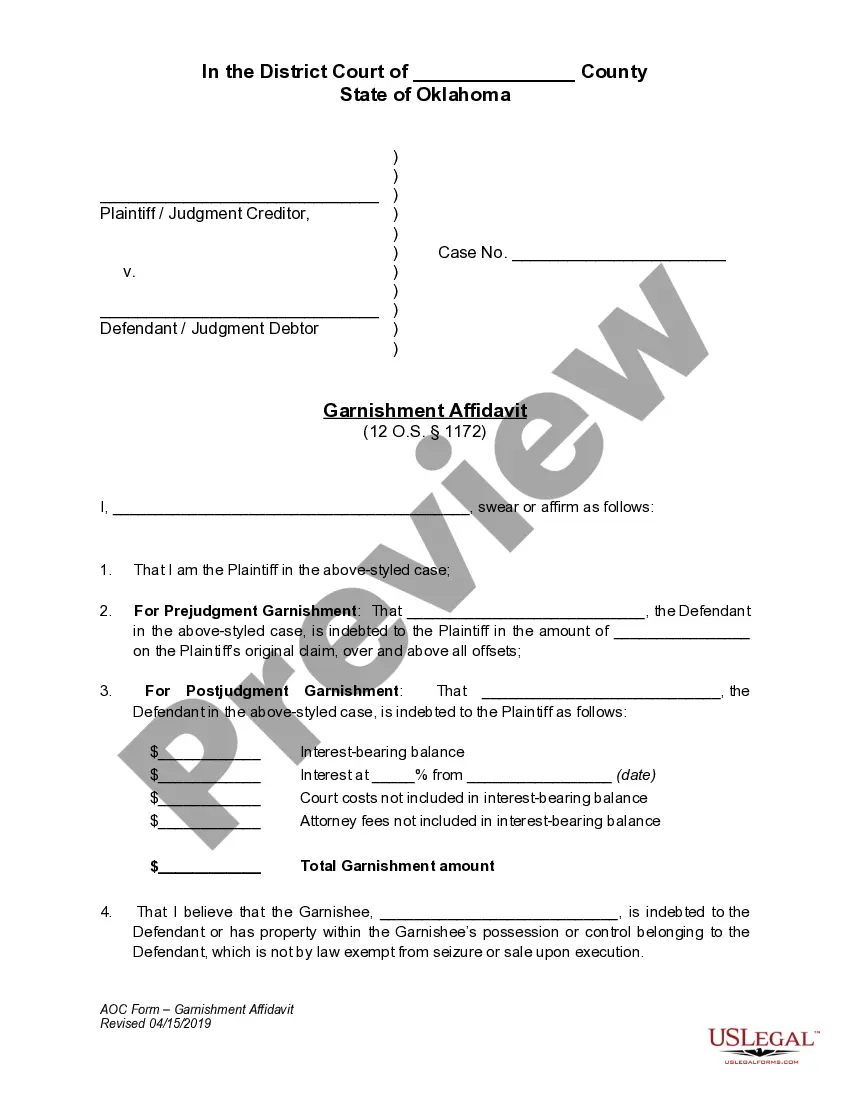

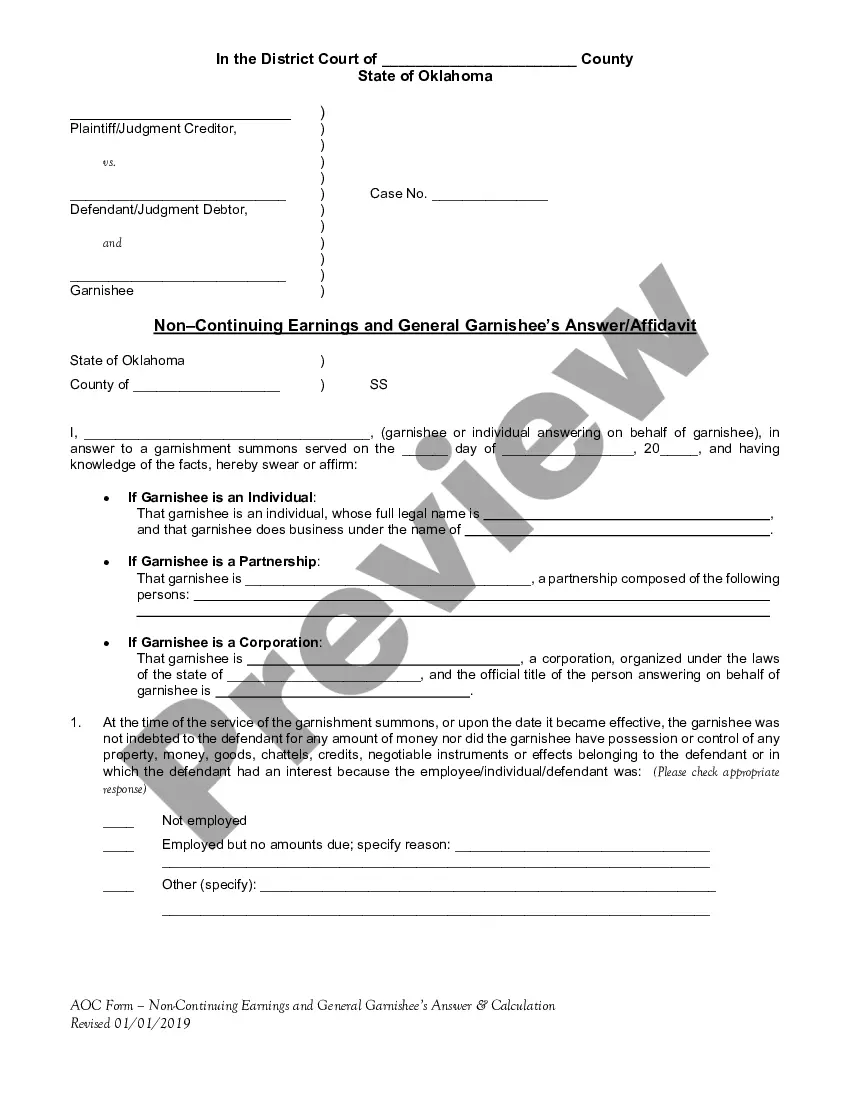

This is an official form from the Oklahoma State Court Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Oklahoma Continuing Garnishee's Answer Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

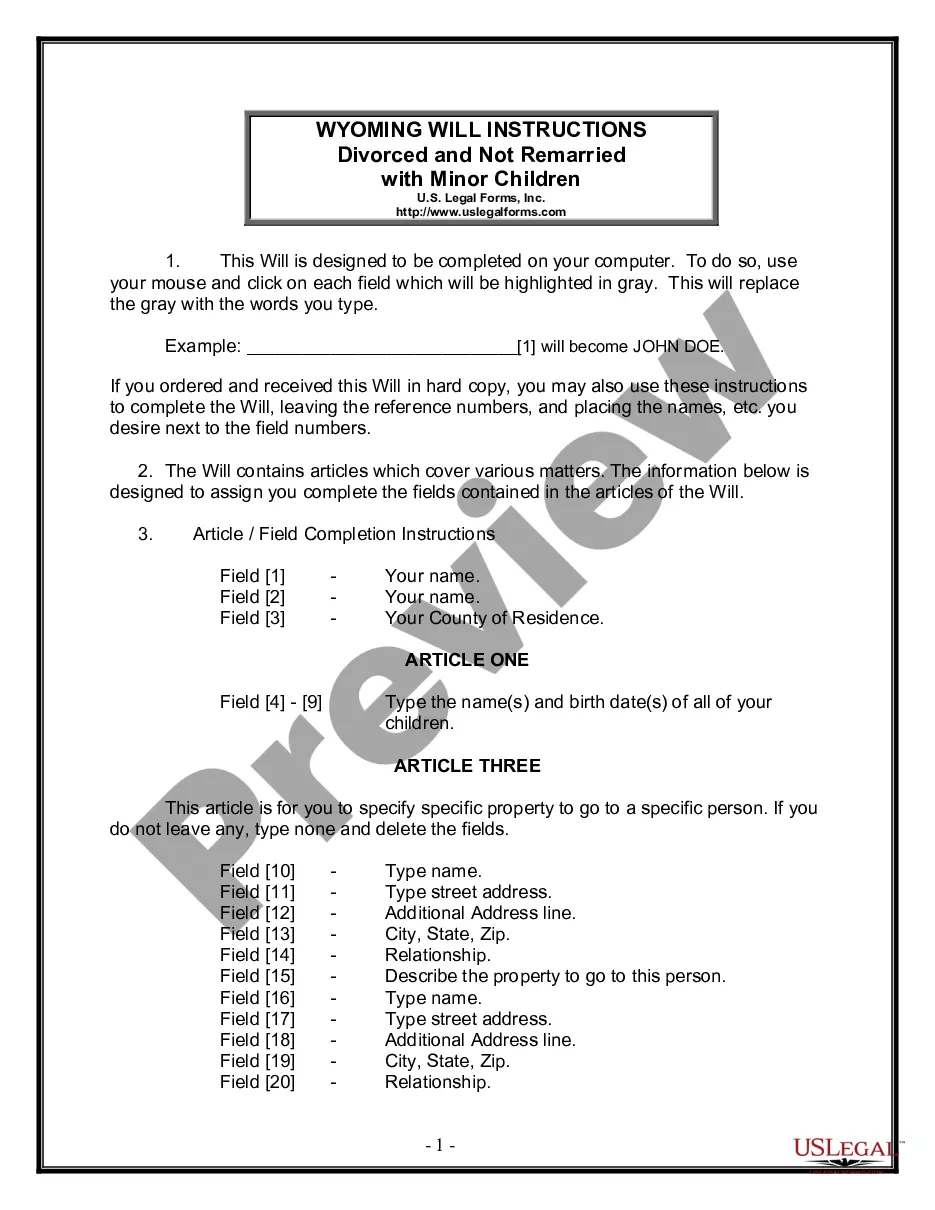

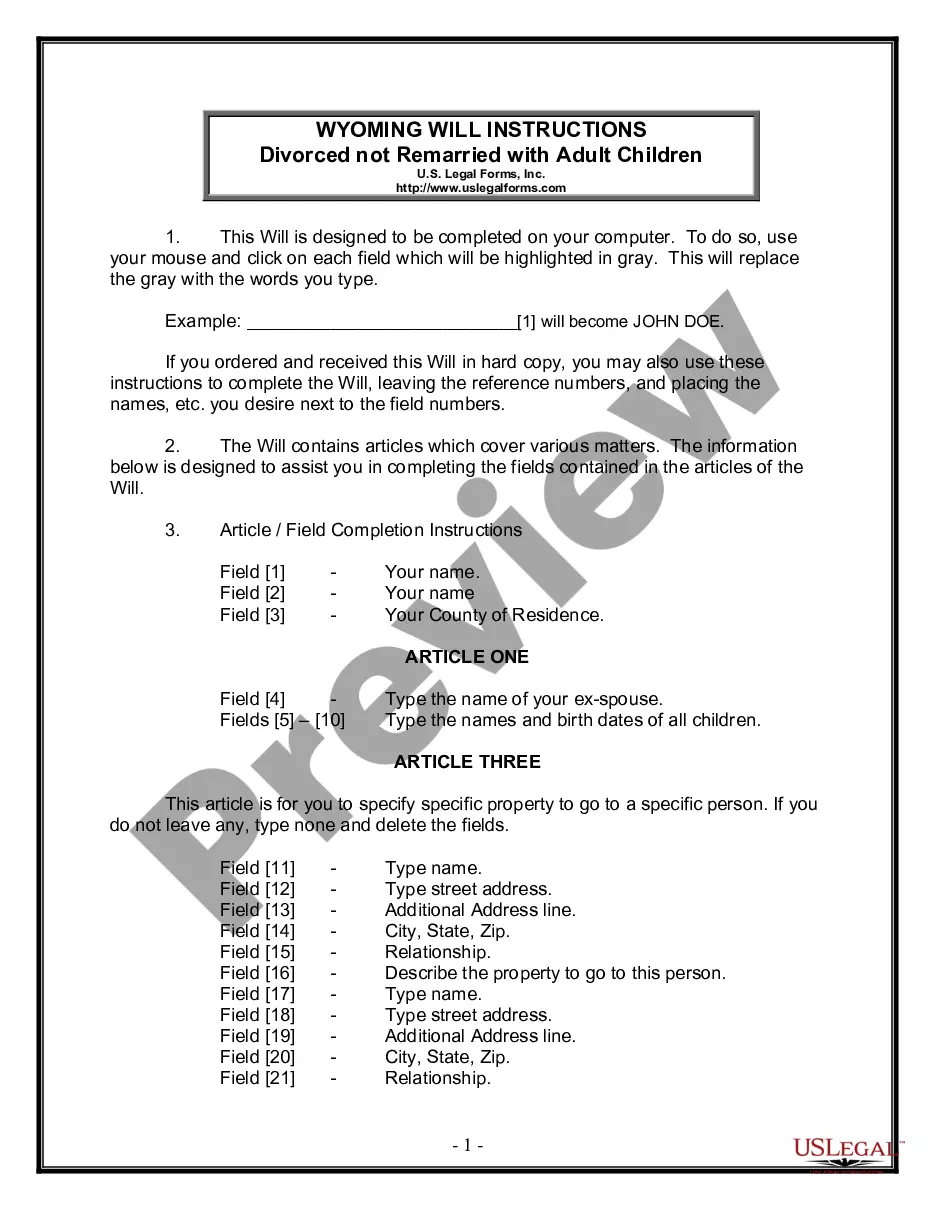

How to fill out Oklahoma Continuing Garnishee's Answer Affidavit?

When it comes to completing Oklahoma Continuing Garnishee's Answer Affidavit, you probably imagine a long process that involves getting a ideal sample among numerous similar ones after which being forced to pay legal counsel to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific template in a matter of clicks.

In case you have a subscription, just log in and click Download to find the Oklahoma Continuing Garnishee's Answer Affidavit form.

If you don’t have an account yet but want one, follow the point-by-point guideline listed below:

- Make sure the file you’re saving is valid in your state (or the state it’s required in).

- Do it by reading the form’s description and by clicking the Preview option (if readily available) to view the form’s information.

- Click on Buy Now button.

- Choose the appropriate plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Professional attorneys draw up our templates to ensure after saving, you don't have to worry about enhancing content material outside of your personal information or your business’s information. Join US Legal Forms and get your Oklahoma Continuing Garnishee's Answer Affidavit sample now.

Form popularity

FAQ

If a creditor's garnishment or levy seized funds that are considered exempt under bankruptcy law, then that transfer can be reversed by the court and the funds may be returned to you.If creditors have begun garnishing your wage or levying your bank accounts, contact us to today to discuss how bankruptcy can help you.

In Oklahoma, wage garnishments stay in force for the lesser of the following: (1) satisfaction of the debt, or (2) the lapse of 180 days (or about six months) from the date the garnishment process started. Some debtor employees are saddled with more than one garnishment order.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. It refers to a legal process that instructs a third party to deduct payments directly from a debtor's wage or bank account. Typically, the third party is the debtor's employer and is known as the garnishee.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

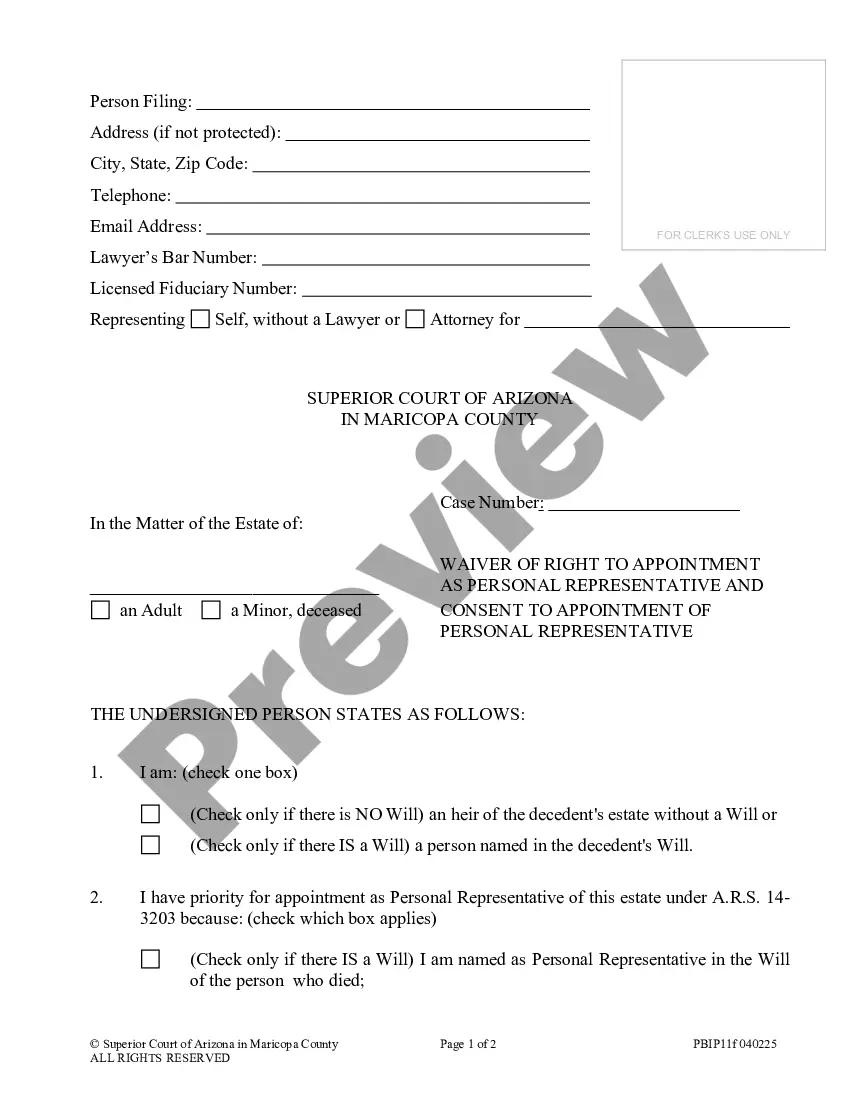

One method is to request the court issue a garnishment summons to a financial institution that is in possession of the debtor's funds. The procedure involves filing a Garnishment Affidavit with the court clerk. The Garnishment Affidavit should state who the parties are and the outstanding balance of the judgment.

Oklahoma law limits the amount that a creditor can garnish (take) from your wages for repayment of debts. The Oklahoma wage garnishment laws (also called wage attachments) protect the same amount of wages as the federal wage garnishment laws. For the most part, creditors with judgments can take only 25% of your wages.

Filing a claim of exemption. filing for bankruptcy, or. vacating the underlying money judgment.

Include in your letter what steps you plan to take to address the default, such as making a reasonable effort at a payment plan. Mention any circumstances that have changed recently to make your ability to pay off the debt more likely. This conveys to the creditor your goodwill toward satisfying the debt.