Ohio Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable versions is challenging.

US Legal Forms offers thousands of form templates, such as the Ohio Withheld Delivery Notice, that are designed to comply with state and federal regulations.

Once you find the appropriate form, click Buy now.

Select the pricing plan you desire, provide the required information to set up your account, and complete your order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Withheld Delivery Notice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

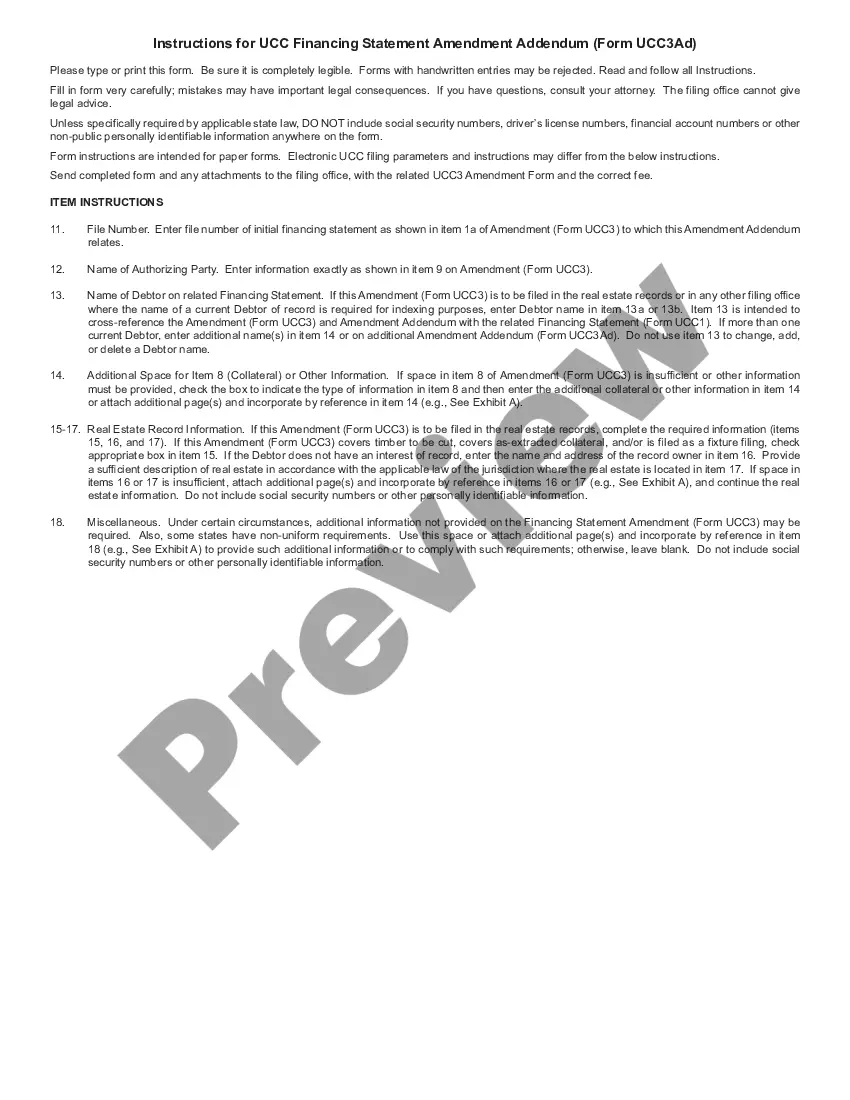

- Utilize the Preview button to review the form.

- Read the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

'I am exempt from Ohio withholding' means that an employee is declaring they should not have state taxes deducted from their paycheck under certain conditions. These may include meeting the income threshold or having no tax liability in the prior year. To confidently manage your tax situation, it's advisable to refer to the Ohio Withheld Delivery Notice and consult resources like US Legal Forms for guidance.

To the Ohio Department of Taxation (Ohio IT 942). An employer who is required to remit partial-weekly shall file the Ohio IT 942, Ohio Employer's EFT 4th Quarter/Annual Reconciliation of Income Tax Withheld, no later than the last day of the month following the end of the calendar year. The Ohio IT 942 is filed on OBG.

Courtesy withholding is an optional benefit where employers collect local income tax for employees who live in another city. Through courtesy withholding, employees don't need to pay local taxes separately, as the employer deducts these amounts and pays them on the employee's behalf.

Ohio IT 4 is an Ohio Employee Withholding Exemption Certificate. The employer is required to have each employee that works in Ohio to complete this form.

Employers are responsible for paying 6% of each employee's first $7,000 of taxable income. Employees are not responsible for paying FUTA. If you pay state unemployment tax in full and on time, you are eligible to receive a 5.4% tax credit, bringing your effective FUTA tax rate down to 0.6%.

As an employer, you must pay careful attention to the local taxes where your employees work. If the tax is a withholding tax, local tax laws require you to withhold the tax from employee wages and remit it. But if the tax is an employer tax, you must pay it.

Revised on 12/21. 2021 Ohio IT 1040 Individual Income Tax Return - This file includes the Ohio IT 1040, Schedule of Adjustments, IT BUS, Schedule of Credits, Schedule of Dependents, IT WH, and IT 40P.

In a situation where an employee begins working remotely (e.g., from home), Ohio ordinarily follows a "20-day rule" under which an employer doesn't need to withhold tax for a municipality if the employee is working in the municipality for 20 or fewer days.

Ohio law requires employers to withhold state income taxes from all wages of residents and wages for services performed in Ohio of certain nonresidents. Withholding is not required for employees who are residents of Indiana, Kentucky, Michigan, Pennsylvania, or West Virginia.

Note: For amended individual return only. Complete the Ohio IT 1040 (checking the amended return box) and include this form with documentation to support any adjustments to the line items on the return.