Ohio Tuition Assistance Request Form

Description

How to fill out Tuition Assistance Request Form?

If you aim to be thorough, obtain, or create authentic document templates, utilize US Legal Forms, the most extensive collection of legitimate forms available online.

Utilize the website's simple and convenient search to find the documents you require. Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Use US Legal Forms to locate the Ohio Tuition Assistance Request Form in just a few clicks.

Each legal document template you purchase is yours permanently. You have access to every form you have acquired within your account. Check the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Ohio Tuition Assistance Request Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Ohio Tuition Assistance Request Form.

- You can also access forms you have previously obtained from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct locality/state.

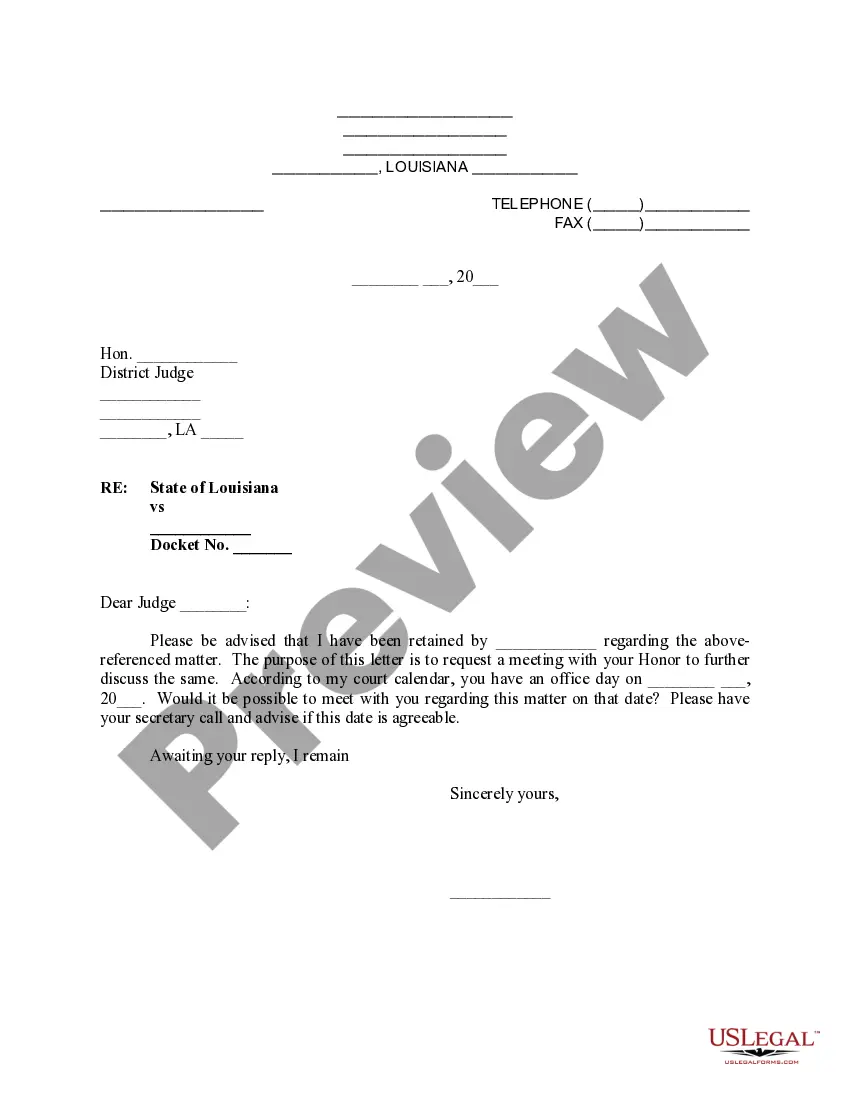

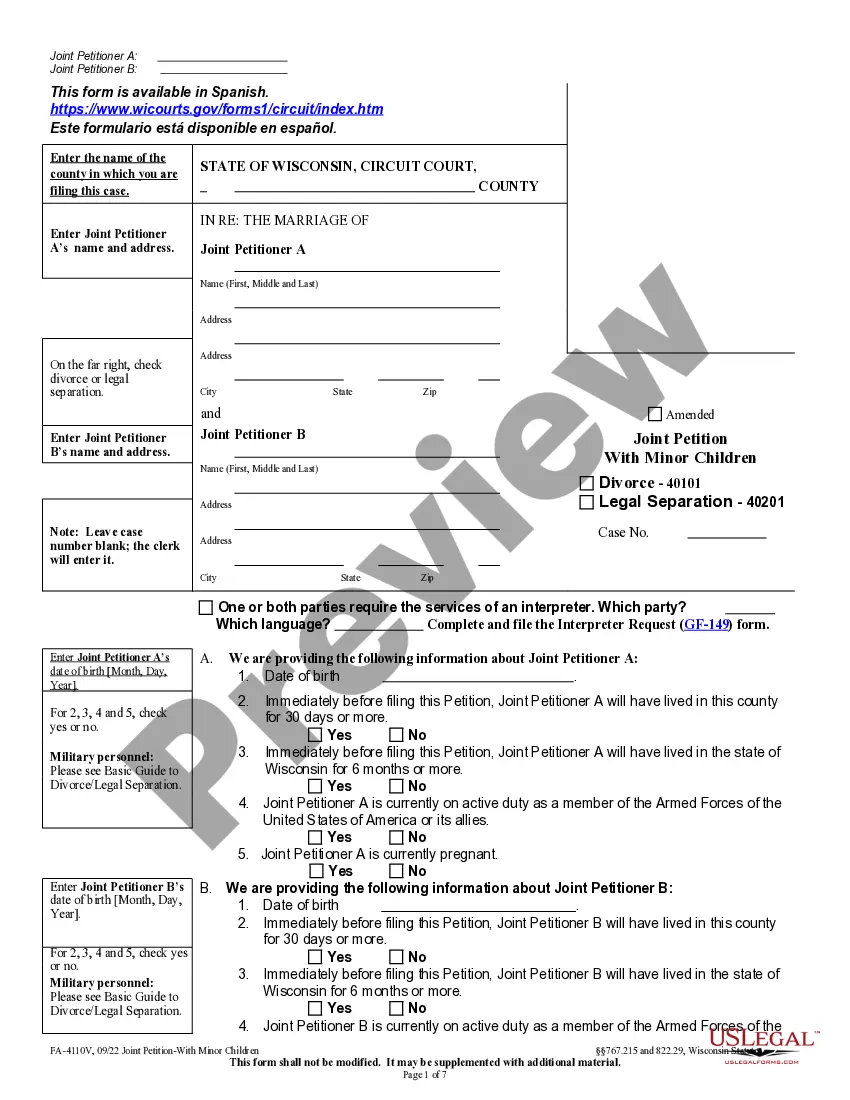

- Step 2. Use the Preview option to review the content of the form. Remember to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Ohio Tuition Assistance Request Form.

Form popularity

FAQ

Free Tuition for National Guard by State. As a member of your state's National Guard, you may be eligible for free tuition!

The Faculty and Staff Tuition Assistance Plan pays the instructional, general and non-Ohio resident fees (up to 10 hours per term) for eligible employees who take courses at Ohio State. The benefit is available upon employment in an eligible appointment of at least 75% FTE.

Reserve military members and those on active duty may be eligible for tuition assistance, which means that the military pays up to 100% of your tuition. The eligibility requirements vary by branch and the total cannot exceed $4,500 per fiscal year.

Create a PitchApproach asking for tuition assistance like you would a formal negotiation. Go into the discussion with clearly outlined and rehearsed messages about what you hope to gain and how it will benefit your boss and organization. Anticipate objections and be prepared to address them.

Oregon State University offers a generous employee benefits package that includes medical, vision, dental, life, and disability coverage for employees working 1/2 time or more. Also provided is a choice of retirement plans after 6 full months of employment in a qualifying position.

The Ohio State Tuition Guarantee, provides Ohio students and their families certainty about the cost of full-time in-state tuition, general fees, housing and dining.

Army National Guard Soldiers can use the Army National Guard Federal Tuition Assistance (FTA). To apply for FTA go to .

In the Army National Guard, soldiers are eligible to for 100% of federal tuition assistance, up to $250 for each semester credit hour, and not above $4,500 per fiscal year. You can also receive reimbursement for related course fees up to $500.

If your employer pays more than $5,250 for educational benefits for you during the year, you must generally pay tax on the amount over $5,250. Your employer should include in your wages (Form W-2, box 1) the amount that you must include in income.

Employees are eligible for tuition remission for credit or audit hours at the undergraduate and graduate levels at the university as follows: (1) Full-time employees are eligible for tuition remission for unlimited regular undergraduate or graduate credit or audit hours per academic term.