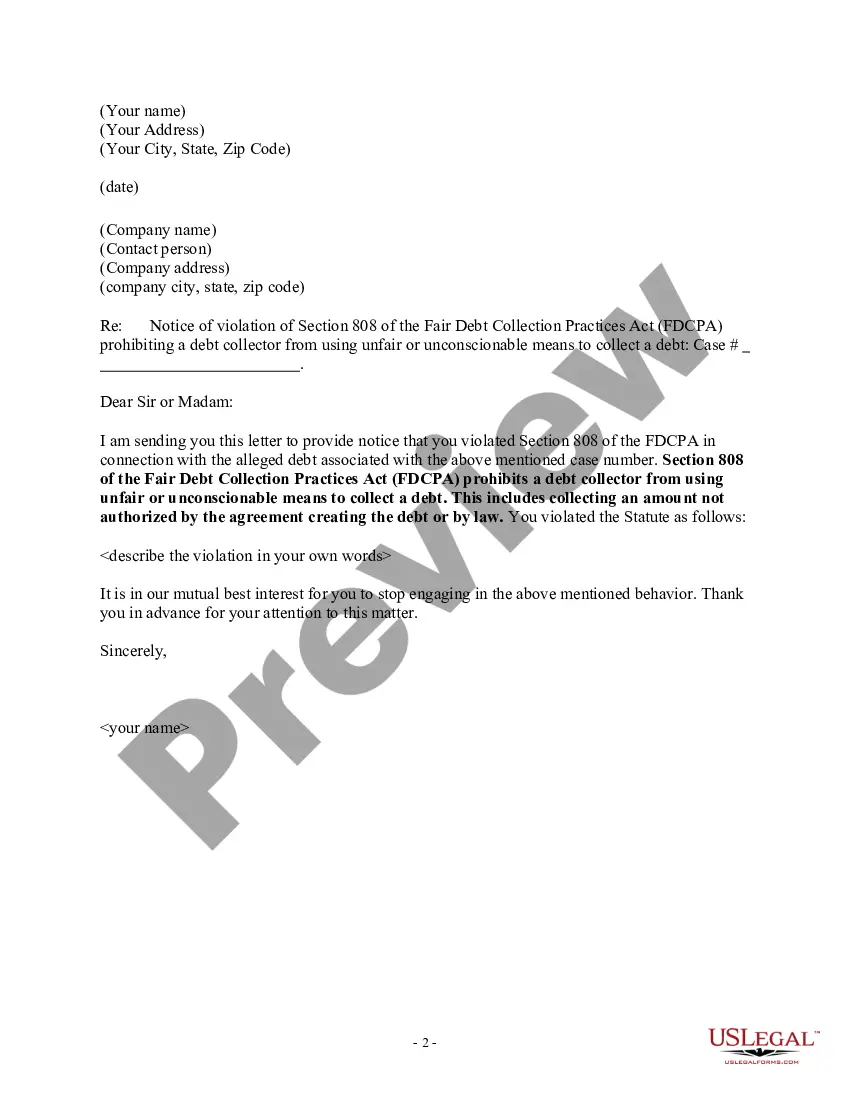

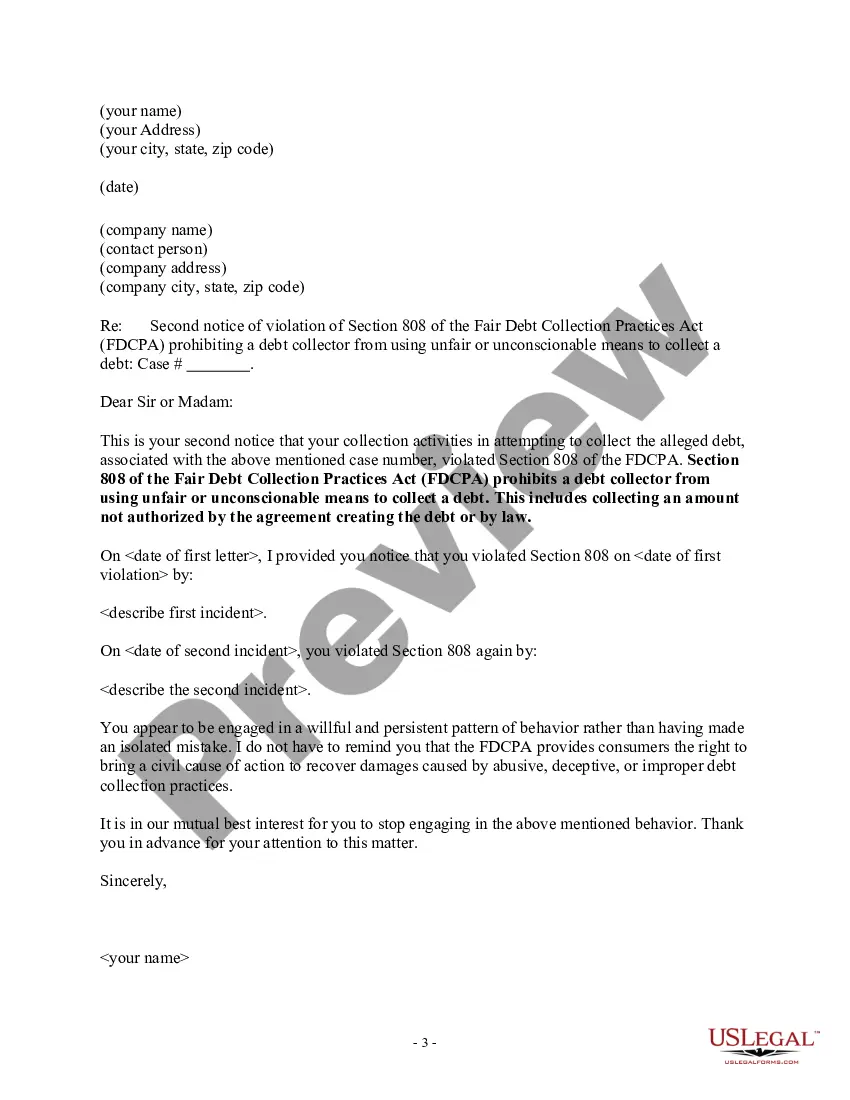

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Puerto Rico Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document templates that you can download or print.

Using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of documents like the Puerto Rico Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law in seconds.

If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

If you are pleased with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you desire and provide your details to register for an account.

- If you already have a subscription, Log In and download the Puerto Rico Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law from your US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you have selected the correct form for your city/county.

- Click the Review button to check the form's content.

Form popularity

FAQ

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

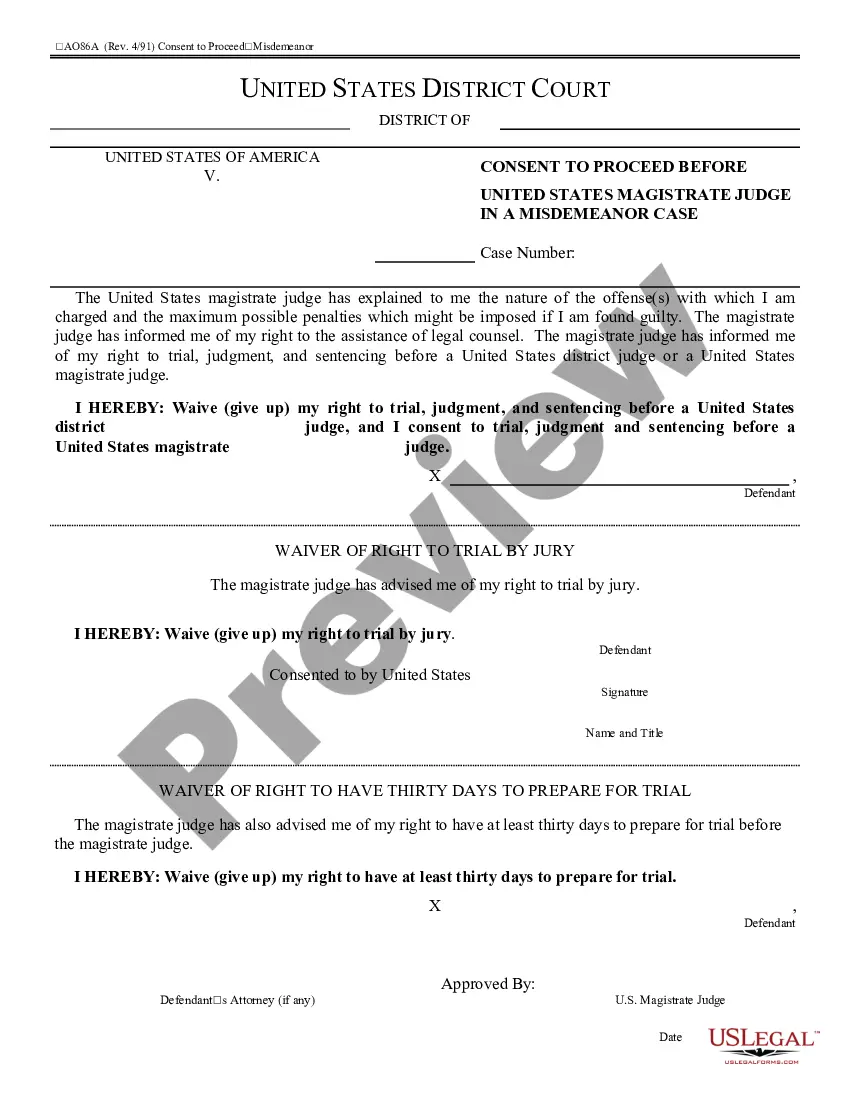

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

What can a debt collector do? Debt collection agencies don't have any special legal powers. They can't do anything different to the original creditor. Collection agencies will use letters and phone calls to contact you.

Plan and modify arrangements with them and the creditor. Organise a settlement offer with you that may make it easier to pay off the debt. Sell your debt to another company who will have the same arrangements and powers as the original creditor. Obtain an order from a court to repossess some of your property.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Debt collection agencies are not bailiffs; They have no extra-legal authority. Debt collectors are either acting on behalf of your creditor or working for a company that has taken on the debt. They don't have any special legal powers and can't do anything different than the original creditor.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

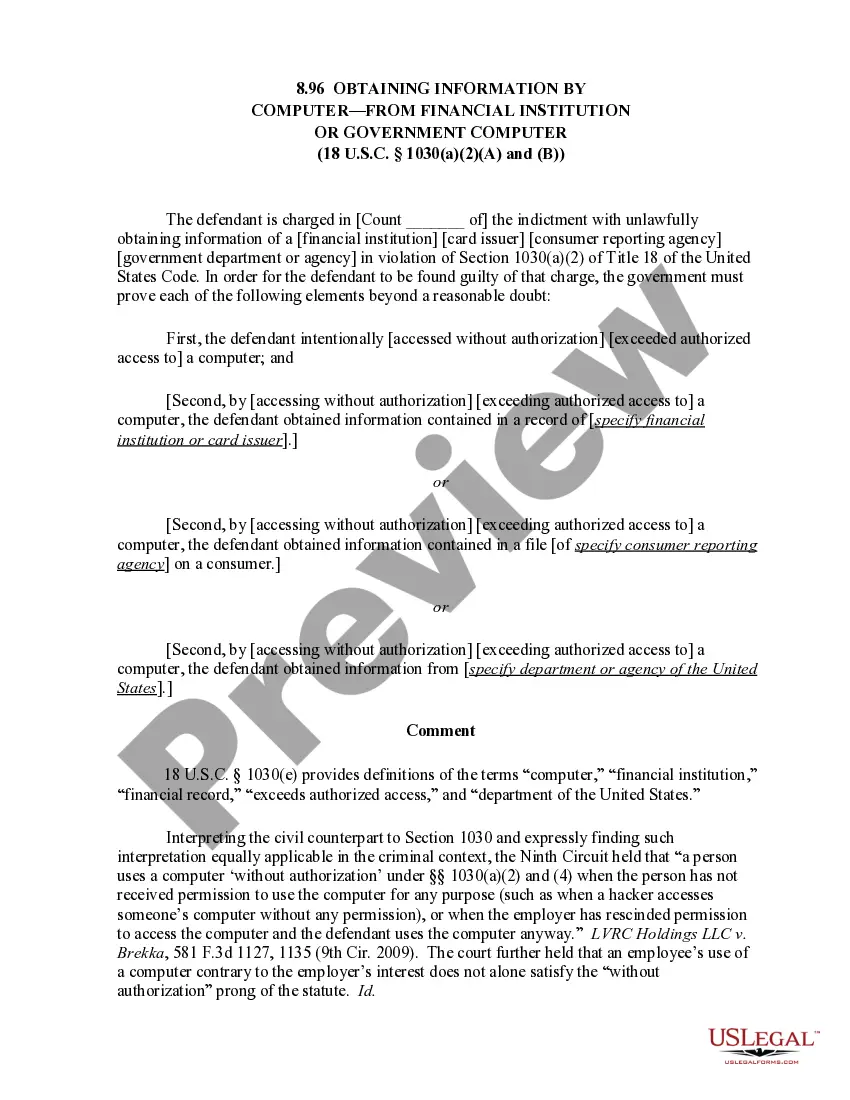

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

What debt collectors can doask for payment.offer to settle or make a payment plan.ask why you haven't met an agreed payment plan.review a payment plan after an agreed period.advise what will happen if you don't pay.repossess goods you owe money on, as long as they've been through the correct process.