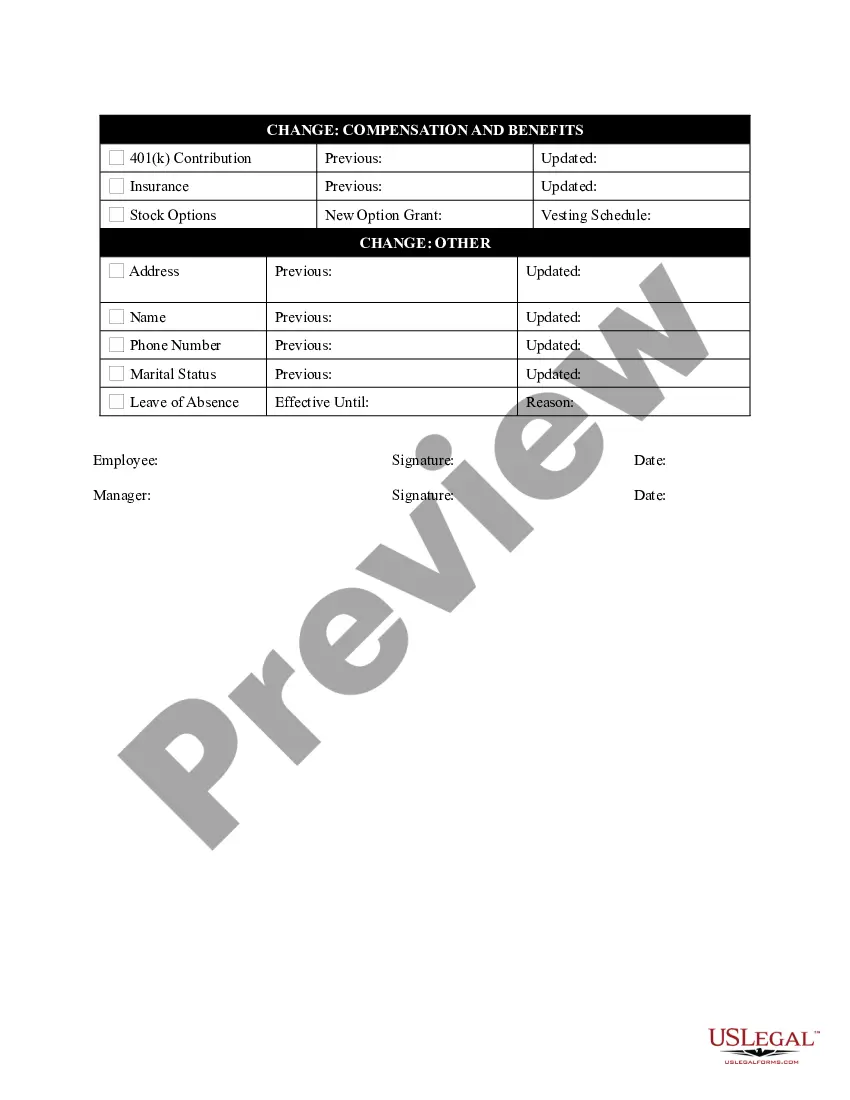

Michigan Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an array of legal document templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Michigan Employee Status Change Worksheet in just moments.

If you already possess a membership, Log In and download the Michigan Employee Status Change Worksheet from the US Legal Forms repository. The Download button will appear on every template you view. You can access all previously downloaded forms in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are simple steps to get you started.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, and print, and sign the downloaded Michigan Employee Status Change Worksheet. Each template you add to your account does not have an expiration date and belongs to you for a long time. So, if you wish to download or print another copy, just go to the My documents section and click on the form you want. Access the Michigan Employee Status Change Worksheet with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Check the form details to confirm you have selected the appropriate form.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose your preferred pricing option and provide your credentials to register for an account.

Form popularity

FAQ

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

For the 2021 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $4,900 for each taxpayer and dependent. An additional personal exemption is available if you are the parent of a stillborn child in 2021.

Line 8: You may claim exemption from Michigan income tax withholding ONLY if you do not anticipate a Michigan income tax liability for the current year because all of the following exist: a) your employment is less than full time, b) your personal and dependency exemption allowance exceeds your annual compensation, c)

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

To be exempt from withholding, both of the following must be true:You owed no federal income tax in the prior tax year, and.You expect to owe no federal income tax in the current tax year.

Employees may claim exemption from withholding only if they do not anticipate a Michigan income tax liability for the current year because their employment is less than full-time and the personal and dependency exemptions exceed their annual compensation.

For the 2021 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $4,900 for each taxpayer and dependent. An additional personal exemption is available if you are the parent of a stillborn child in 2021.

Your employer is required to notify the Michigan Department of Treasury if you have claimed 10 or more personal or dependency exemptions or claimed that you are exempt from withholding.