Ohio Housecleaning Services Contract - Self-Employed

Description

How to fill out Housecleaning Services Contract - Self-Employed?

Are you presently in the situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones isn’t simple.

US Legal Forms provides a vast selection of form templates, including the Ohio Housecleaning Services Contract - Self-Employed, which are crafted to satisfy state and federal requirements.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Housecleaning Services Contract - Self-Employed template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the appropriate area/county.

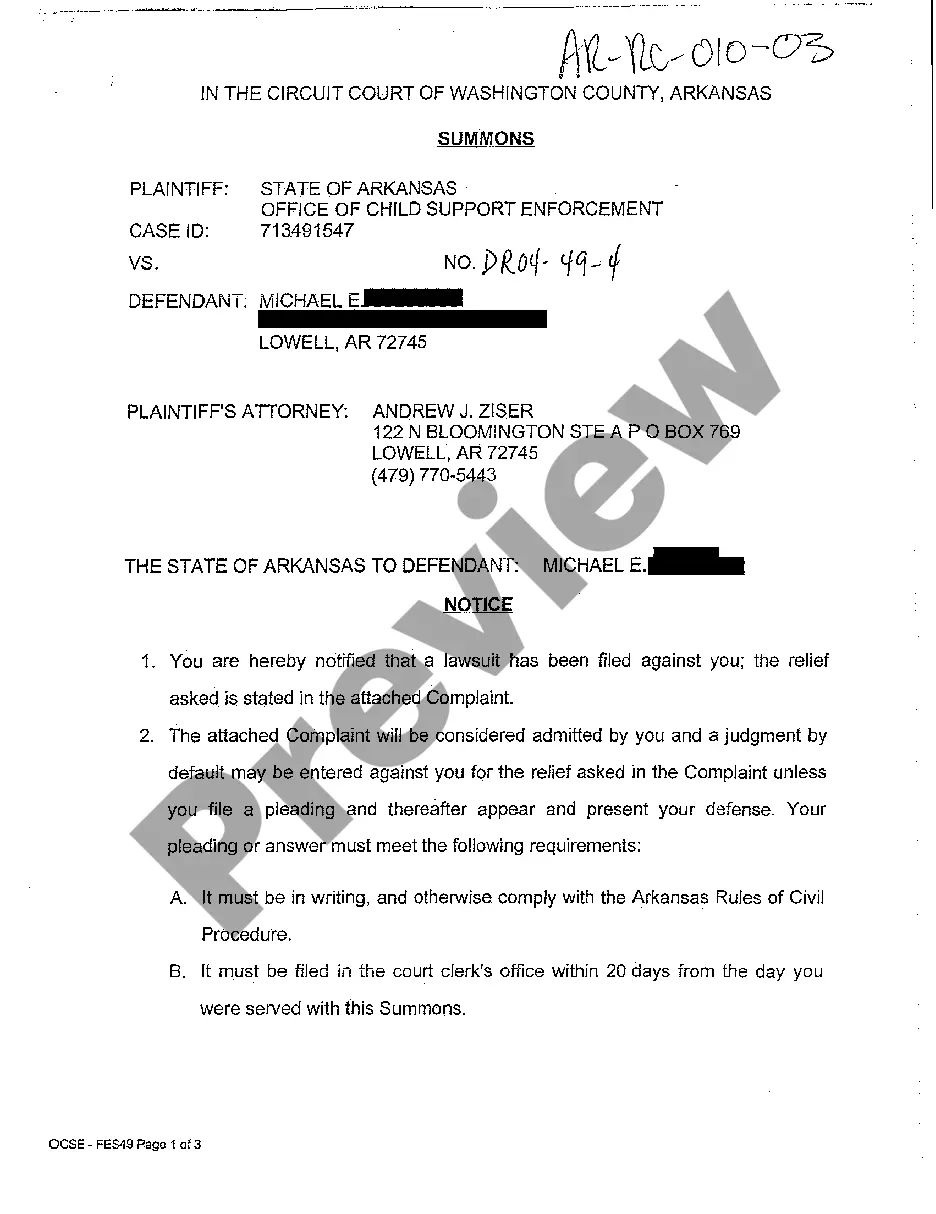

- Utilize the Preview feature to review the document.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that meets your needs and requirements.

- Once you find the right form, click Get now.

- Choose the pricing plan you prefer, enter the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Find all of the document templates you have purchased in the My documents menu. You can obtain another copy of the Ohio Housecleaning Services Contract - Self-Employed anytime, if necessary. Just click the desired form to download or print the document template.

- Use US Legal Forms, one of the most extensive collections of legal forms, to save time and prevent errors.

- The service offers professionally crafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Yes, you can be a self-employed house cleaner in Ohio. It allows you the flexibility to set your hours and choose your clients. To make your venture successful, having an Ohio Housecleaning Services Contract - Self-Employed will help you manage agreements and expectations with clients effectively.

No, you do not need a specific license to clean houses in Ohio. The primary requirement is to operate under local business laws. Ensure you have a proper understanding of taxes and insurance as you navigate the world of Ohio Housecleaning Services Contract - Self-Employed to protect your business.

To become a subcontractor for cleaning services, you should first gain experience in house cleaning. Build a strong portfolio and network with established cleaning businesses. Additionally, an Ohio Housecleaning Services Contract - Self-Employed can assist you in forming clear agreements with clients or employers, making the subcontracting process easier.

In Ohio, a license is not required specifically for house cleaning services. However, self-employed cleaners must comply with local business regulations, which may include registering their business name. It's essential to check with your local county or city for any specific requirements. Utilizing an Ohio Housecleaning Services Contract - Self-Employed can help clarify your obligations.

To write a contract agreement for cleaning services, start by clearly defining the scope of work, including duties and responsibilities. Include payment terms, such as rates and due dates, to ensure both parties agree. Reference your Ohio Housecleaning Services Contract - Self-Employed to create a thorough and professional document. Utilizing platforms like US Legal Forms can simplify this process by providing templates tailored to your needs.

To start a cleaning business in Ohio, you typically need to register your business and may require a vendor's license or other specific local permits. If you plan to hire employees, you must also take additional steps, including obtaining an Employer Identification Number (EIN). The Ohio Housecleaning Services Contract - Self-Employed can guide you through compliance requirements. Using resources like USLegalForms can help simplify this process, ensuring you meet all regulatory obligations.

House cleaners, as self-employed individuals, must adhere to specific IRS rules regarding income reporting and deductions. When working under an Ohio Housecleaning Services Contract - Self-Employed, you must report all income you earn from your cleaning services. Additionally, you can deduct certain business expenses, such as cleaning supplies and transportation. Keeping accurate records of your earnings and expenses is crucial for your tax filings.

Yes, a cleaning business can be classified as a contractor, particularly when the individual operates as self-employed. When you enter into an Ohio Housecleaning Services Contract - Self-Employed, you are establishing a professional relationship where you provide services independently. This means you take on the responsibilities of doing the work according to your own schedule and terms. Understanding your status as a contractor helps you manage your taxes and business obligations effectively.