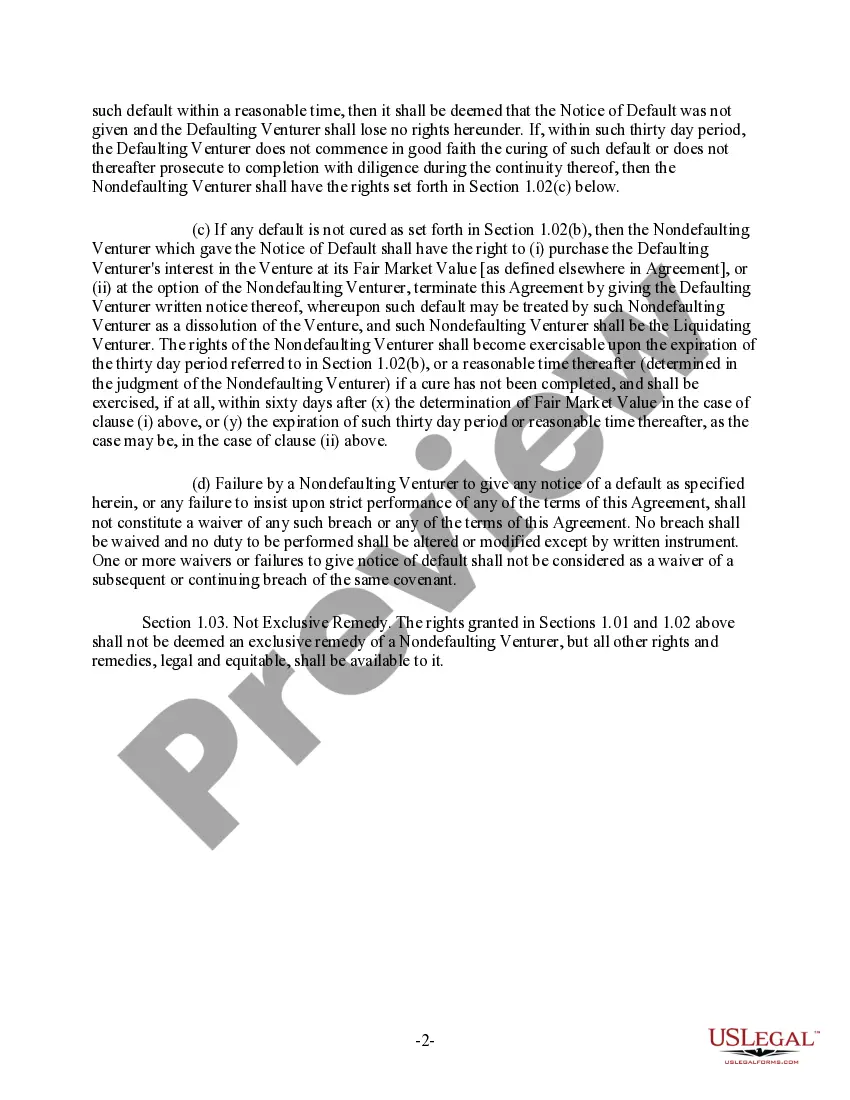

Ohio Clauses Relating to Defaults, Default Remedies

Description

How to fill out Clauses Relating To Defaults, Default Remedies?

Choosing the best legitimate file design can be quite a have a problem. Naturally, there are a variety of layouts accessible on the Internet, but how will you obtain the legitimate develop you want? Utilize the US Legal Forms site. The assistance gives 1000s of layouts, such as the Ohio Clauses Relating to Defaults, Default Remedies, which can be used for organization and private requirements. All of the kinds are inspected by specialists and meet up with state and federal needs.

When you are already listed, log in to the bank account and click the Down load switch to find the Ohio Clauses Relating to Defaults, Default Remedies. Utilize your bank account to look throughout the legitimate kinds you may have ordered in the past. Check out the My Forms tab of your bank account and get yet another version from the file you want.

When you are a fresh customer of US Legal Forms, allow me to share simple recommendations that you can comply with:

- Very first, make certain you have selected the right develop to your town/state. You can examine the form utilizing the Preview switch and browse the form outline to ensure it will be the right one for you.

- When the develop does not meet up with your requirements, use the Seach discipline to obtain the proper develop.

- When you are sure that the form would work, select the Buy now switch to find the develop.

- Choose the costs plan you want and enter in the essential information. Design your bank account and pay money for the order making use of your PayPal bank account or Visa or Mastercard.

- Opt for the data file formatting and obtain the legitimate file design to the gadget.

- Total, edit and print out and indicator the received Ohio Clauses Relating to Defaults, Default Remedies.

US Legal Forms is the largest library of legitimate kinds in which you will find a variety of file layouts. Utilize the company to obtain expertly-made documents that comply with state needs.

Form popularity

FAQ

What is the Repossession Law in Ohio? In Ohio, a lender or creditor can sell your repossessed vehicle to pay off your loan(s) if you have a number of missed payments. A lender can only repossess your car if you have a signed agreement that explicitly states that you are using the property as collateral for a loan.

Pursuant to Ohio Revised Code Section 1706.172(D), articles of organization delivered to the Ohio Secretary of State for filing may specify an effective time and a delayed effective date of not more than ninety days following the date of receipt by the Secretary of State.

(A) In addition to any right otherwise to revoke an offer, the buyer has the right to cancel a home solicitation sale until midnight of the third business day after the day on which the buyer signs an agreement or offer to purchase.

Under the Ohio Credit Services Act, consumers are granted three business days from the time of signature to cancel a contract for for-profit credit repair, as well as debt counseling services. Under the federal Truth in Lending Act, the same is true for certain home equity loans and second mortgages.

Under the TDR law, a consumer has the right to cancel the transaction, and the dealer has an obligation to refund all money paid if the dealer fails to obtain a vehicle title in the consumer's name after 40 days from the date of purchase.

(A) In addition to any right otherwise to revoke an offer, the buyer has the right to cancel a home solicitation sale until midnight of the third business day after the day on which the buyer signs an agreement or offer to purchase.

Cooling-off Rule is a rule that allows you to cancel a contract within a few days (usually three days) after signing it. As explained by the Federal Trade Commission (FTC), the federal cooling-off rules gives the consumer three days to cancel certain sales for a full refund.

A secured party who reasonably believes that a debtor intends to conceal or remove the collateral from this state after curing the default may, within five days after retaking possession of the collateral, move in a court of competent jurisdiction that the secured party be allowed to retain possession of the collateral ...