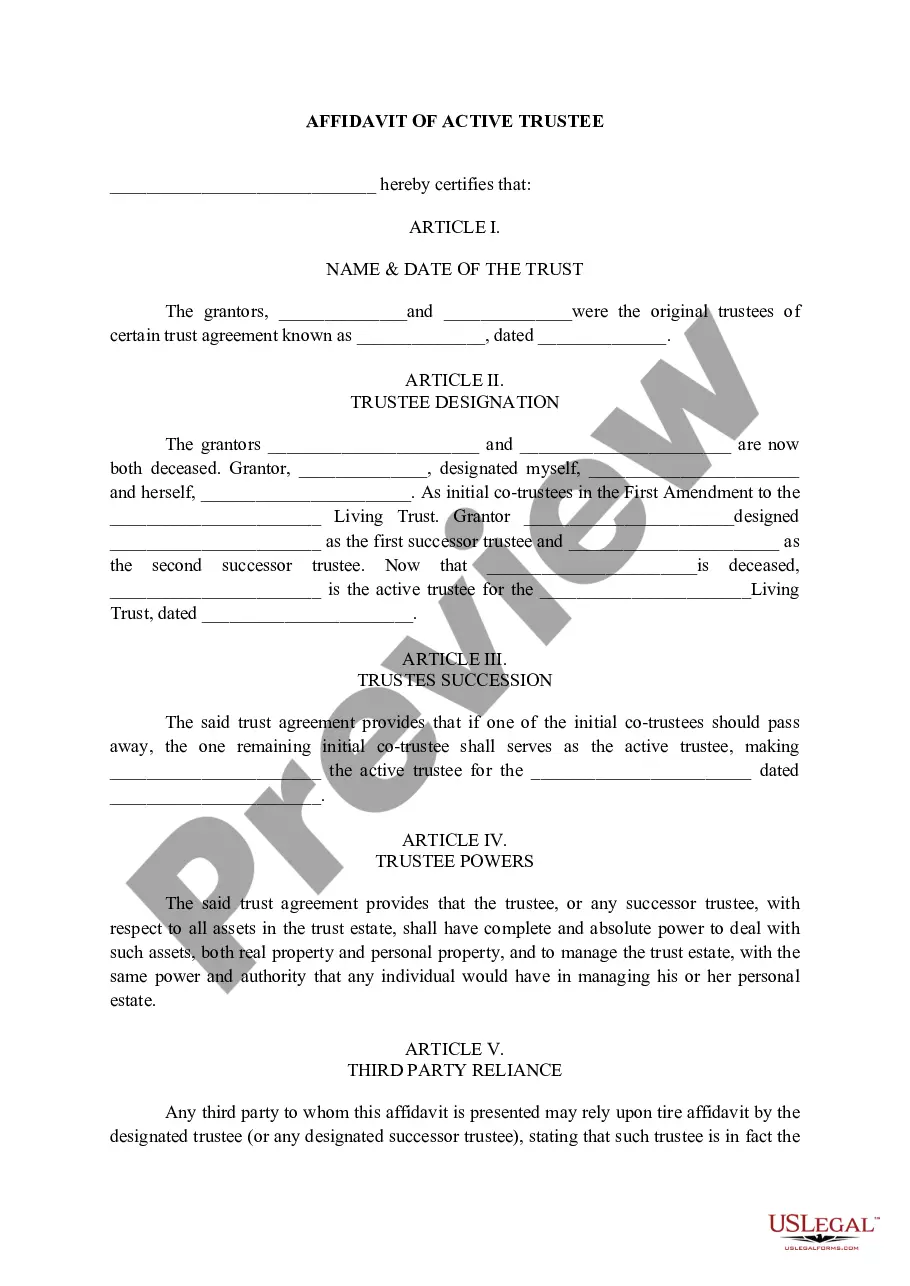

An affidavit of succession of trustee is a legal document used to certify that a new trustee has legally taken over the responsibilities from a previous trustee. This form is necessary when a trustee passes away, resigns, or is otherwise unable to continue in their role, ensuring that the trust operates without interruption according to the trust's terms and applicable laws.

Key Elements of an Affidavit of Succession of Trustee

- Trust Information: Details about the trust, including the trust's name and date of establishment.

- Previous Trustee Information: Names and details of the trustee(s) who are being replaced.

- New Trustee Information: Names and qualifications of the trustee(s) who are assuming the role.

- Declaration of Succession: A formal statement confirming that the new trustee(s) are legally taking over the responsibilities of their predecessors.

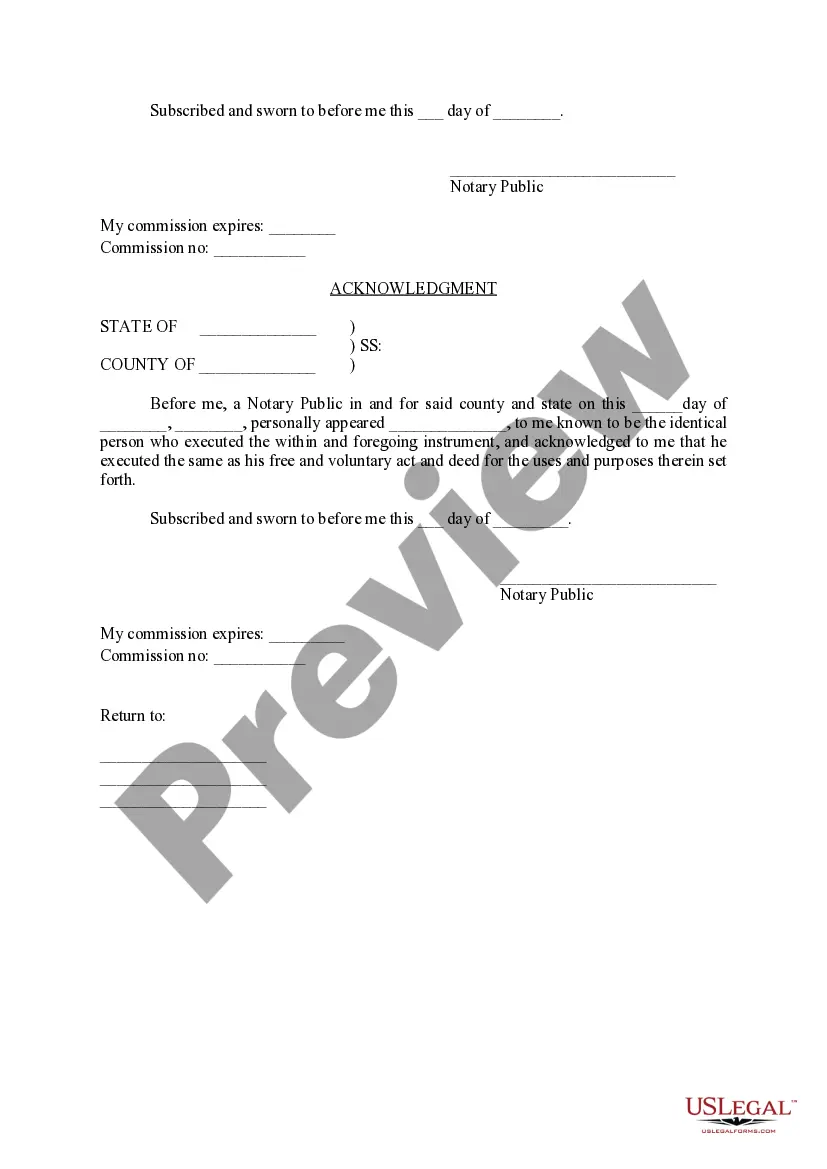

- Signatures: Signature of the new trustee(s) and, often, a notary public to legalize the document.

Step-by-Step Guide to Filling out an Affidavit of Succession of Trustee

- Verify the need for an affidavit by reviewing the trust's documentation and any relevant state laws.

- Collect the necessary information about the trust and trustees involved.

- Complete the affidavit form, following specific instructions that adhere to local jurisdiction requirements.

- Sign the document in the presence of a notary public to ensure its legality and validity.

- File the completed affidavit with relevant parties, such as courts or legal entities, as dictated by the trust's provisions or local laws.

Risk Analysis in Using an Affidavit of Succession of Trustee

Potential Risks: Inaccurate information can lead to legal disputes or a revocation of the trust. Failing to properly file the document can result in delays or financial consequences. Unrecognized or unapproved changes can challenge the trust's integrity.

Key Takeaways

The affidavit of succession of trustee is an essential document that maintains the continuity of trust management. It is crucial to accurately complete and promptly file this document to avoid legal complications and ensure the trust operates as intended.

How to fill out Oklahoma Affidavit Of Succession Of Trustee?

When it comes to completing Oklahoma Affidavit of Succession of Trustee, you most likely visualize an extensive procedure that involves finding a ideal sample among hundreds of similar ones and after that having to pay out legal counsel to fill it out to suit your needs. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific document in a matter of clicks.

In case you have a subscription, just log in and click Download to get the Oklahoma Affidavit of Succession of Trustee form.

If you don’t have an account yet but want one, keep to the point-by-point guide below:

- Make sure the document you’re getting applies in your state (or the state it’s needed in).

- Do this by reading through the form’s description and through clicking the Preview function (if offered) to see the form’s information.

- Click on Buy Now button.

- Pick the appropriate plan for your budget.

- Sign up to an account and choose how you would like to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Professional attorneys work on creating our templates to ensure after downloading, you don't have to worry about enhancing content material outside of your individual details or your business’s information. Sign up for US Legal Forms and receive your Oklahoma Affidavit of Succession of Trustee sample now.

Form popularity

FAQ

Write an amendment to the trust. The amendment prevents the need to write a whole new trust. At the top of the page, state the date and that this is an amendment to name a successor trustee.

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

2 attorney answers Just the grantors. They are usually also the trustees. If they are not the trustees still no need to sign. However, that is why you want successor trustees listed in case trustee does not or cannot serve.

You can do this by simply signing your name and putting your title of executor of the estate afterward. One example of an acceptable signature would be Signed by Jane Doe, Executor of the Estate of John Doe, Deceased. Of course, many institutions may not simply take your word that you are the executor of the estate.

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

A successor trustee is named to step in and manage the trust when the trustee is no longer able to continue (usually due to incapacity or death).The beneficiaries are the persons or organizations who will receive the trust assets after the grantor dies.

Can the Successor Trustee Be a Beneficiary of the Trust? It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common.When Mildred dies, Allison uses her authority as trustee to transfer the trust property to herself.

Successor trustees have to willingly accept their role usually by signing a consent to serve or affidavit of appointment. If an existing trustee wishes to change their successor trustee, they must make an actual amendment to the trust. Most courts won't accept informal, self-made changes.

It depends on the terms of the trust. If the trust designates that the trustees are to act together, and not independently, then yes, a signature by both trustees are required in order to transfer property out of the trust.