Minnesota Personnel Change Form

Description

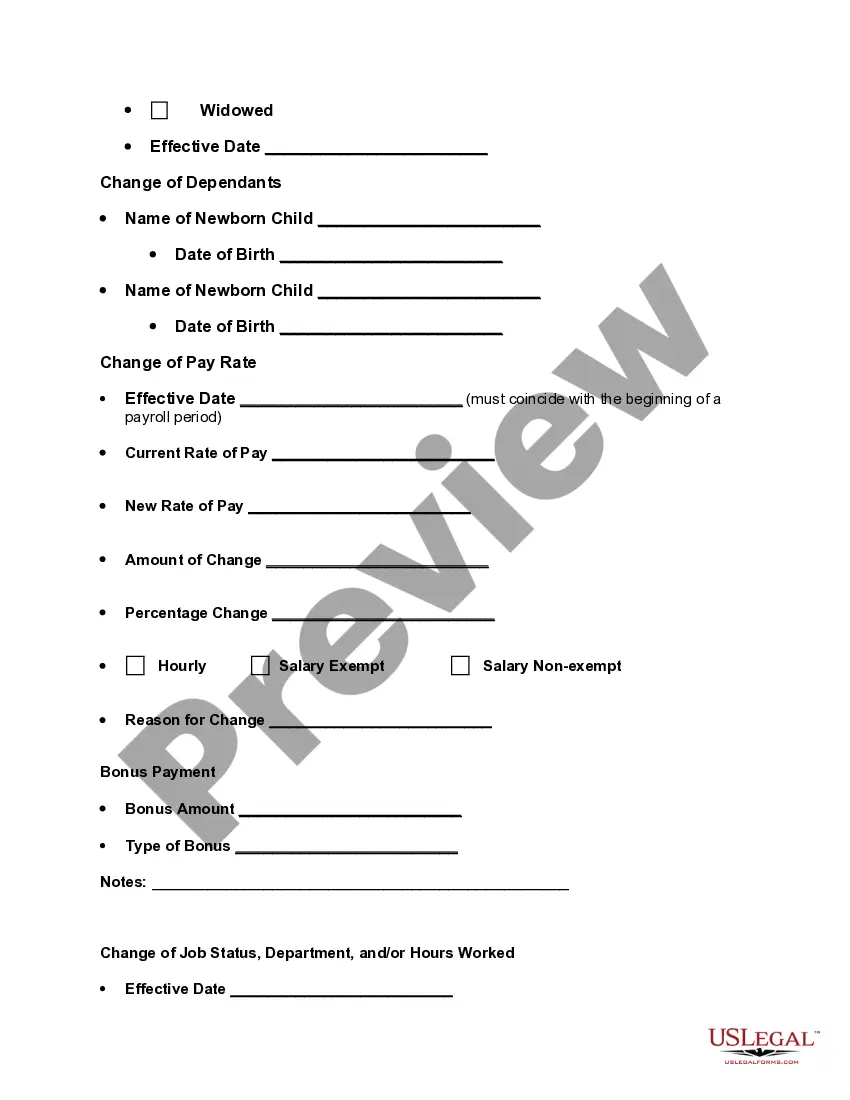

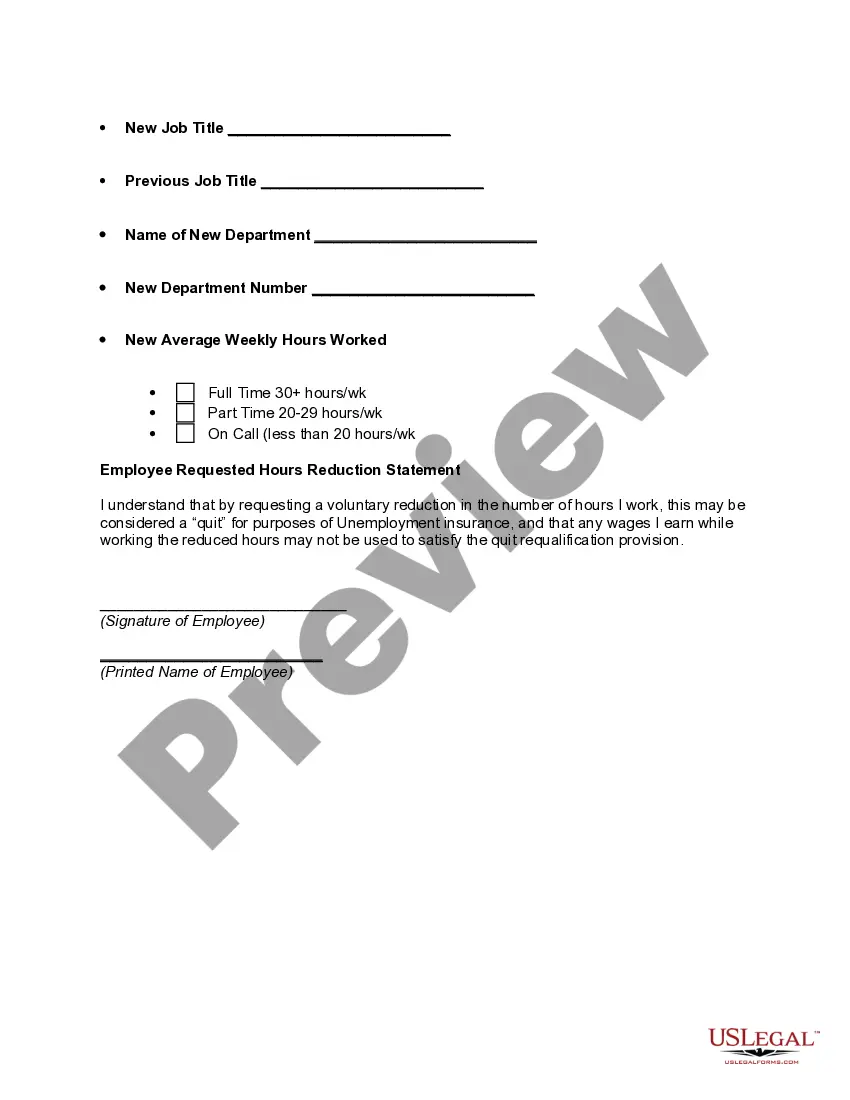

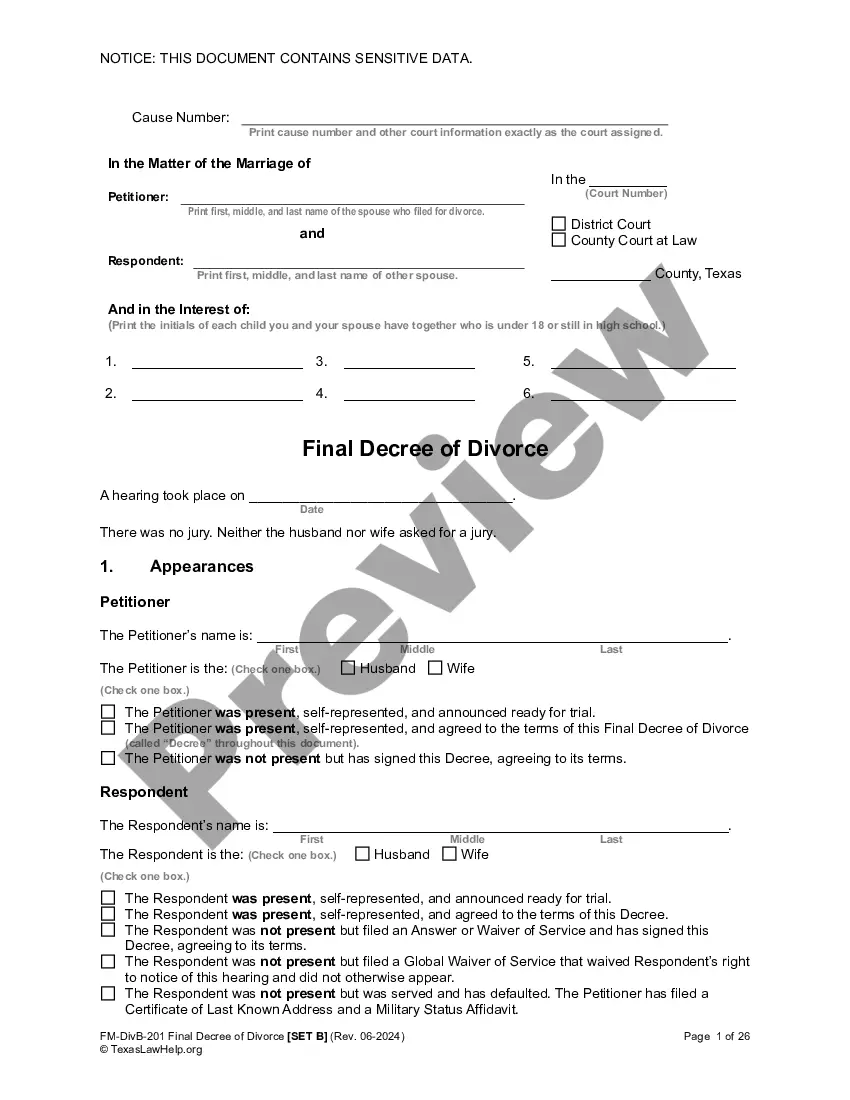

How to fill out Personnel Change Form?

Have you found yourself in a situation where you require documents for both corporate or personal reasons almost every day? There are numerous legal document templates available online, but locating ones you can trust is not easy.

US Legal Forms offers thousands of document templates, including the Minnesota Employee Change Form, designed to meet state and federal standards.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Minnesota Employee Change Form template.

- Find the document you need and verify it's for the correct city/state.

- Use the Review button to examine the form.

- Check the details to ensure you've selected the correct document.

- If the document isn't what you're looking for, use the Search field to find the document that suits your needs and requirements.

- Once you find the appropriate document, click Buy now.

- Choose the pricing plan you prefer, fill out the required information to create your account, and pay for your order using PayPal or a credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Here are five essential steps to follow when hiring a new employee.Do your due diligence. You should contact the references provided by the candidate to check their job application and what they said in their interview.Make a job offer.Be innovative with compensation.Discuss job accommodations.Keep records.

Your employees must complete Form W-4MN to determine their Minnesota tax withheld. You also may need to submit Forms W-4MN to the Minnesota Department of Revenue. Your employees must complete Form W-4MN when they begin employment or when their personal or financial situation changes.

You may claim exempt from Minnesota withholding if at least one of these apply: You meet the requirements and claim exempt from federal withholding. You had no Minnesota income tax liability last year, received a refund of all Minnesota income tax withheld, and expect to have no state income liability this year.

Top 10 Things To Do When Hiring A New EmployeeGet the employee set up on payroll & other company systems.Complete new hire paperwork.Get their desk and phone setup.Run a background check.Schedule an employee orientation.Schedule employee training.Host a team welcome for the new hire.Set employee goals.More items...?14-Nov-2017

If you do not fill out a new W-4, you employer will definitely still give you a paycheck but will also withhold income taxes at the highest rate for single filers, with no other adjustments.

Here's what you'll need to have them sign:An official offer letter.A personal data form.An I-9 Employment Eligibility Verification form that verifies their right to work in the United States.A W-2 tax form.A W-4 tax form.A DE 4 California Payroll Tax Form.Any insurance forms.More items...

A1: Employers are no longer required to routinely submit Forms W-4 to the IRS. However, in certain circumstances, the IRS may direct you to submit copies of Forms W-4 for certain employees in order to ensure that the employees have adequate withholding.

The hiring process stepsDeciding there's a role to fill.Putting together a complete plan.Writing a great job description.Advertising through the right channels.Reaching out using recruiters, headhunters, and referrals.Reviewing candidate applications.Short interviews and pre-interview screenings.Interviews.More items...

4 Important Steps to Hiring a New EmployeeStart with the job description.Publicize the open position.Invite your top candidates to interview.Make an offer.03-Sept-2019

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.