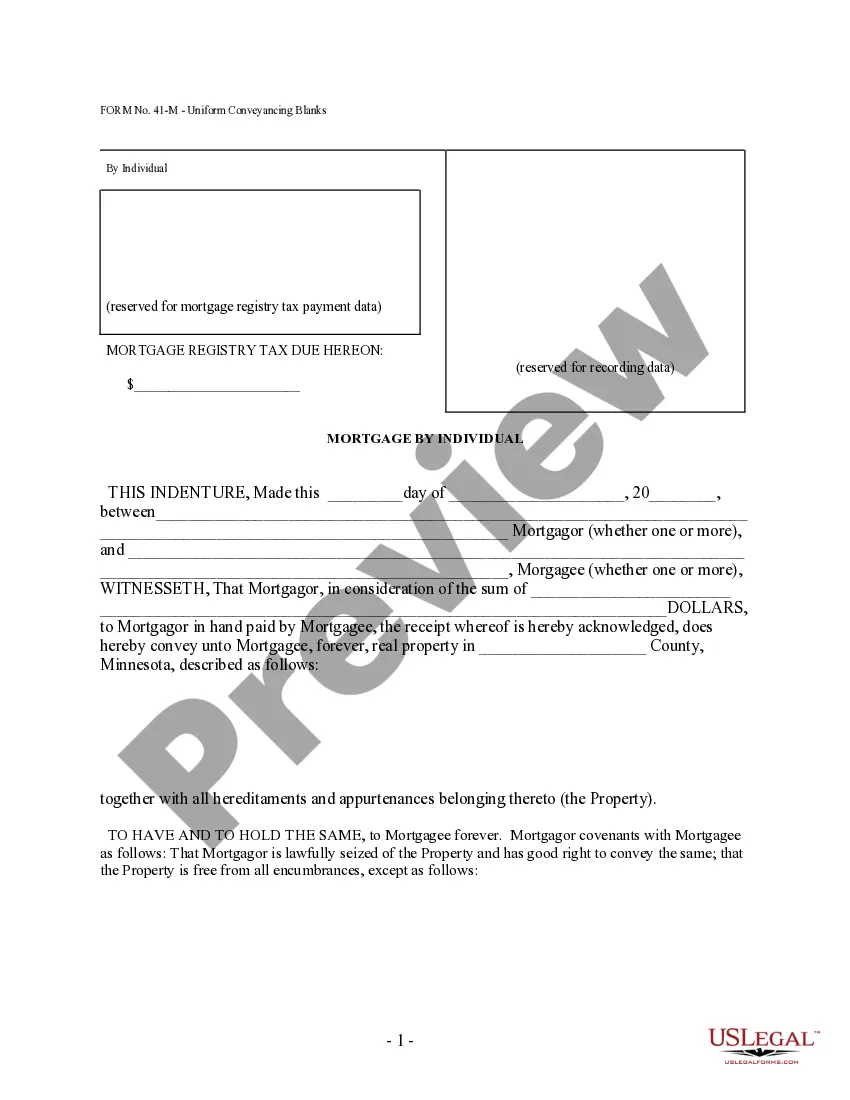

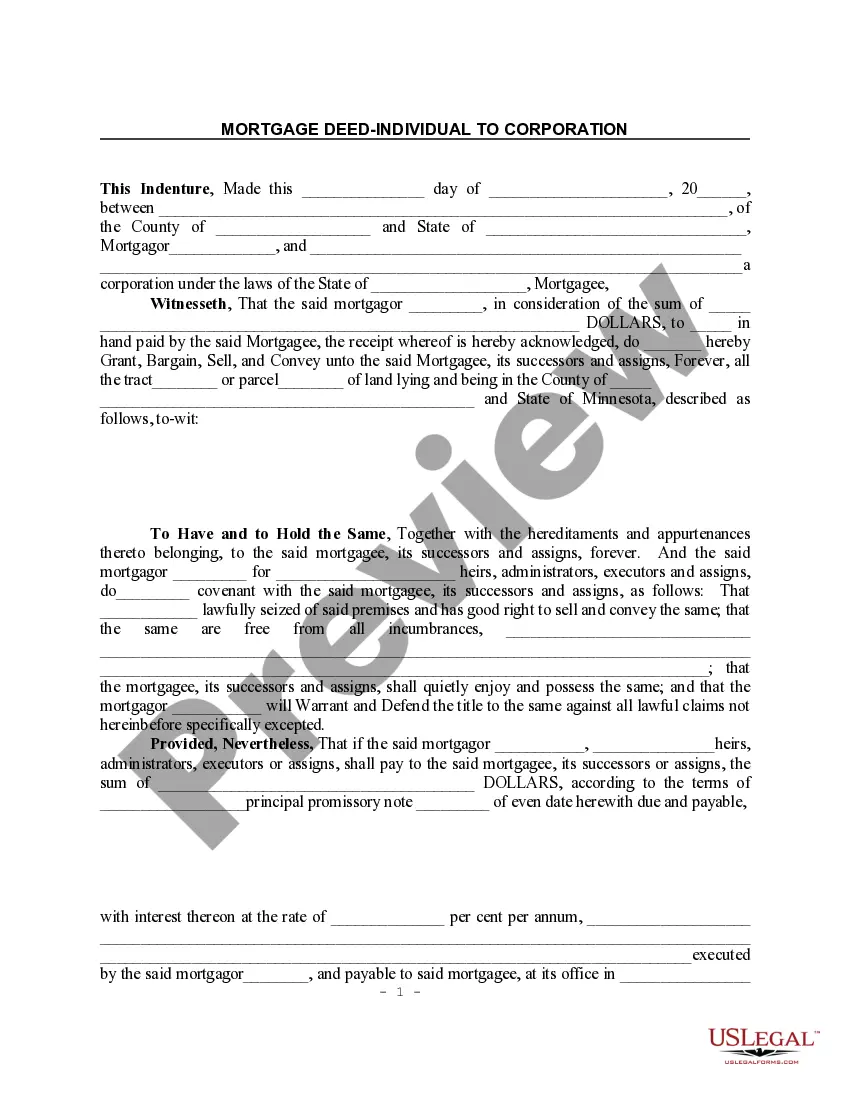

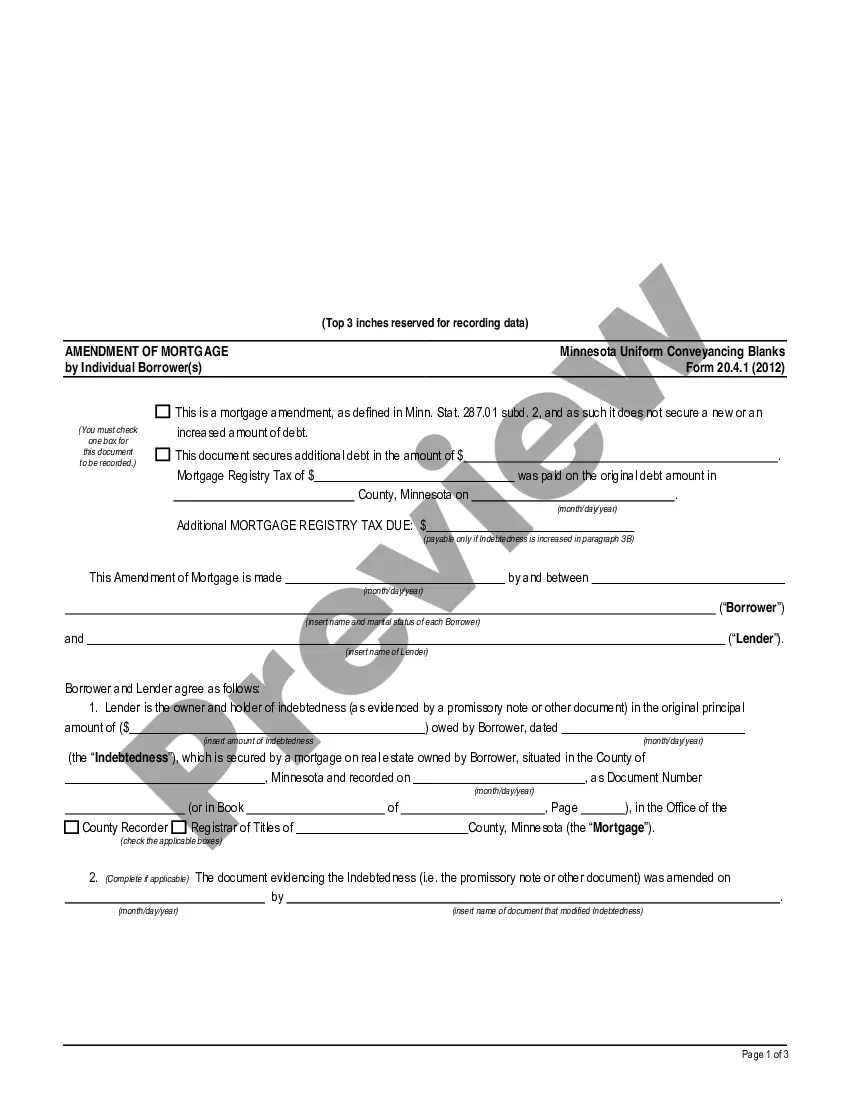

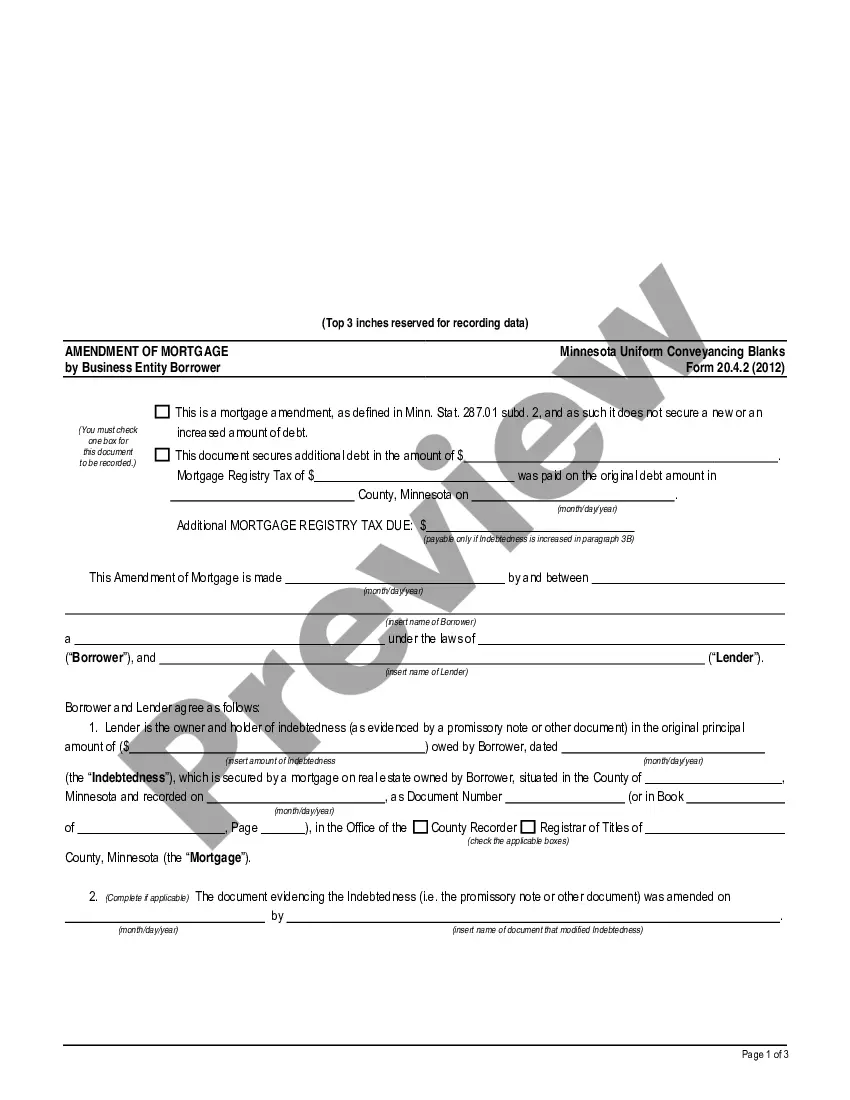

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDf format.

Minnesota Mortgage Addendum - UCBC Form 20.2.1

Description

How to fill out Minnesota Mortgage Addendum - UCBC Form 20.2.1?

Obtain any version from 85,000 lawful documents including Minnesota Mortgage Addendum - UCBC Form 20.2.1 online with US Legal Forms. Each template is prepared and refreshed by state-certified lawyers.

If you possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the guidelines below.

With US Legal Forms, you will always have quick access to the correct downloadable sample. The platform grants you access to documents and categorizes them to simplify your search. Use US Legal Forms to acquire your Minnesota Mortgage Addendum - UCBC Form 20.2.1 swiftly and effortlessly.

- Verify the state-specific criteria for the Minnesota Mortgage Addendum - UCBC Form 20.2.1 you need to utilize.

- Browse the description and preview the example.

- Once you are sure the example is what you require, simply click Buy Now.

- Select a subscription plan that fits your budget.

- Establish a personal account.

- Make a payment using one of two suitable methods: by card or via PayPal.

- Choose a format to download the file in; two choices are available (PDF or Word).

- Download the document to the My documents tab.

- When your reusable form is ready, print it out or save it to your device.

Form popularity

FAQ

A deed in lieu of foreclosure can significantly impact your credit score, although it may be less damaging than a full foreclosure. Typically, you can expect a drop of 100 to 150 points, depending on your overall credit profile. The Minnesota Mortgage Addendum - UCBC Form 20.2.1 can provide insights into how to navigate this situation effectively. It’s crucial to work on rebuilding your credit afterward to mitigate the effects.

The timeline for a deed in lieu of foreclosure can vary, but it generally takes a few weeks to complete. After the agreement is reached, the lender will process the paperwork and conduct any required evaluations. Utilizing the Minnesota Mortgage Addendum - UCBC Form 20.2.1 can streamline this process by clearly outlining the necessary steps and documentation. Staying informed can help expedite the transition.

In Minnesota, a deed in lieu of foreclosure is an agreement where the homeowner voluntarily transfers ownership of the property to the lender to settle a mortgage default. This option allows homeowners to avoid the foreclosure process, which can be lengthy and stressful. The Minnesota Mortgage Addendum - UCBC Form 20.2.1 may outline the necessary steps and conditions for executing such agreements. Understanding these terms can help borrowers make informed decisions.

A deed in lieu of foreclosure benefits both the borrower and the lender. The borrower can avoid the lengthy foreclosure process and potentially reduce their impact on credit scores. On the other hand, lenders can reclaim the property without going through court, saving time and legal costs. Utilizing resources like the Minnesota Mortgage Addendum - UCBC Form 20.2.1 can provide clarity on this process.

Yes, a non-borrowing spouse typically must acknowledge the closing disclosure in Minnesota. This requirement helps ensure that both spouses understand the terms related to the mortgage, especially in community property states. The Minnesota Mortgage Addendum - UCBC Form 20.2.1 may include provisions that clarify this process. It is advisable to consult legal documents or professionals to ensure compliance.

Yes, all borrowers must acknowledge the closing disclosure to ensure they understand the terms of their mortgage. This acknowledgment is crucial for transparency and protects both the borrower and lender during the closing process. The Minnesota Mortgage Addendum - UCBC Form 20.2.1 requires this acknowledgment, making it essential for compliance. You can find this form and additional resources on the US Legal Forms platform, which simplifies managing your mortgage documents.

Conventional / Fixed Rate Mortgage. Conventional fixed rate loans are a safe bet because of their consistency the monthly payments won't change over the life of your loan.Interest-Only Mortgage.Adjustable Rate Mortgage (ARM)FHA Loans.VA Loans.Combo / Piggyback.Balloon.Jumbo.