A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Washington Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

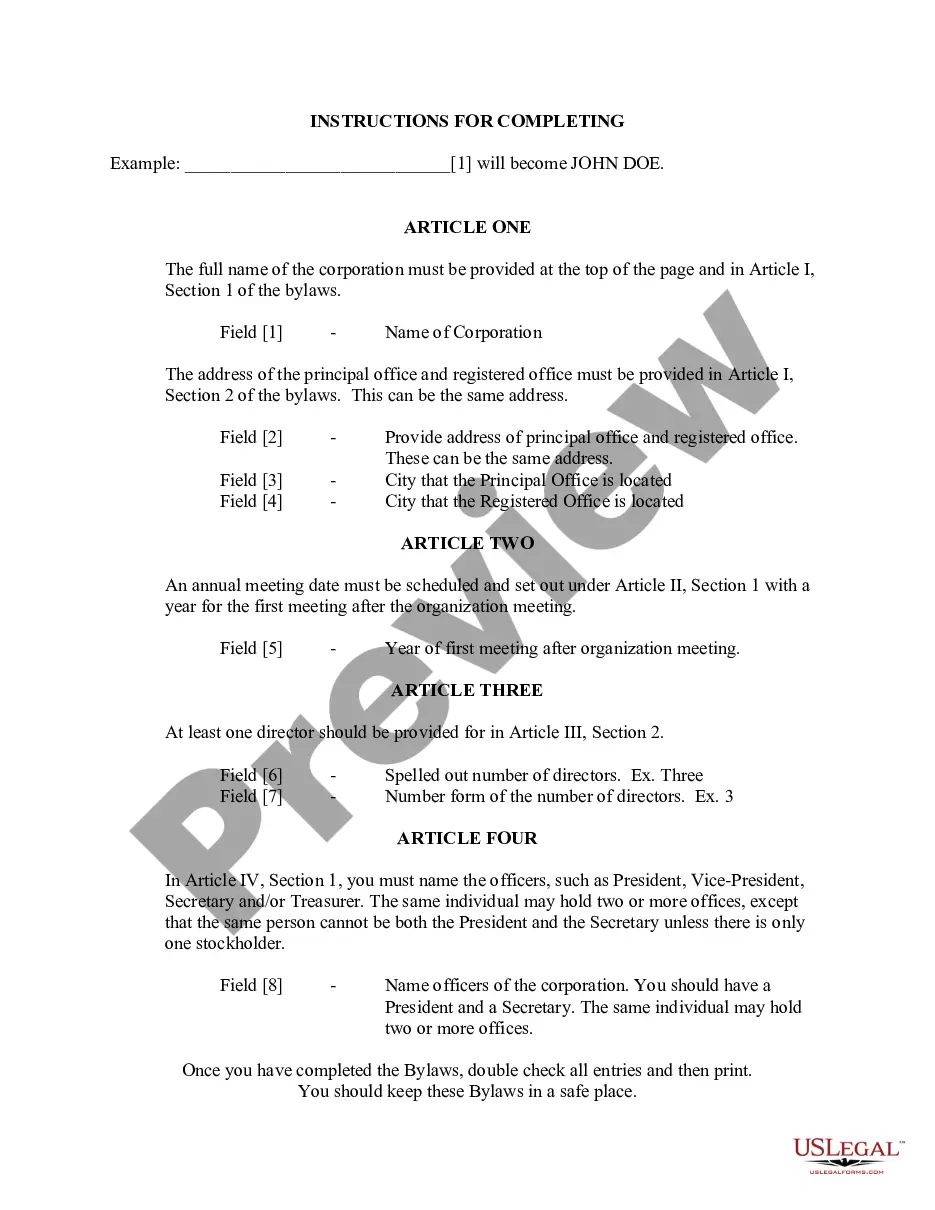

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Are you in a circumstance where you must possess documents for various organizational or personal purposes nearly every day.

There is a multitude of legal document templates available online, but locating ones you can trust is not simple.

US Legal Forms offers numerous template options, such as the Washington Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, that are designed to comply with federal and state regulations.

Select the payment plan you prefer, fill out the required information to set up your account, and place an order using your PayPal or credit card.

Choose a suitable document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Washington Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law whenever necessary. Just navigate to the required template to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Washington Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law template.

- If you do not have an account and want to start using US Legal Forms, follow these directions.

- Identify the template you need and ensure it is for the correct city/state.

- Utilize the Preview feature to review the form.

- Review the description to confirm that you have chosen the appropriate template.

- If the template isn’t what you seek, use the Search area to find the template that fulfills your requirements.

- When you locate the correct template, click Acquire now.

Form popularity

FAQ

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Civil judgments have a life span provided by state law. In Washington, a judgment lasts for 10 years and can be renewed at the end of that period. Therefore once you have a judgment entered against you it can last a long time and incur a large amount of interest.

In Washington, the statute of limitations on debt collection lawsuits is six years after the date of default or last payment on the debt account. Once a debt is past the statute of limitations, debt collectors can still attempt to collect on these debts, but they cannot file a collection lawsuit.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

Yes, a debt can technically be sent to collections without any notice. In some cases, you might not realize the debt is in collections until you check your credit report. Sometimes, you might not realize you owe the debt at all.

Can a Debt Collector Take Money From Your Account Without Permission? Usually, a debt collector must obtain a court order before accessing your bank account. However, certain federal agencies, including the IRS, may be able to access your bank account without permission from a court.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.