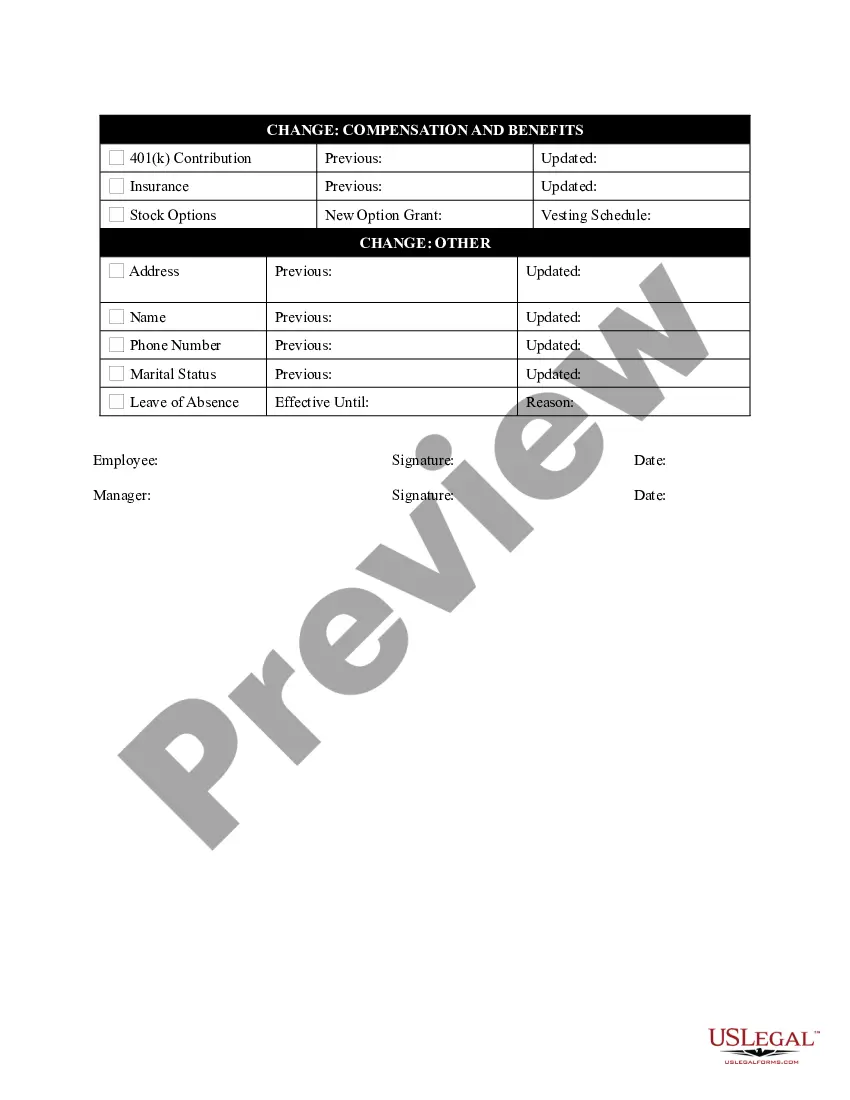

Minnesota Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad assortment of legal form templates that you can download or print.

By using the website, you'll discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Minnesota Employee Status Change Worksheet in moments.

Read the form summary to confirm that you have chosen the right document.

If the form is not suitable for your needs, utilize the Search box at the top of the screen to find the one that is.

- If you have a subscription, Log In to download the Minnesota Employee Status Change Worksheet from the US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously saved forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the correct form for your city/county.

- Click the Review button to check the content of the form.

Form popularity

FAQ

If you claim exempt from Minnesota withholding, complete only Section 2 of Form W-4MN and sign and date the form to validate it. If you complete Section 2, you must complete a new Form W-4MN by February 15 in each following year in which you claim an exemption from Minnesota withholding.

A separate IRS form W-4 will be required for state withholding. Minnesota requires nonresident aliens to claim Single with no withholding allowances. Mark the W-4 "For State Use Only" and enter Marital Status as "Single" and Number of Allowances as 0.

Unlike New York's law, annual notices to employees are not required under California's wage theft protection law. California requires that changes to information initially provided in the notice shall be accomplished by issuing a new notice containing all changes within 7 calendar days after the change or in the manner

You may claim exempt from Minnesota withholding on this income even if it is taxable federally. Note: You may not want to claim exempt if you (or your spouse if filing a joint return) expect to have other forms of income subject to Minnesota tax and you want to avoid owing tax at the end of the year.

What is an Employee Wage Notice? Employee wage notices often fall under the heading of Wage Theft. Wage notices are provided to employees to ensure their expected pay is not different from what was originally noted by employer.

One may claim exempt from 2020 federal tax withholding if they BOTH: had no federal income tax liability in 2019 and you expect to have no federal income tax liability in 2020. If you claim exempt, no federal income tax is withheld from your paycheck; you may owe taxes and penalties when you file your 2020 tax return.

Employee Notice means the notice the employer is required to keep posted in the work place.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

Form W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate, is the Minnesota equivalent of federal Form W-4. Your employees must complete Form W-4MN to determine their Minnesota tax withheld. You also may need to submit Forms W-4MN to the Minnesota Department of Revenue.

If you completed a Form W-4 from 2019 or in prior years, you may complete Form W-4MN to determine your allowances for Minnesota withholding purposes. Your allowances on Form W-4MN must not exceed your allowances on a Form W-4 (from 2019 or earlier) that your employer used to determine your federal withholding.