Ohio Adoption of Stock Option Plan of WSFS Financial Corporation

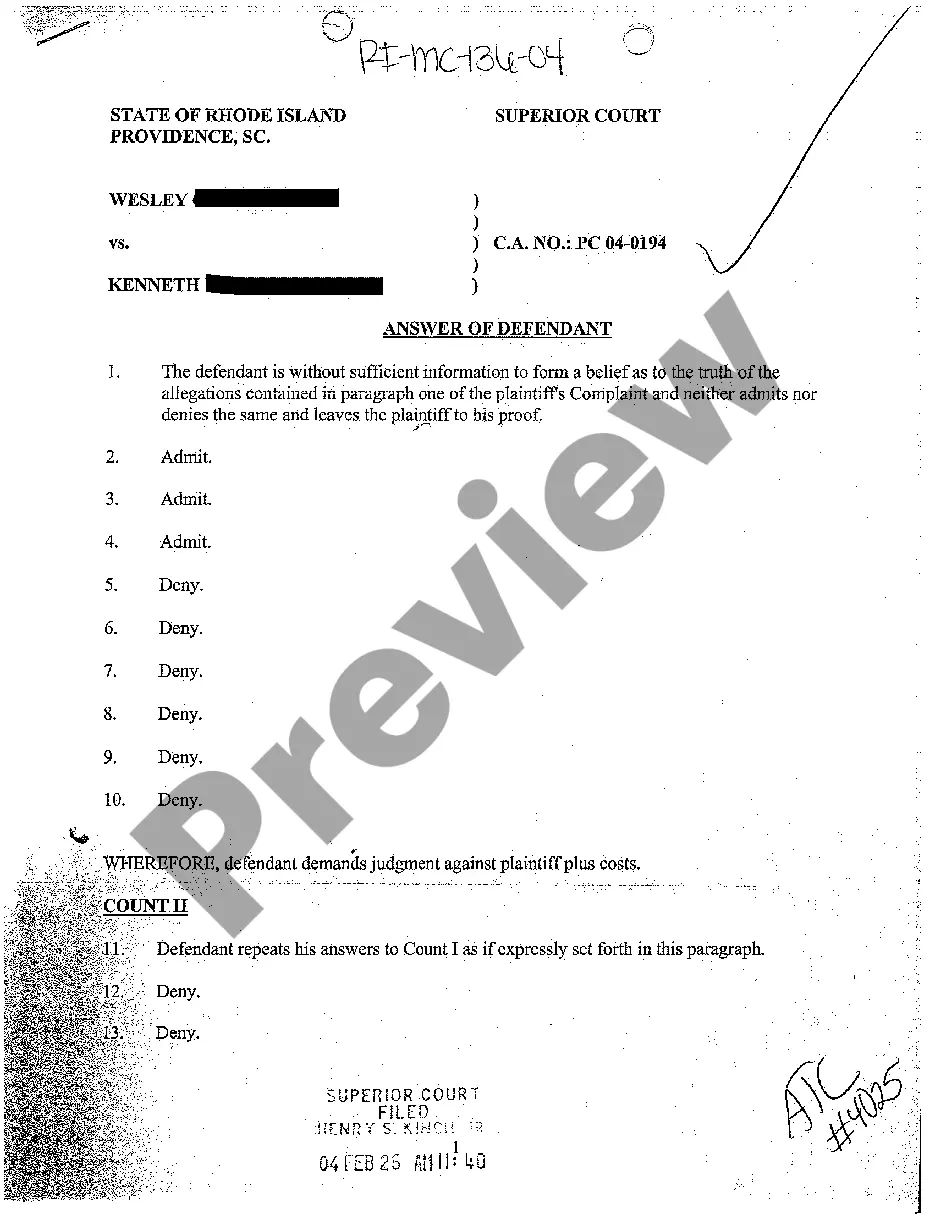

Description

How to fill out Adoption Of Stock Option Plan Of WSFS Financial Corporation?

US Legal Forms - among the largest libraries of authorized forms in the United States - gives a variety of authorized document layouts you may obtain or produce. Making use of the internet site, you will get a huge number of forms for company and specific purposes, categorized by classes, says, or key phrases.You will find the most recent variations of forms just like the Ohio Adoption of Stock Option Plan of WSFS Financial Corporation in seconds.

If you have a registration, log in and obtain Ohio Adoption of Stock Option Plan of WSFS Financial Corporation through the US Legal Forms collection. The Down load key will show up on every single develop you look at. You gain access to all earlier downloaded forms in the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, listed below are easy instructions to help you started out:

- Be sure you have picked out the proper develop for your personal city/state. Select the Review key to analyze the form`s information. Look at the develop description to actually have selected the proper develop.

- In the event the develop doesn`t suit your demands, use the Research area at the top of the monitor to find the the one that does.

- In case you are satisfied with the form, affirm your choice by clicking on the Purchase now key. Then, select the prices strategy you want and give your references to register on an accounts.

- Procedure the transaction. Make use of your bank card or PayPal accounts to finish the transaction.

- Pick the format and obtain the form on your own system.

- Make adjustments. Load, edit and produce and indication the downloaded Ohio Adoption of Stock Option Plan of WSFS Financial Corporation.

Every single format you added to your money lacks an expiry day which is yours eternally. So, if you wish to obtain or produce another version, just visit the My Forms segment and click on on the develop you will need.

Gain access to the Ohio Adoption of Stock Option Plan of WSFS Financial Corporation with US Legal Forms, the most extensive collection of authorized document layouts. Use a huge number of professional and status-certain layouts that meet up with your organization or specific requirements and demands.

Form popularity

FAQ

The security options benefit is taxable to you as employment income in the year you exercise the options. It's reported to you on your T4 tax slip, along with your salary, bonus and other sources of employment income. The security options benefit is normally added to the adjusted cost base (ACB) of your shares.

WSFS common stock is traded on the NASDAQ stock exchange under the symbol WSFS.

However, when you sell an option?or the stock you acquired by exercising the option?you must report the profit or loss on Schedule D of your Form 1040. If you've held the stock or option for one year or less, your sale will result in a short-term gain or loss, which will either add to or reduce your ordinary income.

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

When you exercise your employee stock options, a taxable benefit will be calculated. This benefit should be reported on the T4 slip issued by your employer. The taxable benefit is the difference between the price you paid for the shares (the ?strike price?) and their value on the date of exercise.